In today’s volatile economic landscape, it is crucial to stay informed and navigate the complexities of the market effectively. This article delves into the current state of the market, debt ceiling negotiations, and Nvidia’s Q1 earnings report, providing valuable insights for investors and traders alike. We will explore how Nvidia’s stock has surged despite negative year-on-year revenue growth, examine the distorted nature of the market, and shed light on concerns surrounding inflation, the Federal Reserve’s actions, and potential economic risks.

The State of the Market

The current market environment is a dynamic landscape that is shaped by a multitude of factors, creating a complex and often unpredictable state. Understanding the state of the market is crucial for investors, analysts, and economists alike as it influences investment decisions, economic forecasts, and overall financial stability.

One notable observation in the market is the distorted nature of certain indices, such as the S&P 500. While this index is widely regarded as a benchmark for the U.S. stock market, it is important to delve deeper into its composition to gain a more accurate understanding of market dynamics. When the S&P 500 is examined using equal weight methodology, where each stock has an equal impact on the index’s performance, it reveals an interesting phenomenon. The index appears to underperform, suggesting that a few large-cap stocks have a disproportionate influence on its overall performance.

This discrepancy highlights the concept of market skewness, where a handful of influential companies can significantly impact the perceived health and direction of the broader market. Such a skewed perception can distort investors’ understanding of the true market conditions, leading to potential misinterpretations and misallocations of capital.

Debt Ceiling Negotiations

Debt ceiling negotiations have emerged as a critical concern for both investors and financial markets. The debt ceiling refers to the maximum amount of debt that the U.S. government is legally allowed to accumulate to fund its financial obligations. Raising the debt ceiling requires congressional approval, and failure to do so can have severe consequences for the economy.

When the government reaches the debt ceiling, it means that it has exhausted its borrowing capacity. Without an increase in the debt ceiling, the government may not be able to meet its financial obligations, including paying for essential services, salaries, and interest on existing debt. This situation can potentially lead to a default, which would have far-reaching implications for the economy.

The debt ceiling negotiations attract significant attention from market participants, including investors, analysts, and financial institutions. The outcome of these negotiations can have a profound impact on market sentiment and investor confidence. Any uncertainty or delay in raising the debt ceiling can increase volatility in financial markets and create a sense of apprehension among investors.

Nvidia’s Q1 Earnings Report

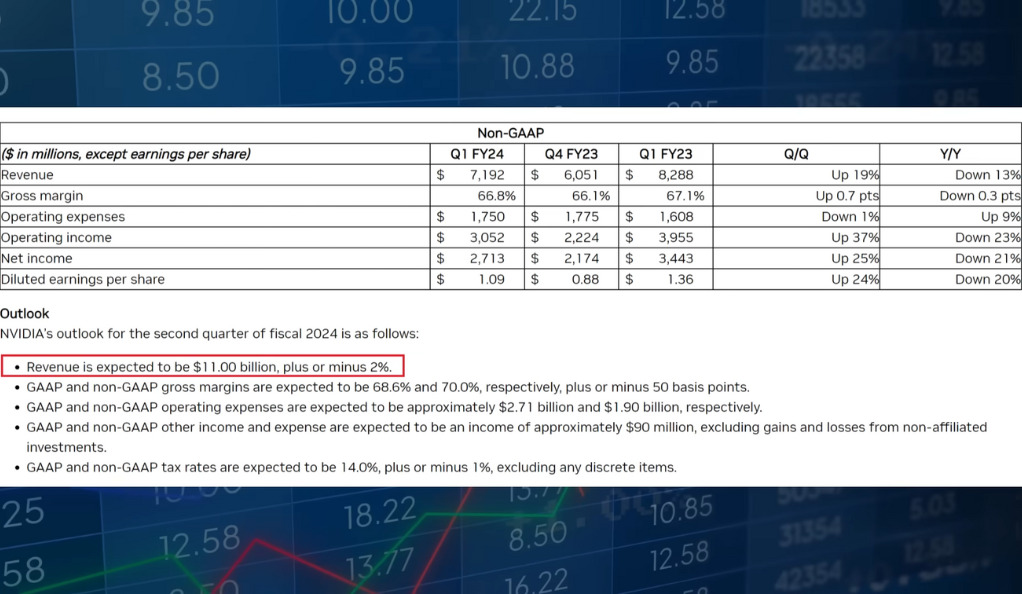

In the third section, we will discuss Nvidia’s Q1 earnings report and delve into the reasons behind the company’s stock surge despite negative year-on-year revenue growth. This seemingly contradictory trend can be explained by considering various factors.

Firstly, investors may be optimistic about Nvidia’s long-term growth prospects. The company is involved in emerging technologies such as artificial intelligence (AI) and autonomous vehicles, which are expected to have a significant impact on various industries. Nvidia has been at the forefront of developing advanced AI technologies and providing high-performance computing solutions, making it well-positioned to benefit from the increasing demand for AI-related products and services. Additionally, the company’s focus on autonomous vehicles has garnered attention, as this industry is projected to experience significant growth in the coming years. Investors may believe that Nvidia’s involvement in these promising areas will drive future revenue and profit growth, leading to a positive outlook for the company’s stock.

Secondly, the stock market often places more emphasis on forward-looking guidance and future potential rather than solely considering historical performance. While Nvidia’s year-on-year revenue growth may be negative, the company’s earnings report could have included positive guidance or outlook for the future. This forward-looking information could include details about new product launches, partnerships, or market expansion plans that have the potential to generate increased revenue in the coming quarters or years. Investors tend to respond positively to such announcements, as they see future growth potential in the company and anticipate higher stock valuations.

To make informed investment decisions, it is crucial to understand the underlying factors that contribute to a stock’s performance. In the case of Nvidia, despite the negative year-on-year revenue growth, factors such as its involvement in emerging technologies like AI and autonomous vehicles, as well as positive forward-looking guidance, have likely contributed to the surge in its stock price. By considering these aspects and conducting thorough research, investors can gain insights into the company’s long-term prospects and make informed decisions about investing in Nvidia.

Inflation Concerns and the Federal Reserve’s Actions

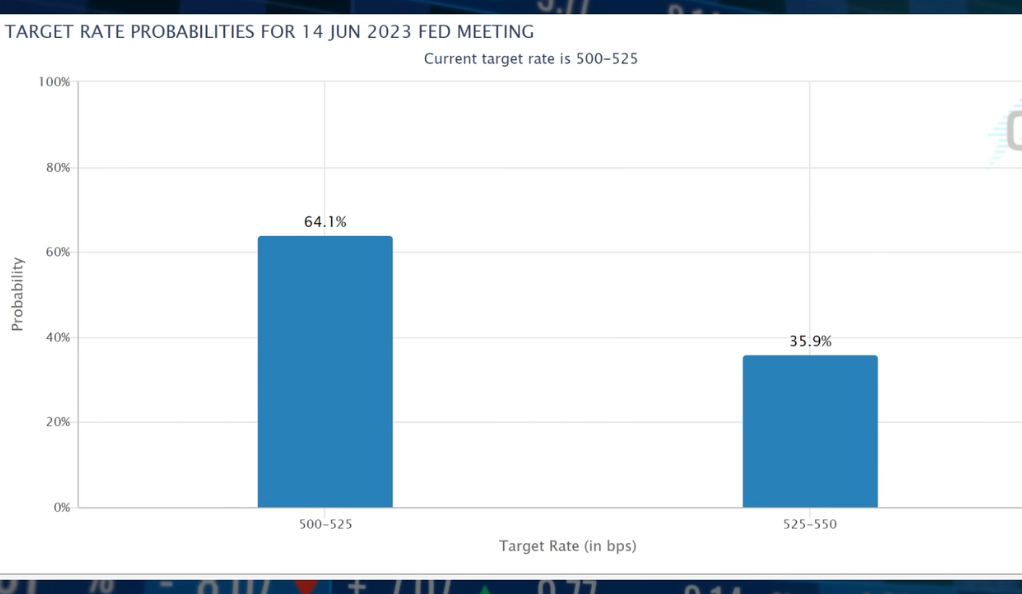

Inflation remains a key concern for market participants and policymakers alike. The recent economic recovery, coupled with substantial fiscal stimulus measures, has sparked fears of rising prices. The Federal Reserve plays a crucial role in managing inflation through its monetary policy decisions. As the economy shows signs of overheating, the Fed faces the delicate task of striking the right balance between supporting growth and controlling inflation. The market closely watches the central bank’s actions and statements, as any unexpected policy shifts can have a significant impact on investor sentiment and market dynamics.

Potential Economic Risks

In addition to the issues of inflation and debt ceiling negotiations, there are other potential economic risks that exist in uncharted territories. Financial markets are intricate and interconnected systems, which makes it difficult to foresee and address risks before they materialize. If a major problem were to occur in an unfamiliar sector of the economy, it could have a cascading effect, impacting multiple industries and types of assets. Therefore, it is crucial for investors to stay watchful and take steps to diversify their investment portfolios in order to minimize potential risks.

The global economy is a complex web of interconnected factors, such as industries, financial institutions, governments, and consumers. Each component plays a role in shaping the overall economic landscape. While experts and policymakers try to anticipate and manage risks, there are always areas that remain unexplored or less understood. These uncharted areas can pose potential dangers to the stability and growth of the economy.

One example of such risks is the possibility of a blow-up in an unknown area of the economy. This refers to a sudden and severe disruption or failure in a sector or market that was not previously considered a significant source of risk. For instance, a collapse in a particular industry or a financial market segment could trigger a domino effect, spreading distress to other sectors and asset classes. This contagion effect could result in widespread economic consequences, such as a decline in consumer confidence, investment losses, and reduced economic activity.

Technical Analysis

Technical analysis is a fundamental aspect of analyzing individual stocks and indices within the broader market. It involves studying price patterns, trends, and various indicators to identify potential entry and exit points for investments. By utilizing technical analysis tools, investors and traders can make informed decisions based on historical price data and market trends.

One of the primary goals of technical analysis is to identify patterns and trends in stock price movements. These patterns can provide insights into the behavior of the market and help predict future price movements. By analyzing historical price data, investors can identify recurring patterns, such as support and resistance levels, trend lines, and chart patterns like head and shoulders or double bottoms.

In addition to patterns, technical analysis also focuses on trend analysis. This involves analyzing the overall direction of a stock’s price movement. Trends can be classified as upward (bullish), downward (bearish), or sideways (consolidation). Identifying and understanding the prevailing trend can help investors make decisions regarding buying, selling, or holding a particular stock.

Conclusion

Navigating the complexities of the current market requires a deep understanding of the various factors at play. Debt ceiling negotiations, Nvidia’s Q1 earnings report, and market analysis provide valuable insights for investors and traders seeking to make informed decisions. By staying abreast of the market’s distorted nature, inflation concerns, the Federal Reserve’s actions, and potential economic risks, individuals can position themselves forsuccess in this dynamic environment. It is important to remember that market conditions can change rapidly, and staying informed and adaptable is key to effectively managing investments. Conducting thorough research, analyzing both fundamental and technical aspects, and seeking professional advice can help investors navigate the complexities and make well-informed decisions.

In conclusion, the current market presents both opportunities and challenges. By closely monitoring debt ceiling negotiations, understanding the factors behind Nvidia’s stock surge, staying informed about inflation concerns and the Federal Reserve’s actions, and remaining alert to potential economic risks, investors can position themselves for success. However, it is crucial to approach the market with caution, diversify portfolios, and adapt strategies as needed. With a comprehensive understanding of the market’s intricacies, investors can make informed decisions and navigate the complexities with confidence.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)