Litecoin (LTC), one of the largest cryptocurrencies in the market, has been deemed a commodity by the Commodity Futures Trading Commission (CFTC) in the United States. This news has created a buzz in the crypto world and many investors are looking forward to investing in Litecoin. As of March 28th, 2023, the current price of Litecoin is $86.05, and we expect it to rise to $92.42 in the month of April. In this article, we will analyze the reasons behind this expected price increase and what it means for Litecoin investors.

Contents

Litecoin Deemed a Commodity by CFTC

The CFTC has declared Litecoin as a commodity, which means that it is now regulated as a commodity in the United States. This is a significant step for Litecoin and the crypto world as a whole, as it shows that cryptocurrencies are being recognized as legitimate assets and are being taken seriously by regulators. The CFTC’s decision to classify Litecoin as a commodity is a positive step for the crypto world and will likely encourage more institutional investors to invest in cryptocurrencies.

This classification of Litecoin as a commodity has also given it more legitimacy in the eyes of traditional financial institutions. This will likely lead to more widespread adoption of Litecoin and other cryptocurrencies, which in turn will drive up their prices.

Supply and Demand Dynamics

Litecoin has a finite supply of 84 million, of which more than 70 million have already been mined. This limited supply, combined with increasing demand, is likely to drive up the price of Litecoin. As more people adopt Litecoin and more institutional investors invest in it, the demand for Litecoin is likely to increase, which will drive up its price.

Litecoin has been designed to be a faster and cheaper alternative to Bitcoin. Its faster transaction times and lower fees make it an attractive option for people who want to use cryptocurrencies for day-to-day transactions. This increased demand for a fast and cheap cryptocurrency is likely to drive up the price of Litecoin.

Technical Analysis

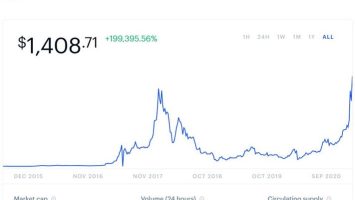

A technical analysis of Litecoin’s price chart shows that the coin is currently in a bullish trend. The 50-day moving average is above the 200-day moving average, which is a bullish signal. The RSI (Relative Strength Index) is also in bullish territory, which suggests that the coin is overbought. However, this does not mean that the price of Litecoin cannot go higher.

The next resistance level for Litecoin is $92.42, which we expect it to reach in April. If Litecoin breaks through this resistance level, it is likely to continue its upward trend.

Conclusion

Litecoin’s recent classification as a commodity by the CFTC is a positive step for the crypto world and will likely drive up the price of Litecoin. The limited supply of Litecoin, combined with increasing demand, is likely to drive up its price. The technical analysis of Litecoin’s price chart also suggests that the coin is in a bullish trend and is likely to reach the next resistance level of $92.42 in April.

Investors should keep an eye on Litecoin and consider investing in it as it is likely to see price appreciation in the near future. However, as with any investment, it is important to do your own research and understand the risks involved.

FAQs

Litecoin is a decentralized, open-source cryptocurrency that was created as an alternative to Bitcoin. It was designed to be faster and cheaper than Bitcoin, with faster transaction times and lower fees. Litecoin is also a peer-to-peer digital currency that enables instant, near-zero cost payments to anyone in the world.

The Commodity Futures Trading Commission (CFTC) has declared Litecoin as a commodity, which means that it is now regulated as a commodity in the United States. This is a significant step for Litecoin and the crypto world as a whole, as it shows that cryptocurrencies are being recognized as legitimate assets and are being taken seriously by regulators. The CFTC’s decision to classify Litecoin as a commodity is a positive step for the crypto world and will likely encourage more institutional investors to invest in cryptocurrencies.

As of March 28th, 2023, the current price of Litecoin is $86.05, and we expect it to rise to $92.42 in the month of April. This expected price increase is due to the recent classification of Litecoin as a commodity by the CFTC and the increasing demand for a fast and cheap cryptocurrency. However, as with any investment, it is important to do your own research and understand the risks involved.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)