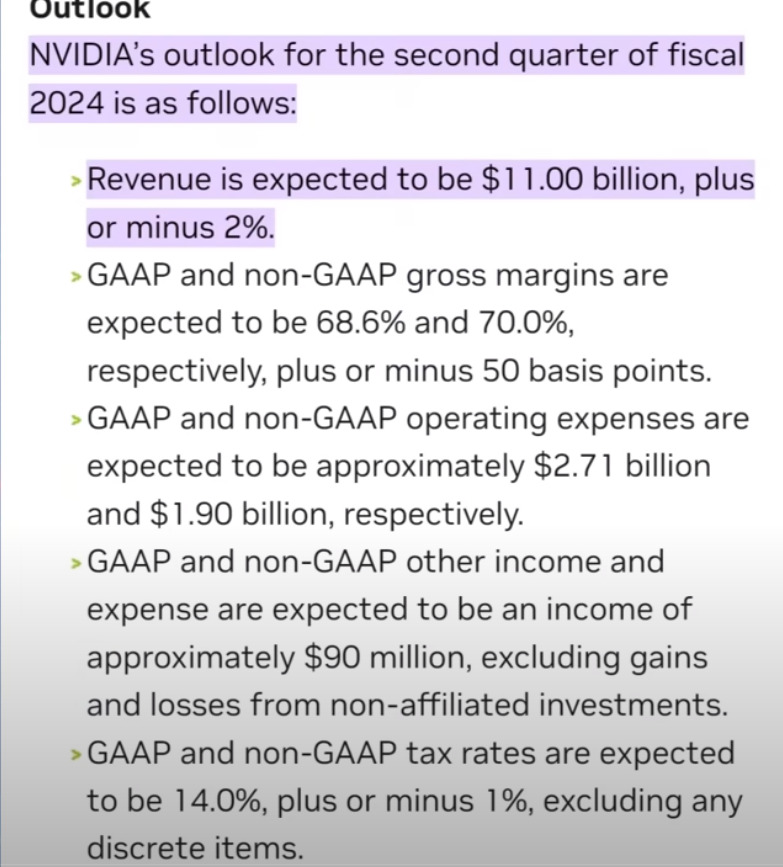

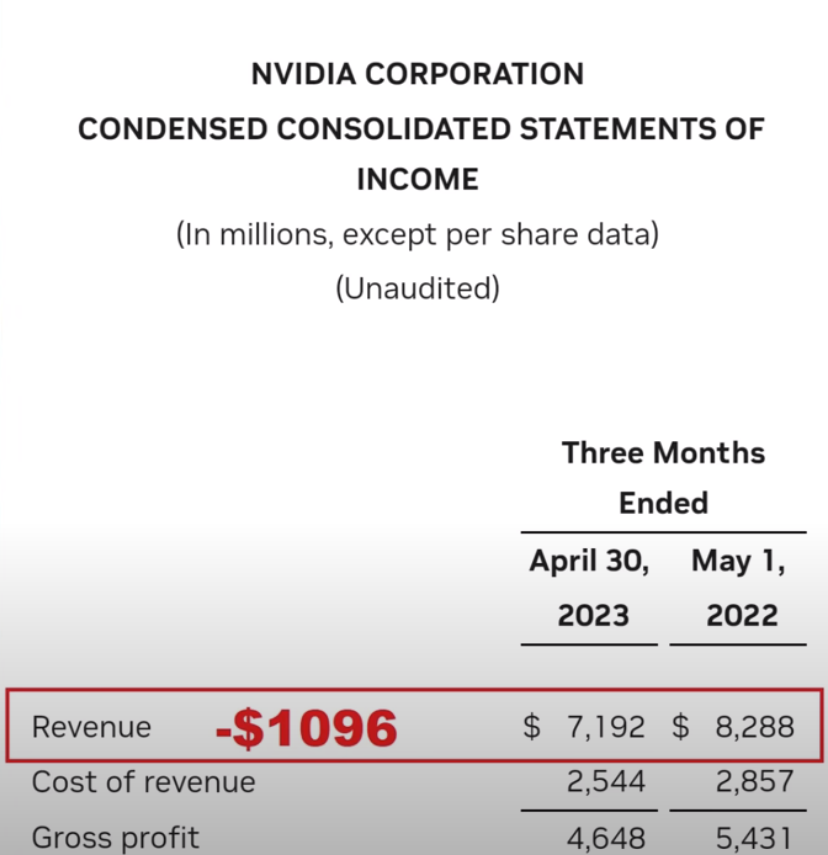

Welcome, dear readers. Nvidia, a dominant force in the tech industry, recently made a daring proclamation of increasing their revenues from $7 to $11 billion in one quarter. A startling claim, don’t you think? But let’s ask the pressing question – is this claim backed by credible evidence?

Understanding Nvidia’s Revenue Surge

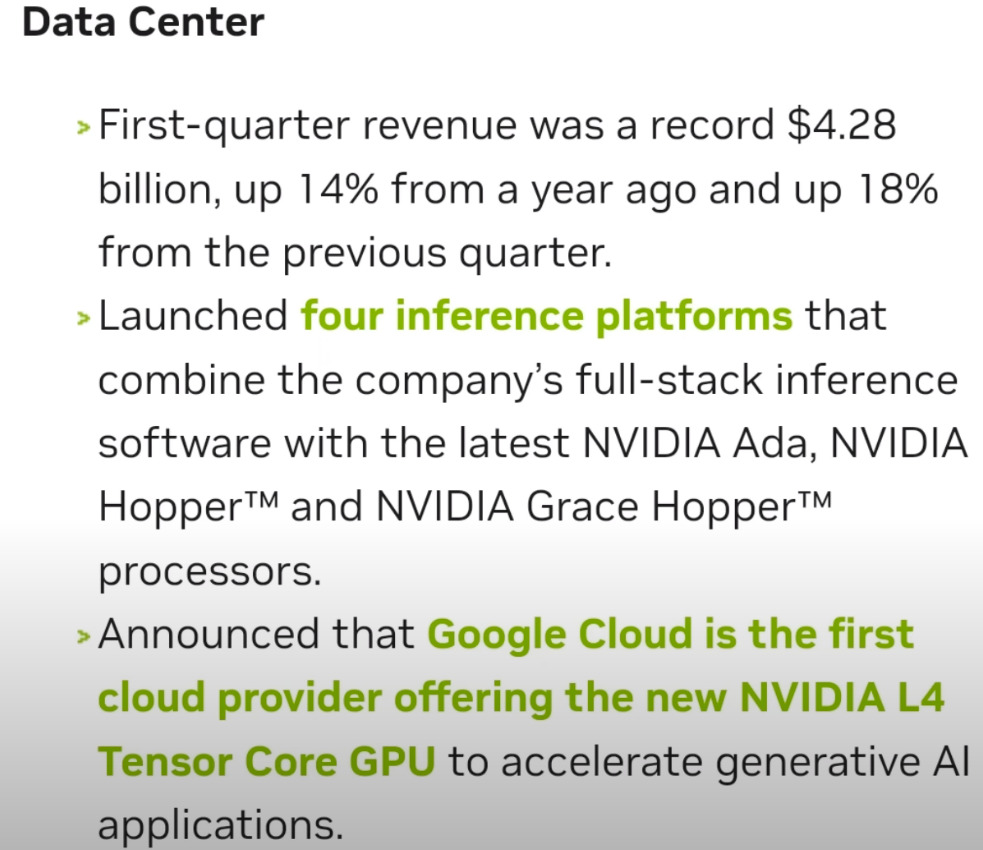

The unexpected surge is primarily attributed to Nvidia’s aggressive foray into the world of AI. Nvidia, renowned for its graphics processing units (GPUs), has found a way to repurpose its technology for AI applications, causing a spike in demand for its GPUs and driving up revenues.

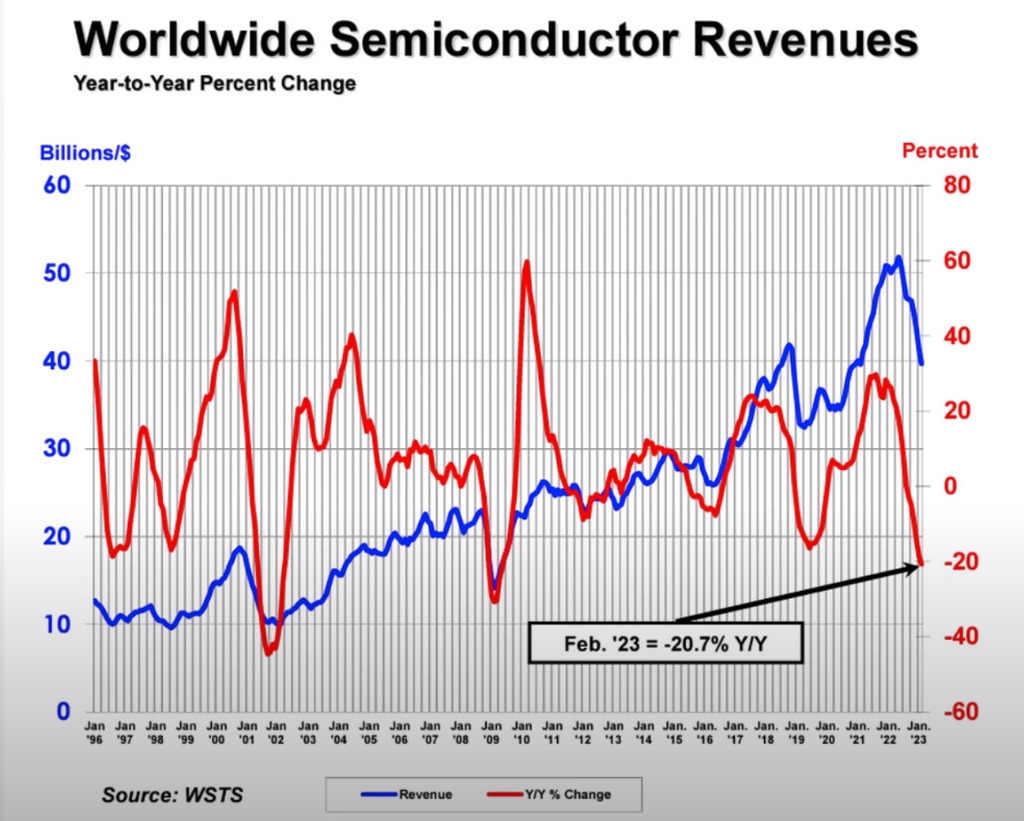

Examining the Industry-Wide Data

Despite global economic uncertainties, there’s a visible growing appetite for AI-driven technologies, with Nvidia leading the charge. The company’s bet on AI technology seems to be paying off with a significant increase in projected revenue.

Nvidia vs AMD’s Reports

Interestingly, while Nvidia has seen a rise in revenues, its rival AMD’s reports do not reflect a similar trend. This discrepancy emphasizes Nvidia’s competitive edge in utilizing the potential of AI, contributing to its stronger financial performance.

Potential Large-Scale Buyers of Nvidia’s Chips

Nvidia’s dramatic rise in revenue suggests possible large-scale purchases by major tech corporations. These industry giants could be silently fueling Nvidia’s financial ascent.

Amazon’s Hidden Purchases?

There’s speculation about Amazon being one of the major buyers of Nvidia’s AI chips. Recent inconsistencies in Amazon’s quarterly reports suggest potential undisclosed expenditures on advanced technologies like AI.

Inconsistencies in Amazon’s Quarterly Reports

The inconsistencies in Amazon’s financial disclosures have raised eyebrows. The sudden surge in capital expenditure without a corresponding increase in infrastructure may hint at hidden purchases of advanced technology, like Nvidia’s high-performance AI chips.

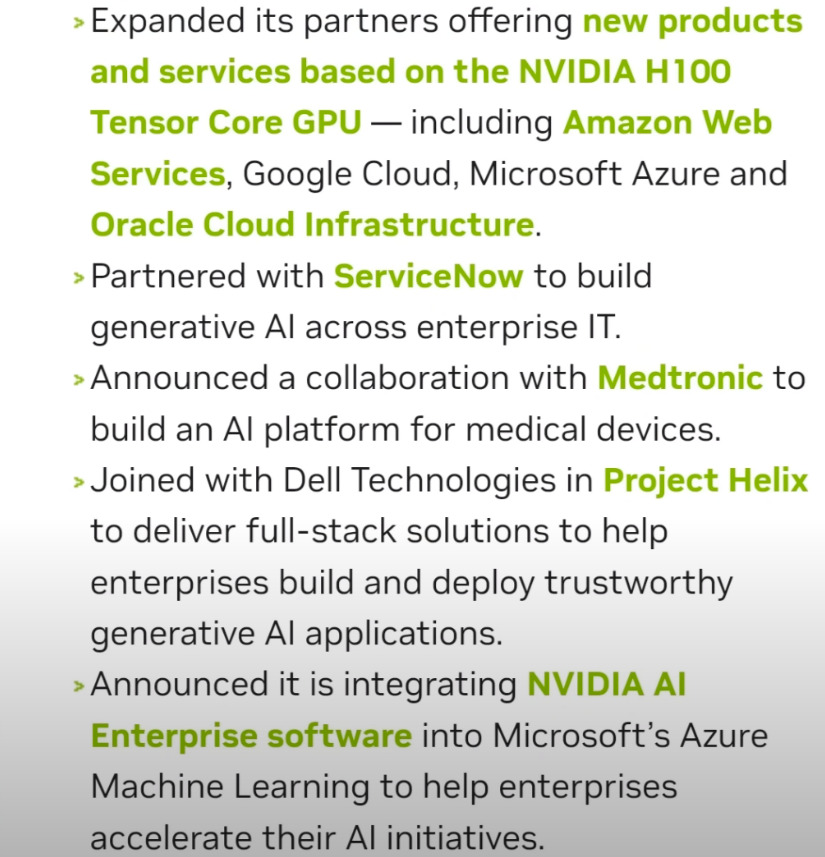

Medtronic: Chasing the AI Hype

Medtronic, a prominent player in medical technology, has shown an increased interest in AI, suggesting that they might be another potential buyer of Nvidia’s chips, given the growing role of AI in healthcare.

Evaluating Medtronic’s Recent Report

A closer look at Medtronic’s recent financial reports reveals a notable increase in R&D expenditure, suggesting strategic investments in AI technology. This could indicate a hidden business relationship with Nvidia.

Considering Other Prospective Buyers

Given Nvidia’s expertise in AI, there are likely several other tech giants who could be prospective buyers of its chips.

ServiceNow: A New AI Player?

Recently, ServiceNow announced a strategic collaboration with Nvidia to integrate AI into its workflows. This collaboration suggests that ServiceNow could be another key purchaser of Nvidia’s AI chips.

Deciphering ServiceNow and Nvidia’s Partnership

The partnership between ServiceNow and Nvidia aims to build generative AI models, which would likely require a significant investment in Nvidia’s AI chips, thereby contributing to its revenue surge.

Oracle: Spending Surge or Expense Problem?

On the other hand, Oracle, despite a notable spike in expenditure, has not reported a corresponding revenue growth. This raises questions about Oracle’s financial management and whether it could be investing in Nvidia’s AI technology.

Nvidia and Oracle: A Complex Relation

Given the financial intricacies and Oracle’s increased spending, it’s possible that Oracle could be a large-scale buyer of Nvidia’s chips. However, the lack of corresponding revenue growth casts doubts on this hypothesis.

Nvidia’s Misleading Guidance: A Look Into the Past

It’s crucial to reflect on Nvidia’s past while evaluating its current claims. The company has a history of misleading financial guidance, which could cast doubts on its present audacious revenue claim.

Nvidia’s Financial Scandal

In the past, Nvidia was involved in a financial scandal, where it faced allegations of misleading investors with inflated revenue projections. This past incident adds a layer of skepticism to Nvidia’s current revenue claim.

Current Red Flags and Executive Actions

Furthermore, recent executive actions raise red flags about Nvidia’s financial integrity. High-level executives have been cashing in their stocks, which often precedes a financial downturn, adding fuel to the skepticism.

Analyzing Nvidia’s Potential Future

Despite the skepticism, it’s essential to analyze the possible scenarios for Nvidia given the boom in the AI industry.

Possible Scenarios: Price vs Volume

Future success for Nvidia will largely depend on its ability to maintain high prices for its AI chips while also ensuring a high volume of sales. This is achievable given the strong demand for AI technology.

Nvidia’s Pricing Power and Market Competition

However, Nvidia’s pricing power could be impacted by market competition. As rivals like AMD step up their game in AI, Nvidia might face competitive pricing pressures, which could affect its financial future.

Final Thoughts: Nvidia’s Hype or Reality?

While Nvidia’s audacious revenue claim has stirred the tech industry, it remains to be seen whether this is just hype or the reality of a booming AI industry.

Audience Opinions and Predictions

Public opinion is divided. While some see Nvidia’s claim as an overestimation, others view it as a reflection of the burgeoning AI market. The company’s bold prediction, despite its past scandals, has ignited a buzz among investors, tech enthusiasts, and market analysts.

Recap and Outlook

As we unravel Nvidia’s audacious revenue claim, several factors come into play. From Nvidia’s industry positioning and aggressive AI strategy to potential hidden purchases by tech giants, and historical financial misguidance, it’s a complex, intertwined narrative.

Despite these complexities, one thing is clear – Nvidia is poised at the forefront of a rapidly expanding AI industry. Whether its revenue projection is hype or reality will be seen in the coming quarters. Until then, we remain on the edge of our seats, watching the story unfold.

In conclusion, Nvidia’s claim has triggered an industry-wide debate, raising questions about its financial integrity while also highlighting the potential of AI technology. As we anticipate the coming quarters, we’re left to ponder whether this is the dawn of a new AI era or merely an inflated projection from a tech giant with a questionable past. Only time will reveal the true tale.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)