Backtesting is a critical tool in a trader’s arsenal. It’s a method that allows traders to simulate their trading strategies using historical data to see how they would have performed. This process is crucial as it provides a glimpse into the potential effectiveness of a strategy before it’s implemented in real-time trading. It’s like a rehearsal before the actual performance, allowing traders to fine-tune their strategies and make necessary adjustments. In this article, we’ll delve into the specifics of backtesting, using a particular strategy as an example. We’ll explore the indicators used, the trading rules, and the results of the backtest. This comprehensive guide aims to provide you with a deeper understanding of backtesting and its importance in successful trading.

What is Backtesting?

Backtesting is a vital method used by traders to assess the effectiveness of a trading strategy. It involves applying the strategy to historical data to see how it would have performed in the past. This simulation process is akin to a rehearsal before the actual performance, allowing traders to fine-tune their strategies and make necessary adjustments based on the results. By doing so, traders can gain insights into the potential profitability and risk level of their strategy, helping them make more informed trading decisions.

However, it’s crucial to remember that while backtesting provides valuable insights, it’s not a foolproof method. Past performance is not always indicative of future results. The market conditions of the past may not necessarily replicate in the future. Therefore, while backtesting is a powerful tool that can increase the chances of a strategy’s success by providing a data-driven approach, it should be used in conjunction with other tools and techniques. It’s a piece of the puzzle in strategy development, not the entire picture.

The Strategy in Focus

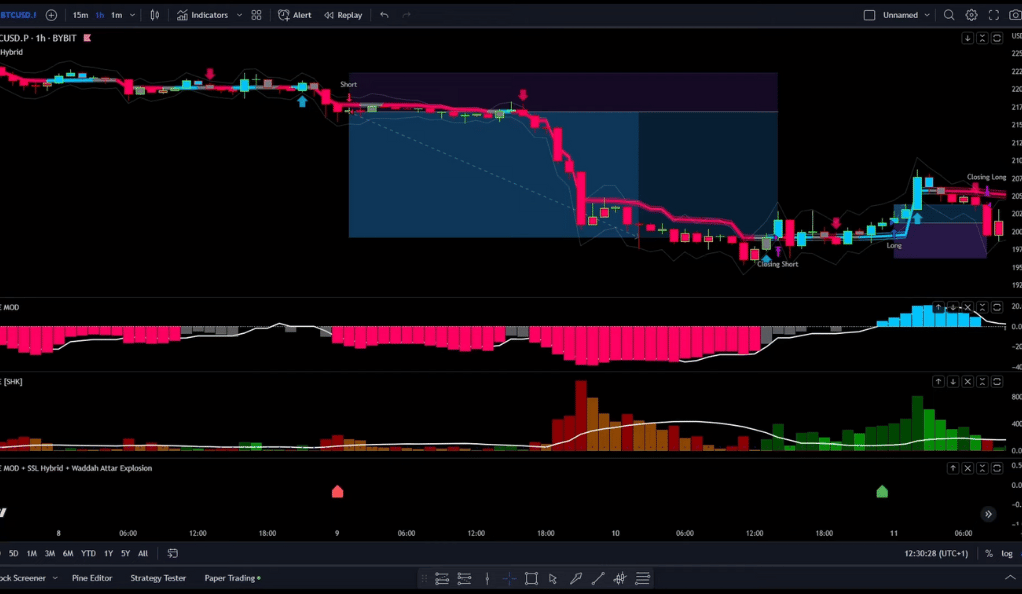

The strategy we’re focusing on is designed for markets with high daily volume, such as Forex, stocks, or crypto. It’s versatile, working on various time frames, from 1, 5, or 15 minutes to the one-hour chart. This flexibility makes it adaptable to different market conditions and trading styles. For our example, we’ll use the Bitcoin chart on the one-hour time frame. Bitcoin, with its high volatility and volume, provides a perfect testing ground for our strategy. The goal here is to identify patterns and signals that can lead to profitable trades.

The Indicators

In the world of trading, indicators serve as valuable tools that can help traders make informed decisions. They provide insights into various aspects of the market, such as trends, volatility, and momentum, among others. In the strategy we’re focusing on, three free TradingView indicators are used, each serving a unique purpose.

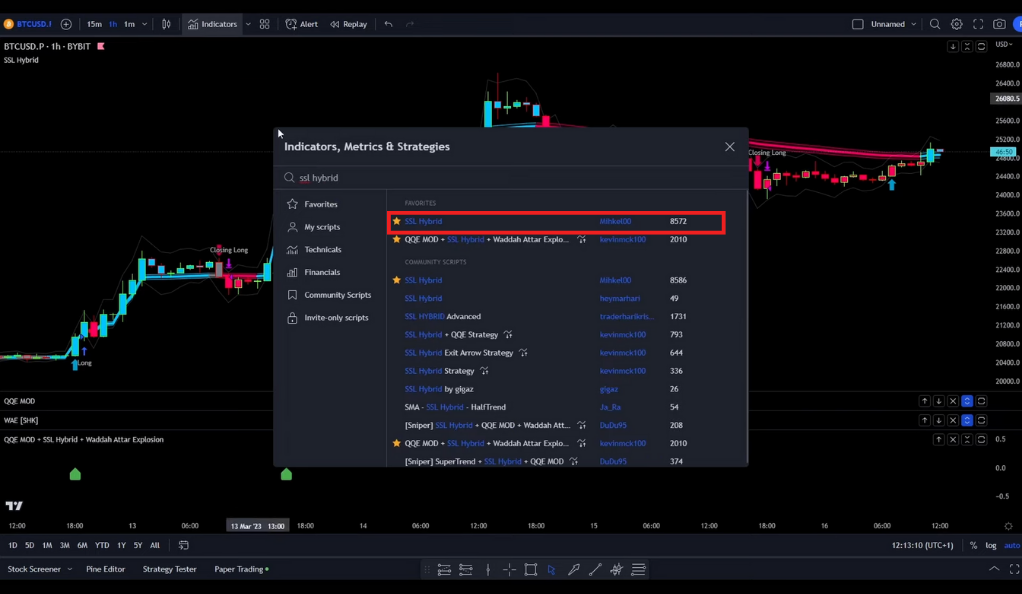

SSL Hybrid by michael00 (1st Indicator)

This indicator is designed to identify trend changes, acting as a compass that guides traders through the often choppy waters of the market. It provides entry and exit signals, helping traders determine the optimal times to enter or exit a trade. By doing so, it aids in maximizing potential profits and minimizing potential losses.

More on The Indicators

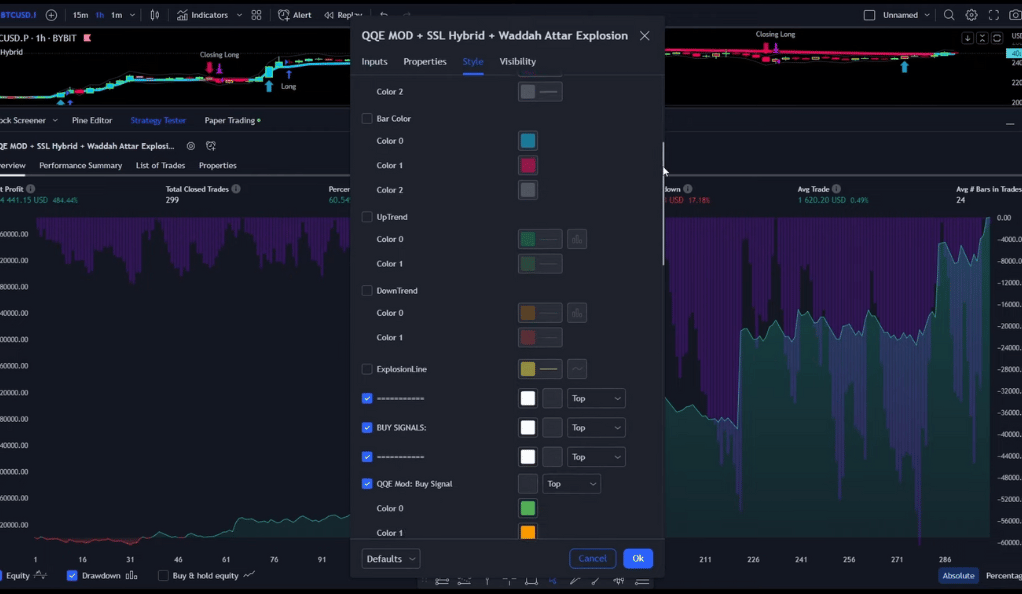

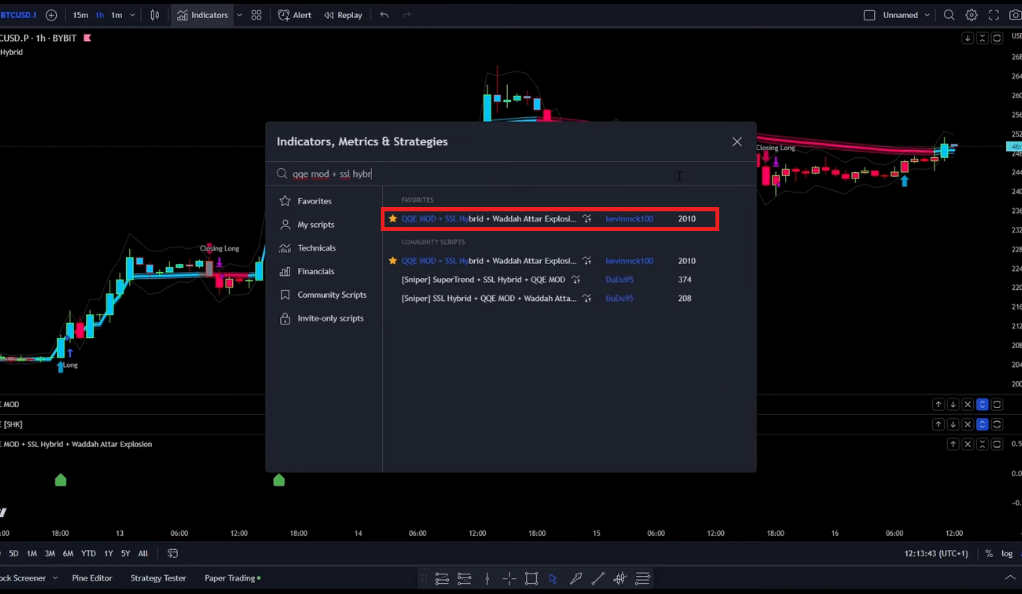

QQE Mod by Michael (2nd Indicator)

This indicator serves as a confirmation tool for the signals provided by the SSL Hybrid. It’s like a second opinion that reinforces the signals, increasing the confidence in the trade. This reinforcement helps traders avoid false signals, which can lead to unprofitable trades.

Wada Adder Explosion by Shane (3rd Indicator)

This indicator is designed to identify periods of high volatility. It’s like a weather forecast, alerting traders to the market storms where big moves can happen. High volatility periods can be ideal for trading as they often come with significant price movements, providing opportunities for profit.

In addition to these indicators, a strategy backtester script by Canon nck 100 is used to automate the backtesting process. This script saves time and effort by running the strategy on historical data and providing detailed results, allowing traders to focus more on refining their strategies and less on the manual work of backtesting.

The Trading Rules

The trading rules form the backbone of any strategy. They provide a clear framework for making trading decisions, reducing the role of emotions and subjectivity. In the strategy we’re discussing, the trading rules are straightforward yet effective. The first rule pertains to the entry of a trade. A long trade is entered when a green buy signal is received, and a short trade is initiated when a sell signal is received. These signals are generated based on the indicators discussed earlier, providing a data-driven approach to entering trades.

Stop Loss Trading Rules

The second rule is about setting a stop loss. In this strategy, the stop loss is set at the highest point of the previous nine candles. This rule is crucial as it helps limit potential losses if the market moves against the trade. A stop loss is like a safety net, protecting traders from significant losses. It’s important to remember that while trading can be profitable, it also comes with risks. Therefore, having a stop loss in place is a key risk management strategy that can prevent a single trade from wiping out a significant portion of the trading account.

Final Thoughts on The Trading Rules

The final rule concerns the exit of a trade. The position is closed when an exit arrow is printed, and the trade is in profit. This rule ensures that profits are locked in before the market can reverse. It’s like cashing in your chips when you’re ahead in a game of poker. By adhering to this rule, traders can ensure they don’t let profitable trades turn into losing ones due to market reversals. These rules, while simple, provide a clear and effective framework for trading. By following them, traders can navigate the markets with a clear plan, making their trading journey less stressful and more profitable.

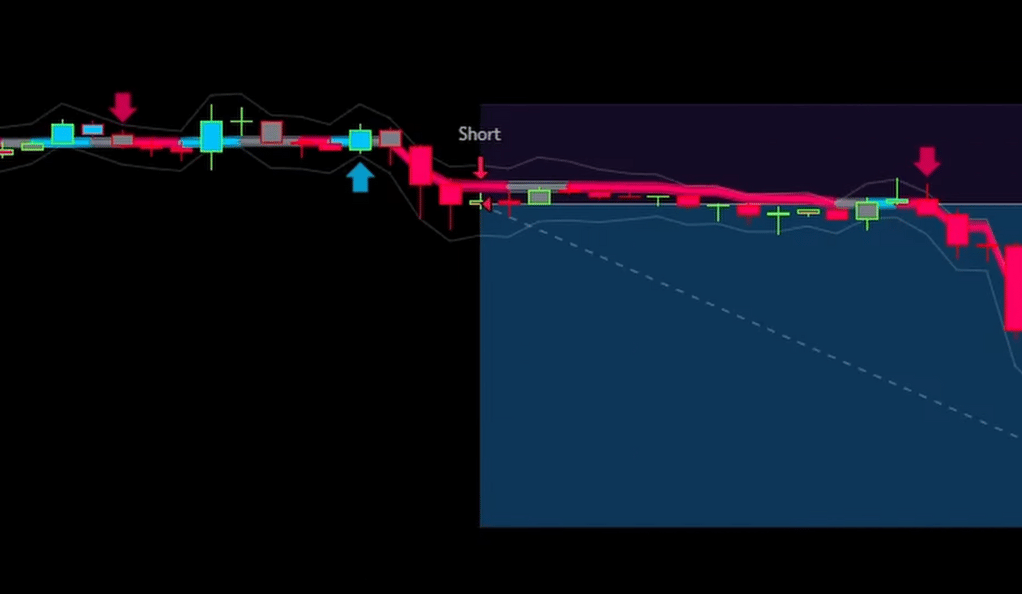

Short Entry

The short entry trading rule is a key component of the strategy we’re discussing. It’s initiated when a sell signal is received from the indicators. This signal is a data-driven prompt suggesting that the asset’s price is likely to decrease. Upon receiving this signal, a short trade is entered. This means that the trader sells the asset with the expectation that they can buy it back at a lower price in the future, thus making a profit from the price decrease. It’s crucial to remember that this rule, like all trading rules, should be used in conjunction with proper risk management techniques, such as setting a stop loss, to protect against significant losses if the market moves in the opposite direction.

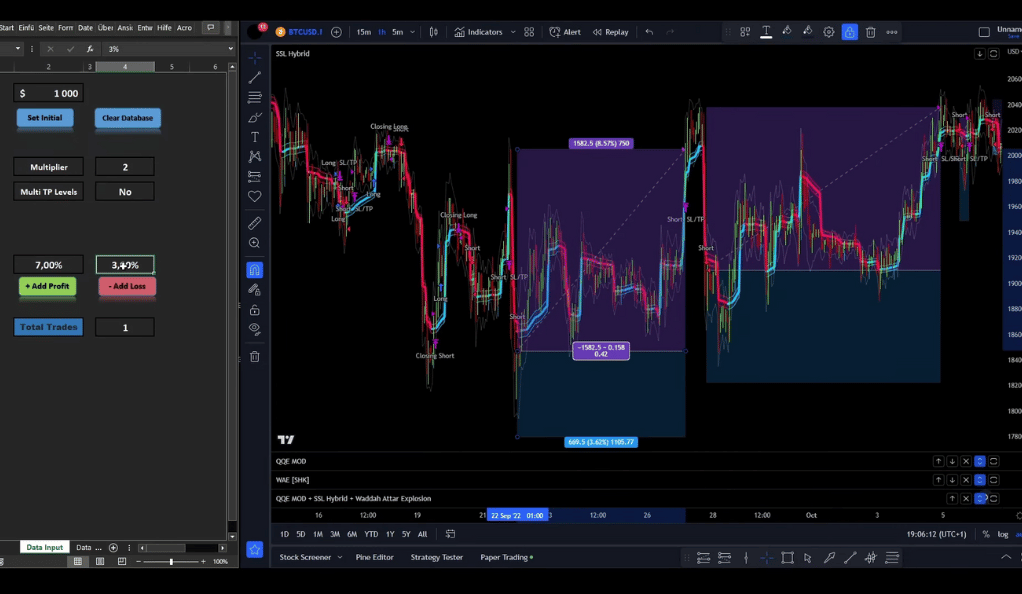

The Backtesting Process

The backtesting process is where the rubber meets the road in strategy development. It’s where the strategy, with all its rules and indicators, is tested on historical data. In this strategy, the backtesting was conducted with an initial balance of $1,000 and a leverage of 2x. Leverage is a tool that allows traders to control larger positions with a smaller amount of money. It can amplify potential profits, but it can also amplify potential losses, making it a double-edged sword that should be used with caution. The backtesting process involves running the strategy on the historical data, recording the trades, and analyzing the results.

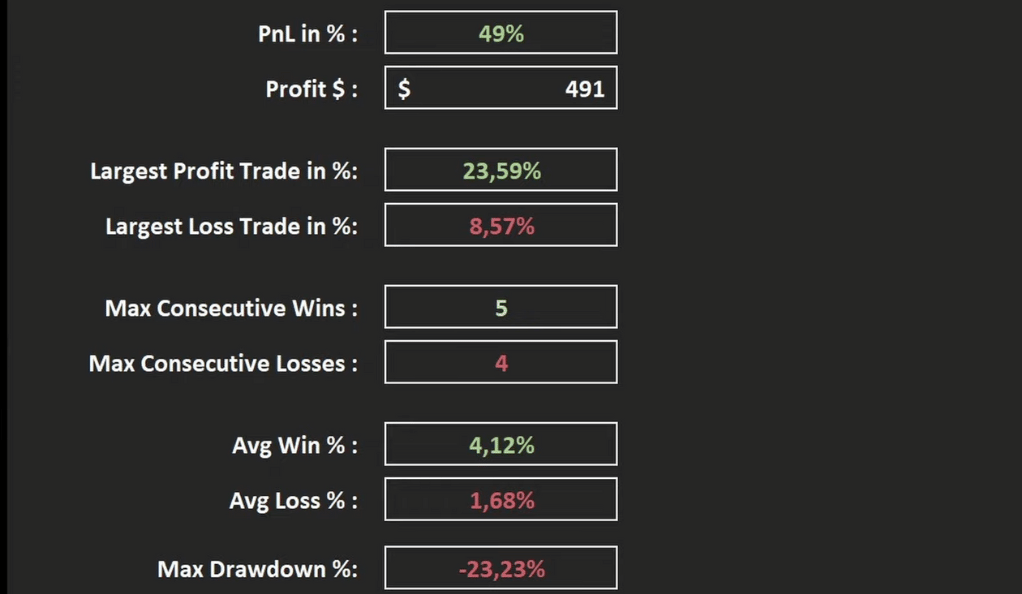

After 100 trades, the results of the backtesting process were analyzed. The account size, which started at $1,000, grew to almost $1,500. This growth shows the potential profitability of the strategy. The win rate, which is the percentage of trades that were profitable, was 53%. This means that more than half of the trades were profitable, indicating the effectiveness of the strategy. The maximum drawdown, which is the largest drop in account value, was 23%. This value is an important measure of risk, and it’s something traders should keep an eye on. The backtesting process, while time-consuming, provides valuable insights into the strategy’s potential performance, helping traders refine their strategies and make more informed trading decisions.

The Results

The results of the backtest were promising. Despite some initial bad trades, the equity curve, which is a graphical representation of the account value over time, looked good. After 100 trades, the account size increased by almost 50%. This growth shows the potential profitability of the strategy. The win rate of 53% is decent, indicating that the strategy was successful more than half of the time. The maximum drawdown of 23% is manageable, but it’s something that traders should keep an eye on. It’s important to remember that while the results are promising, they are based on historical data, and past performance is not always indicative of future results.

The Takeaway

Backtesting is an invaluable tool for any trader. It allows us to test our strategies using historical data, giving us an idea of how they might perform in the future. The strategy we discussed today showed promising results in the backtest. However, remember that past performance is not always indicative of future results. Always use proper risk management and never risk more than you can afford to lose. Backtesting is not a guarantee of future success, but it does provide valuable insights that can help us refine our strategies and make more informed trading decisions.

Conclusion

In conclusion, backtesting is a crucial step in developing and refining your trading strategy. It provides valuable insights into how your strategy would have performed in the past, helping you make informed decisions about its potential future performance. The strategy we discussed today is just one of many that can be backtested. So, why not give backtesting a try? It might just be the key to your trading success! Remember, successful trading is not just about making profitable trades. It’s also about continuous learning and improvement, and backtesting is a powerful tool in that journey.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)