In the ever-evolving landscape of Forex trading, strategies are the linchpin that holds successful trading together. One such strategy that has been making significant strides in the trading community is the Heikin Ashi RSI trading strategy. This strategy, originally discovered on the “Trade IQ” channel, is a 1-minute scalping strategy that has reportedly made an astounding 1741% profit with a win rate of 74%. Intriguing, isn’t it? Let’s delve deeper into this strategy, dissect its components, and understand its workings.

The Indispensable Trio: The Indicators

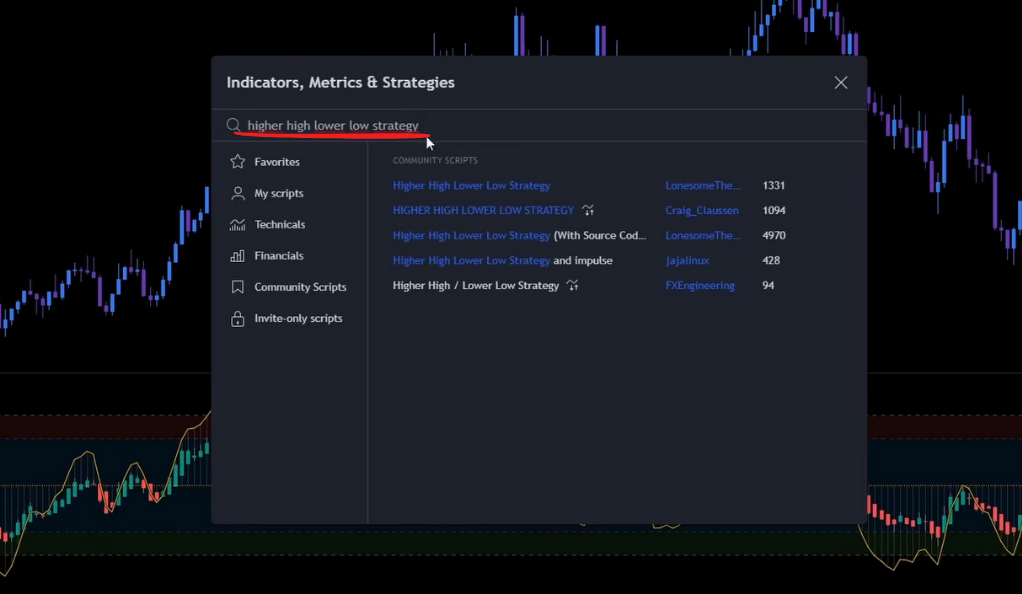

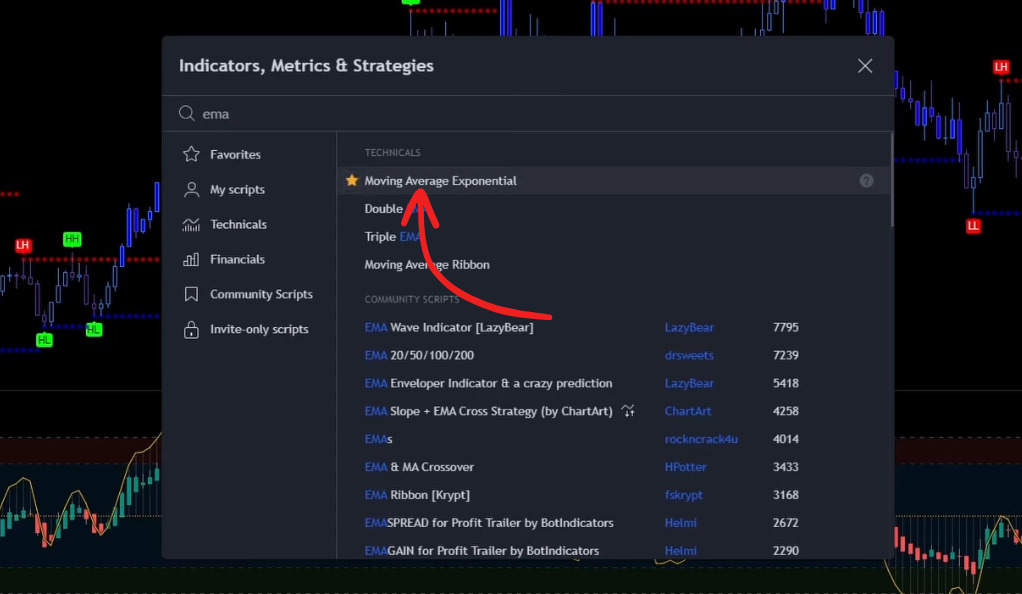

The Heikin Ashi RSI strategy is built upon the foundation of three free Tradingview Indicators. These are the Heikin Ashi RSI Oscillator by Jay Rogers, the Higher High Lower Low Strategy by LoneSome, and the Exponential Moving Average. When used in unison, these indicators create a potent synergy that forms the backbone of this strategy.

Heikin Ashi RSI Oscillator: The Trend Identifier

The Heikin Ashi RSI Oscillator is a unique blend of the traditional Heikin Ashi and RSI indicators. It provides a smoothed version of the RSI, which helps to eliminate market noise and focus on the main trends. This oscillator is crucial in identifying potential entry points for trades, making it an essential part of the strategy.

Higher High Lower Low Strategy: The Trend Tracker

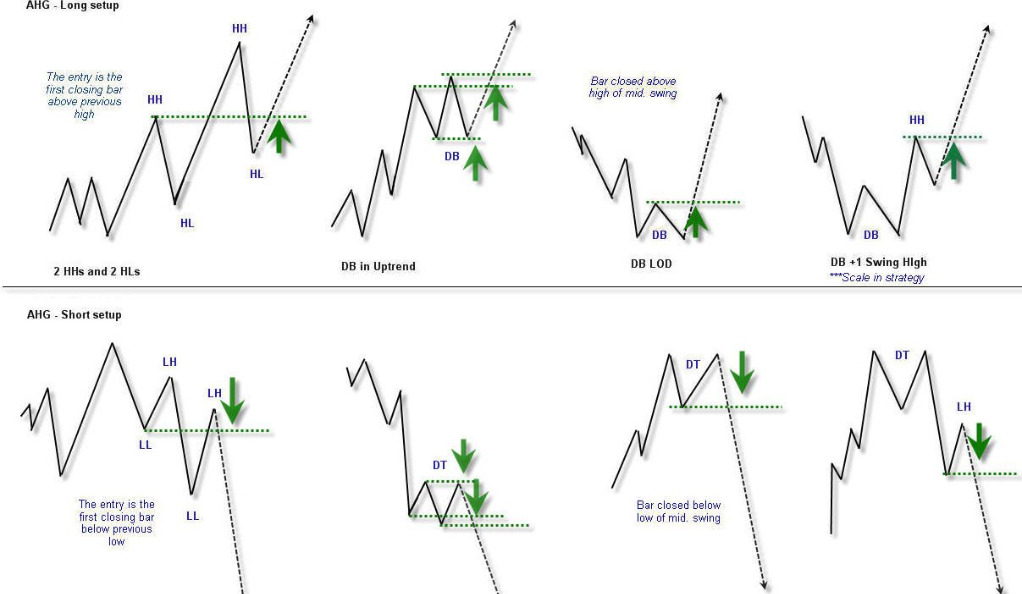

The Higher High Lower Low Strategy is a simple yet effective tool that helps traders identify the direction of the trend. It does this by marking higher highs and lower lows on the chart. This indicator is instrumental in confirming the trend direction and ensuring that trades are placed in alignment with the trend, thus increasing the probability of successful trades.

Exponential Moving Average: The Trend Filter

The Exponential Moving Average (EMA) is a type of moving average that gives more weight to recent data. This makes it faster to respond to price changes, making it ideal for this fast-paced scalping strategy. The EMA acts as a trend filter in this strategy, ensuring that trades are only taken in the direction of the prevailing trend.

The EMA as a Trend Filter

In the Heikin Ashi RSI strategy, the EMA serves as a trend filter. But what does this mean? A trend filter is a tool that helps traders identify the direction of the market trend and ensure that trades are placed in alignment with this trend. Trading in the direction of the trend increases the probability of successful trades, as it’s often easier to predict the continuation of an existing trend than to predict when the trend will change.

In the case of the Heikin Ashi RSI strategy, the EMA helps to identify the overall trend direction. If the price is above the EMA, it indicates an upward trend, suggesting that it might be a good time to consider entering a long position. Conversely, if the price is below the EMA, it indicates a downward trend, suggesting that it might be a good time to consider entering a short position.

The EMA in the Heikin Ashi RSI Strategy

In the Heikin Ashi RSI strategy, the EMA plays a crucial role in determining whether to enter a long or short position. For a long entry, the price action must be above the 200-EMA-Line. This ensures that the trade is taken in the direction of the prevailing upward trend. For a short entry, the price action must be below the 200-EMA-Line, indicating a downward trend.

By acting as a trend filter, the EMA helps to filter out false signals and increase the strategy’s effectiveness. It ensures that trades are only taken when the market conditions are favorable, thereby increasing the chances of a successful trade.

The Trading Rules: Long Entry

The trading rules for a long entry in the Heikin Ashi RSI strategy are straightforward yet effective. First, the price action must be above the 200-EMA-Line. This ensures that the trade is taken in the direction of the prevailing trend, thus increasing the probability of a successful trade. Second, the Heikin Ashi RSI must get oversold, indicated by the candlestick either touching or entering the green zone. This is a sign that the price may soon reverse in the upward direction. Third, a green candlestick must be printed by the Heikin Ashi RSI oscillator. This is the entry signal. To confirm the long entry, a bullish candlestick must be printed on the chart. Finally, the last signal printed by the higher high lower low indicator must be a higher high. If all these conditions are met, a long position is entered with the stop loss at the recent swing low.

The Trading Rules: Short Entry

The rules for a short entry are the mirror image of the long entry rules. The price action must be below the 200-EMA-Line, indicating a downward trend. The Heikin Ashi RSI must get overbought, suggesting that the price may soon reverse in the downward direction. A red candlestick must be printed by the Heikin Ashi RSI oscillator, serving as the entry signal. To confirm the short entry, a bearish candlestick must be printed on the chart. Finally, the last signal printed by the higher high lower low indicator must be a lower low. If all these conditions are met, a short position is entered with the stop loss at the recent swing high.

Backtesting: The Key to Confidence

Backtesting is a crucial part of any trading strategy. It involves testing the strategy on historical data to see how it would have performed. This process provides valuable insights into the strategy’s effectiveness and helps build confidence in its potential. The Heikin Ashi RSI strategy was backtested with 100 trades, starting with an initial balance of 1000 USD and risking 2% per trade. The results were quite promising, with a win rate of 54% and a profit of 8.7%. The account grew to 1086 USD after 100 trades, demonstrating the strategy’s potential for account growth.

Consistency: The Hallmark of Successful Trading

In trading, consistency is key. The Heikin Ashi RSI strategy demonstrated this with 4 consecutive wins and 5 consecutive losses. While losses are inevitable in trading, the ability to string together consecutive wins can significantly boost a trader’s confidence and account balance. This consistency is a testament to the strategy’s robustness and its potential for long-term success.

Ranking and Performance: A Comparative Analysis

When compared to 37 other strategies, the Heikin Ashi RSI strategy ranked 9th with 7 points. This shows that while it may not be the top-performing strategy, it holds its own in the competitive world of Forex trading. This ranking is a testament to the strategy’s effectiveness and its potential to deliver consistent results.

The Performance: A Consistent Track Record

The consistent performance of the Heikin Ashi RSI strategy further underscores its potential. In backtesting, the strategy demonstrated a win rate of 54% and a profit of 8.7%. This consistent performance suggests that the strategy has the potential to deliver steady returns over time.

While past performance is not a guarantee of future results, a consistent track record is a positive sign. It indicates that the strategy has been able to navigate various market conditions and deliver consistent results, suggesting that it has the potential to do so in the future as well.

The Potential: A Look into the Future

The ranking and performance of the Heikin Ashi RSI strategy indicate its potential to deliver consistent results. While past performance is not a guarantee of future results, it provides a glimpse into the strategy’s potential. The strategy’s ability to rank 9th out of 37 strategies shows that it has the potential to perform well in various market conditions.

Conclusion

In conclusion, the Heikin Ashi RSI trading strategy is a powerful tool in the hands of a Forex trader. With its unique combination of indicators and clear trading rules, it provides a structured approach to trading. While it may not be the holy grail of trading strategies, its performance in backtesting shows that it has the potential to deliver consistent results. The strategy’s ability to deliver consecutive wins and its respectable ranking among other strategies further underscore its potential. So, are you ready to dive into the world of Heikin Ashi RSI trading and harness its potential?

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)