The world of financial trading can often seem like a labyrinth to the uninitiated. With its unpredictable market trends and high stakes, it can be a daunting venture, especially for those who are new to the game. However, with the right tools, a disciplined approach, and a dash of patience, trading can transform from a daunting task into a profitable venture. One such tool that has been gaining traction among traders is backtesting. But what exactly is backtesting, and how can it be applied to different markets? Let’s delve deeper into this intriguing concept.

Backtesting: A Crucial Ingredient in the Recipe for Trading Success

Backtesting is a method used by traders to evaluate the effectiveness of a trading strategy. It involves simulating trades using historical market data, which provides traders with a glimpse of how a particular strategy would have performed in the past. This invaluable information allows traders to fine-tune their strategies, making necessary adjustments before risking their capital in live trading. Backtesting, therefore, serves as a safety net, helping traders to avoid potential pitfalls and maximize their profits. It’s like a time machine, allowing traders to travel back in time and see how their strategies would have played out.

The Secret Trading Strategy: A Versatile Approach

In the dynamic world of financial trading, having a versatile strategy that can adapt to various market conditions and timeframes is a significant advantage. The secret trading strategy we’re discussing here fits this description perfectly. It’s a flexible approach that can be applied to any market, including but not limited to cryptocurrencies, forex, options, and stocks. But what makes this strategy so adaptable and effective? Let’s delve deeper into its components and workings.

The Universality of the Secret Trading Strategy

One of the key strengths of this secret trading strategy is its universality. It’s not confined to a specific market or timeframe. Whether you’re trading Bitcoin on a one-hour chart, speculating on forex markets on a daily chart, or investing in stocks on a weekly chart, this strategy can be applied effectively. This versatility makes it a valuable tool for traders operating in different markets and timeframes.

The Power of Two: Smooth Heiken Ashi Candles and Heiken Ashi RSI Oscillator

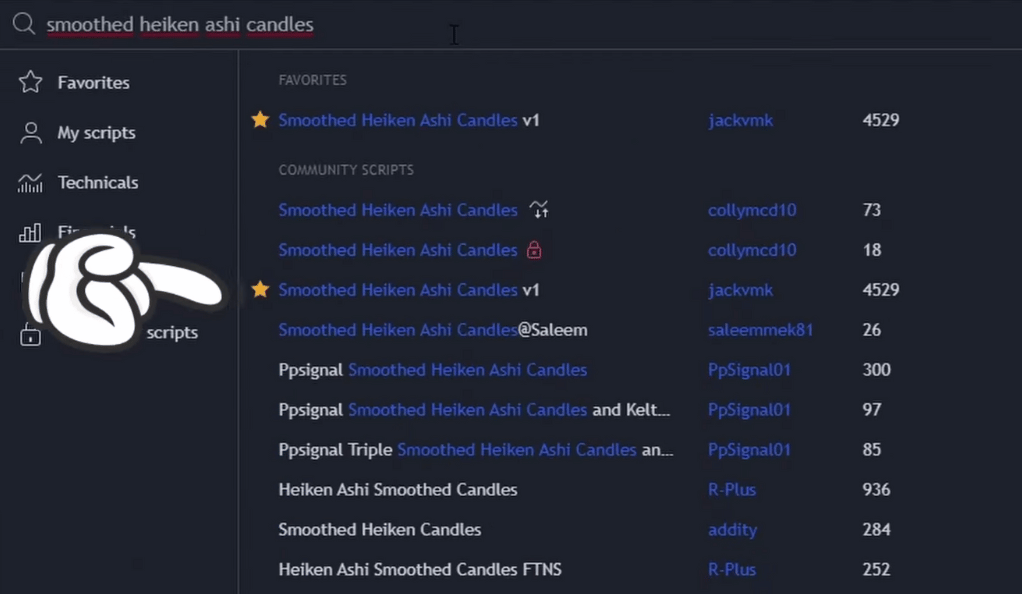

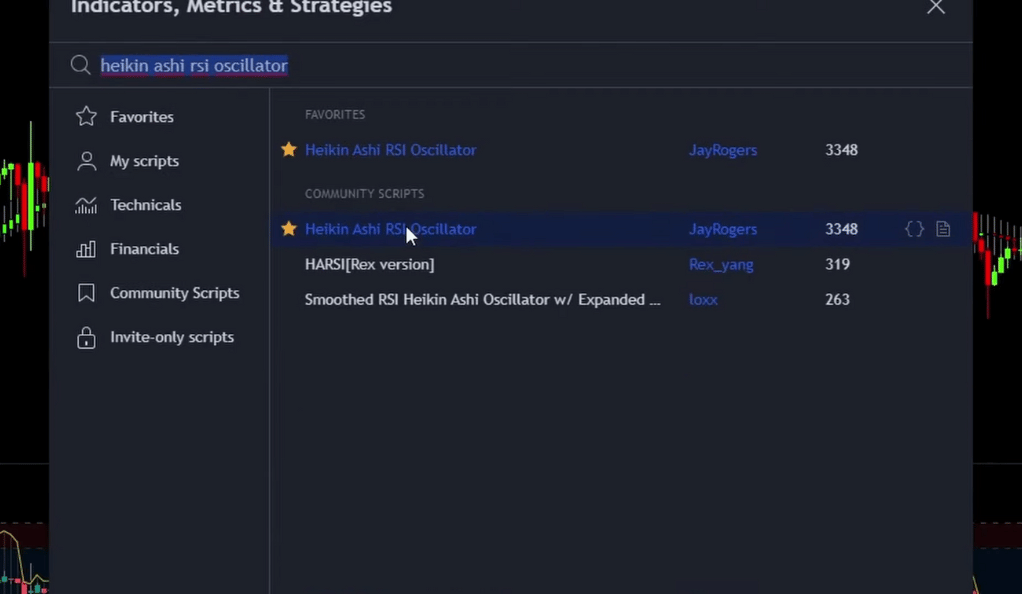

The secret trading strategy hinges on two powerful yet freely available indicators: the Smooth Heiken Ashi Candles and the Heiken Ashi RSI Oscillator. These indicators, when used in tandem, form the backbone of this strategy, providing traders with a comprehensive understanding of market trends and potential entry and exit points.

Smooth Heiken Ashi Candles

The Smooth Heiken Ashi Candles indicator is used to determine the overall trend or directional bias of the market. If the candle is green, it signals a bullish market, suggesting a potential long entry. Conversely, if the candle is red, it indicates a bearish market, suggesting a potential short entry. This indicator helps traders to align their trades with the prevailing market trend, increasing the probability of successful trades.

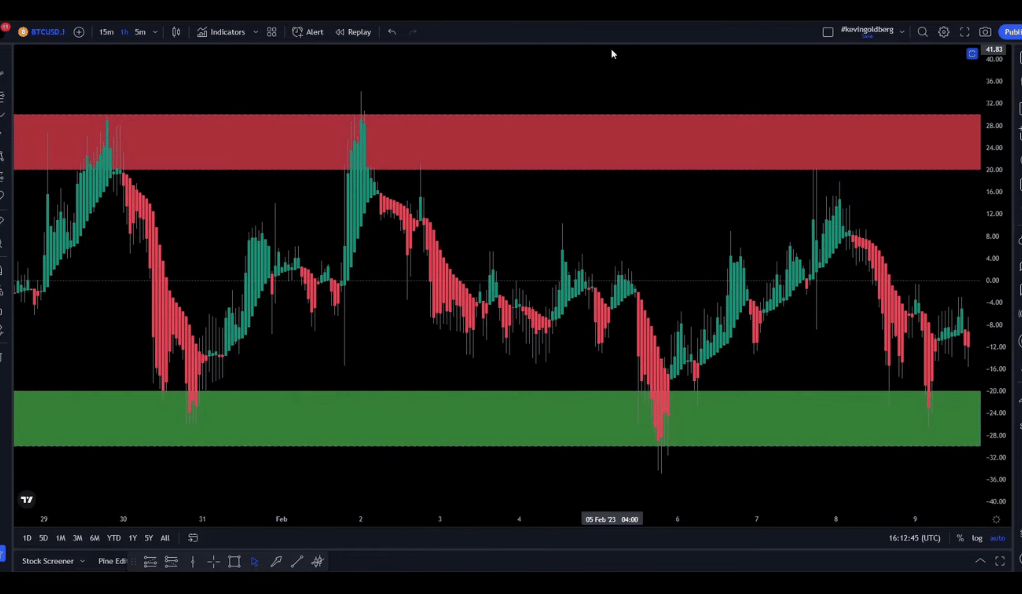

Heiken Ashi RSI Oscillator

The Heiken Ashi RSI Oscillator complements the Smooth Heiken Ashi Candles by providing a confirmation of the entry signals. If the oscillator is green, it confirms the entry of a long position. If it’s red, it confirms the entry of a short position. This oscillator acts as a second layer of confirmation, reinforcing the trading decisions and minimizing the risk of false signals.A Comprehensive Understanding of Market Trends

Smooth Heiken Ashi Candles: Your Compass in the Market Jungle

The Smooth Heiken Ashi Candles indicator is a crucial component of this strategy. It helps traders determine the directional bias or the overall trend of the market. If the candle is green, it signals a bullish market, prompting traders to look for a long entry. Conversely, if the candle is red, it indicates a bearish market, suggesting a short entry. This indicator, therefore, serves as a compass, guiding traders in the right direction amidst the often chaotic market trends.

Heiken Ashi RSI Oscillator: The Confirmation You Need

The Heiken Ashi RSI Oscillator complements the Smooth Heiken Ashi Candles indicator by providing a confirmation of the entry signals. If the oscillator is green, it confirms the entry of a long position. If it’s red, it confirms the entry of a short position. This indicator acts as a second layer of confirmation, reinforcing the trading decisions and minimizing the risk of false signals. It’s like a trusted friend, always there to provide a second opinion when you need it.

The Role of the Heiken Ashi RSI Oscillator

The Heiken Ashi RSI Oscillator serves as a confirmation tool in the trading strategy. Its primary role is to confirm the entry signals provided by the Smooth Heiken Ashi Candles indicator. In essence, it acts as a second opinion, reinforcing the trading decisions made based on the Smooth Heiken Ashi Candles indicator.

Understanding the Signals

The Heiken Ashi RSI Oscillator provides signals in a simple and easy-to-understand manner. If the oscillator turns green, it’s confirming the entry of a long position. This means that the market trend is bullish, and it’s an opportune time to buy. Conversely, if the oscillator turns red, it confirms the entry of a short position. This indicates a bearish market trend, suggesting that it might be a good time to sell.

Minimizing the Risk of False Signals

One of the significant advantages of the Heiken Ashi RSI Oscillator is its ability to minimize the risk of false signals. In trading, false signals can lead to misguided trading decisions, which can result in losses. By providing a second layer of confirmation, the Heiken Ashi RSI Oscillator helps to filter out potential false signals from the Smooth Heiken Ashi Candles indicator. This double-check mechanism ensures that traders are making informed decisions based on reliable signals.

The Heiken Ashi RSI Oscillator as a Trusted Companion

In the often turbulent seas of trading, the Heiken Ashi RSI Oscillator acts as a trusted companion. It’s always there, providing a second opinion when you need it the most. It’s like having a seasoned trader by your side, guiding you through the complex world of financial markets. With its ability to confirm entry signals and minimize the risk of false signals, the Heiken Ashi RSI Oscillator is an invaluable tool in any trader’s arsenal.

Trade Execution: The Art and Science of Making the Right Moves

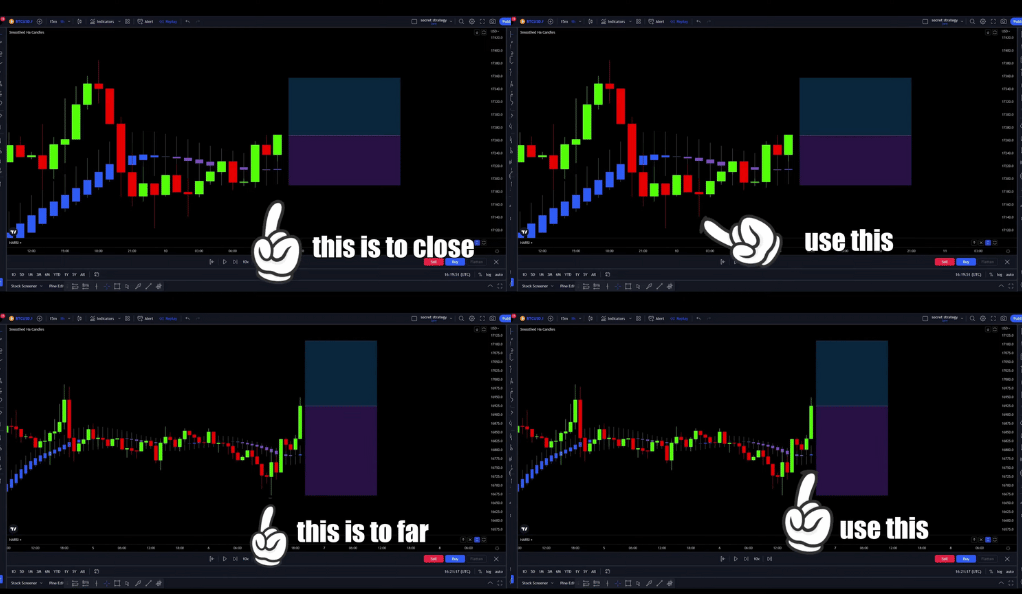

Once the indicators are set up, and the market trends are identified, it’s time to execute the trades. The stop loss is set at the recent swing low (for long trades) or high (for short trades), or below/above the Smooth Heiken Ashi Candles. Instead of setting a specific target, the strategy involves closing 50% of the position when the wick of the RSI indicator touches the overbought (for long trades) or oversold (for short trades) zone. The remaining position is closed when the RSI candles turn red (for long trades) or green (for short trades). This approach ensures that traders can maximize their profits while minimizing their risks.

Risk Management: The Lifeline of Successful Trading

Risk management is the lifeline of any successful trading strategy. It involves limiting potential losses by setting a stop loss at the right level. If the Smooth Heiken Ashi candle is too close to the entry candle, the stop loss is placed at the recent swing. If the recent swing is too far away from the entry, the stop loss is placed at the Smooth Heiken Ashi. This ensures that traders are not risking more than they’re willing to lose, thereby preserving their capital. It’s like an insurance policy, protecting traders from potential financial disasters.

Backtesting Results: The Moment of Truth

The backtesting of this strategy was conducted over 100 setups within five months, starting with an initial balance of $1,000 and using 2x leverage. The results were promising. The win rate was 47%, and the account growth was a whopping 185.6%, ending with a balance of $2,856. These results underscore the potential of this strategy when applied with discipline and proper risk management. It’s like a report card, providing a clear picture of the strategy’s performance.

Conclusion

Backtesting is a potent tool in a trader’s arsenal. It provides a safety net, allowing traders to test their strategies without risking their capital. The secret trading strategy discussed in this article, which uses the Smooth Heiken Ashi Candles and the Heiken Ashi RSI Oscillator, has shown promising results in backtesting. However, it’s crucial to remember that while backtesting can provide valuable insights, it does not guarantee future performance. Always use proper risk management and consult with a financial advisor before making investment decisions. After all, in the world of trading, knowledge is power, and caution is the key to survival.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)