In the ever-changing landscape of trading, having a firm grasp of market trends is essential for success. Traders commonly classify markets into two main categories: trending and ranging. While trending markets exhibit clear directional movements, ranging markets, also known as sideways markets, lack a well-defined trend and fluctuate within a specific price range. This informative article aims to shed light on ranging markets, offering valuable insights and strategies to help traders identify and capitalize on such market conditions.

Understanding ranging markets is crucial as they present distinct opportunities and challenges compared to trending markets. In a ranging market, price movements oscillate between established support and resistance levels, forming a trading range. Traders can employ various strategies to take advantage of these market conditions. Some effective approaches include range trading, which involves buying near support and selling near resistance, and breakout trading, where traders aim to capitalize on price breaking out of the established range. Additionally, using technical indicators, such as oscillators like the Relative Strength Index (RSI) or the Moving Average Convergence Divergence (MACD), can provide further insights into potential entry and exit points within a ranging market.

By familiarizing themselves with the concepts and strategies outlined in this article, traders can enhance their ability to identify and profit from ranging markets. Recognizing when the market is in a ranging phase and implementing appropriate tactics can lead to more informed trading decisions and improved outcomes. Ultimately, by harnessing the potential of ranging markets, traders can navigate the complexities of the trading world with greater confidence and achieve their financial goals.

What is a Ranging Market?

In the world of financial markets, a ranging market refers to a specific market condition where the price of a financial instrument experiences erratic movements without a discernible trend. In other words, instead of displaying a clear upward or downward trajectory like in a trending market, the price fluctuates within a defined range. This range is typically determined by identifiable support and resistance levels. Traders often encounter ranging markets during periods of consolidation or indecision in the market, where buying and selling pressures are relatively balanced.

Identifying a ranging market is crucial for traders as it requires a different approach and set of strategies compared to trending markets. In a ranging market, traders need to be cautious about entering trades based on the assumption of a sustained trend. Instead, they focus on capitalizing on the price oscillations within the established range. This can be done through range trading, which involves buying near support levels and selling near resistance levels. Traders may also use technical indicators such as Bollinger Bands or the Average True Range (ATR) to gauge the volatility within the range and identify potential entry and exit points.

Understanding and adapting to ranging markets is an important skill for traders. By recognizing the characteristics of a ranging market and employing appropriate strategies, traders can navigate these price fluctuations more effectively and potentially profit from the opportunities presented by these market conditions. It is important to note that ranging markets can transition into trending markets or vice versa, so traders should always stay vigilant and adjust their strategies accordingly.

Identifying Ranging Markets

Identifying a ranging market requires a keen eye on the market structure. Traders look for shifts in the market structure, such as when an uptrend or downtrend fails to continue making higher highs or lower lows, respectively. This shift indicates a transition from a trending to a ranging market.

Market Structure: The Key to Spotting Ranging Markets

The market structure is the foundation of identifying ranging markets. In an uptrend, the price forms higher highs and higher lows. In a downtrend, it forms lower highs and lower lows. When the price fails to continue this pattern, it’s a signal that the market might be ranging.

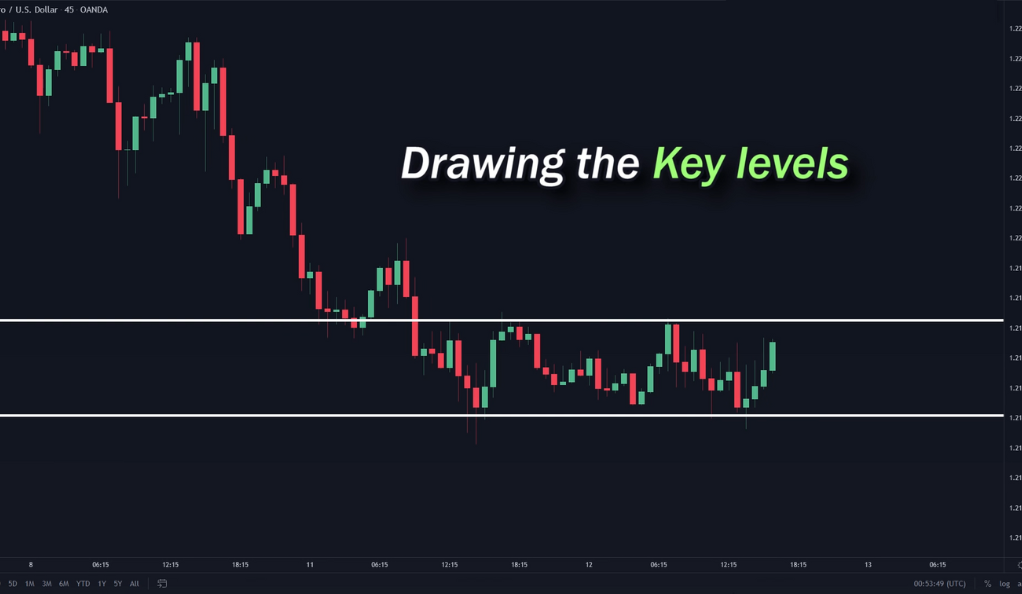

Drawing Key Levels in Ranging Markets

In a ranging market, drawing key levels of resistance and support is a fundamental step for traders. These levels provide valuable insights into the boundaries of the price range and establish the trading zone. Resistance levels are price levels where selling pressure is expected to be significant, preventing the price from rising further. On the other hand, support levels are price levels where buying pressure is anticipated to be strong enough to prevent the price from falling further. By identifying and marking these levels on a price chart, traders gain a visual representation of the range within which the price is oscillating.

Drawing key levels in a ranging market requires careful analysis of historical price action. Traders typically look for areas where the price has previously encountered resistance or support and use those levels as a reference. These levels can be identified by observing price bounces, consolidation zones, or areas where the price has exhibited a strong reaction in the past. Once the key levels are drawn, traders can monitor price behavior around these levels to gauge potential trading opportunities. For example, buying near support and selling near resistance can be a viable strategy for traders looking to capitalize on the price movements within the established range.

By drawing key levels in a ranging market, traders can visually define the boundaries of the trading zone and better navigate price fluctuations. These levels act as crucial reference points for making trading decisions, including identifying potential entry and exit points, setting stop-loss orders, and assessing the risk-reward ratio of a trade. Keeping a close eye on price reactions around these levels can provide valuable insights into market sentiment and help traders make more informed trading decisions within a ranging market environment.

Resistance and Support: The Pillars of Ranging Markets

Resistance and support levels are the pillars of ranging markets. They define the trading zone and provide traders with potential entry and exit points.

Finding Entry Signals in Ranging Markets

In a ranging market, traders can take advantage of the price bouncing off key levels for entry signals. It’s also important to keep an eye on new key levels that may form, as the price doesn’t have to react to just one key level exclusively.

Bouncing Off Key Levels: The Entry Signal

The price bouncing off key levels provides an entry signal for traders. This pattern can be a powerful tool in a trader’s arsenal, allowing them to capitalize on the price fluctuations within the range.

Trading Narrow Ranging Markets

rading in narrow ranging markets, where the distance between the upper and lower levels of the range is relatively small, requires a specific approach due to the limited price movement. In such market conditions, a breakout strategy is often recommended to capture potential opportunities.

A breakout strategy involves monitoring the price closely and waiting for it to break out of the established range. Traders can set entry orders slightly above the resistance level or below the support level, anticipating a breakout in either direction. This strategy aims to take advantage of the potential surge in momentum and volatility that can occur when the price breaks out of the narrow range.

When implementing a breakout strategy in narrow ranging markets, it is important to consider other factors that can influence the success of the trade. Traders often analyze volume patterns to confirm the strength of the breakout. Higher trading volume during a breakout can provide validation and increase the likelihood of a sustained move in the direction of the breakout.

Risk management is crucial when trading narrow ranging markets with a breakout strategy. Traders should set stop-loss orders to limit potential losses if the breakout fails and the price retraces back into the range. Additionally, it is important to adjust position sizing and consider the risk-reward ratio before entering a trade to ensure a balanced and controlled approach.

Breakout Strategy: The Answer to Narrow Ranging Markets

A breakout strategy is an effective way to trade narrow ranging markets. It involves entering a position before a breakout happens, allowing traders to profit from the subsequent price movement.

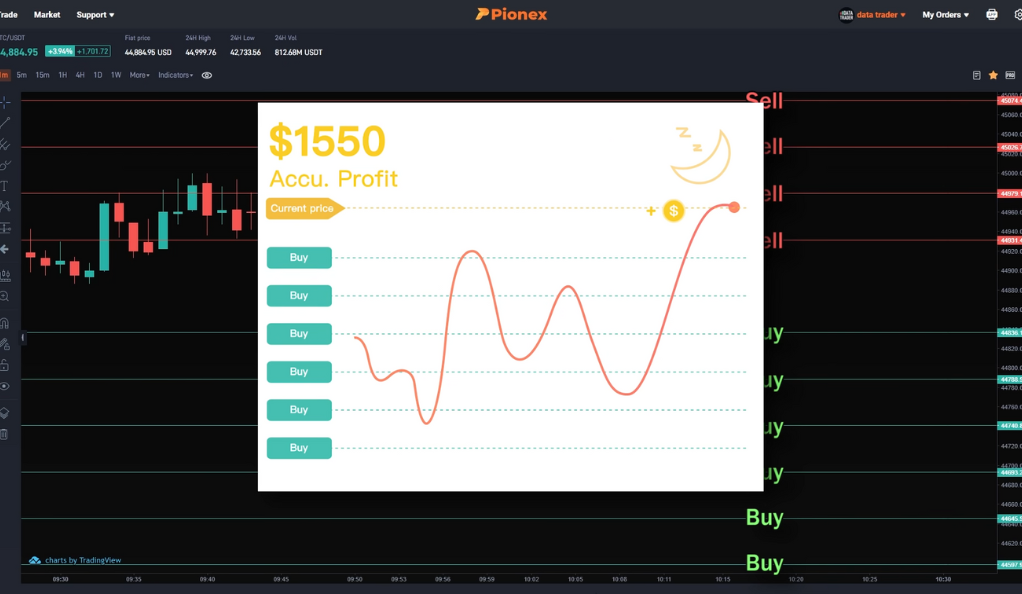

Using Grid Bots in Ranging Markets

In the era of automated trading, grid bots have emerged as a powerful tool for trading in ranging markets. These bots automatically place a series of buy and sell orders above and below the price, forming a grid shape.

Grid Bots: The Automated Solution

Grid bots buy as the price goes down and sell for profit as the price goes up. They are fully automated, making them perfect for traders who prefer not to trade manually.

Setting Up a Grid Bot on Pinex

Pinex, a cryptocurrency exchange, offers a free grid bot. Setting up a grid bot on Pinex involves identifying an asset that is currently moving within range, drawing key levels, and applying the grid bot.

Step-by-Step Guide to Setting Up a Grid Bot on Pinex

The process of setting up a grid bot on Pinex is straightforward. It involves identifying the asset to trade, drawing the key levels, and applying the grid bot.

Conclusion

Understanding and profiting from ranging markets requires a blend of technical analysis, strategic planning, and the right tools. By identifying ranging markets, drawing key levels, finding entry signals, and using tools like grid bots, traders can turn the challenges of ranging markets into profitable opportunities. Remember, while these strategies can be helpful, trading in any market involves risk, and it’s important to do your own research and consider seeking advice from financial advisors.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)