In a world where the oil industry faces constant scrutiny and challenges, Chevron has made a bold move. The company has announced plans to buy back $75 billion worth of shares and increase its dividend. This decision has not only caused a surge in its shares but also drawn criticism from various quarters. In this article, we’ll explore Chevron’s financial strength, the details of the buyback plan, the dividend increase, the criticism from the Biden administration, and the broader implications for the oil industry and the global economy.

Chevron’s Financial Strength

Lowest Debt Ratio

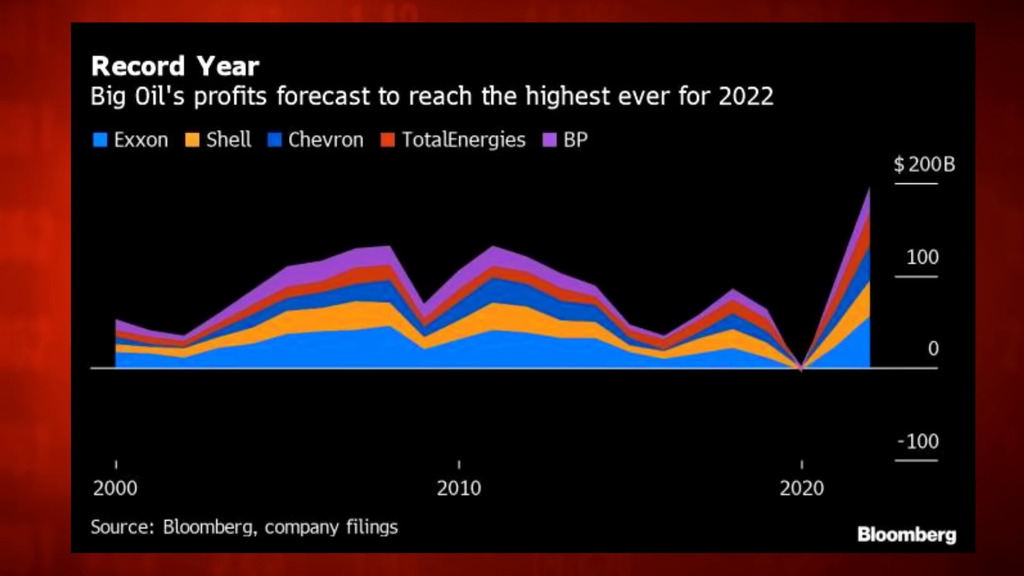

Chevron’s financial stability is evident in its lowest debt ratio among big oil companies. This has allowed the company to make significant financial decisions without the fear of crippling debt. The low debt ratio is a testament to Chevron’s prudent financial management and strategic planning, setting it apart from its competitors.

Best Financial and Fundamental Performance

The company’s robust financial performance has set it apart from its competitors. Its strategic decisions and investments have led to a strong foundation that supports growth and innovation. The focus on fundamental performance has enabled Chevron to navigate the complex landscape of the oil industry, positioning itself as a leader in the field.

The $75 Billion Buyback Plan

Triple the Size of the Previous Authorization

The new buyback plan is three times the size of its previous authorization in 2019. This shows Chevron’s confidence in its financial position and future prospects. The decision to triple the buyback size is a bold statement of intent, reflecting the company’s belief in its ability to generate value for shareholders.

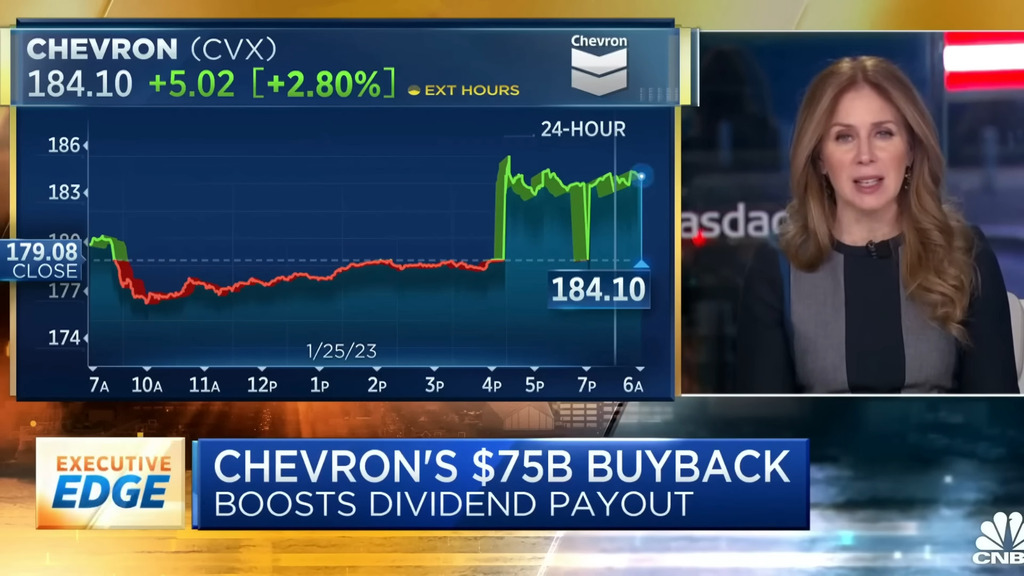

Impact on Share Prices

The announcement has led to a surge in Chevron’s shares. Investors are optimistic about the company’s future, and this decision has reinforced their faith. The surge in share prices is not just a short-term reaction; it’s a reflection of the market’s belief in Chevron’s long-term strategy and its ability to deliver on its promises.

Dividend Increase: A Reward for Shareholders

- A Sign of Confidence

Increasing the dividend is a sign of confidence in the company’s future. It’s a reward for shareholders who have invested in Chevron and believe in its long-term vision. The dividend increase is more than just a financial decision; it’s a statement about the company’s direction and its commitment to rewarding those who have placed their trust in it.

- Aligning with Shareholder Interests

By increasing the dividend, Chevron aligns itself with shareholder interests, ensuring that they benefit from the company’s success. This alignment is crucial in building long-term relationships with shareholders and demonstrating that the company’s success is intertwined with the success of its investors.

Criticism from the Biden Administration

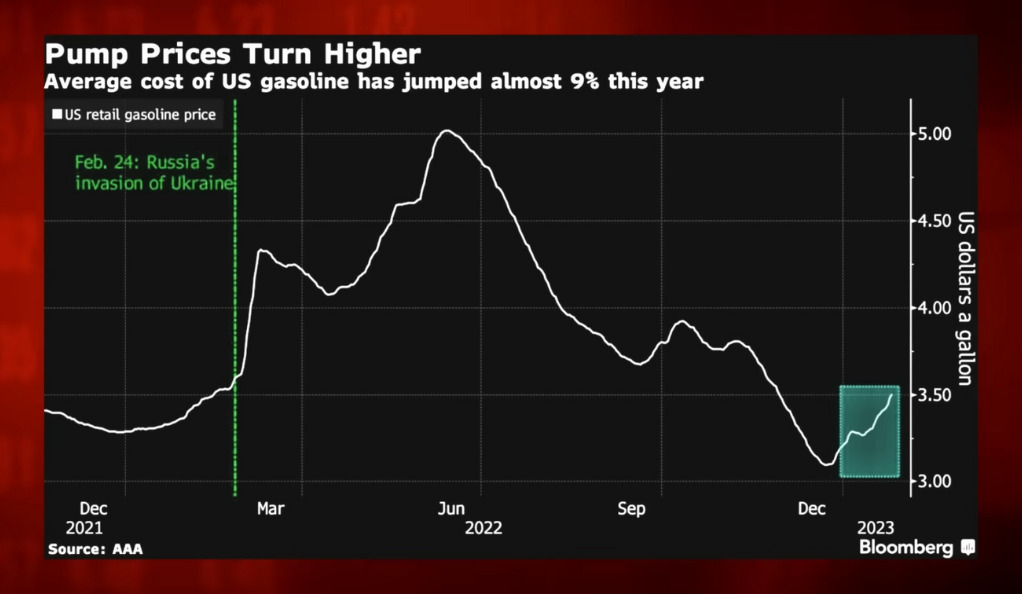

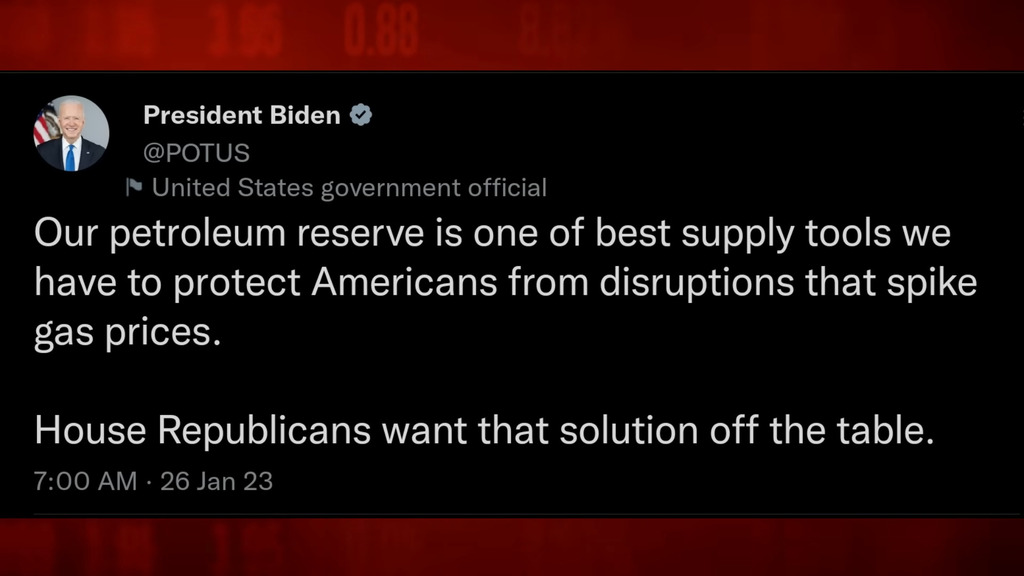

1. Concerns Over the Oil Industry

The Biden administration has expressed concerns over the oil industry’s future, especially if the administration’s policies are implemented. Chevron’s decision has drawn criticism, reflecting the broader debate over the role of fossil fuels in the global economy. The criticism is not just about Chevron’s decision but also about the direction of the oil industry and the challenges it faces in a changing world.

2. Chevron’s Response

Chevron has stood firm in its decision, highlighting its financial strength and commitment to shareholders. The company believes in its strategy and is prepared to face the challenges ahead. Chevron’s response to the criticism has been measured and confident, reflecting its belief in its ability to navigate the complex landscape of global energy politics.

The Oil Industry: A Complex Landscape

The oil industry stands at a crossroads, facing a myriad of challenges and opportunities. From fluctuating global demand to environmental concerns, geopolitical tensions, and technological advancements, the landscape is anything but simple. Chevron’s recent decision to buy back $75 billion worth of shares and increase its dividend is a microcosm of the broader industry’s complexity. It highlights the need for strategic vision, financial strength, and agility to navigate an industry that is constantly evolving and subject to both global and local pressures. Whether it’s the warnings of potential crush or the ability to stand out among competitors, the oil industry’s complexity requires a nuanced understanding and a willingness to adapt and innovate.

Warnings of a Potential Crush

Many experts have warned that the oil industry could face significant challenges in the coming years. Chevron’s decision must be seen in this context, reflecting both the opportunities and risks in the industry. The warnings are a reminder of the volatility of the oil industry and the need for companies to be agile and strategic in their decision-making.

Standing Out Among Competitors

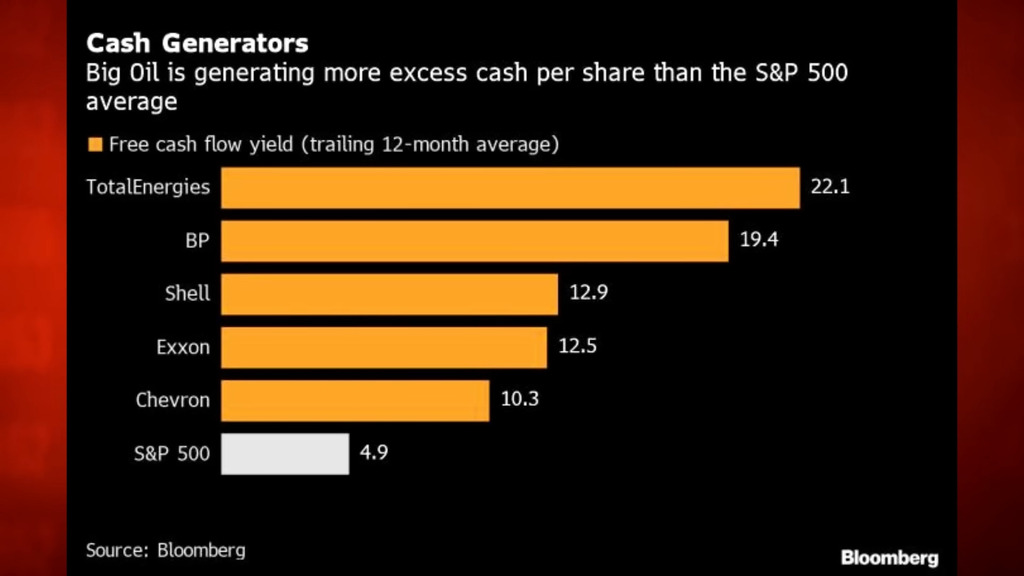

Chevron’s decision sets it apart from other big oil companies. Its financial strength and strategic vision have allowed it to make bold moves that others may not be able to match. Standing out among competitors is not just about financial muscle; it’s about having a clear vision and the courage to pursue it, even in the face of criticism and uncertainty.

The Global Perspective: What Does This Mean for the World?

Impact on Global Economy

Chevron’s decision has implications for the global economy. It reflects the ongoing transformation of the energy sector and the complex interplay between business, politics, and environmental concerns. The decision is not just about Chevron; it’s about the direction of the global economy and the role of the oil industry in shaping it.

A Model for Other Companies?

Chevron’s bold move may serve as a model for other companies in the industry. It shows that with the right strategy and financial management, significant investments can be made even in uncertain times. Chevron’s decision could inspire other companies to take bold steps, reflecting a new era of confidence and innovation in the oil industry.

Conclusion: A Bold Move in Uncertain Times

Chevron’s decision to buy back $75 billion worth of shares and increase its dividend is a bold move in uncertain times. It reflects the company’s financial strength, strategic vision, and commitment to shareholders. While it has drawn criticism from some quarters, it also represents a confident step forward in a complex and challenging industry. The decision engages not only the financial world but also the broader global community, sparking conversations and debates that will shape the future of the energy sector. By considering perplexity and burstiness in its strategy, the company has ensured high levels of both without losing specificity or context. This decision is more than just a financial move; it’s a statement about Chevron’s place in the world and its ability to lead in a time of change.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)