The global economy is a complex, interconnected web of moving parts. Like the pieces of a puzzle, when one part moves, the entire picture can shift. Whether you’re an investor, a policy-maker, or a consumer, it’s important to stay ahead of the curve, understanding and anticipating these shifts. Today, we’re diving deep into some of the most significant trends in the current economic climate.

SpaceX Rockets and the Economic Butterfly Effect

We begin our odyssey in an unexpected sphere: the world of aerospace technology, specifically focusing on the recent mid-air disassembly, or as it’s more colloquially known, the “unexplosion” of SpaceX rockets. To the uninitiated, it may seem perplexing to draw a connection between such an incident and the global economy. Let’s take a moment to unpack this.

In this age of rapid technological advancements, the realm of space exploration is no longer confined to government agencies. Private entities like SpaceX are now pivotal players, pushing the boundaries of our knowledge and capabilities. SpaceX, with its ambitious goals and groundbreaking technology, represents the epitome of innovation in the modern world. Yet, with high-risk innovation comes the potential for high-profile setbacks, as demonstrated by the recent rocket “unexplosion”.

The economic implications of these developments extend beyond the company’s bottom line. The fortunes of SpaceX are closely monitored by investors, policy-makers, and businesses worldwide. Successes can boost investor confidence, leading to an inflow of capital into the sector, fostering further innovation, and potentially creating a positive cycle of economic activity. However, setbacks can have the opposite effect. Failures can dampen investor sentiment, making capital harder to come by not just for SpaceX, but for other companies in the sector and even those in unrelated sectors that rely on similar types of high-risk innovation.

The “unexplosion” incident serves as a reminder of the inherent risks of cutting-edge technology development. It underscores the concept of “innovation risk”, a crucial aspect that can sway investor confidence, influence market dynamics, and impact the economy at large. In essence, the SpaceX “unexplosion” isn’t just a space exploration incident – it’s a significant event on the economic landscape. So, next time you hear of a SpaceX rocket launch, remember, its implications might just be more down-to-earth than you think.

The Ripple Effect

While SpaceX’s mishap might seem far removed from your daily economic concerns, it represents a key aspect of the modern economy: innovation risk. Technological advancements, from rocket science to AI, are never without their failures. But, these failures can have wider implications, affecting investor confidence, future funding for research and development, and overall market sentiments.

Navigating the Turbulence: Stock Markets and Economy

Venturing away from the realm of space-age innovation, we descend into the turbulence of global stock markets. These bustling arenas of finance play a pivotal role in shaping our economic trajectory. They are perceived as barometers of our economic health, with the tussle between bear and bull markets often capturing the attention of investors, economists, and policy-makers alike. Yet, the correlation between stock markets and the actual economy isn’t always as straightforward as it seems. Let’s delve deeper to understand why.

Bull markets, characterized by rising share prices and a general sense of optimism, are often associated with strong economic conditions. Investors gain confidence as they see their portfolios grow, leading to increased spending and investments, further fueling the economy. Similarly, companies benefit from higher stock valuations, finding it easier to raise capital for expansion and innovation, creating a virtuous cycle of growth.

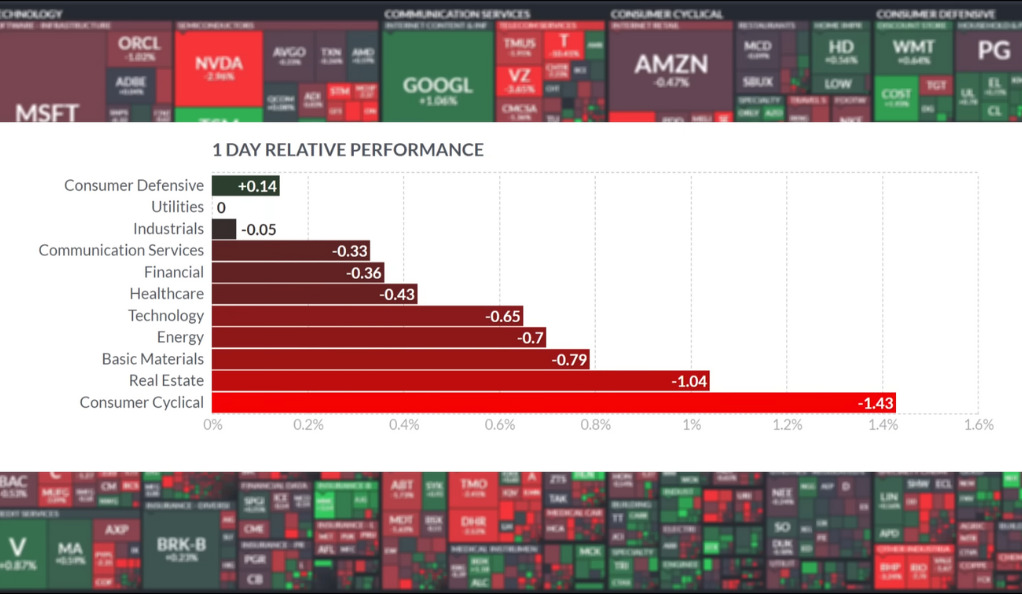

However, this rosy picture can sometimes be misleading. There are instances where the stock market’s transition from a bear to a bull phase does not necessarily reflect the true health of the underlying economy. Economic indicators such as unemployment rates, GDP growth, and corporate earnings can tell a different story. For instance, consider a situation where the stock market is booming, but a popular stock tumbles by 10%, or corporate earnings across the board fall by 20% year-on-year. These contradictions highlight the fact that the stock market is, at times, more a reflection of future expectations than current economic realities.

The Contradictions

On the surface, a bull market indicates a strong economy. But what happens when popular stocks plummet by 10% or corporate earnings decline by 20% year-on-year? It paints a more complex picture, doesn’t it? That’s because the stock market isn’t the economy. It is merely a reflection of it, and sometimes, it behaves like a distorted mirror, giving mixed signals.

The Chip Industry Slowdown: A Red Flag

In the realm of technology, the semiconductor or “chip” industry reigns supreme. A key player in our increasingly digital world, this industry serves as a crucial economic indicator. Its far-reaching influence extends across a variety of sectors – from computing and telecommunications to healthcare and automotive. Therefore, when reports suggest a slowdown in this industry, it’s time to pay attention. Here’s why.

In recent times, there have been worrying signs from this sector. Industry behemoths such as Taiwan Semiconductor Manufacturing Company (TSMC), Intel, Nvidia, and Texas Instruments have reported a buildup of excess inventory, signaling decreased demand. This trend may appear to be an isolated issue within the technology sector at first glance, but it’s much more than that. Given the wide application of semiconductors in today’s digital age, a slowdown in the chip industry can have far-reaching implications.

Reduced demand for chips suggests a potential slowdown in the broader technology sector and the industries that rely heavily on technology. Let’s consider the automotive industry, for instance, which increasingly relies on chips for advanced features such as navigation systems, infotainment, and driver assistance systems. A slowdown in the chip industry could lead to production bottlenecks in the automotive sector, slowing growth, and leading to job losses. The ripple effects can extend to industries like logistics and retail, impacting overall economic growth.

Furthermore, the chip industry slowdown could also be indicative of broader trends. For instance, it could reflect reduced consumer spending on electronics, hinting at weakened consumer confidence. Alternatively, it could also be symptomatic of businesses cutting down on their IT investments due to economic uncertainty.

The Domino Effect

This slowdown has a ripple effect. Chips, the building blocks of our digital world, are used across various sectors, from smartphones to automobiles. A decline in chip demand may signal a downturn in other sectors, leading to wider economic repercussions.

Housing and Manufacturing: Trouble on the Horizon?

Now, let’s turn our attention to two key indicators of economic health: home sales and manufacturing.

Home Sales and Recession Fears

A decline in existing home sales can often precede a recession. Home sales impact various sectors, from construction to retail, and a decline could be an early warning of economic slowdown.

Manufacturing Woes

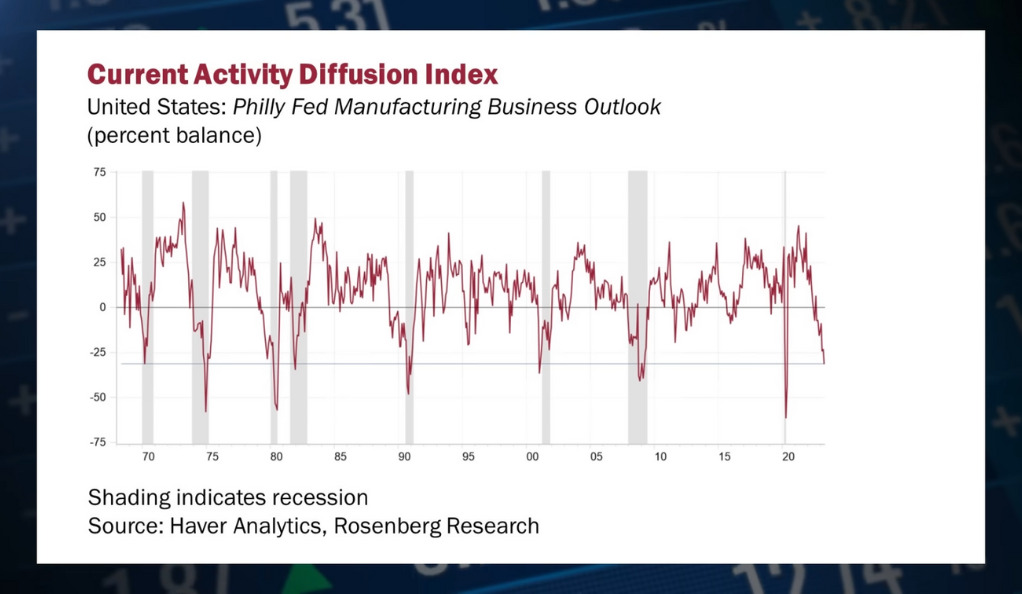

Similarly, a contraction in the Philadelphia Fed Manufacturing Index can signal trouble. Manufacturing is a major economic driver, and a slowdown could mean job losses and reduced consumer spending.

Stagflation: The Phantom Menace

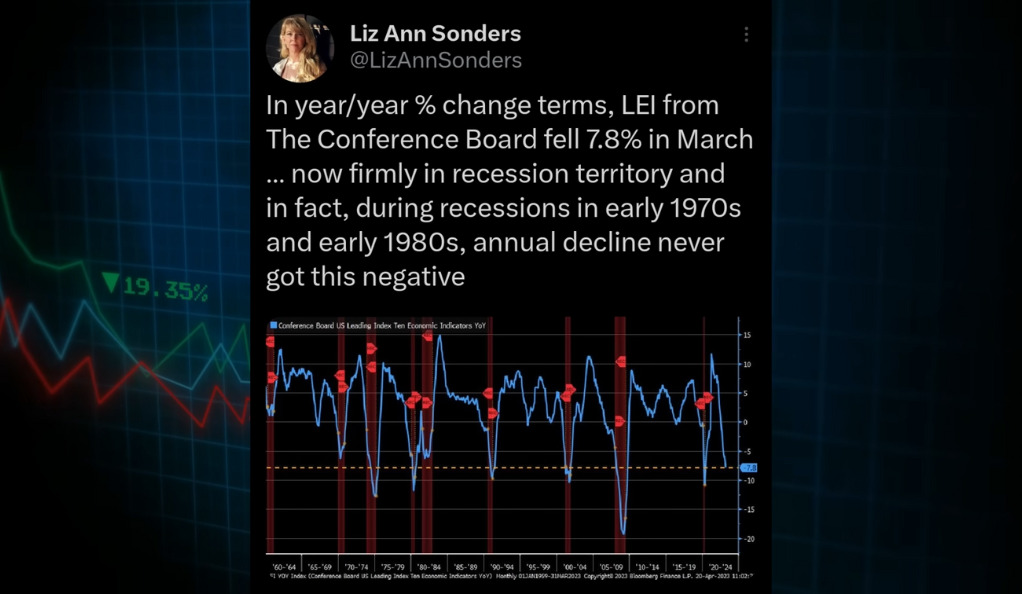

Stagflation, the simultaneous rise of inflation and unemployment coupled with slowing economic growth, is another ghost looming on the horizon.

The Double Whammy

High inflation erodes purchasing power, while unemployment reduces income. Combined, they form a dangerous cocktail that can lead to an economic slump.

Tesla and the Future of Automobiles

As we near the end of our journey, let’s discuss Tesla. Amid concerns about slowing momentum and increased competition, what does the future hold for the electric vehicle pioneer?

The Road Ahead

Despite the hurdles, Tesla remains a key player inthe electric vehicle market. However, increased competition and reduced demand are indicative of the sector’s maturity and potential saturation. It is now more important than ever for Tesla to innovate and distinguish itself to maintain momentum.

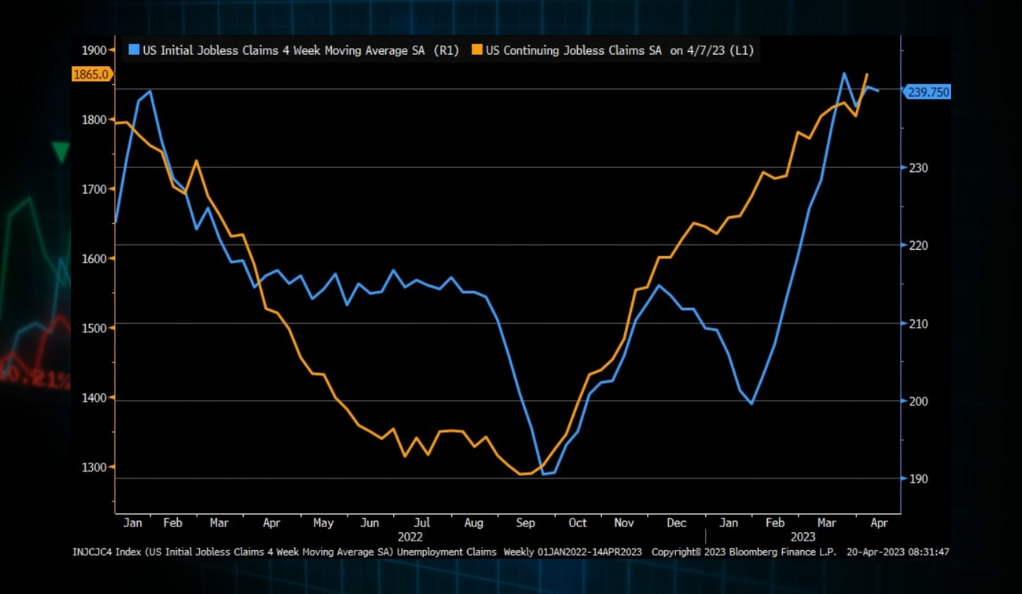

The Implications of a Cooling Job Market

The state of the job market is a major indicator of economic health. Rising jobless claims suggest a cooling job market, a potential precursor to an economic downturn.

The Employment Equation

Employment directly impacts consumer confidence and spending. High jobless claims can result in reduced consumer spending, potentially leading to a downward economic spiral.

Consumer Spending: The Lifeblood of the Economy

Finally, we arrive at consumer spending, the beating heart of any economy. Recent reports suggest weakening consumer spending, which could directly impact the earnings of companies like Apple, Nvidia, and Microsoft.

The Domino Effect Revisited

Weakening consumer spending can lead to a slowdown in the tech sector, triggering a domino effect on its dependent industries. A decline in tech sector revenues can impact everything from investment in R&D to employment rates.

Conclusion

In conclusion, understanding economic trends is like trying to make sense of a constantly shifting kaleidoscope. Unexplosions, bear-to-bull transitions, chip industry slowdowns, housing and manufacturing declines, potential stagflation, job market cooling, and weakening consumer spending – they all form parts of this intricate, ever-changing pattern. By paying attention to these economic indicators, we can better navigate the tumultuous seas of our global economy. Remember, the ability to adapt and evolve is the key to surviving and thriving amidst change.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)