The dawn of the year was met with a grim economic landscape. High inflation, Federal Reserve rate hikes, a deteriorating macroeconomic environment, and layoffs in the technology sector have all contributed to a rather bleak outlook. This comprehensive analysis will delve into these issues, exploring their implications for the tech sector and the broader economy.

The Specter of High Inflation

Inflation, the economic phenomenon that erodes purchasing power and increases the cost of living, has been a significant concern. The surge in inflation rates has been attributed to various factors, including supply chain disruptions, labor shortages, and increased government spending. This has led to increased prices for consumers and businesses alike, squeezing profit margins and dampening economic growth.

The Causes of High Inflation

Inflation is primarily driven by two factors: demand-pull and cost-push inflation. Demand-pull inflation occurs when demand for goods and services exceeds their supply. On the other hand, cost-push inflation happens when the costs of production increase, causing producers to raise prices to maintain their profit margins.

The current inflation surge can be attributed to both. The pandemic has caused unprecedented disruptions in supply chains, leading to a shortage of goods. At the same time, government stimulus packages have boosted consumer spending, further increasing demand. Additionally, businesses have been grappling with increased costs due to labor shortages and higher raw material prices.

The Impact of Inflation on the Tech Sector

High inflation can be particularly detrimental to the tech sector. Tech companies often rely on imported components for their products. With inflation, the cost of these components increases, squeezing profit margins. Furthermore, tech companies often invest heavily in research and development. Inflation increases the cost of these investments, potentially stifling innovation.

The Federal Reserve’s Response

In response to the rising inflation, the Federal Reserve has taken a hawkish stance, raising interest rates to curb inflationary pressures. While this move is intended to stabilize the economy, it has significant implications for businesses, particularly those in the tech sector. Higher interest rates increase borrowing costs, making it more expensive for companies to finance their operations or invest in growth.

The Mechanism of Interest Rate Hikes

The Federal Reserve raises interest rates by increasing the federal funds rate, which is the rate at which banks lend to each other overnight. When this rate increases, banks pass on the cost to their customers, leading to higher interest rates for loans and credit. This discourages borrowing and spending, reducing the money supply in the economy and, in turn, inflation.

The Impact on the Tech Sector

Tech companies, particularly startups, often rely on borrowed money for their operations and growth. When interest rates rise, these companies face higher borrowing costs, which can strain their finances. This can lead to reduced investment in research and development, layoffs, and in extreme cases, bankruptcy.

The Macroeconomic Environment

The macroeconomic environment has also been less than favorable. Economic indicators have pointed to a slowdown, with lower consumer spending, reduced business investment, and increased unemployment. This has created a challenging environment for businesses, leading to cost-cutting measures and, in some cases, layoffs.

The Indicators of a Deteriorating Macroeconomic Environment

Several indicators point to a deteriorating macroeconomic environment. Consumer spending, a major driver of economic growth, has been on a decline. This is likely due to the reduced purchasing power caused by inflation. Business investment has also been sluggish, as companies grapple with uncertainty and high borrowing costs. Furthermore, unemployment rates have been on the rise, signaling a slowdown in economic activity.

The Tech Sector’s Response

Faced with a challenging macroeconomic environment, tech companies have been forced to adapt. Some have implemented cost-cutting measures, including layoffs, to maintain profitability. Others have pivoted their business models or sought new markets to sustain growth. However, these measures have not been without consequences. Layoffs, for instance, have not only affected the employees who have lost their jobs but also the overall morale and productivity in the sector.

Layoffs in the Tech Sector

The technology sector, once considered immune to economic downturns due to its innovative nature and high growth potential, has not been spared. Several tech companies have announced layoffs as they grapple with the economic downturn and the effects of the Federal Reserve’s policies.

The Reasons Behind the Layoffs

The reasons behind the layoffs in the tech sector are multifaceted. The high borrowing costs resulting from the Federal Reserve’s rate hikes have strained the finances of many tech companies, particularly startups. This, coupled with the challenging macroeconomic environment, has forced many companies to cut costs, leading to layoffs.

The Impact of the Layoffs

The layoffs have had a profound impact on the tech sector. Beyond the immediate job losses, they have also affected morale and productivity. Employees may feel insecure about their jobs, leading to decreased motivation and productivity. Furthermore, layoffs can lead to a loss of talent, which can be detrimental to the sector’s innovation and growth.

The Silver Lining: The Rise of AI

Despite these challenges, there has been a glimmer of hope in the form of artificial intelligence (AI). The acquisition of ChatGPT by Microsoft sparked a new wave of interest in AI, leading to a surge in investment and speculation. The belief is that AI will increase efficiency, reduce the need for employees, and boost revenues for many companies.

The Potential of AI

AI has the potential to revolutionize various sectors, from healthcare to finance to transportation. It can automate routine tasks, freeing up humans to focus on more complex tasks. It can also analyze large amounts of data quickly and accurately, leading to better decision-making. Furthermore, AI can create new products and services, opening up new revenue streams for companies.

The Risks and Challenges of AI

However, the rise of AI is not without risks and challenges. There are concerns about job losses due to automation, privacy issues, and the potential misuse of AI. Furthermore, developing and implementing AI can be costly and complex, requiring significant investment and expertise.

The AI Gold Rush

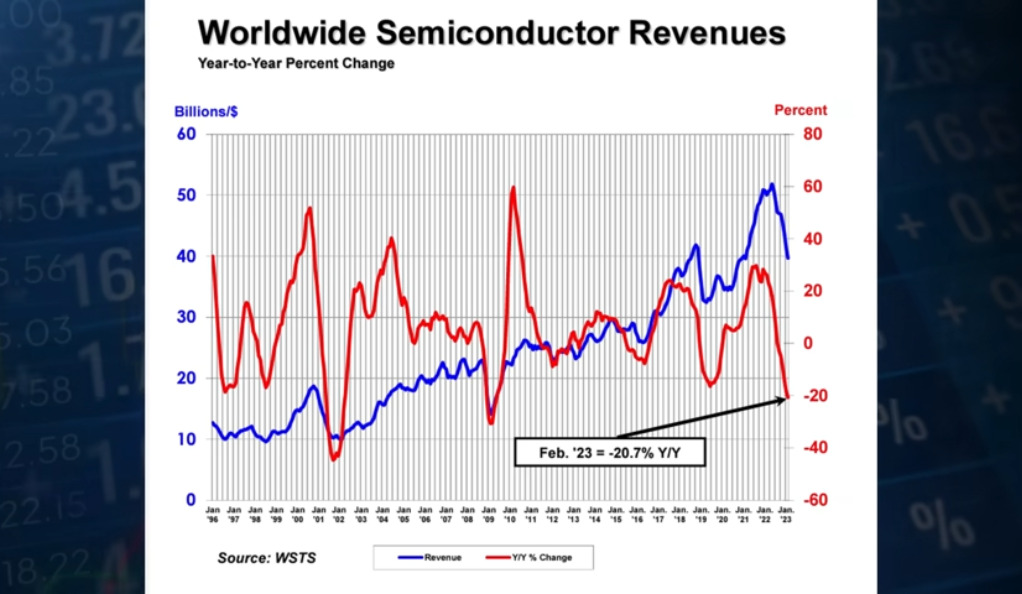

The AI mania has seen investors rushing to buy stocks related to AI and chips. Companies like Nvidia have seen their stock prices soar as they project significant revenue increases. However, there are questions about whether these optimistic projections are realistic given the current macroeconomic situation.

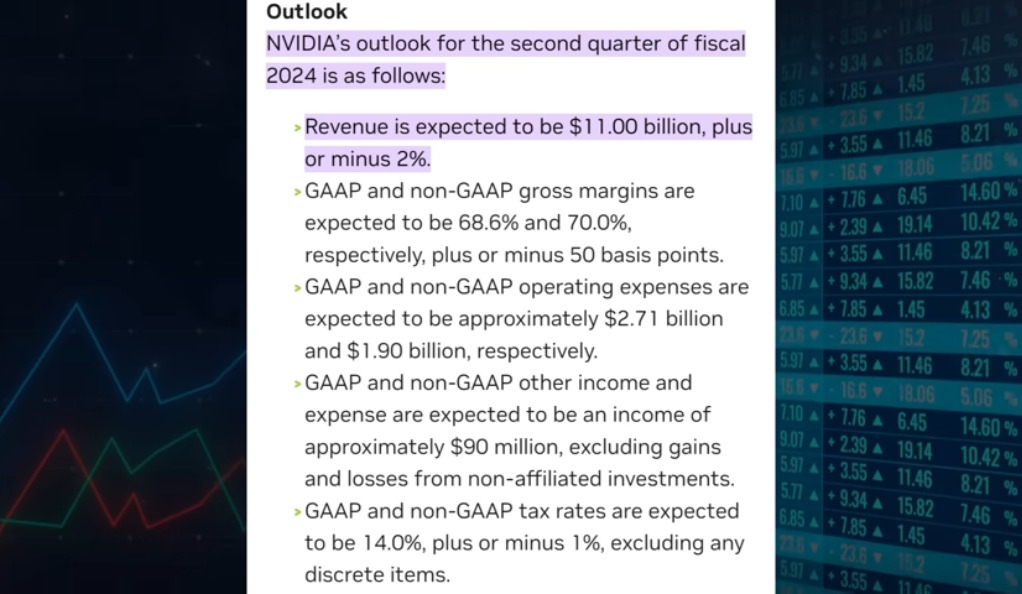

The Role of Nvidia

Nvidia, a leading player in the AI and chip market, has been at the forefront of the AI gold rush. The company’s GPUs are widely used in AI applications, from data centers to autonomous vehicles. Nvidia’s optimistic revenue projections have fueled investor enthusiasm, driving up its stock price.

The Sustainability of the AI Gold Rush

However, there are concerns about the sustainability of the AI gold rush. The current macroeconomic situation, characterized by high inflation and a slowing economy, may not be conducive to the high growth rates projected by companies like Nvidia. Furthermore, the AI market is highly competitive, with many players vying for a piece of the pie. This could lead to price wars and reduced profit margins.

Winners and Losers in the AI War

In the AI “war”, there will inevitably be winners and losers. While some companies will benefit from the AI boom, others may see their margins crushed as they compete in this highly competitive field. The question remains: who will emerge victorious in this high-stakes battle?

The Potential Winners

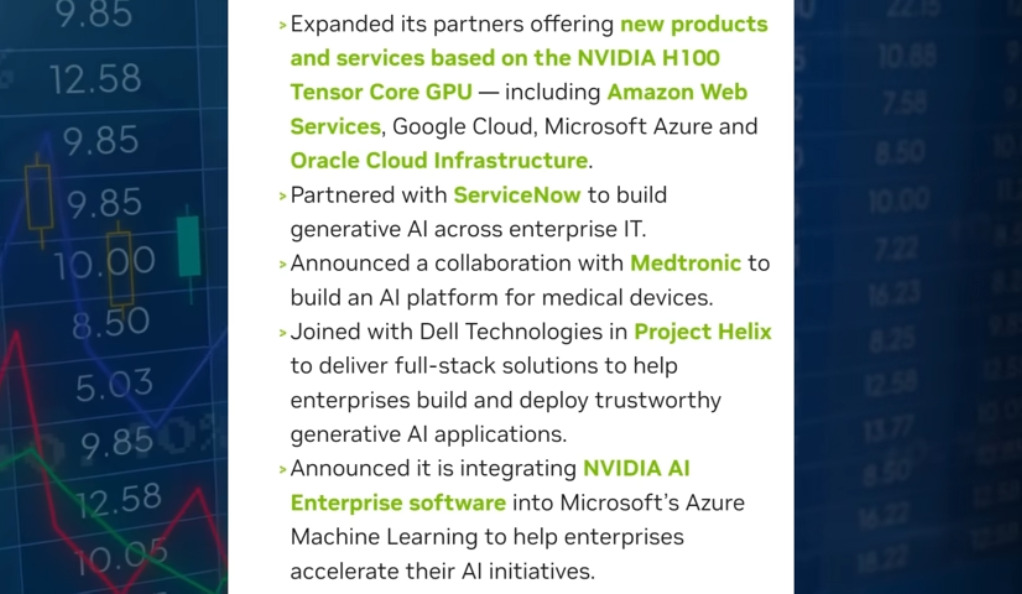

Companies that can leverage AI to improve theirproducts or services, reduce costs, or create new revenue streams stand to benefit from the AI boom. These include tech giants like Google, Microsoft, and Amazon, which have the resources and expertise to invest heavily in AI. Also, companies that provide the hardware and software needed for AI, like Nvidia, could see increased demand for their products.

The Potential Losers

On the other hand, companies that are unable to adapt to the AI revolution could be left behind. This includes companies that lack the resources or expertise to invest in AI. Furthermore, companies in sectors that are highly susceptible to automation, like manufacturing and transportation, could see significant job losses.

The Big Buyers: Are They Really Spending More?

Companies that are supposedly buying these AI chips, like Google, Microsoft, Amazon, Medtronic, ServiceNow, and Oracle, are under scrutiny. Are they really increasing their spending significantly, or is this just part of the hype? The evidence, so far, seems to be inconclusive.

The Evidence

While these companies have announced plans to invest in AI, there is little evidence of significant increases in spending in their financial reports. This raises questions about the sustainability of the AI boom. If these companies are not actually increasing their spending, it could indicate that the AI boom is more hype than reality.

The Implications

If the AI boom turns out to be more hype than reality, it could lead to a market correction, with AI stocks falling in value. This could be particularly detrimental to investors who have bought into the AI hype. On the other hand, if these companies are indeed increasing their spending on AI, it could fuel the AI boom, leading to increased demand for AI chips and higher stock prices for companies like Nvidia.

Conclusion

In conclusion, the market has entered the year under challenging conditions, with high inflation, Federal Reserve rate hikes, a deteriorating macroeconomic environment, and layoffs in the tech sector. However, the rise of AI offers a beacon of hope, sparking a new wave of investment and speculation. As we navigate these turbulent waters, it will be interesting to see how the tech sector adapts and evolves in response to these challenges. The AI revolution is upon us, but its ultimate impact remains to be seen. Will it be the panacea for the tech sector’s woes, or will it lead to a new set of challenges? Only time will tell.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)