In the ever-evolving realm of finance, trends emerge and fade away, often accompanied by significant buzz. Presently, the stock market is experiencing a surge of speculative interest in prominent technology companies like Tesla and Apple. Investors are captivated by the allure of soaring valuations, with some predictions even suggesting that Tesla’s worth could increase by an astounding $150 billion, propelled by the anticipated advent of robo-taxis. However, it is imperative to approach these forecasts with a prudent skepticism and a deep comprehension of market dynamics.

The AI Revolution: A Mirage or a Tangible Force?

The advent of artificial intelligence (AI) has been hailed as the next revolutionary wave that will propel the bull market further, even in the face of an impending economic downturn. AI technologies have the potential to revolutionize various industries, including finance, healthcare, and transportation. Proponents argue that AI can improve efficiency, enhance decision-making processes, and drive productivity gains. However, it is crucial to question whether these claims are grounded in reality or if they are simply part of a speculative bubble waiting to burst.

Artificial intelligence has undoubtedly made significant advancements in recent years. Machine learning algorithms, natural language processing, and computer vision have shown remarkable capabilities in solving complex problems and automating tasks. In the financial sector, AI is being applied for algorithmic trading, risk management, fraud detection, and personalized investment advice. The potential for AI to generate substantial returns and disrupt traditional business models is enticing to investors.

However, the sustainability of the market boom fueled by AI-driven advancements remains uncertain. It is important to consider the limitations and risks associated with AI technologies. AI models rely on vast amounts of data for training, and their performance is influenced by the quality and diversity of the data. Biases present in the data can lead to biased decision-making by AI systems. Additionally, AI models can be susceptible to adversarial attacks, where malicious actors manipulate input data to deceive the system. These challenges raise questions about the reliability and robustness of AI-driven solutions in real-world scenarios.

Apple’s Ascension to a $4 Trillion Valuation

Apple, the technology giant renowned for its iconic products, has garnered significant attention in recent years. The company’s stock price has experienced a remarkable ascent, leading to speculations about its future trajectory. Forecasts speculate that Apple’s stock could potentially reach a staggering $4 trillion market valuation by the end of 2024.

Apple’s success can be attributed to various factors. The company has built a strong brand with a loyal customer base that eagerly awaits each new product release. Apple’s ecosystem, which includes devices like iPhones, iPads, Macs, and services like iCloud and Apple Music, creates a seamless user experience and fosters customer retention. Additionally, Apple’s focus on innovation and design excellence has allowed it to differentiate itself from competitors and maintain a premium pricing strategy.

However, it is worth considering who will be the buyers responsible for driving the demand that justifies such an astronomical price. With economic challenges looming in China, a key market for Apple, and American consumers burdened by mounting student loans and dwindling savings, the optimism surrounding Apple’s future growth might be exaggerated. Furthermore, the smartphone market is maturing, and competition is intensifying. Apple faces fierce competition from Android-based smartphone manufacturers, and its ability to sustain its market dominance and drive continued growth remains uncertain.

The Pump and Dump Scheme: A Lesson in Caution

The excitement surrounding tech giants like Tesla and Apple might be part of a larger scheme known as ‘pump and dump.’ This deceptive tactic involves artificially inflating stock prices through aggressive promotion, enticing the public to invest, only for the orchestrators to sell their shares once prices peak. The result is a sudden and significant decline in the stock’s value, leaving unsuspecting investors with substantial losses.

The pump and dump scheme preys on investors’ emotions and their desire for quick gains. It often involves spreading false or misleading information about a company’s prospects or exaggerating positive news to create a sense of urgency to buy the stock. This artificially drives up demand and prices. Once the orchestrators have sold their shares at the peak, the market demand collapses, leading to a sharp decline in the stock price.

To protect themselves from falling victim to pump and dump schemes, investors should exercise caution and skepticism. They should thoroughly research the companies they are considering investing in, analyze their financials, evaluate their competitive position, and scrutinize the information presented. It is crucial to rely on reputable sources of information and consult financial professionals before making investment decisions.

When Oligarchs Capitalize and Depart

Instances have arisen where prominent figures have championed their companies and subsequently cashed out their own shares for substantial profits. This phenomenon raises questions about the integrity and motivations of company leaders. For instance, Oracle CEO Larry Ellison purportedly promoted AI fervently before cashing out over $600 million worth of stock. These occurrences serve as stark reminders for individuals to remain vigilant and discerning amidst market hype. It is essential to consider the actions of company insiders and their potential impact on the stock’s performance.

Insider selling can provide valuable insights into a company’s prospects and should be carefully evaluated by investors. While it is natural for company executives to diversify their wealth and monetize their holdings, a large-scale or sudden sell-off by insiders might indicate a lack of confidence in the company’s future performance. Investors should pay attention to insider trading activities, monitor regulatory filings, and assess the overall sentiment among company executives and major shareholders.

The Widening Wealth Gap: A Consequence of Speculation

One unfortunate consequence of these market trends is the exacerbation of wealth inequality. During periods of hype and speculation, wealth often transfers from less-informed individuals to more astute ones. The rapid rise in stock prices can lead to substantial gains for investors who have the means and knowledge to participate in the market. However, those who are unable to invest or lack the necessary information often miss out on these opportunities, widening the wealth gap.

To address the issue of wealth inequality, policymakers need to focus on promoting financial literacy, improving access to investment opportunities, and reducing barriers to participation in the stock market. Efforts should be made to educate individuals about investment strategies, risk management, and the importance of diversification. Additionally, policies that promote inclusive economic growth and provide support to disadvantaged communities can help reduce wealth disparities.

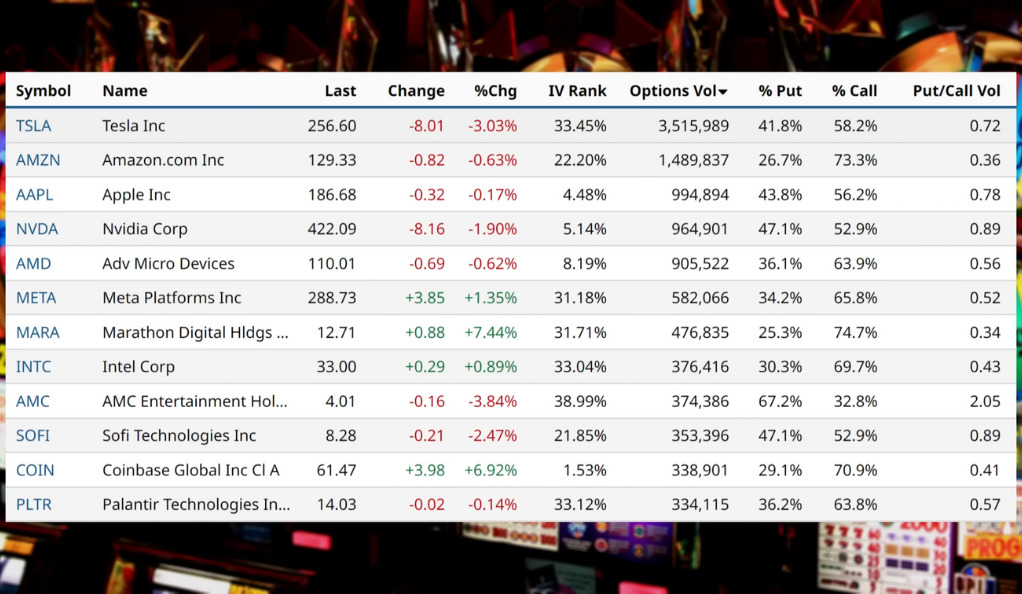

The Market Rally: Driven by the Magnificent Seven

It is worth noting that the current stock market rally is primarily led by just seven companies within the S&P 500 index. These companies, predominantly operating in the technology, communication services, and consumer discretionary sectors, are the primary driving force behind the market’s upward trajectory. These firms, often referred to as the “Magnificent Seven,” include giants like Apple, Amazon, Microsoft, Google (Alphabet), Facebook, Tesla, and NVIDIA. Their exceptional performance and market dominance have overshadowed the majority of other stocks, which have remained stagnant or even declined.

The concentration of market gains in a few companies raises concerns about market dynamics and the potential risks associated with overreliance on a handful of stocks. The performance of the stock market as a whole can become heavily influenced by the success or failure of these dominant companies. Investors should carefully assess their investment portfolios and ensure proper diversification to mitigate the impact of any adverse developments in these key companies.

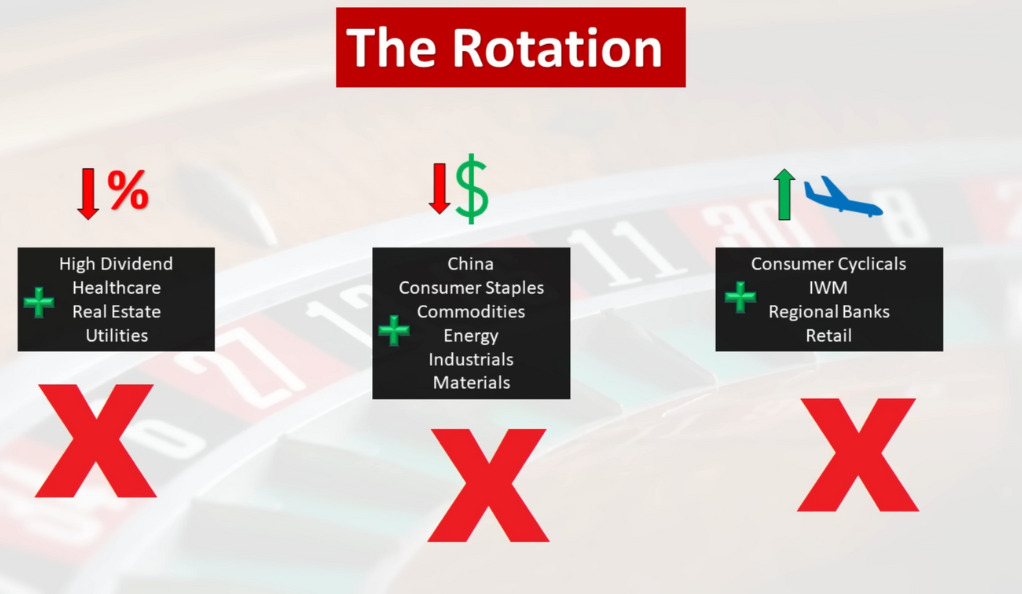

Market Rotation: Debunking the Myth or Embracing the Reality?

Market rotation is a strategy employed by investors and fund managers that involves reallocating investments across different sectors based on shifting market conditions. The idea is to capitalize on sectors that are expected to outperform in a particular market phase while reducing exposure to sectors expected to underperform. This strategy aims to take advantage of changing trends and market cycles.

Proponents of market rotation argue that it can lead to better risk-adjusted returns by actively adjusting investments to align with the prevailing market conditions. They believe that different sectors perform well at different stages of the economic cycle, and by identifying these stages, investors can optimize their returns. For example, during an economic expansion, cyclical sectors like technology, industrials, and consumer discretionary tend to outperform, while defensive sectors like utilities and consumer staples perform better during economic downturns.

However, critics of market rotation argue that it is challenging to time the market accurately and consistently identify the sectors that will outperform or underperform. They believe that attempting to time the market and make frequent adjustments to portfolios can lead to increased transaction costs and potential tax implications. Additionally, conflicting signals from various sectors make it challenging to determine whether a genuine market rotation is occurring or if it is merely an illusion created by short-term fluctuations.

While market rotation can offer opportunities for diversification and risk management, it requires careful analysis, a deep understanding of market dynamics, and a long-term perspective. Investors should avoid making knee-jerk reactions based on short-term market movements and focus on the fundamentals of the companies they invest in. A well-diversified portfolio that aligns with one’s risk tolerance and investment objectives remains a sound approach to long-term investing.

Conclusion

As we navigate uncharted territory in the stock market, striking a balance between optimism and caution becomes imperative. While the allure of tech giants and the potential of AI is undeniably captivating, it is vital to comprehend the underlying market dynamics and exercise prudence in investment decisions. By staying informed, conducting thorough research, and adopting a discerning approach, investors can navigate uncertain circumstances and make informed choices that align with their financial goals.

Investors should evaluate market forecasts critically, be wary of deceptive schemes, consider the wider implications of market trends on wealth inequality, remain mindful of the concentration of market gains in a few dominant companies, and exercise caution when interpreting insider trading activities. By diversifying portfolios, promoting financial literacy, and implementing policies that support inclusive economic growth, we can work towards a more resilient and equitable financial system.

In the ever-changing landscape of the stock market, knowledge and adaptability are crucial. By staying informed and adopting a disciplined investment approach, individuals can make prudent decisions that have the potential to yield long-term success.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)