In the fast-paced and ever-changing realm of finance, investors constantly seek ways to optimize their returns. One strategy that has garnered considerable attention is market rotation. Market rotation involves the strategic reallocation of investments from one sector or asset to another, driven by shifts in economic or market conditions. In this article, we will take a deep dive into the concept of market rotation, examining its significance, the indicators that guide it, the sectors that often experience rotations, the presence of market bubbles, and future predictions. By comprehending these key aspects, investors can make well-informed decisions and leverage market rotations to bolster their investment strategies.

Market rotation holds immense importance in the investment landscape. It revolves around identifying emerging trends and shifts in market sentiment, allowing investors to capitalize on lucrative opportunities. Successful investors have earned substantial profits by adeptly recognizing and seizing various trends, such as the hype around artificial intelligence or the mania surrounding weight loss. Acquiring a keen sense of when to anticipate rotations and where capital is likely to flow provides a competitive edge in the market.

Timing is a critical element in market rotation. Investors must patiently wait for specific indicators to align before making significant trades or investments. This necessitates going beyond the surface-level observations and delving deeper into underlying opportunities. By meticulously analyzing and identifying indicators that indicate a potential rotation, investors can enter and exit positions at optimal times, ultimately maximizing their returns. The ability to exercise patience and strategically time rotations is a hallmark of successful investors.

The Significance of Market Rotation

Market rotation holds great importance in the realm of investments. It involves identifying and capitalizing on emerging trends and shifts in market sentiment. Different investors have made substantial profits by astutely recognizing and acting upon various trends, such as the AI hype or weight loss mania. Understanding when to look for rotation and where to expect money to flow can provide a competitive edge in the market.

Indicators and Timing

Timing is crucial when it comes to market rotation. Investors must wait for certain indicators to align before making significant bets or trades. It is essential to look beyond what is immediately visible and consider underlying opportunities. This requires careful analysis and the ability to identify indicators that signal a potential rotation. By patiently waiting for the right timing, investors can enter and exit positions more effectively, optimizing their returns.

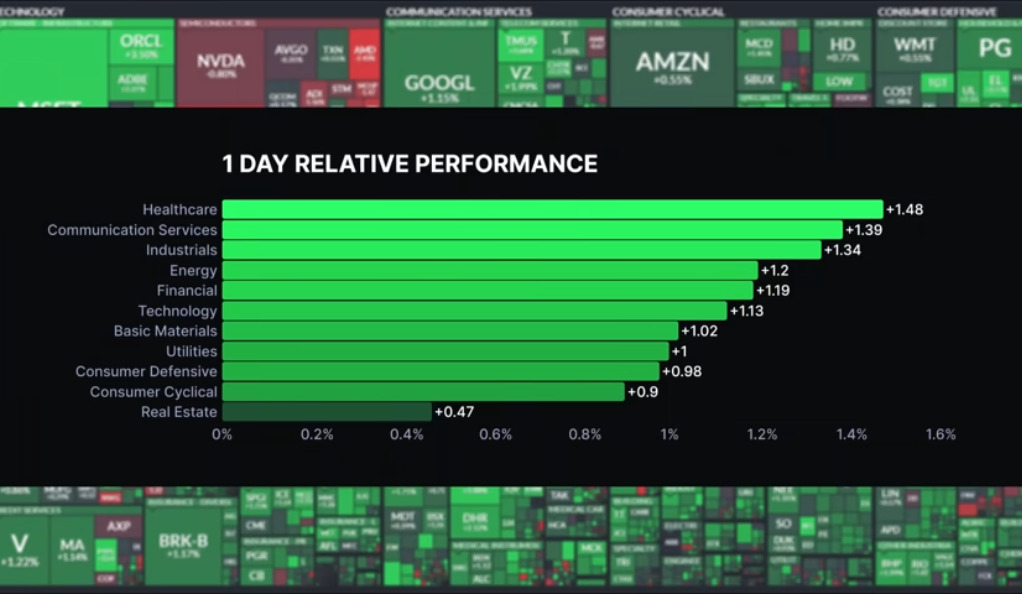

Potential Sectors for Rotation

In the world of market rotations, certain sectors frequently capture the attention of investors. By closely monitoring indicators that are specific to these sectors, investors can gauge whether a rotation is occurring. Some sectors that commonly witness rotations include copper, small caps, airlines, regional banks, industrials, consumer staples, and healthcare.

- Copper

Copper, often referred to as “Dr. Copper” due to its ability to gauge economic health, can be an indicator of market rotations. Changes in copper prices may signify shifts in industrial demand, construction activity, and overall economic growth. Investors keenly observe copper prices as a potential signal for sector rotation. - Small Caps

Small-cap stocks, typically representing smaller companies with higher growth potential, can attract investors during rotation periods. These stocks often offer more significant upside potential, as they may be undervalued or overlooked by the market. Small caps tend to perform well during economic recoveries and expansions. - Airlines

Airlines are a sector that can experience rotations based on factors such as fuel prices, travel demand, and overall economic conditions. During periods of economic expansion, airline stocks may become more attractive as travel increases. Conversely, during economic downturns or periods of high fuel prices, rotation out of airlines may occur. - Regional Banks

Regional banks are another sector that can witness rotations. Economic indicators, such as interest rates and credit demand, can influence the attractiveness of regional bank stocks. Investors closely monitor these indicators to identify potential rotations. Higher interest rates and increased lending activity may signal a rotation into regional banks, while lower interest rates and decreased lending activity may lead to a rotation out of this sector. - Industrials

The industrial sector can undergo rotations, particularly during periods of economic recovery or expansion. Industries such as manufacturing, construction, and infrastructure development often experience increased demand, leading to potential rotations within this sector. Investors watch for indicators such as rising orders, increased construction activity, and infrastructure spending as potential signals for a rotation into industrial stocks. - Consumer Staples

Consumer staples, including essential household products and non-cyclical goods, tend to be more resilient during economic downturns. However, shifts in market sentiment and economic conditions can still trigger rotations within this sector, making it an area of interest for investors. For example, during periods of economic growth and rising consumer confidence, investors may rotate out of consumer staples and into more growth-oriented sectors. - Healthcare

Healthcare is a sector that remains relatively stable even during economic uncertainties. However, advancements in medical technology, regulatory changes, and demographic shifts can lead to rotations within specific healthcare subsectors, such as biotechnology or pharmaceuticals. Investors monitor factors like FDA approvals, clinical trial results, and demographic trends to identify potential rotation opportunities within the healthcare sector.

Market Indicators

Understanding market indicators is crucial when assessing potential rotations. While there are numerous indicators to consider, a few key ones can provide insights into market trends. Some indicators that investors often monitor include:

Dollar and Yields

The value of the dollar and bond yields can influence market rotations. A weaker dollar may make commodities more attractive, potentially triggering a rotation into this asset class. Similarly, changes in bond yields can affect the relative attractiveness of different sectors. For instance, rising bond yields may lead to a rotation out of high-dividend-yield stocks and into sectors that benefit from higher interest rates, such as financials.

Commodities

Commodities, including oil, gold, and industrial metals, can be subject to rotations. Changes in commodity prices can be driven by factors such as supply and demand dynamics, geopolitical events, and central bank policies. Investors analyze these indicators to assess potential rotations within the commodities market. For instance, a rotation into commodities like gold may occur during periods of market uncertainty and inflation concerns.

Market Bubbles

Market conditions that exhibit signs of a bubble can present both risks and opportunities for investors. While bubbles can be concerning due to the potential for sharp market corrections, they also offer opportunities when they burst. By carefully monitoring market conditions and identifying signs of excessive speculation, investors can position themselves to capitalize on the aftermath of a burst bubble. This requires caution and a thorough understanding of market dynamics.

Future Predictions and Advice

- Exercise caution and patience when considering rotations.

Wait for important events to pass before making decisions to avoid unnecessary risks. - Take note of significant macroeconomic and Federal Reserve (FED) activities in the current week, as they can have a pivotal impact on market dynamics.

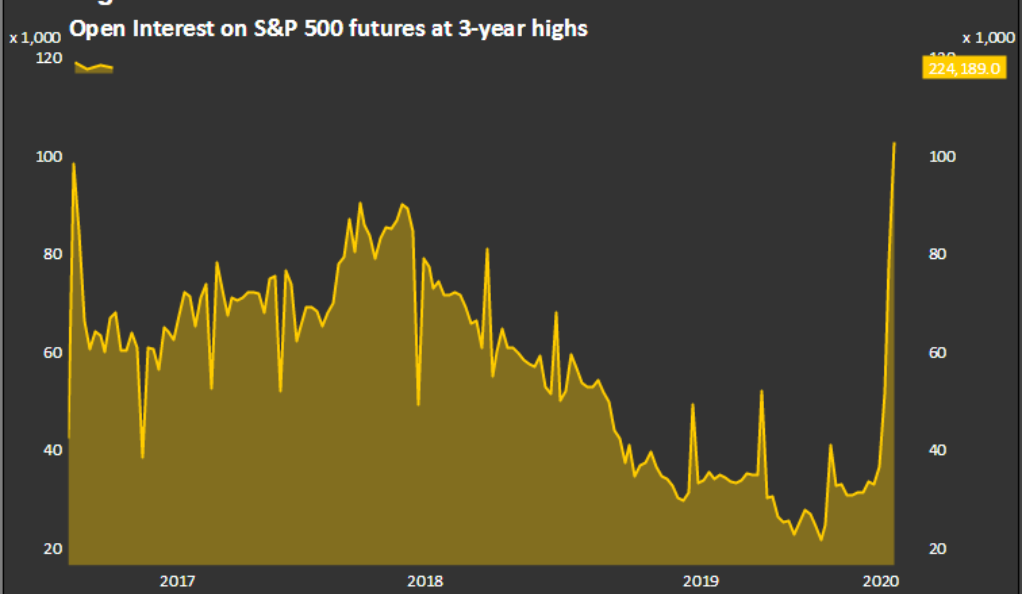

- Be aware of “quad witching,” the simultaneous expiration of stock index futures, stock index options, stock options, and single stock futures, which can introduce additional market volatility.

Stay informed about these factors to navigate market rotations more effectively.

Conclusion

Market rotation plays a vital role in the investment landscape, offering opportunities for savvy investors to capitalize on changing market conditions. By understanding the significance of market rotation, identifying indicators and timing, exploring potential sectors for rotation, monitoring market bubbles, and making informed predictions, investors can enhance their investment strategies. It is essential to approach market rotations with patience, careful analysis, and a deep understanding of market dynamics. By doing so, investors can position themselves advantageously, maximizing their returns and achieving their financial goals in an ever-evolving market.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)