Earnings reports play a pivotal role in the world of finance, providing a window into the financial health and performance of companies. These reports offer a comprehensive view of a company’s revenue, expenses, net income, and operating margins, among other crucial financial indicators. By delving into the details of these reports, we can gain valuable insights into how a company is faring and what implications its performance might have on the stock market and the broader economy.

In this article, we will focus on the recent earnings reports of three notable companies: Verizon, 3M, and Lockheed Martin. These companies operate in diverse sectors, including telecommunications, manufacturing, and aerospace and defense, respectively. Their earnings reports reveal unique trends, challenges, and opportunities, shedding light on their current financial state and the factors that can shape their future prospects.

Understanding the fundamentals of these companies’ financial performance is crucial not only for investors but also for economists and analysts attempting to gauge the pulse of the economy. Earnings reports provide valuable insights into the overall health of the corporate sector, serving as a barometer for economic activity.

By analyzing the financial fundamentals and examining how these factors influence the stock market and the broader economy, we can better comprehend the interconnected nature of these entities. Moreover, we can explore the potential ripple effects of a company’s performance on investor sentiment, consumer and business confidence, and the overall economic landscape.

Throughout this article, we will navigate through the nuances of Verizon, 3M, and Lockheed Martin’s earnings reports, dissecting their revenue growth, expense challenges, net income fluctuations, and operating margin trends. Additionally, we will delve into the specific implications of these reports on the stock market, including the impact on stock prices and investor sentiment. Furthermore, we will explore how the stock market’s reaction to these reports can, in turn, influence consumer behavior, business decisions, and the overall economic outlook.

By examining these earnings reports through a comprehensive lens, we can gain a deeper understanding of the intricate relationship between corporate performance, stock market dynamics, and the broader economy. This knowledge equips investors, economists, and market participants with insights and tools to navigate the ever-changing financial landscape and make informed decisions that contribute to sustainable growth and prosperity.

Verizon: Balancing Margins Amid Rising Expenses

Revenue Growth and Expense Challenges

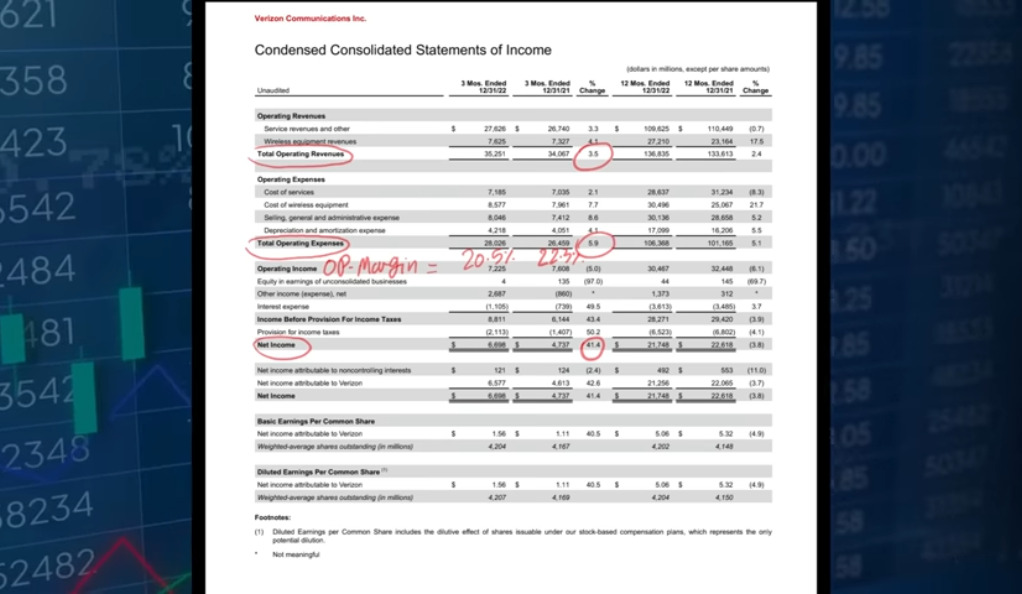

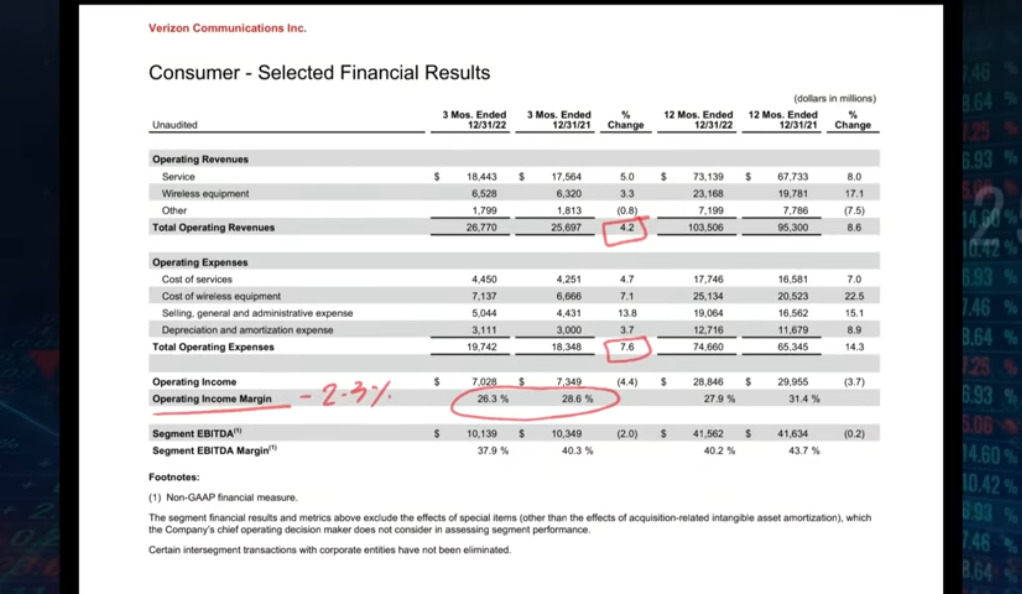

Verizon, a leading telecommunications company, experienced a 3.5% year-over-year (YoY) increase in operating revenues. This growth indicates a positive trend and reflects the company’s ability to generate revenue in a competitive market. However, challenges arise when we examine the expenses.

The Growing Gap: Expenses Outpace Revenues

While Verizon’s revenues grew by 3.5% YoY, the expenses rose at a faster pace of 5.9% YoY. This discrepancy suggests that the company’s expenses are growing more rapidly than its revenues, potentially impacting profit margins. To address this concern, Verizon may consider cost-saving measures, including employee layoffs, to restore balance to its margins.

Net Income Boost through Pension Fund Recalculation

Although the increased expenses pose challenges, Verizon’s net income witnessed a substantial growth of 41.4% YoY. This surge can be attributed to a recalculation of pension funds. While the rise in net income is encouraging, it is essential for Verizon to streamline its cost structure to ensure sustained profitability and stability in the long run.

3M: Declining Sales and Cost Pressures

Sales Slump and Escalating Costs

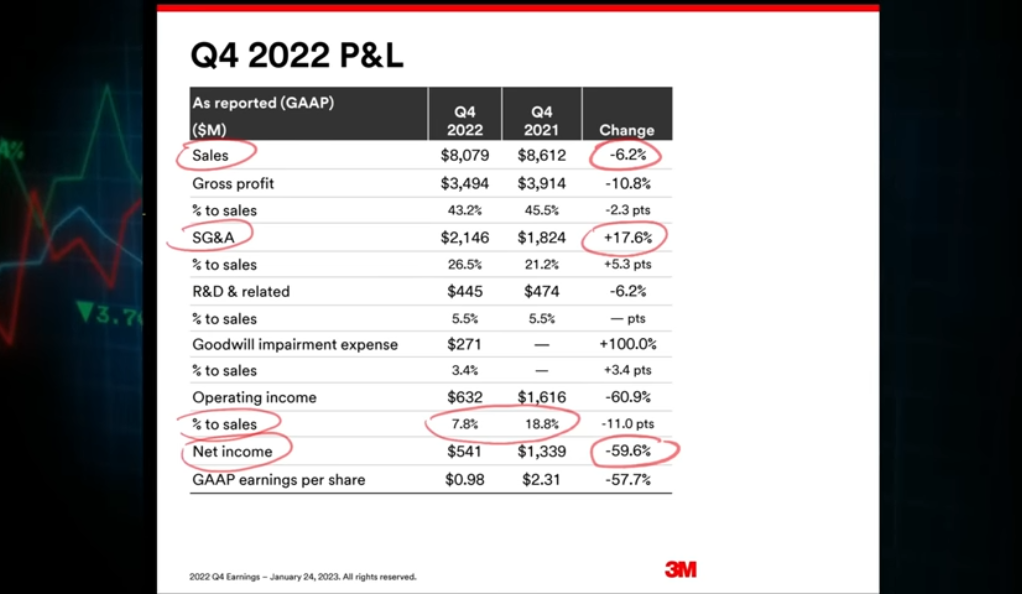

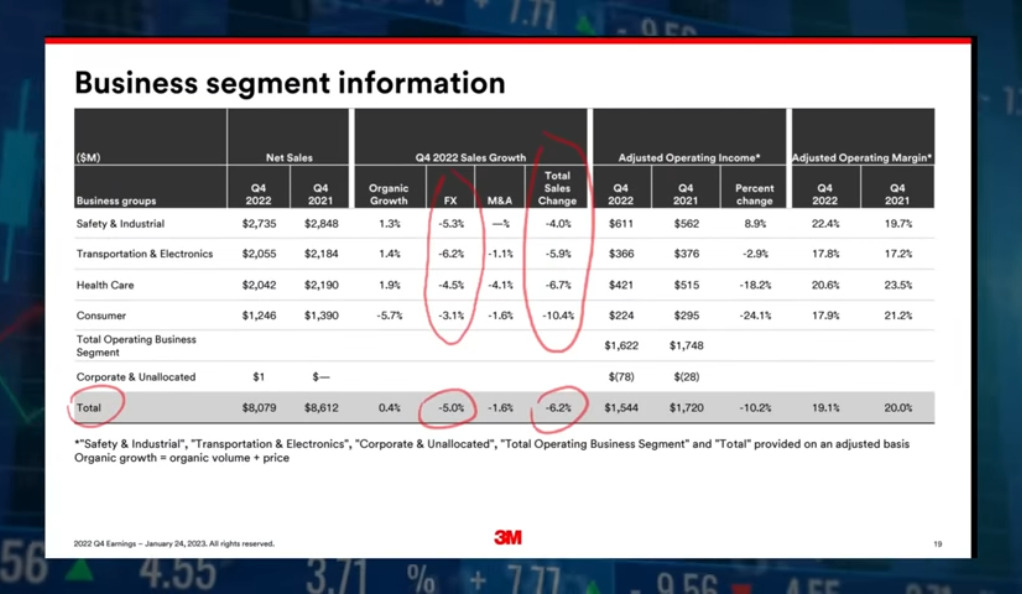

3M, a diversified manufacturing company, faced a decline in sales of 6.2% YoY. This decrease indicates reduced demand for their products and services, posing a significant challenge for the company. Simultaneously, costs surged by 17.6% YoY, creating additional pressures on 3M’s financial performance.

Earnings Plunge and the Need for Strategic Measures

The decline in sales and the substantial increase in costs present a challenging scenario for 3M. Consequently, the company has initiated employee layoffs as a response to the declining demand and the need to address cost pressures. These measures aim to optimize the cost structure and improve overall profitability.

Operating Margin Squeeze

The operating margins of 3M also experienced a significant drop, falling from 18.8% to 7.8%. This decline underscores the urgent need for strategic measures to enhance efficiency and control costs. 3M must focus on revitalizing its sales efforts and implementing cost optimization strategies to stabilize its financial position and regain growth momentum.

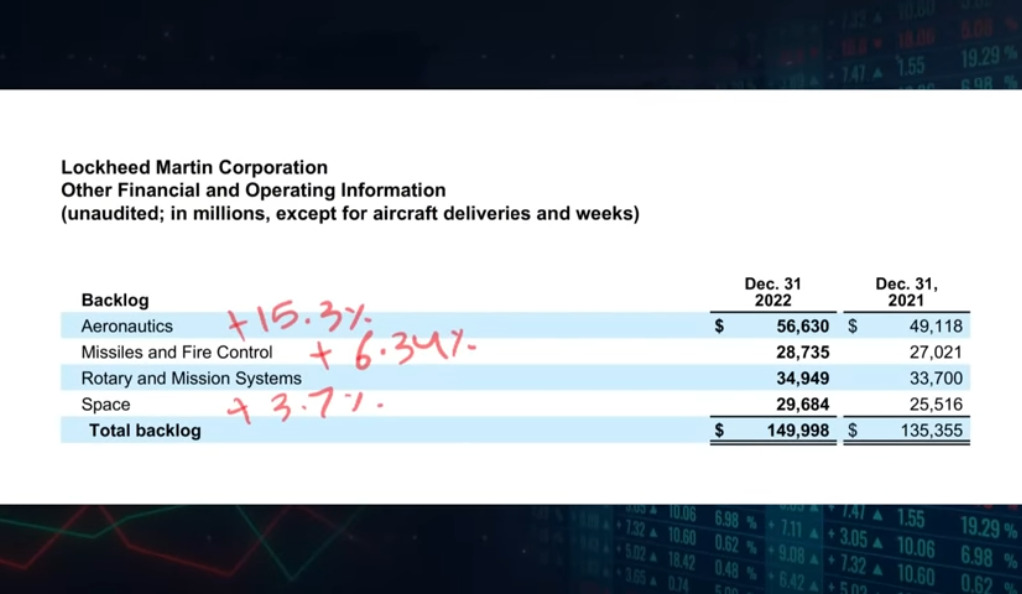

Lockheed Martin: Mixed Performance across Segments

Revenue Growth and Cost Challenges

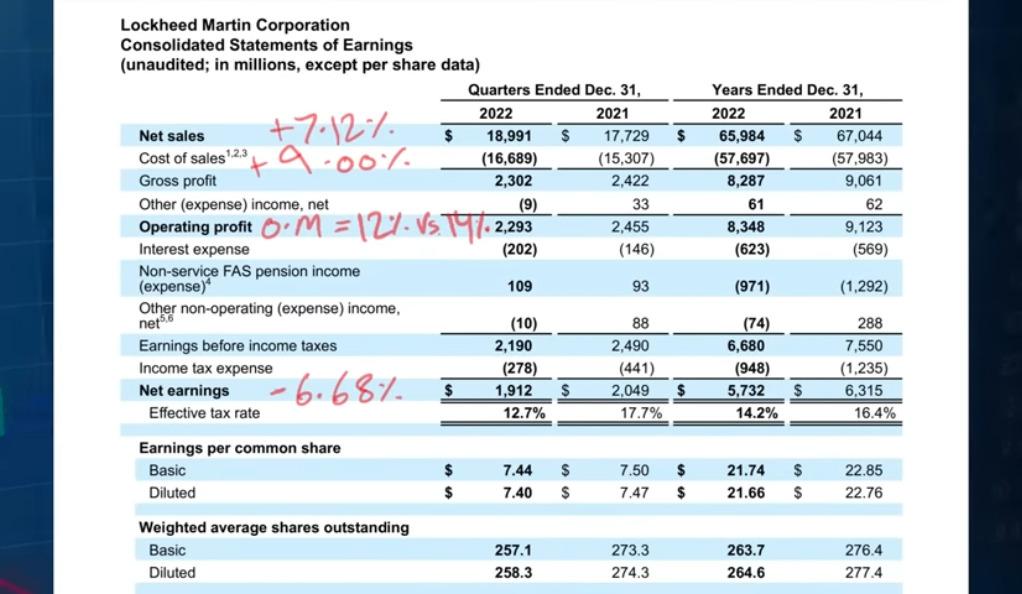

Lockheed Martin, a renowned aerospace and defense company, recorded a 7.12% YoY increase in net sales. This growth indicates positive market demand for their products and services. However, challenges arise when we consider the cost side of the equation.

Struggles with Cost Management

While the company’s net sales increased, the cost of sales rose by 9% YoY. This increase in costs created a challenging environment for Lockheed Martin’s profitability. The company needs to carefully manage and optimize costs to mitigate the impact on their financial performance.

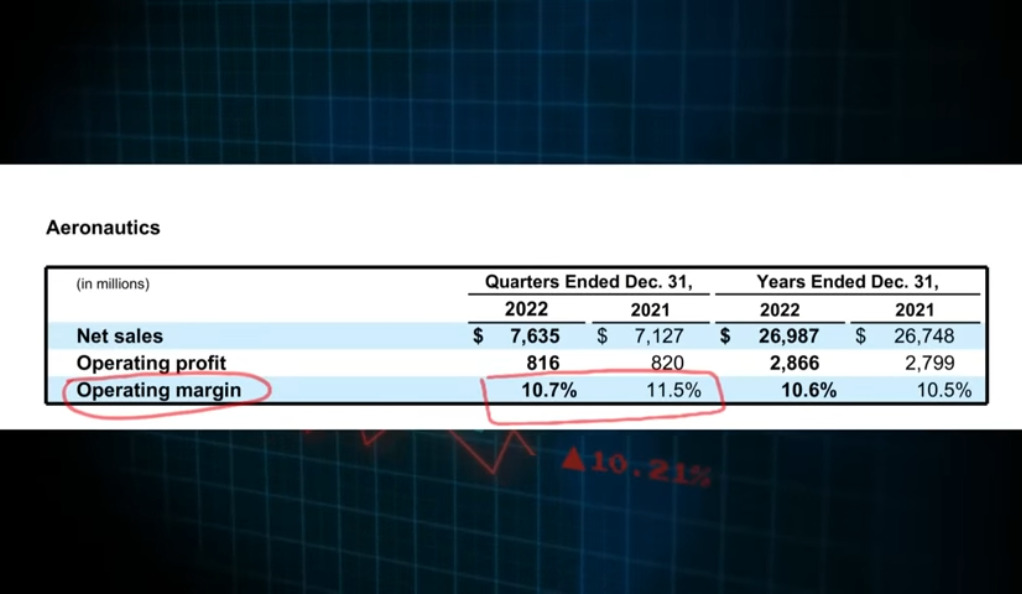

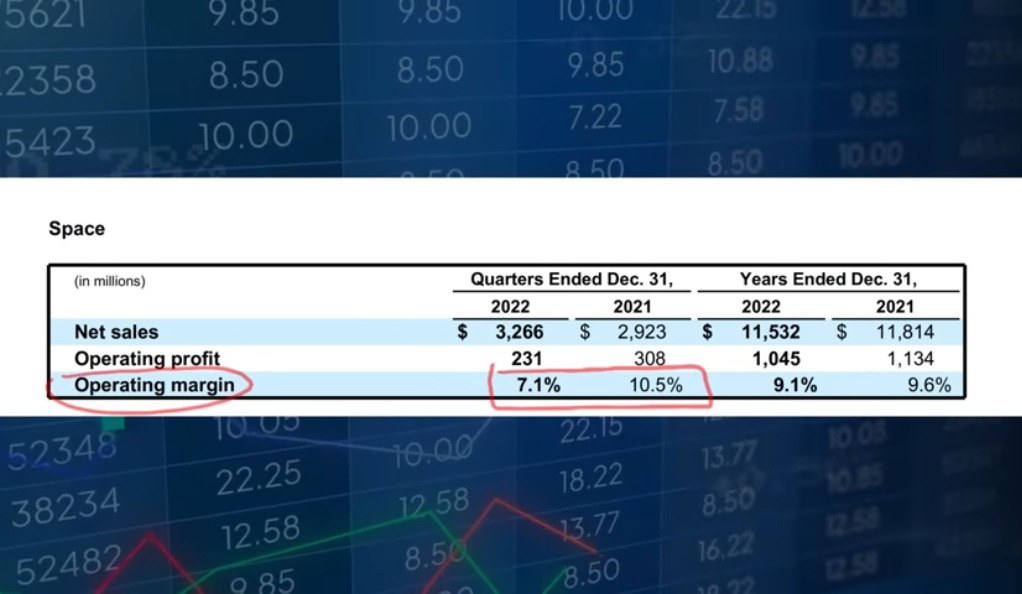

Segmented Results: A Tale of Success and Struggles

Despite the overall decrease in net earnings, certain segments within Lockheed Martin demonstrated improved operating margins. These positive results indicate the effectiveness of their strategies and highlight areas of strength within the company. Conversely, other segments experienced a declinein operating margins, requiring focused attention to mitigate the impact on overall profitability.

Navigating Complexity and Maximizing Potential

Lockheed Martin’s performance reflects the complexity of operating in multiple segments. The company needs to identify the key drivers behind the mixed results and develop targeted plans to optimize performance and maximize profitability. By leveraging the successful segments and addressing the challenges faced by others, Lockheed Martin can enhance its overall financial performance.

Impact on the Stock Market and Economy

The financial performance of companies like Verizon, 3M, and Lockheed Martin has a significant impact on the stock market and, consequently, the broader economy. When these companies face challenges, such as declining sales, rising expenses, or reduced profitability, it can lead to market volatility and investor concern.

Investor Sentiment and Stock Prices

Investors closely monitor earnings reports as they provide insights into a company’s financial health and future prospects. Negative earnings surprises, such as declines in net income or operating margins, can result in a decline in stock prices as investors adjust their expectations. Conversely, positive earnings surprises often lead to stock price increases, signaling that investors have confidence in the company’s performance and growth potential.

Ripple Effects on the Economy

The stock market’s reaction to these earnings reports can have broader implications for the economy. Positive earnings reports and stock price increases can boost investor sentiment, leading to increased consumer and business confidence. This confidence often translates into higher spending, investments, and economic growth. Conversely, negative earnings reports and stock price declines can dampen investor and consumer confidence, potentially leading to reduced spending and a slowdown in economic activity.

Conclusion

In conclusion, analyzing the earnings reports of companies like Verizon, 3M, and Lockheed Martin provides valuable insights into their financial fundamentals and the resulting impact on the stock market and the economy. These reports reveal trends, challenges, and opportunities faced by these companies, guiding investors in making informed decisions.

Verizon’s need to balance margins amid rising expenses highlights the importance of cost optimization strategies. 3M’s declining sales and cost pressures underline the urgency to revitalize growth and control expenses. Lockheed Martin’s mixed performance across segments necessitates targeted measures to maximize profitability.

The stock market closely watches these earnings reports, as they influence investor sentiment and confidence. The market’s reaction to these reports, in turn, impacts the broader economy, influencing consumer and business confidence and driving economic growth.

By understanding and analyzing earnings reports, investors and market participants can navigate the dynamic landscape of the stock market and contribute to a robust and thriving economy. These insights provide a foundation for strategic decision-making, promoting sustainable growth and stability for companies and the economy as a whole.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)