Smart money refers to a select group of influential investors comprising banks, institutions, and hedge funds who possess substantial financial resources capable of exerting a significant impact on the market. Due to their considerable trading power, these investors are responsible for shaping market trends and movements. Consequently, gaining insights into their mindset and, ideally, comprehending their trading strategies can offer distinct advantages and opportunities to generate profits.

The term “smart money” denotes a sophisticated cohort of investors who possess not only substantial financial capital but also a comprehensive understanding of market dynamics and trends. Their vast financial resources enable them to execute large-scale trades that can swiftly and significantly impact the market. By closely monitoring their actions, it becomes possible to discern patterns and signals that can inform one’s own trading decisions.

These prominent investors, such as banks, institutions, and hedge funds, employ a variety of strategies to maximize their returns and minimize risks. Their extensive knowledge and expertise enable them to identify market inefficiencies, anticipate future trends, and exploit lucrative investment opportunities. Consequently, understanding their way of thinking and aligning one’s own strategies with theirs can prove beneficial in navigating the complex and ever-changing financial landscape.

Being aware of the trading activities and strategies of smart money investors can offer valuable insights into market sentiment and direction. For example, if these influential investors are seen accumulating shares of a particular company, it may indicate that they anticipate positive developments or value in that stock. Such information can be leveraged to make informed investment decisions and potentially profit from the anticipated market movement.

Moreover, tracking the movements of smart money investors can provide a gauge of market confidence and stability. When these seasoned investors display confidence by deploying substantial capital into specific sectors or asset classes, it can bolster overall market sentiment and attract further investor participation. Conversely, a withdrawal of funds or a cautious approach by smart money investors may signify concerns or anticipate market downturns, prompting other market participants to adjust their strategies accordingly.

It is worth noting that attempting to replicate the exact trading strategies of smart money investors can be challenging, as their actions are often influenced by a myriad of factors and confidential information not readily available to the public. However, by staying attuned to their overall market positioning and general trends, one can gain valuable insights to inform their own investment decisions.

Contents

What is Smart Money?

Smart money refers to influential investors like banks, institutions, and hedge funds that possess significant capital and can heavily influence the market. Understanding their mindset and trading strategies can provide an advantage for making profitable decisions. Monitoring their actions offers insights into market dynamics, such as discerning trends and anticipating movements. For instance, observing smart money investors accumulating shares in a specific company suggests potential value in that stock. This information can guide investment decisions and capitalize on expected market shifts.

Tracking their activities provides a glimpse into market sentiment and stability. When these investors display confidence by allocating substantial capital to certain sectors or assets, it fosters a positive outlook and attracts more participants. Conversely, a withdrawal of funds or cautious approach signals concerns and potential market downturns, prompting adjustments in strategies. Though replicating their precise strategies is challenging due to privileged information, staying informed about their general trends contributes to understanding market dynamics and making informed decisions.

Smart Money Concept

Supply and Demand Areas

A fundamental concept in comprehending the functioning of smart money revolves around supply and demand areas. These areas denote specific price ranges where a significant volume of capital enters or exits the market. They are also referred to as liquidity zones, signifying the presence of substantial liquidity, which suggests that institutional traders or smart money may choose to enter or exit at these particular price levels in the future. Recognizing and analyzing these supply and demand areas can offer valuable insights and aid in identifying potential trade opportunities.

Supply and demand areas act as essential reference points for traders and investors. When a supply area is encountered, it indicates a price level where a surplus of sell orders exceeds the buying pressure, potentially leading to downward price movements. Conversely, a demand area represents a price level where buying interest surpasses selling pressure, which can result in upward price movements. Understanding these areas allows market participants to identify regions where the balance between supply and demand may shift, providing opportunities to enter or exit trades.

Smart money, being composed of experienced and influential investors, often operates based on careful analysis of supply and demand areas. They strategically position themselves to take advantage of these liquidity zones, entering positions when prices are favorable and exiting when the supply or demand dynamics shift. By studying these areas and aligning our trading strategies with the potential actions of smart money, we can enhance our decision-making process and increase the probability of profitable trades.

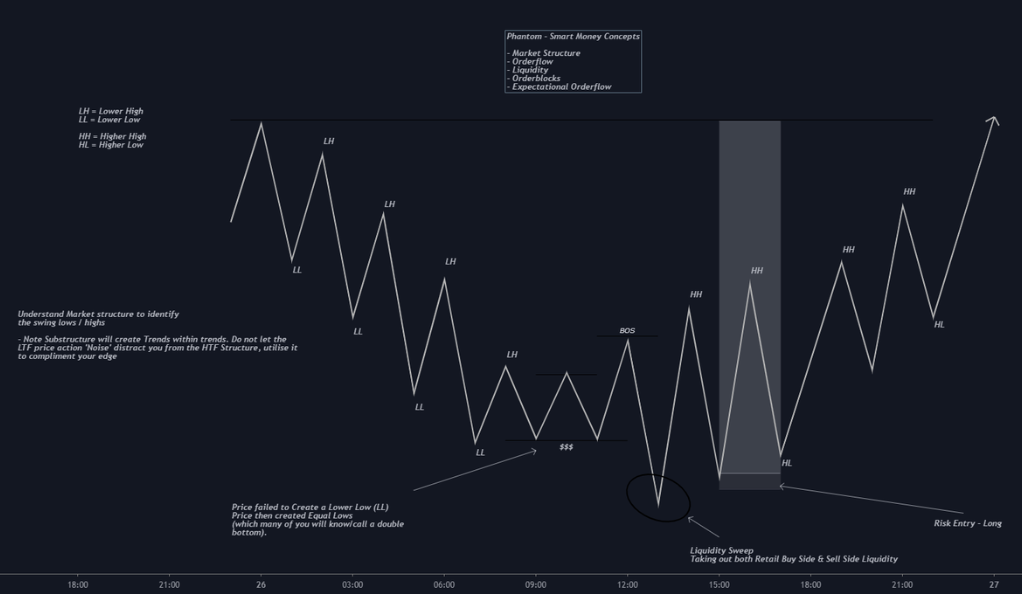

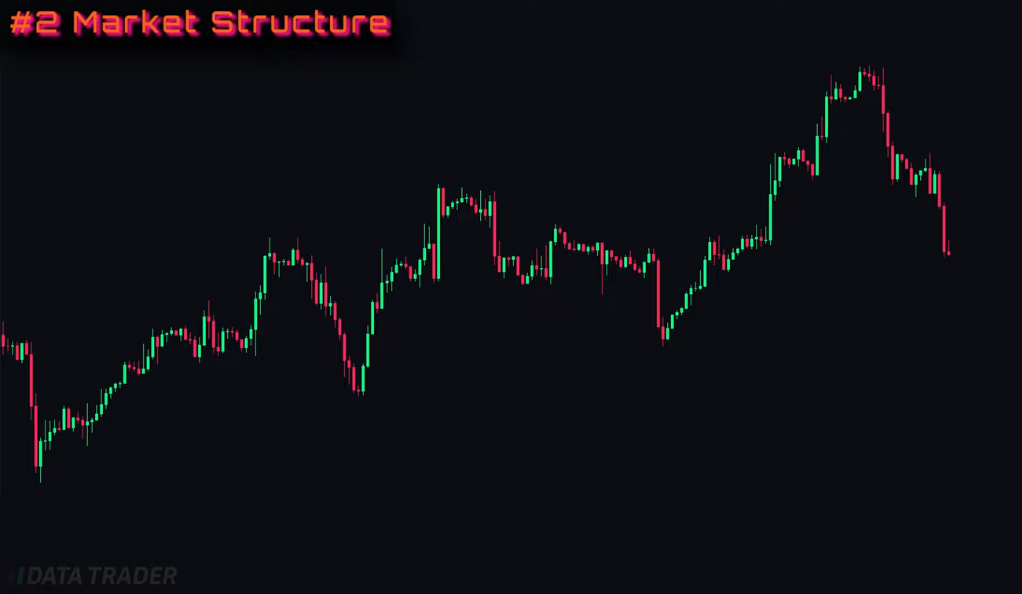

Market Structure

Understanding market structure is a vital component of comprehending the smart money concept. Market structure refers to the way in which the market moves and behaves. By analyzing market structure, traders can gain insights into trends and patterns that occur within the market. This understanding empowers traders to make better-informed trading decisions. By recognizing support and resistance areas, key levels, and differentiating between trending and ranging markets, traders can adjust their strategies accordingly. Understanding market structure enables traders to anticipate potential market movements, adapt to prevailing market conditions, and optimize their profitability within the dynamic financial landscape.

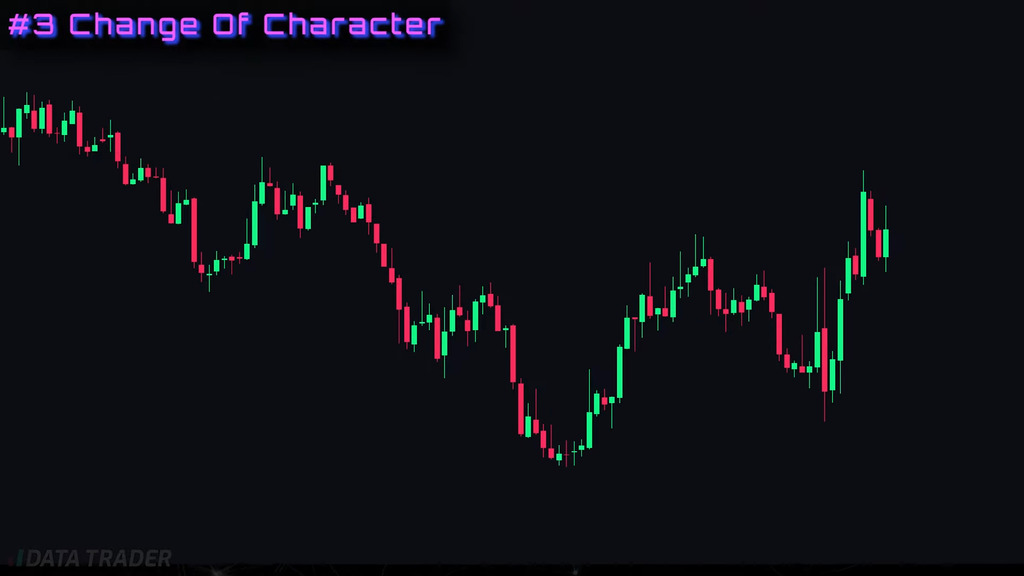

Change of Character

The change of character is crucial in comprehending the smart money concept. It refers to shifts in market behavior, such as transitioning from a trending market to a range-bound market. Recognizing these changes enables traders to adjust their strategies accordingly, aligning with the current market conditions and optimizing their trading approach. By adapting to the evolving market character, traders can enhance their decision-making process and increase their chances of success in the dynamic financial landscape.

Identifying Key Levels

Identifying key levels is crucial in understanding the smart money concept. These levels, determined through technical analysis tools like support and resistance levels, trend lines, and moving averages, indicate areas on the chart where price is likely to react. By recognizing these key levels, traders can make informed decisions, anticipate price movements, and align their strategies with smart money actions. Incorporating the identification of key levels enhances trading effectiveness and improves the ability to capitalize on profitable opportunities within the smart money framework.

Confirmation

Confirmation holds significant importance in comprehending the smart money concept. It entails seeking additional evidence that supports a trading decision. This evidence can take various forms, including the utilization of technical analysis tools such as indicators and oscillators, as well as incorporating fundamental analysis through news events and economic data.

By seeking confirmation, traders can validate their trading decisions and enhance their confidence in executing trades aligned with smart money movements. Technical analysis tools provide insights into price patterns, trends, and momentum, reinforcing the trading signal. Fundamental analysis, on the other hand, considers external factors such as market news and economic indicators, which can provide further support or validation for the trade.

Incorporating confirmation into the decision-making process helps traders mitigate risks and increase the probability of successful trades. It ensures a more thorough assessment of the market environment and provides a more comprehensive foundation for trading decisions within the smart money framework.

Risk Management

Risk management plays a crucial role in both trading and understanding the smart money concept. It encompasses the process of identifying, evaluating, and mitigating the risks associated with trading activities. Effective risk management involves various strategies, such as setting stop-loss orders, employing proper position sizing, and managing leverage.

Setting stop-loss orders is an essential risk management technique that helps limit potential losses by automatically closing a trade at a predetermined price level. This ensures that losses are controlled and helps protect capital. Proper position sizing is another critical aspect of risk management, as it involves determining the appropriate amount of capital to allocate for each trade, considering factors such as account size, risk tolerance, and market conditions.

Additionally, managing leverage is crucial to mitigate risk. Leverage amplifies trading positions, but it also magnifies potential losses. Understanding the smart money concept requires traders to use leverage judiciously and avoid excessive risk exposure. By managing leverage effectively, traders can control risk and protect their capital while taking advantage of trading opportunities.

Using the Smart Money Concept to Your Advantage

To leverage the smart money concept, traders can utilize various strategies for their benefit. These include identifying supply and demand areas, comprehending market structure and changes in character, recognizing key levels, seeking confirmation, and practicing effective risk management. By applying these approaches, traders can enhance their profitability and make informed decisions aligned with smart money movements. Analyzing liquidity zones, understanding market trends, pinpointing entry and exit points, validating decisions, and managing risk appropriately are key aspects to consider. By adapting these strategies to their individual trading styles and staying attuned to market dynamics, traders can maximize their chances of success.

Conclusion

To enhance profitability, it is vital to grasp the smart money concept and gain insights into the trading behavior of major institutions like banks. This understanding enables traders to leverage strategies such as identifying supply and demand areas, comprehending market structure, recognizing changes in character, identifying key levels, utilizing confirmation, and practicing effective risk management. By employing these tactics, traders can capitalize on the smart money concept, align their decisions with market trends, and maximize profitability. Implementing these strategies enables traders to make informed choices and manage risk appropriately, resulting in increased profitability.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)