2022 was a year of turmoil in the world of cryptocurrency. As economic conditions worsened, unsustainable practices that had flourished in 2021 crumbled. Among these were irresponsible credit, “ponzinomic” token models, and frauds that caused chaos in the crypto space.

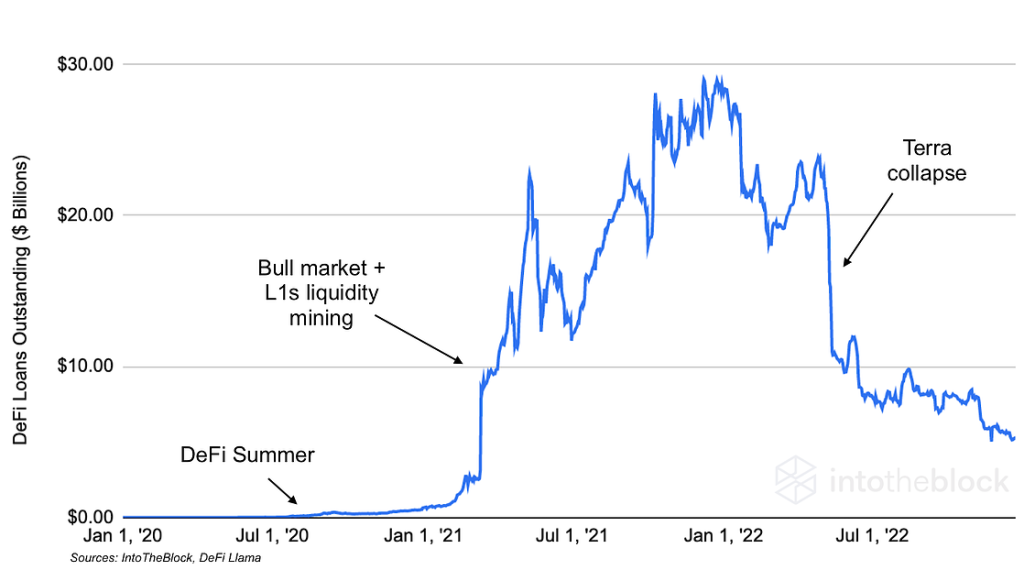

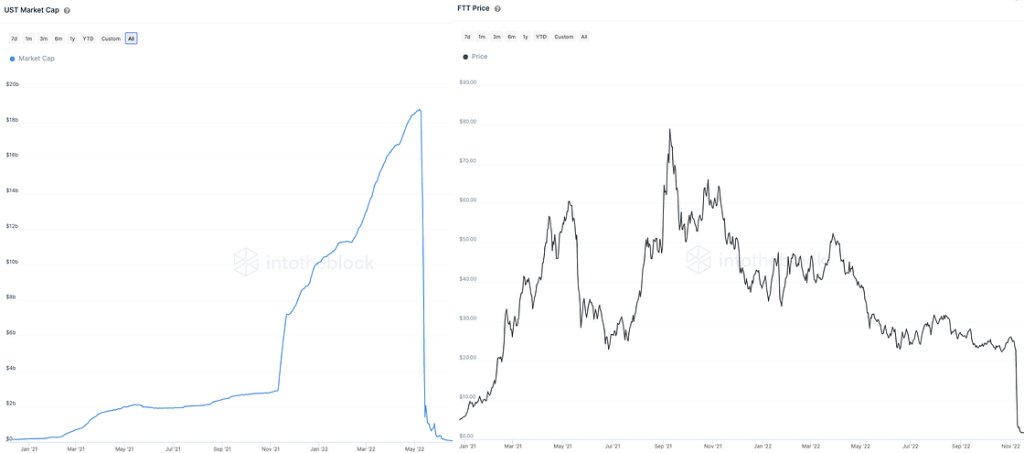

One major problem was the collapse of credit in the cryptocurrency market. According to DeFi Llama, the amount of borrowing in protocols fell by 82% in 2022, after skyrocketing by 43 times in 2021. While the full extent of the damage to centralized loans is not clear, three of the top centralized finance (CeFi) lenders in 2021 – Genesis, BlockFi, and Celsius – all collapsed. In 2021, the rapid growth of the lending industry led to fierce competition as lenders offered unsustainable yields of 8% to 12% to attract depositors. This prompted CeFi lenders to turn to riskier borrowers or protocols to generate these yields, driving the growth of UST in late 2021 and early 2022. The collapse of Terra set off a domino effect that brought down the entire industry.

Another factor contributing to the turmoil in the crypto space was the presence of bad actors who engaged in high leverage, inadequate risk management, and fraudulent practices. The collapse of LUNA and UST resulted in the loss of $50 billion in value, and it was revealed that Three Arrows Capital (3AC), one of the largest borrowers, had lied about the size of its assets under management. When 3AC defaulted on its loans and was unable to repay many CeFi lenders, it left billions of dollars in balances on their balance sheets. Around the same time, it was rumored that Alameda Research had become insolvent and had taken funds from FTX users without their knowledge. As FTX users began withdrawing funds in a “bank run” manner, the scheme was uncovered and caused at least $8 billion in losses for FTX users. It is not yet known how long FTX had been illegally transferring user funds to Alameda, but Caroline Ellison, the CEO of Alameda, admitted to the SEC that they had a “virtually unlimited credit line” and had “siphoned” FTX customer funds onto Alameda’s books as she pleaded guilty to fraud. This story is still unfolding, as it has recently been reported that SBF may pay a bail of $250 million and be placed on house arrest.

These events not only resulted in tens of billions of dollars in losses of user deposits, but they also created forced sellers and contributed to the overall loss of $1.3 trillion in crypto market capitalization. While these losses can be disheartening, the situation also presents an opportunity for the crypto space to be rebuilt in a more sustainable way now that these bad actors have been eliminated.

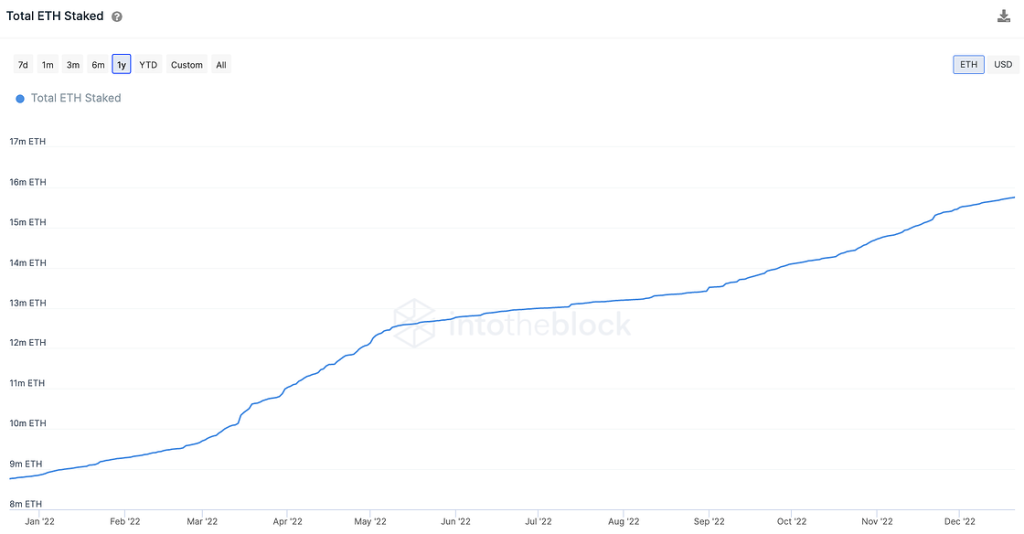

Despite all of this drama, one of the most notable milestones in the crypto space in 2022 was the merger of Ethereum. The transition to proof of stake brought a number of key benefits to the network, including reduced energy consumption (which dropped by approximately 99%), a much smaller increase in the circulating supply of Ether (only 2,100 ETH compared to the 1.16 million ETH that would have been added under proof of work, according to Ultrasound Money), and a nearly doubling of the amount of ETH staked (to 15.8 million ETH). These improvements not only made Ethereum more eco-friendly and secure, but they also made it less inflationary and aligned the incentives of validators with the long-term growth of Ethereum. In addition to the mainnet upgrade of Ethereum, layer 2 solutions such as Arbitrum and Optimism also saw significant growth in 2022, with L2s now processing more transactions per second than the mainnet and seeing a nearly 3x increase in the total value of ETH locked in, according to L2Beat data.

Overall, while these achievements may seem small in comparison to the drama that unfolded in the crypto world in 2022, they have been years in the making and are worth recognizing. These upgrades, along with many others that were not mentioned, demonstrate the resilience and innovation of the crypto community, and provide hope for a more stable and sustainable future for cryptocurrency.

It’s important to note that the events of 2022 should serve as a lesson to the crypto community. Irresponsible credit, unsustainable token models, and fraudulent practices can have serious consequences, not just for individual projects or companies, but for the entire industry. It’s crucial that the crypto space learn from these mistakes and work towards building a more sustainable and trustworthy ecosystem.

One way to do this is to prioritize transparency and accountability. Projects should be upfront about their practices, risks, and limitations, and should be willing to subject themselves to independent audits and oversight. Additionally, the industry should work towards developing better risk management systems, including stronger protections for users’ funds and more robust due diligence processes for new projects.

The events of 2022 also underscore the importance of decentralization. Decentralized finance (DeFi) protocols, in particular, have the potential to offer greater accessibility, transparency, and security to users compared to centralized alternatives. However, as the collapse of DeFi protocols in 2022 demonstrated, it’s important for these protocols to be built on solid foundations and not over-leverage themselves or engage in questionable practices. By embracing decentralization and striving for transparency and accountability, the crypto community can work towards building a more stable and trustworthy ecosystem.

In conclusion, while 2022 was a challenging year for the crypto community, it also presented opportunities for growth and improvement. By learning from the mistakes of the past and prioritizing transparency, accountability, and decentralization, the industry can work towards a more sustainable and trustworthy future.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)