The XDC Network’s price performance has been a subject of interest for investors and market analysts. This section provides a detailed analysis of its price trends, factors influencing its price, and future prospects.

Historical Price Trends

- Mid-2021: The XDC Network began trading in mid-2021, showing steady growth and outpacing Bitcoin during the late 2021 bull market.

- 2022 Bear Market: It weathered the 2022 bear market cycle better than most altcoins, maintaining stability.

- 2023 Performance: For the majority of 2023, its performance closely mirrored that of Bitcoin.

Mid-July 2023 Surge

- Price Doubling: In mid-July, the XDC Network’s price nearly doubled in the last two weeks of the month.

- Potential Factors: This surge could be attributed to various factors, including positive news, strategic partnerships, increased adoption, or speculative trading.

Comparative Analysis

- Against Bitcoin: The XDC Network’s performance has often been compared to Bitcoin, with periods of close mirroring and outpacing.

- Against Other Altcoins: Its resilience during bear markets and recent surge sets it apart from many other altcoins.

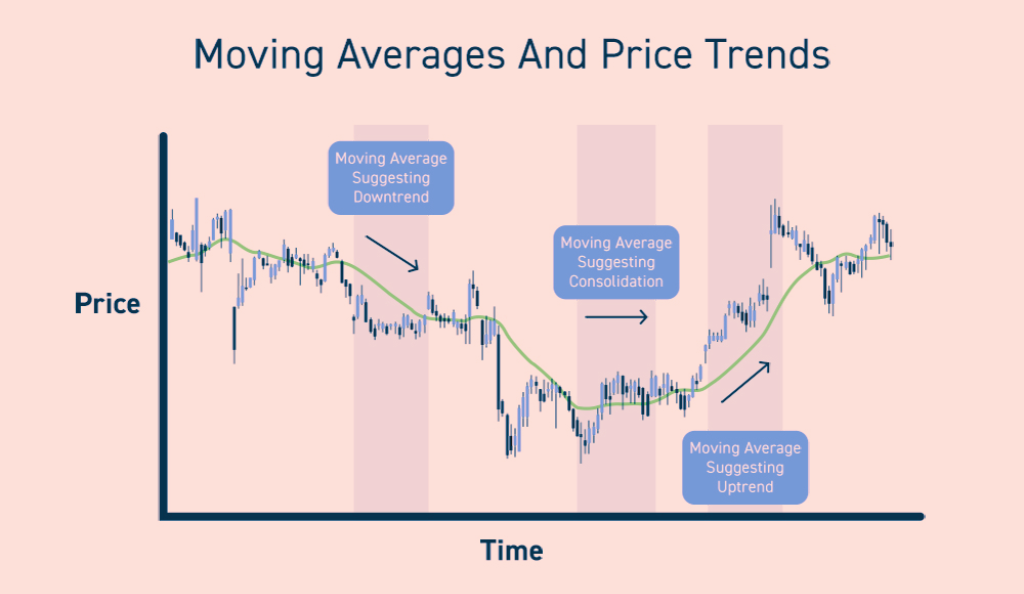

Technical Indicators

- Moving Averages: The short-term moving averages have been bullish, indicating upward momentum.

- Volume Analysis: Increased trading volumes during the surge suggest strong investor interest.

- Resistance and Support Levels: Key resistance and support levels need to be monitored for potential breakout or reversal patterns.

Future Prospects

- Short-Term Outlook: The recent surge may lead to a period of consolidation or correction.

- Long-Term Potential: The underlying technology, partnerships, and alignment with financial standards bode well for long-term growth.

- Risk Considerations: Investors should be aware of the potential risks, including market volatility and regulatory changes.

Conclusion

The XDC Network’s price analysis reveals a complex interplay of factors influencing its price. Its robust performance, recent surge, and alignment with broader market trends make it an intriguing asset for investors. However, careful consideration of risks and a comprehensive understanding of the market dynamics are essential for investment decisions.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)