The United States, often perceived as the cornerstone of the global economy, finds itself embarking on a treacherous dance as the cash reserves of its government teeter on the brink of depletion. With debt ceiling discussions seemingly in a stalemate, a precarious situation threatens the very integrity of the nation’s economic structure. Now, the million-dollar question remains: could a deal be more harmful to the economy than no deal at all?

The Current Quandary: Debt Ceiling Talks in a Gridlock

The ongoing predicament revolves around the stalemate in debt ceiling talks within the United States government. The debt ceiling represents a cap imposed by Congress on the amount of money the U.S. Treasury can borrow to finance government activities. Its purpose is to regulate the expansion of public debt and curb excessive borrowing. Nevertheless, the debt ceiling has increasingly transformed into a contentious arena for political clashes, frequently resulting in an impasse during negotiations.

At its core, the impasse arises from conflicting interests and ideological differences among lawmakers. When the debt ceiling needs to be raised, it requires bipartisan support in Congress. However, partisan disagreements often obstruct the process, leading to gridlock. Political factions may leverage the debt ceiling as a bargaining chip to push their policy agenda or extract concessions from opposing parties. This politicking can lead to protracted and intense negotiations, as each side seeks to advance its priorities while safeguarding its political capital.

Past Debt Ceiling Debates and Resolutions

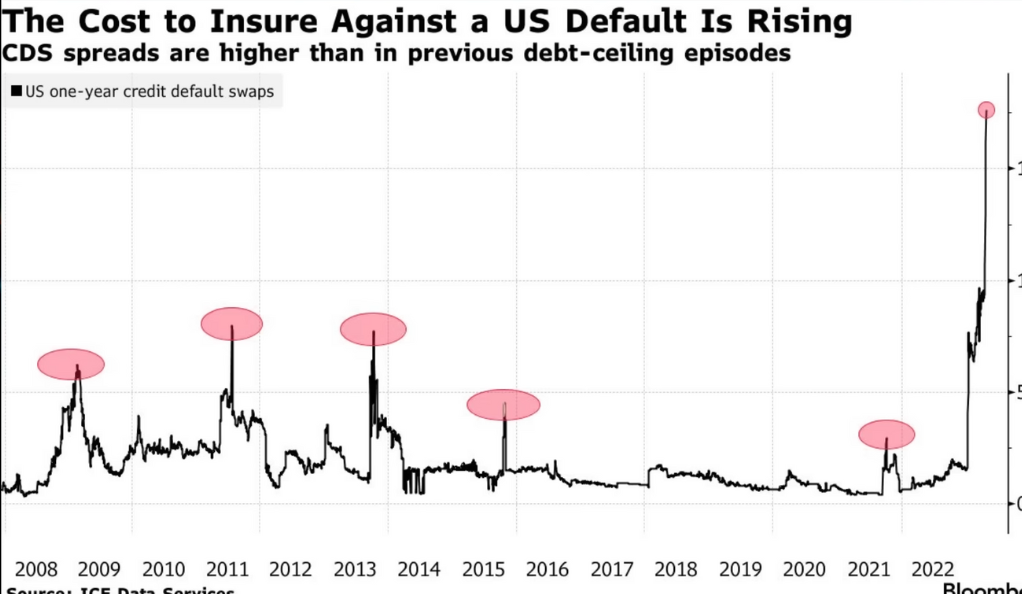

The consequences of a deadlock in debt ceiling talks can be severe and far-reaching. Failure to raise the debt ceiling could result in the United States defaulting on its financial obligations, leading to significant economic repercussions both domestically and globally. The uncertainty surrounding the country’s ability to meet its debt payments can erode investor confidence, destabilize financial markets, and raise borrowing costs. Moreover, the impact can extend beyond economic realms, affecting government operations and public services. Thus, the gridlock in debt ceiling discussions underscores the need for effective bipartisan collaboration to ensure the financial stability of the United States.

The Damocles Sword: Consequences of a Debt Default

The consequences of a debt default by the United States would be severe and far-reaching. In the event of a default, the government would be unable to fulfill its financial obligations to both domestic and international creditors. This would lead to a significant loss of investor confidence, as the United States is considered a safe haven for investments and has historically been regarded as having a strong and stable economy. The resulting instability in financial markets would have a ripple effect across the globe, potentially causing a global economic downturn.

The impact of a U.S. debt default would extend beyond financial markets. The U.S. dollar, being the world’s primary reserve currency, would likely suffer a sharp decline in value. This would lead to higher borrowing costs for the government and increased inflationary pressures, further exacerbating the economic situation. The consequences would not be limited to the United States alone, as the interconnectedness of the global economy means that other countries would also experience negative effects. International trade and investment would be disrupted, leading to decreased economic growth and potential job losses worldwide. In summary, a debt default by the United States would have catastrophic implications, jeopardizing the stability of global financial systems and triggering a chain of economic repercussions across nations.

The Negotiation Conundrum: The Dire Need for Compromise

The urgent need for compromise in the ongoing negotiation becomes increasingly evident, given the high stakes involved. However, bridging the gap between the two sides has proven to be an immensely difficult task. One potential avenue for compromise involves Congress reaching an agreement to raise the debt ceiling while simultaneously implementing measures to address the country’s growing debt burden. This could entail a combination of spending cuts and tax reforms aimed at reducing government expenditures and increasing revenue. By striking a balance between fiscal responsibility and the ability to meet financial obligations, this approach seeks to address concerns from both sides of the aisle.

Another possible compromise could focus on tackling the long-standing issue of the federal deficit. This could involve implementing comprehensive measures to reduce the deficit, such as restructuring entitlement programs, implementing stricter budgetary controls, or exploring additional revenue streams. However, in the current era of intense political polarization, finding common ground on such contentious issues proves to be a formidable challenge. The rigid party lines and divergent ideologies often hinder the negotiation process and hinder the ability to arrive at a compromise that satisfies all parties involved.

The Cash Crunch: Strained Finances and Growing Obligations

As the United States government navigates the treacherous landscape of its finances, it faces an imminent cash crunch coupled with a looming debt ceiling standoff. This intricate dance puts the nation’s financial stability at risk, highlighting the pressing need for the government to address its fiscal challenges and find a solution that can avert a potential crisis.

At the heart of this precarious situation lies the impending cash crunch. The US government relies on a consistent inflow of revenue through taxes, tariffs, and other sources to finance its operations. However, if the incoming revenue falls short of meeting the government’s financial obligations, it can lead to a shortage of available cash. This strain can have severe consequences, as the government may struggle to fulfill its essential responsibilities, such as paying federal employees’ salaries, meeting social security commitments, and making interest payments on outstanding debts.

The Debt Ceiling Standoff: Navigating Political Challenges and Financial Implications

In addition to the cash crunch, the US government faces a daunting debt ceiling standoff, further adding to the complexity of the situation. The debt ceiling represents the maximum amount of debt that the government can legally borrow to finance its activities. Once the debt ceiling is reached, the government must either reduce its spending, increase its revenue, or take measures to raise the debt ceiling to continue meeting its financial obligations.

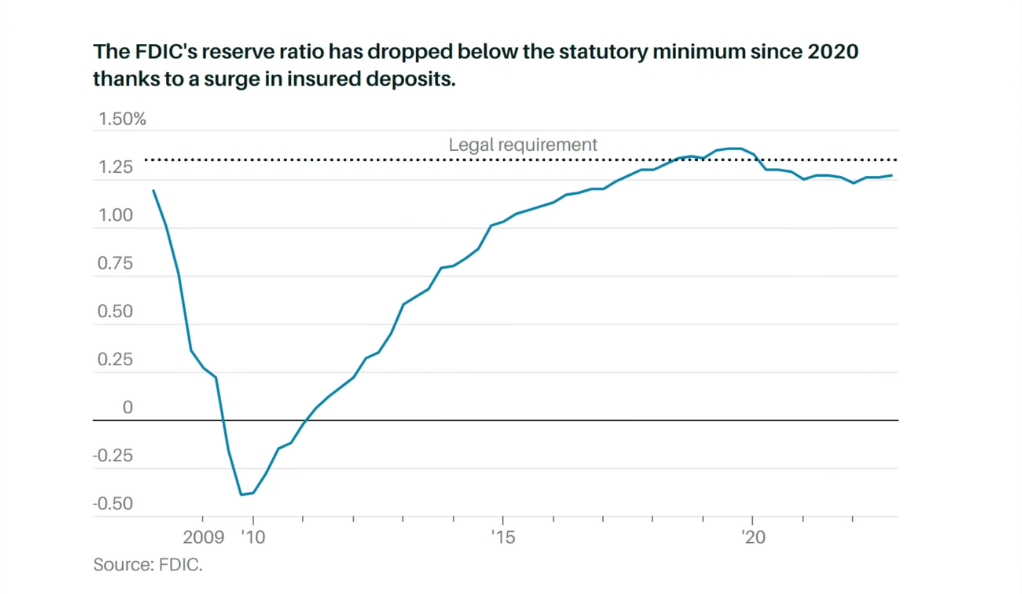

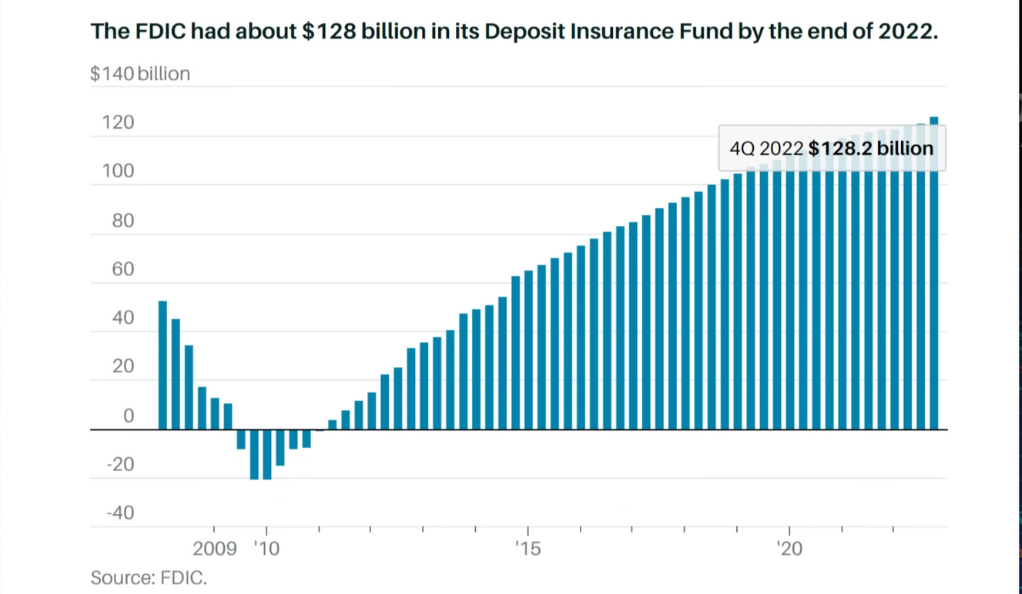

The debt ceiling standoff arises when there is a disagreement or political deadlock surrounding the decision to raise the debt ceiling. Failure to raise the debt ceiling in a timely manner can have severe consequences. It can lead to a potential default on existing obligations, increase borrowing costs, lower the nation’s credit rating, and cause widespread market turmoil.

Implications and Urgency: Averting Crisis and Ensuring Long-Term Stability

The combination of a cash crunch and a debt ceiling standoff creates an urgent need for action by the US government. The implications of inaction or delay in finding a viable solution could have far-reaching consequences, affecting not only the US economy but also global financial markets. It is crucial to avert a crisis that could lead to a loss of investor confidence, higher borrowing costs, and potential disruptions in the availability of essential services.

Furthermore, the urgency of addressing these challenges extends beyond immediate crisis management. Long-term stability and fiscal sustainability are at stake. The US government must address the underlying structural issues contributing to the cash crunch and debt ceiling standoff. This may involve comprehensive reforms to revenue generation, expenditure prioritization, and long-term debt management strategies.

The Aftermath: A Looming Liquidity Drain and Credit Tightening

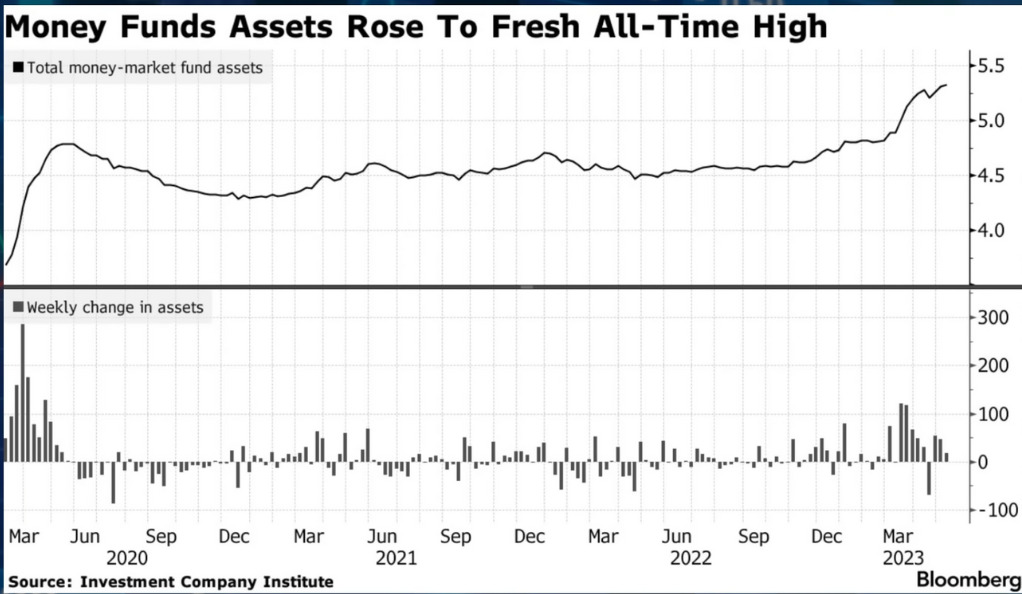

The aftermath of a resolution to the debt issue brings forth concerns that extend beyond the immediate resolution itself. One potential consequence is the looming liquidity drain that could occur. In practical terms, this means that money becomes scarcer within the economy. As the government takes steps to strengthen its financial position, it may reduce spending, leading to a decrease in the overall circulation of money. This, in turn, can result in reduced spending power for both consumers and businesses, leading to a slowdown in economic activity.

In addition to the liquidity drain, another worrisome outcome is the tightening of credit in the banking sector. In the face of the recent instability, banks may adopt a more cautious approach to lending. Fearing potential risks and uncertain economic conditions, they may tighten their lending practices, making it more difficult for individuals and businesses to access credit. This credit tightening can have a detrimental effect on economic growth and investment. Reduced access to credit hampers business expansion, constrains investment projects, and stifles entrepreneurial activity, ultimately impeding overall economic recovery.

It is important to recognize that the very resolution sought to protect the economy from further harm, but the unintended consequences of a liquidity drain and credit tightening may undermine these efforts. Therefore, careful consideration and proactive measures are required to mitigate these potential side effects and ensure the stability and vitality of the economy in the post-resolution period.

A Devil’s Bargain: Could a Deal be Worse than No Deal?

The question of whether a deal could be worse for the economy than no deal at all raises uncomfortable concerns and highlights a potential dilemma. While it may seem counterintuitive, there are valid reasons to consider the possibility. In some cases, the terms of a deal, especially those that involve austerity measures or significant spending cuts, could result in a detrimental impact on the economy. This could further squeeze economic activity, exacerbate inequality, and impede long-term growth prospects.

It is important to recognize that certain deals or agreements might impose stringent conditions that limit government spending or implement austerity measures to address fiscal concerns. While these measures may be intended to restore economic stability and confidence, they can have adverse effects. Severe spending cuts can lead to a reduction in public investment, which can negatively impact infrastructure development, education, and healthcare systems. This, in turn, may hinder productivity and innovation, ultimately impeding long-term economic growth.

Furthermore, austerity measures often have disproportionate impacts on marginalized communities and vulnerable populations, exacerbating social inequality. Reduced government spending can result in job losses, decreased social welfare programs, and limited access to essential services. Consequently, the overall economic and social fabric of a nation may suffer, and the burden of the deal’s consequences may fall disproportionately on those who are already disadvantaged.

Conclusion

In conclusion, the United States finds itself walking a complex economic tightrope. The current impasse over the debt ceiling and the threat of the government running out of cash has put the economy in a bind. While a resolution is necessary to avoid the dire consequences of a default, it’s essential to carefully weigh the potential aftermath of any deal.

The scenario at hand necessitates not just compromise but also a strategic and balanced approach to economic recovery. It’s a daunting task for any government to strike a balance between fiscal responsibility and economic growth. It is, after all, a delicate dance on a tightrope.

As the United States navigates this precarious dance, it is crucial for policymakers to consider both short-term and long-term implications. While addressing the immediate debt ceiling issue is vital, it should not come at the cost of undermining the country’s economic stability and growth potential. Balancing fiscal responsibility with targeted investments, such as infrastructure development and social programs, can help spur economic growth while also addressing long-standing structural challenges.

Moreover, fostering a collaborative and bipartisan approach to decision-making is essential. The hyper-partisan environment often impedes progress and makes reaching consensus incredibly difficult. Both sides must recognize the importance of putting the nation’s economic well-being above political differences. Engaging in constructive dialogue, finding common ground, and demonstrating a commitment to the long-term prosperity of the country should be the guiding principles.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)