The mighty Federal Reserve, the watchdog of the U.S. economy, has found itself in a rather precarious position. The specter of inflation – once dismissed as transitory – has emerged as a persistent threat, and the Fed’s response is being closely scrutinized. The past has shown that these situations are not black and white; they’re a muddle of grays. Let’s delve deeper into this intricate waltz of inflation and economic control.

The Inflation Narrative

At the onset of rising inflation, the Federal Reserve and major economic players chose to downplay initial warnings, viewing the trend as transitory. This dismissal gave way to a delayed and gentle response when inflation proved persistent. The Fed’s cautious approach, which prioritized stability of the stock market over aggressive measures to curb inflation, allowed inflation to gain momentum unchecked. The consequence was a more deeply entrenched inflation issue, leading to a far more complex economic situation than originally anticipated.

Ignoring Early Warnings

The genesis of our current economic predicament can be traced back to when the initial warnings about inflation started trickling in. Many economists rang the alarm bells, but the Fed, along with other major economic stakeholders, opted to downplay these cautionary voices. Their belief was that the inflation was transitory – a passing phase attributed to the economy’s recovery from the COVID-19 pandemic. This dismissal, whether based on complacency or calculated strategy, led to a muted response to these early warning signs.

Late and Gentle Reaction

When the specter of inflation refused to fade away and instead began casting longer shadows, the Federal Reserve was compelled to change its stance. However, their response was marked by caution. They hesitated to bring out the big guns, in this case, aggressive interest rate hikes. The fear looming large was that such a harsh step could destabilize the stock market, causing potentially disastrous ripples throughout the economy. Thus, the approach was gentle – some critics argue, too gentle.

Consequences of the Cautious Approach

This careful approach may have shielded the stock market from potential shockwaves, but it also allowed inflation to build momentum. Instead of being nipped in the bud, inflation began to grow, gradually at first, and then at an alarming rate. With each passing day, it became more apparent that inflation wasn’t merely a visitor passing through. It was here to stay, digging its claws deeper into the economy. The late and gentle response from the Federal Reserve, meant to avert one crisis, inadvertently let another one unfold. The inflation narrative was evolving, and it was evolving fast.

The Out-Of-Control Inflation Impact

The unchecked surge of inflation has inflicted significant damage on the U.S. economy. Rising prices have strained both households and businesses, stunting economic growth. The Federal Reserve is now faced with a difficult choice: let inflation continue its destructive course or implement aggressive measures that could destabilize the economy. This dilemma, combined with the potential long-term repercussions such as a slower recovery and higher unemployment rates, underscores the importance of managing inflation effectively.

Economic Damage

The unchecked growth of inflation has left a visible trail of destruction in the U.S. economy. As prices rise, the purchasing power of the dollar diminishes. This scenario has resulted in strained household budgets, as the cost of goods and services skyrockets. But it doesn’t end there. Businesses are feeling the squeeze too. From higher operational costs to reduced consumer spending, the rampant inflation is an obstacle for economic growth.

The Fed’s Dilemma

In the face of this financial storm, the Federal Reserve finds itself in a difficult position. The options are stark and carry substantial risks. They can either allow inflation to continue its devastating ascent, further eroding the economy’s strength, or they can implement aggressive measures to curb it. However, the latter could potentially destabilize the economy and trigger a recession. It’s a proverbial game of economic chess, with the next move potentially deciding the fate of the nation’s economy.

Repercussions on the Horizon

The potential repercussions of this out-of-control inflation are not restricted to the present. Its impact may well seep into the future, shaping the course of the U.S. economy for years to come. Economic recovery could become a longer, more challenging journey, potentially slowing down progress in various sectors. Unemployment rates could increase, and small businesses might struggle to survive in this harsh economic climate. The weight of these implications underscores the urgent need for effective inflation management.

The Disturbing Economic Indicators

Economic indicators are signaling distress as inflation continues to soar. The Consumer Price Index (CPI), a critical measure of inflation, is on an alarming upward trend, reflecting the increasing cost of goods and services. Simultaneously, other indicators hint at the looming threat of a recession, with signs of an inverted yield curve and a slowing GDP growth rate. These disturbing signs point to the possibility of an economic slowdown or stagnation, emphasizing the urgent need to control inflation.

Rising Inflation Indicators

Inflation indicators serve as the barometer of an economy’s health, and at present, they’re pointing towards a concerning trend. They continue to rise, suggesting that inflation has no intention of slowing down. The Consumer Price Index (CPI), one such critical indicator, is on a steady incline, revealing that the average prices of goods and services purchased by households are increasing. This upward trajectory sends a clear signal that inflationary pressure remains robust.

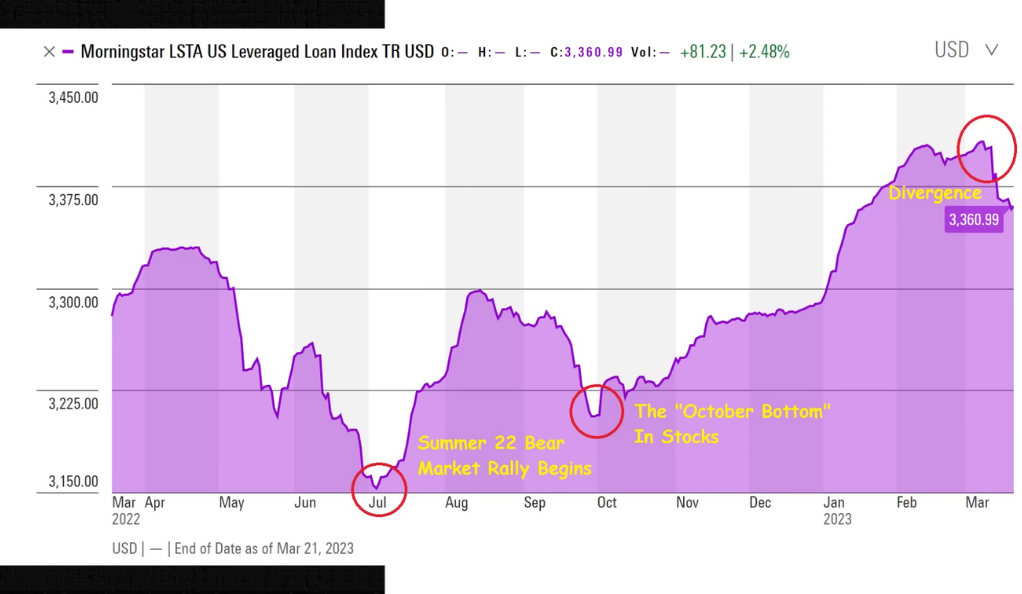

The Threat of Recession

Besides inflation indicators, other economic indices are sounding the alarm bells too. For instance, the Yield Curve, often a reliable predictor of recessions, is starting to show signs of inversion. An inverted yield curve means that the interest rates on short-term bonds are higher than the interest rates paid by long-term bonds. Historically, this inversion has often been followed by a recession. Additionally, unemployment rates have seen a slight uptick, and GDP growth rates are slowing, both of which suggest that the economy might be headed towards a downturn.

A Potentially Stagnant Economy

These alarming indicators hint at an economy that could potentially stagnate if the inflationary trend is not checked. High inflation can erode purchasing power, leading to decreased consumer spending, which, in turn, can slow economic growth. In other words, unchecked inflation could potentially create a vicious cycle where reduced spending leads to slowed economic growth, which can then lead to even more reduced spending and further economic stagnation.

The Fed’s Current Strategy: A Misstep?

The Federal Reserve’s current strategy, predicated on the belief that an impending economic downturn will curb inflation, is under scrutiny. This approach seems perilous, akin to sacrificing overall economic health in an attempt to combat inflation. The market is responding accordingly, with indices dropping due to uncertainty and a lack of confidence in this strategy. There’s an increasing concern that this could be a misstep, further destabilizing an already turbulent economic landscape.

The Stock Market Reaction

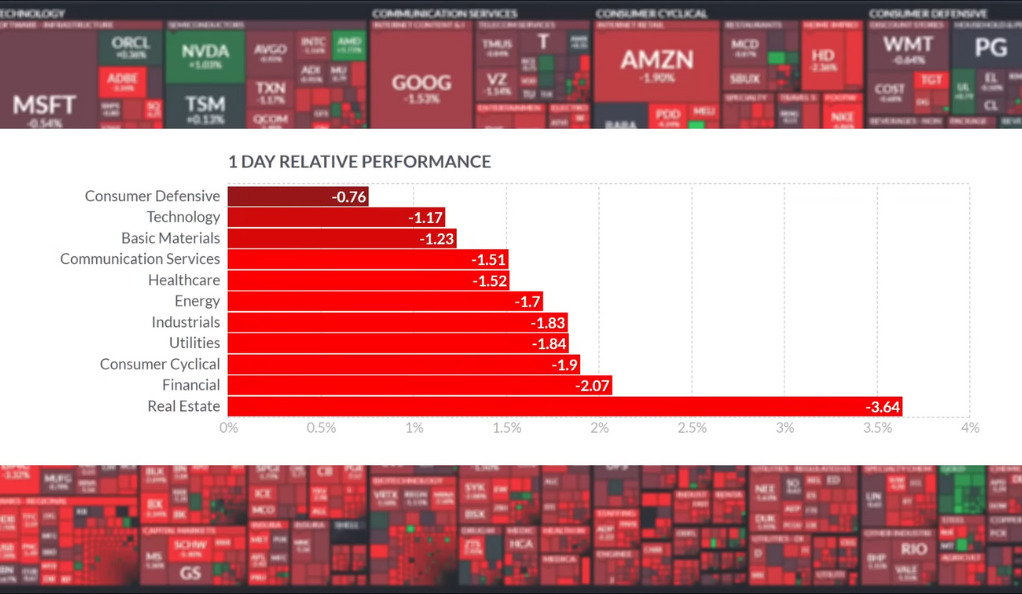

The stock market is reacting negatively to the current economic uncertainty, with major indices like the Dow Jones Industrial Average experiencing significant drops. This volatility reflects the market’s unease with the Federal Reserve’s current strategy, creating an unpredictable investment environment. The implications for investors are profound, potentially indicating a shift towards a bear market and requiring careful decision-making and potential portfolio rebalancing.

Negative Market Reaction

The stock market, often considered a leading economic indicator, is bearing the brunt of the current economic uncertainty. Major indices, such as the Dow Jones Industrial Average, are experiencing significant drops. This decline reflects the market’s skepticism regarding the Federal Reserve’s current strategy. The uncertain environment has left investors skittish, leading to increased volatility and sell-offs in the market.

Uncertainty and Confusion

The Fed’s strategy, which seemingly hinges on the prospect of an economic downturn to control inflation, is contributing to the market’s jitteriness. Investors prefer predictability and clear strategic direction, both of which appear to be lacking in the current scenario. This has led to a fluctuating market with high volatility. Every announcement from the Fed is met with anticipation and nervousness, further feeding the market’s erratic behavior.

Long-term Implications for Investors

The market reaction has significant implications for investors. The downward trend in the indices and the increased volatility may signal a shift towards a bear market, impacting portfolios and investment strategies. For those heavily invested in equities, this period is proving to be challenging. It’s a time that calls for careful decision-making, risk assessment, and potentially, portfolio rebalancing. Future investment strategies will likely need to account for this period of economic instability and market uncertainty.

Conclusion

In conclusion, the Fed’s balancing act with inflation is a complex and nuanced issue. Their current strategy has been questioned, their previous decisions scrutinized, and their future actions eagerly awaited. This economic tightrope walk is a delicate dance, and it’s clear that the Fed must tread carefully to prevent further economic damage. Whether they can successfully navigate this precarious path remains to be seen. One thing is certain, though – the eyes ofthe world are firmly fixed on the Fed as it grapples with the inflation specter. The choices they make now will echo into the future, shaping the landscape of our economy for years to come.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)