Welcome to the dawn of a new era in cryptocurrency trading, where machine learning and sophisticated algorithms pave the way for optimized trading strategies. The days of chaotic speculation and guesswork in the cryptocurrency market are rapidly being replaced by more systematic, quantifiable, and scientific methods. In the heart of this revolution are advanced trading algorithms, pushing the frontiers of technology and finance to unimagined heights.

Our main protagonist today is a highly customizable, GPT-coded trading algorithm designed specifically for the mercurial world of Bitcoin and Ethereum. Boasting high returns across all time frames, this algorithm is the modern trader’s weapon in the unpredictable battlefield of cryptocurrency markets. It’s like having a seasoned, tireless financial analyst, working round the clock, making calculated decisions based on cold, hard data.

The Basics of Algorithmic Trading

For many, the world of algorithmic trading can seem as bewildering as a labyrinth, full of intricate mathematical models and complex terminologies. But at its core, it’s a simple, methodical, and systematic approach to trading. It’s all about making decisions based on predefined criteria instead of gut feelings or hunches. So, what are the key components of algorithmic trading? What are the markers that these algorithms track? Let’s break down the complexity.

The power of algorithmic trading lies in its objectivity and precision, both derived from the use of technical indicators. These indicators, much like a compass guiding a ship, provide objective measures of market conditions and behavior. They also help identify potential trading opportunities, akin to a treasure map revealing where ‘X’ marks the spot. Bollinger Bands, Relative Strength Index (RSI), and Volume Flow Indicator (VFI) form the holy trinity of technical indicators used in our state-of-the-art algorithm.

Understanding Technical Indicators

Technical indicators are the secret ingredients in a successful trading recipe. They’re objective metrics that provide insight into market conditions and help identify potential trading opportunities. But how do they do that? Let’s delve into the three key indicators our algorithm uses: Bollinger Bands, Relative Strength Index (RSI), and Volume Flow Indicator (VFI).

Bollinger Bands might sound like a new genre of music, but they’re actually statistical bands plotted at standard deviation levels above and below a moving average. Like invisible boundaries, they define the ‘high’ and ‘low’ of a cryptocurrency’s price. Imagine a basketball game; the hoop represents the average, and the players jumping to score are the prices trying to break through the bands.

The Relative Strength Index (RSI), on the other hand, functions like the heartbeat of the market. It’s an oscillator that measures the speed and change of price movements. When the heart rate spikes, it’s a sign of exertion, and when it’s too low, it’s a sign of inactivity. Similarly, the RSI indicates overbought or oversold conditions in the market.

Finally, we have the Volume Flow Indicator (VFI), the pulse of the market that gauges the flow of money into and out of a cryptocurrency. It’s like monitoring the pulse of a runner to gauge their strength and predict their performance.

A Peek Into Our Trading Algorithm

Armed with a fundamental understanding of technical indicators, we can now explore the core of our GPT-coded trading algorithm. This isn’t just an arbitrary combination of indicators; it’s a perfectly harmonized orchestra, each player contributing to create a symphony of high returns.

Our algorithm is a unique blend of three aforementioned technical indicators and an additional factor, the Average True Range (ATR). Think of this setup as a group of specialized detectives, each bringing their unique skills to the table to solve the mystery of the ever-changing market.

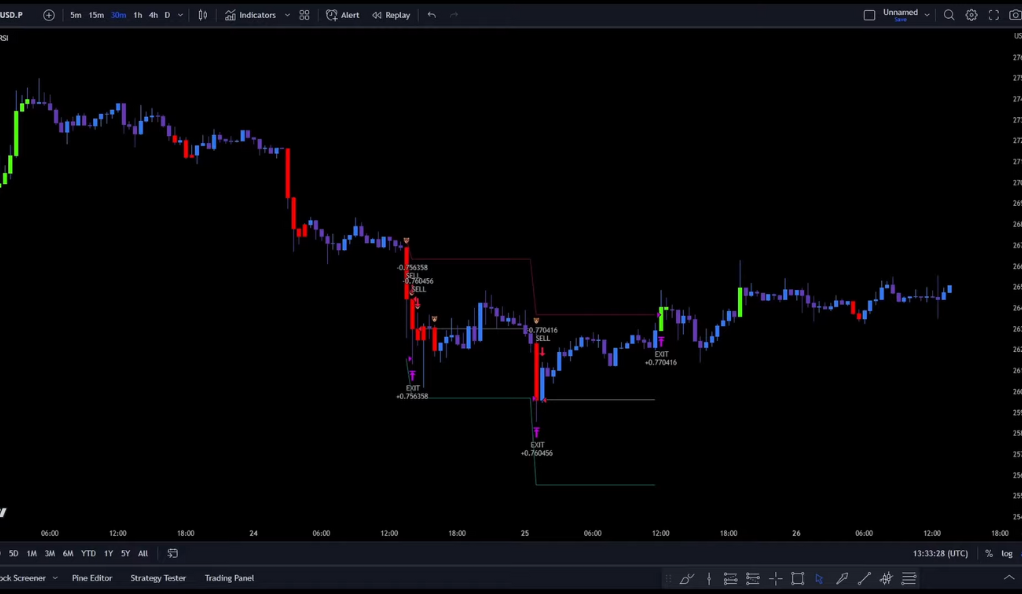

The Bollinger Bands set the scene, delineating the playing field. It’s like the initial briefing in a detective story, setting the boundaries of the investigation. The RSI then steps in as the lead investigator, detecting unusual market conditions that might signal foul play. It’s that intuitive detective who has a knack for knowing when things don’t add up.

The Algorithm Blueprint

The algorithm blueprint is the masterplan that drives our GPT-coded trading algorithm, providing a clear roadmap for generating optimal trading decisions. It’s the culmination of meticulous analysis, rigorous testing, and strategic design. Let’s dive into the intricate details of this blueprint and uncover the inner workings of our algorithm.

At the core of our algorithm, we have the Bollinger Bands, serving as the foundation for market analysis. These bands create dynamic price channels around the moving average, reflecting the volatility and price range of the cryptocurrency. By monitoring the price’s interaction with these bands, our algorithm can identify potential entry and exit points for trades. It’s like an experienced tightrope walker, maintaining balance by carefully navigating between the upper and lower bounds of the bands.

The Relative Strength Index (RSI) plays a vital role in detecting market conditions that are ripe for trading opportunities. By measuring the strength and momentum of price movements, the RSI can identify overbought and oversold conditions. It’s akin to a seasoned weather forecaster, recognizing when the market has reached extreme levels and a potential reversal or correction is imminent. This valuable insight helps our algorithm determine when to enter or exit trades, maximizing the chances of profitable outcomes.

The Volume Flow Indicator (VFI) acts as a guide to the flow of money within the cryptocurrency market. By analyzing the volume of buy and sell orders, the VFI provides insights into the strength and direction of market trends. It’s like studying the currents in a river to determine the path of least resistance. Our algorithm leverages this information to identify periods of increased buying or selling pressure, enabling it to make well-informed trading decisions.

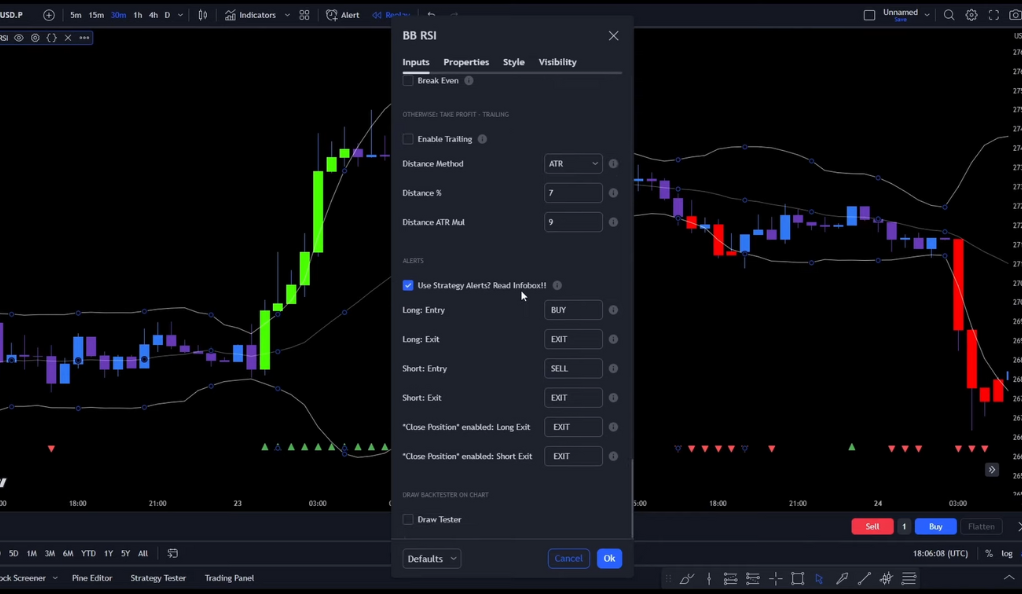

To complement the technical indicators, our algorithm incorporates the Average True Range (ATR) as a crucial component. The ATR serves as a risk management tool, helping determine optimal stop-loss and take-profit levels for each trade. It assesses the volatility and price range of the cryptocurrency to establish appropriate risk parameters. Think of it as a protective shield, safeguarding your capital by strategically placing stop-loss orders and securing profits with well-placed take-profit targets.

The Trading Rules and Risk Management Settings

The ability to consistently generate profits in trading isn’t just about making the right decisions. It’s also about effectively managing potential risks. Our algorithm’s trading rules and risk management settings work hand in hand like a pair of vigilant guardians. One eagerly seeks profitable opportunities, while the other is ever ready to protect the capital from potential pitfalls.

Unveiling The Strategy Script

Unraveling the strategy script of our GPT-coded trading algorithm is akin to embarking on an adventure, navigating the labyrinth of code that fuels this sophisticated trading tool. While it might seem daunting at first, understanding the underlying logic and design offers a fascinating glimpse into the world of advanced trading technology. Much like a timepiece, its beauty lies not just in the visible display of time but the intricate gears working behind the scenes.

The strategy script serves as the backbone of our algorithm, seamlessly integrating different technical indicators and decision-making processes. It’s like a master conductor, adeptly orchestrating the harmonious symphony of data analysis and trade execution. The language of coding might seem alien to the untrained eye, but each line, each function, and each command plays a crucial role, akin to the notes on a music sheet contributing to a beautiful melody.

Our algorithm operates on the script’s meticulous instructions, applying Bollinger Bands, RSI, VFI, and ATR to evaluate the market condition accurately. The script analyzes the raw market data, applies the technical indicators, and identifies potential trading opportunities. Just like an experienced detective connecting the dots, the script discerns patterns, trends, and anomalies in the market data.

But the role of the script goes beyond simple analysis. It’s also responsible for executing trades based on the trading rules and managing potential risks. Once the script identifies a trading opportunity, it springs into action, executing the trade at the right time and managing it throughout its life cycle. Consider it a proficient chess player, strategizing moves, making calculated decisions, and adjusting tactics based on the opponent’s moves.

Navigating through the strategy script is an insightful journey into the inner workings of algorithmic trading. It showcases the elegance of combining technology and trading principles to create a robust and efficient trading system. In the next section, we’ll dive into the specific trading rules and risk management settings that ensure our algorithm not only reaches for profitable opportunities but also safeguards the capital from potential risks.

Conclusion

The world of cryptocurrency trading is rapidly evolving, and embracing advanced technologies is crucial for staying ahead of the curve. Our GPT-coded trading algorithm represents the culmination of cutting-edge innovation, combining the power of machine learning, sophisticated technical indicators, and meticulous risk management. It offers a glimpse into the future of trading, where human intuition and expertise are augmented by the speed, precision, and objectivity of artificial intelligence.

With our algorithm, traders can unlock new realms of profitability in the dynamic and often unpredictable cryptocurrency markets. By harnessing the potential of Bollinger Bands, RSI, VFI, and ATR, the algorithm provides a comprehensive and adaptable framework for making informed trading decisions. It acts as a trusted companion, tirelessly scanning the market, detecting opportunities, and executing trades with precision.

Moreover, our algorithm is not confined to a specific time frame or rigid set of rules. Its high level of customizability empowers traders to tailor the strategy to their individual preferences and trading style. Whether you’re a short-term scalper, a long-term investor, or somewhere in between, our algorithm can be fine-tuned to suit your needs.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)