In the fast-paced, ever-evolving world of cryptocurrency trading, automated strategies have emerged as a significant game-changer. These strategies, powered by advanced algorithms and machine learning, have revolutionized the way traders navigate the volatile crypto market. One such strategy that has gained substantial traction among traders is the “Mac Generally” strategy for Bybit BTCUSDT. This strategy, with its unique blend of automation and customization, has proven its worth in the unpredictable crypto market. The strategy’s ability to automatically enter and exit trades, coupled with its compatibility with third-party apps, makes it a versatile tool for traders. Whether you’re a seasoned trader or a novice, the “Mac Generally” strategy offers a unique approach to crypto trading that can help optimize your trading performance.

The Genesis of the “Mac Generally” Strategy

The “Mac Generally” strategy is not a new invention. It’s a refined version of a previously published strategy script. The original script, designed to automatically enter and exit trades, was a significant success among traders. This success was due to the script’s ability to navigate the volatile crypto market with precision and efficiency. However, as the crypto market evolved, so did the needs of the traders. The original script, while effective, was not optimized for all market conditions and timeframes. Recognizing this, the creators of the script decided to refine it, leading to the birth of the “Mac Generally” strategy.

The Evolution

The new strategy, while retaining the core features of the original script, introduced several tweaks to optimize it for the Bybit BTCUSDT Perpetual market on a 15-minute timeframe. These tweaks were based on extensive market analysis and back-testing. Each tweak was designed to enhance the strategy’s performance in these specific market conditions. The result was a new, more efficient strategy script that offered improved trade entry and exit points, better risk management, and higher profitability. The strategy scripts are designed with a primary focus on bot trading, but their utility for manual trading is equally commendable. This dual functionality makes the “Mac Generally” strategy a versatile tool for all types of traders.

The Strategy in Action

The “Mac Generally” strategy, specifically designed for the Bybit BTCUSDT Perpetual market on a 15-minute timeframe, is a perfect example of a well-orchestrated trading strategy. Initially, it was a mirror image of the distinguished “Mac Generally” strategy script. However, the need for a more specialized approach for different market conditions led to several modifications, optimizing it for the 15-minute timeframe. This timeframe was chosen for its unique blend of short-term volatility and long-term trend identification, providing a balance that allows traders to capitalize on short-term price fluctuations while still keeping an eye on the broader market trend.

The Modifications

The modifications to the “Mac Generally” strategy were not made arbitrarily. They were the result of extensive market analysis and back-testing, each tweak designed to enhance the strategy’s performance in the specific market conditions of the Bybit BTCUSDT Perpetual market. These tweaks included adjustments to the strategy’s trade entry and exit points, risk management parameters, and profitability targets. The strategy’s trade entry points are determined by a combination of technical indicators and market analysis. When these indicators align, the strategy enters a trade, aiming to capitalize on the predicted market movement.

The Execution

The strategy’s exit points are equally strategic. The strategy employs a dynamic stop-loss system that adjusts based on market conditions. This system allows the strategy to limit losses during market downturns while maximizing profits during market upturns. In terms of risk management, the strategy employs a strict risk-to-reward ratio. This ratio ensures that potential profits always outweigh potential losses, ensuring long-term profitability even if some trades are unsuccessful. Finally, the strategy’s profitability targets are set based on extensive back-testing. These targets, while ambitious, are realistic and achievable. They provide traders with a clear goal to strive for, adding an element of motivation to the trading process. In action, the “Mac Generally” strategy is a sight to behold. It seamlessly navigates the volatile crypto market, entering and exiting trades with precision and efficiency. It’s a strategy that truly embodies the power of automated trading.

Setting Up the Strategy

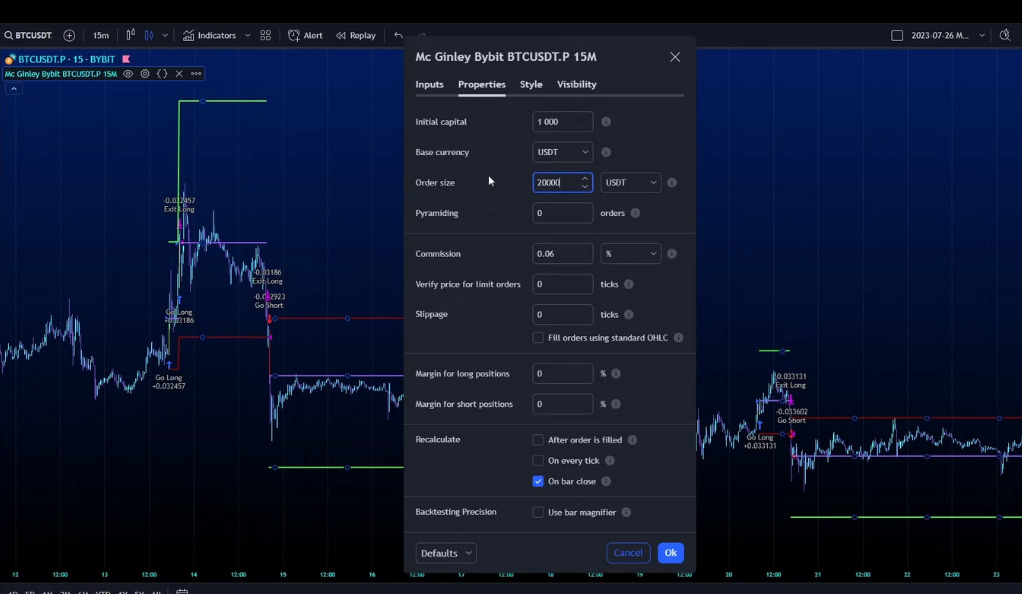

Setting up the “Mac Generally” strategy on Bybit’s Bitcoin USDT Perpetual chart is a straightforward process. The default settings are already optimized for Bitcoin USDT on the 15-minute chart. However, traders can customize these settings based on their trading preferences and risk tolerance. The customization options include adjusting the initial capital, order size, and currency. Traders can also enable the option to recalculate on bar close, which ensures that the strategy is always updated with the latest market data. This level of customization allows traders to tailor the strategy to their specific needs, making it a versatile tool for different trading styles and risk profiles.

Alerts for Manual Trading

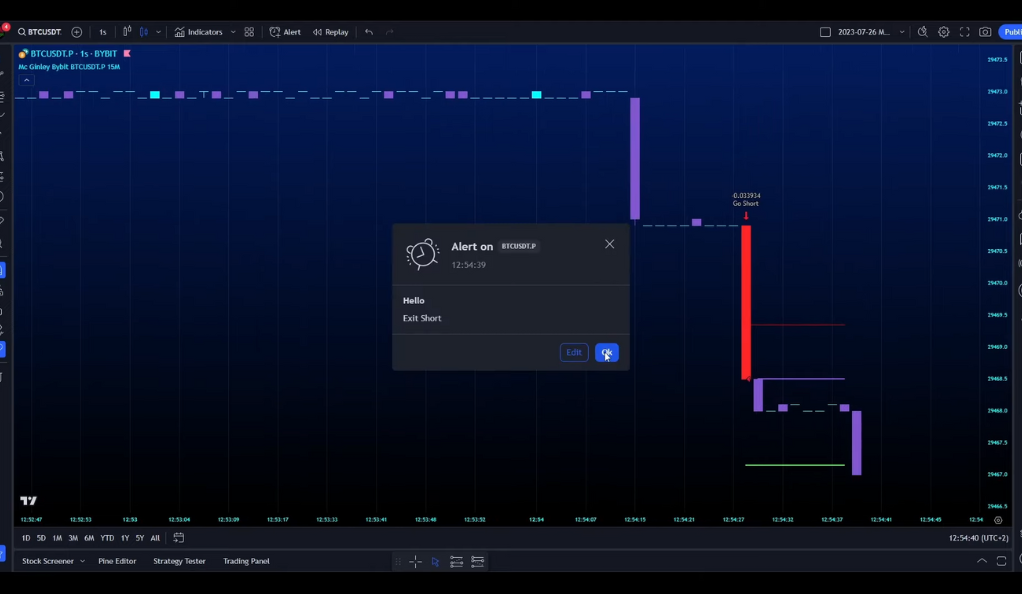

For traders who prefer manual trading, the “Mac Generally” strategy offers a unique feature: an alert setup. These alerts, which can be customized based on the trader’s preferences, serve as a bridge between the automated strategy and manual trading. They provide real-time notifications about the optimal times to enter or exit trades, thus helping traders make informed decisions. This feature is particularly useful for traders who prefer to maintain a hands-on approach to their trading. It allows them to leverage the benefits of automated trading, such as precise timing and data-driven decisions, while still maintaining control over their trades.

The Execution

The alert setup process is straightforward and user-friendly. Traders can enable the option to use strategy alerts and enter their commands, such as “buy,” “exit,” “go long,” “go short,” “exit long,” “exit short,” etc. These commands are then linked to the strategy’s trade entry and exit points, resulting in real-time alerts whenever these points are reached. The alert setup is a testament to the strategy’s adaptability to different trading styles. Whether you’re a bot trader who prefers automated trading or a manual trader who likes to be in control, the “Mac Generally” strategy caters to your needs. It’s a feature that truly embodies the strategy’s commitment to providing a versatile and efficient trading solution for all types of traders.

Performance of the “Mac Generally” Strategy

The true measure of a trading strategy’s effectiveness lies in its performance. The “Mac Generally” strategy, with its deep back-testing results, has proven to be a profitable tool for traders. The strategy has yielded a net profit of almost 300% after 639 closed trades. This impressive figure is a testament to the strategy’s robustness and reliability. It shows that the strategy, despite the market’s volatility, can deliver consistent profits. This level of consistency is particularly important in the crypto market, where prices can fluctuate wildly within a single day.

The Win Rate and Drawdown

In addition to its impressive net profit, the “Mac Generally” strategy also boasts a win rate of 50%. This win rate, which represents the percentage of trades that resulted in a profit, is a strong indicator of the strategy’s effectiveness. It shows that the strategy can deliver profitable trades consistently, making it a reliable choice for traders. Furthermore, the strategy has a drawdown of only 13%. Drawdown, which represents the largest loss from a peak to a trough during a specific period, is a key measure of risk. A low drawdown, like the one exhibited by the “Mac Generally” strategy, indicates a lower risk level, making the strategy a safer choice for traders.

The Long-Term Profitability

The long-term profitability of the “Mac Generally” strategy is another aspect worth noting. Despite the short-term volatility of the crypto market, the strategy has proven to be profitable in the long run. This long-term profitability is a testament to the strategy’s robustness and adaptability. It shows that the strategy, with its unique blend of automation and customization, can navigate the market’s ups and downs and deliver consistent profits over time. Whether the market is in a bullish or bearish phase, the “Mac Generally” strategy has consistently delivered positive results, making it a reliable choice for traders.

The Daily Gain

One of the most impressive aspects of the “Mac Generally” strategy is its daily gain. The strategy brings a daily gain of 0.24%, a figure that is quite remarkable in the volatile crypto market. This consistent daily gain is a testament to the strategy’s robustness and reliability. It shows that the strategy, despite the market’s volatility, can deliver consistent profits. This level of consistency is particularly important in the crypto market, where prices can fluctuate wildly within a single day. With the “Mac Generally” strategy, traders can enjoy a steady stream of profits, regardless of the market conditions.

Conclusion

In conclusion, the “Mac Generally” strategy for Bybit BTCUSDT is a powerful tool in the arsenal of any crypto trader. Its adaptability to both bot and manual trading, coupled with its impressive performance, makes it a strategy worth considering. Whether you’re a seasoned trader or a beginner, this strategy could be the key to unlocking your trading potential. With its unique blend of automation and customization, the “Mac Generally” strategy offers a unique approach to crypto trading that can help optimize your trading performance. So, why not give it a try? After all, in the world of trading, the right strategy can make all the difference.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)