In the vast and dynamic world of trading, strategies are the compass that guides traders towards their financial goals. One such strategy that has been making waves in the trading community is the Heikin Ashi Trading View Indicator combined with the Triple Exponential Moving Average. This powerful strategy has gained significant attention and recognition due to its impressive track record and potential for generating profitable trades. With its roots traced back to the YouTube channel of Magic Indicator Strategies, traders have been captivated by the strategy’s ability to navigate the complexities of the market and deliver consistent results.

What sets this strategy apart is its rigorous testing and validation process. It has been meticulously backtested on Bitcoin’s five-minute price chart, an environment known for its rapid price movements and volatility. Remarkably, the strategy has not reported a single losing trade, igniting curiosity and intrigue among traders of all experience levels. This exceptional performance has led traders to explore the strategy further and delve into its underlying principles to uncover the secret behind its success.

The combination of the Heikin Ashi Trading View Indicator and the Triple Exponential Moving Average forms the foundation of this strategy. The Heikin Ashi indicator, known for its ability to smooth out price fluctuations and highlight trends, works in harmony with the Triple Exponential Moving Average, which provides a dynamic view of the market’s direction and momentum. Together, these indicators create a comprehensive framework that helps traders identify potential trade setups with increased precision and confidence. As we embark on a journey to understand the intricacies of this strategy, we will uncover its rules, risk management principles, and additional features that contribute to its effectiveness in the ever-changing landscape of trading.

The Magic Indicator Strategy: An Overview

The Magic Indicator Strategy is a unique blend of the Heikin Ashi Trading View Indicator and the Triple Exponential Moving Average. It’s a versatile strategy that can be applied to shorter time frames like 5 and 15 minutes, as well as higher time frames like one hour and daily charts. It’s not just limited to cryptocurrencies like Bitcoin, Ethereum, and Solana, but also works well on major Forex Pairs and stocks.

The strategy aims to capitalize on the power of moving averages and the insights provided by the Heikin Ashi indicator. By combining these two elements, traders can identify potential trade setups with improved accuracy and efficiency.

Understanding Moving Averages

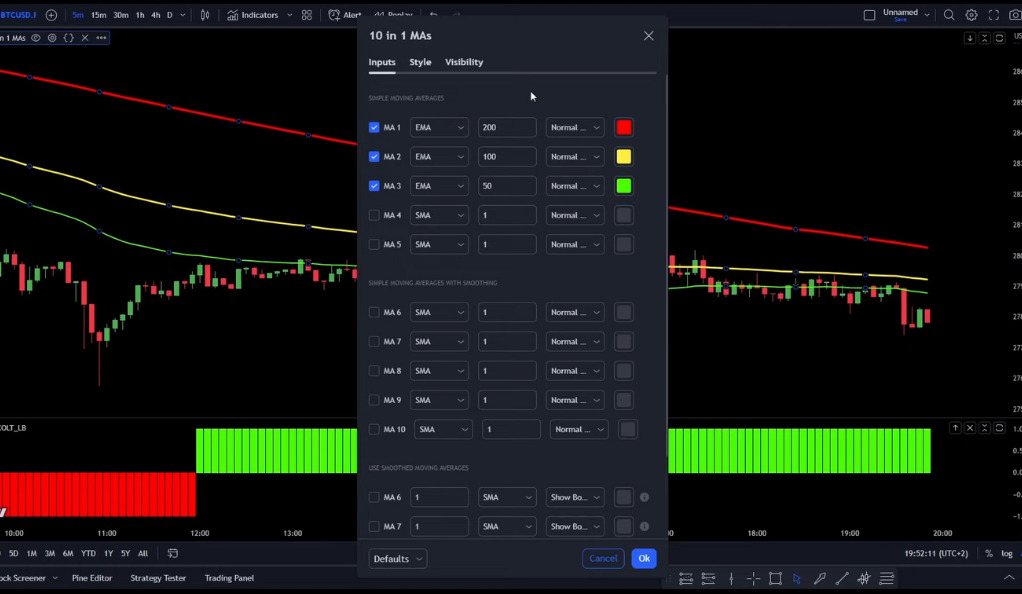

Moving averages (MAs) are widely used technical indicators in the trading world. They help smooth out price data and provide a visual representation of the overall trend. In the Magic Indicator Strategy, three specific moving averages play a crucial role: the 50, 100, and 200 Exponential Moving Averages (EMA).

The 50 EMA represents the short-term trend, the 100 EMA reflects the intermediate-term trend, and the 200 EMA indicates the long-term trend. These moving averages act as dynamic support and resistance levels, providing valuable insights into the strength and direction of the market.

When the 50 EMA is above the 100 EMA, and the 100 EMA is above the 200 EMA, it signals a bullish trend. On the other hand, if the 50 EMA is below the 100 EMA, and the 100 EMA is below the 200 EMA, it indicates a bearish trend. This alignment of moving averages forms the foundation for determining potential trade opportunities.

Entering a Long Position: The Rules

To enter a long position using the Magic Indicator Strategy, traders need to follow a set of specific rules. These rules ensure that the trade is taken in alignment with the overall trend and increases the probability of a successful trade.

EMA Alignment: The first rule requires the 50 EMA to be positioned above the 100 EMA, and the 100 EMA to be above the 200 EMA. This alignment confirms a bullish trend and sets the stage for potential long trades.

Valid Pullback: After confirming the EMA alignment, traders wait for a pullback into the 50 moving average. The price action should touch the 50 EMA but should not close below it. This pullback provides an opportunity to enter the trade at a favorable price level within the overall bullish trend.

Heikin Ashi Signal: The final rule involves the Heikin Ashi indicator. Traders need to wait for the Heikin Ashi indicator to print a new green signal, indicating a bullish reversal or continuation of the trend. This confirmation signal adds an extra layer of validation to the trade setup.

By combining these rules, traders can identify high-probability long trade opportunities. Once these conditions are met, they can enter the trade with confidence.

Setting the Stop Loss and Take Profit

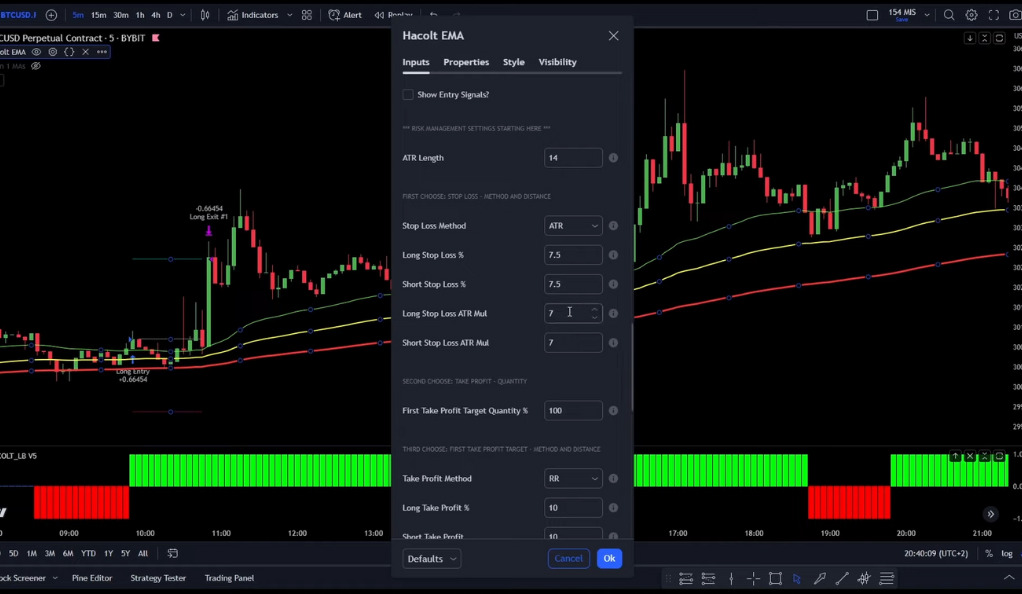

Managing risk is an essential aspect of any trading strategy, and the Magic Indicator Strategy is no exception. To protect capital and minimize potential losses, traders must determine appropriate stop loss and take profit levels.

For long positions, the stop loss is set below the 100 moving average. Placing the stop loss below this level helps to safeguard against sudden price reversals. The take profit level, on the other hand, is set using a two-to-one risk-reward ratio. This means that the potential profit target is twice the size of the initial risk taken.

By adhering to these risk management principles, traders can maintain a favorable risk-reward ratio and enhance the overall profitability of the strategy.

Entering a Short Position: The Mirror Image

While the focus has been on long positions so far, the Magic Indicator Strategy is equally applicable to short positions. The rules for entering a short position are essentially the mirror image of the rules for a long position.

Instead of the 50 EMA being above the 100 EMA, the 50 EMA should be below the 100 EMA. Similarly, the 100 EMA should be below the 200 EMA to confirm a bearish trend. Traders also wait for a valid pullback into the 50 moving average, but this time the price action should not close above it. Finally, the Heikin Ashi indicator needs to print a new red signal, signaling a bearish reversal or continuation of the trend.

Following these rules allows traders to identify potential short trade opportunities within a bearish trend. Applying the same risk management principles as with long positions, traders can effectively manage their risk and maximize their profit potential.

Additional Features of the Strategy

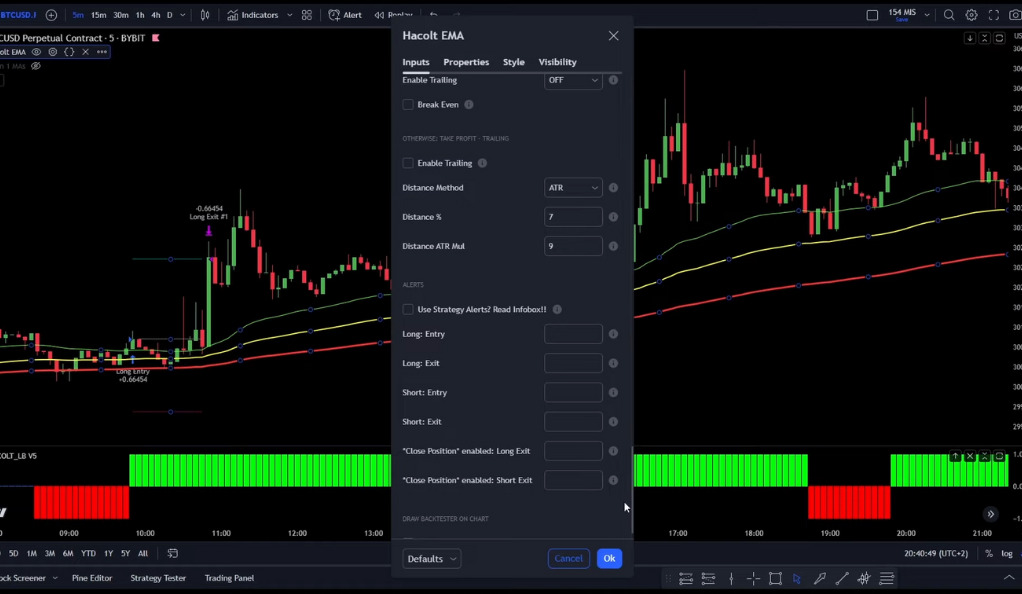

The Magic Indicator Strategy goes beyond the basic entry and exit rules. It offers additional features that provide traders with more control and flexibility in their trading approach. These features include:

- Trading Sessions and Days: Traders can customize the strategy to trade only within specific sessions or on specific days. This allows for more targeted trading based on market conditions and individual preferences.

- Additional Filters: The strategy also provides additional filters that can be used to refine trade selection. These filters may include indicators such as the Average Directional Index (ADX), flat market filters, or volume flow indicators. Traders can experiment with these filters to further enhance the accuracy of trade signals.

- Risk Management Settings: Effective risk management is crucial in trading. The strategy offers options to adjust risk management settings, such as the ATR stop loss multiplier and risk-reward ratios. Traders can tailor these settings to their risk tolerance and overall trading strategy.

- Automated Trading Alerts: For traders utilizing automated trading systems or platforms, the strategy includes alerts functions. These functions enable traders to set up alerts through platforms like Three Commas, keeping them informed of potential trade setups and market conditions.

These additional features provide traders with the flexibility to customize and fine-tune the strategy according to their individual trading style and preferences.

Backtesting Results: The Proof in the Pudding

To assess the effectiveness of any trading strategy, it is crucial to conduct thorough backtesting. The Magic Indicator Strategy has undergone extensive backtesting, providing valuable insights into its historical performance.

During the backtesting process, the strategy filtered out a significant number of trades, focusing on high-probability setups. Despite the reduced number of trades, the strategy demonstrated a commendable 60% win rate. This indicates a favorable risk-reward ratio and the potential for consistent profitability.

Over a two-month period of trading, the strategy managed to grow the account size from $1,000 to $2,600, showcasing its ability to generate substantial returns. However, traders should exercise caution and remember that past performance is not indicative of future results. It is crucial to regularly reassess and adapt trading strategies to changing market conditions.

Conclusion

The Magic Indicator Strategy, with its combination of the Heikin Ashi Trading View Indicator and the Triple Exponential Moving Average, offers traders a versatile and potentially profitable approach to the markets. By leveraging the power of moving averages and the confirmation provided by the Heikin Ashi indicator, traders can identify high-probability trade setups.

However, it is important to approach trading with caution and fully understand the risks involved. While the Magic Indicator Strategy has demonstrated promising results in backtesting, there are no guarantees in the ever-changing world of trading. Traders should always conduct their own research, practice proper risk management, and adapt the strategy to their own trading style and preferences.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)