In the dynamic and often unpredictable world of trading, having a reliable strategy can be the difference between success and failure. Among the myriad of trading techniques, Smart Money Concepts (SMC) has emerged as a beacon for traders, especially in the thrilling arena of cryptocurrency. But what exactly is SMC, and why has it become such a buzzword in trading circles?

SMC is not just a strategy; it’s a philosophy that seeks to understand and follow the moves of large institutional investors or “smart money.” These big players, with their vast resources and market influence, often leave footprints that can be tracked and analyzed. The SMC strategy is about deciphering these footprints, understanding the underlying market trends, and making informed trading decisions.

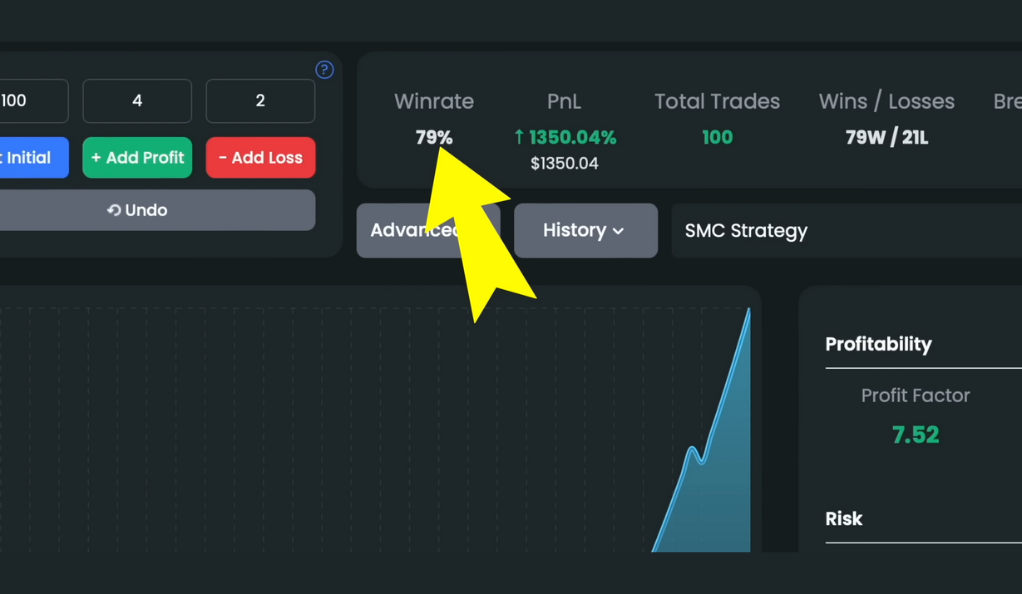

With a win ratio close to 80% and a drawdown under 10%, the SMC strategy has proven its mettle in the cryptocurrency market. It’s like having a secret recipe that, when followed with precision, leads to consistent success. But like any recipe, understanding the ingredients and the process is key.

This comprehensive guide will take you on a journey through the essentials of SMC, exploring its key indicators, long and short trading strategies, real-life examples, and much more. Whether you’re a seasoned trader looking to refine your approach or a beginner eager to learn the ropes, this guide offers valuable insights and practical tools to help you navigate the complex world of trading.

Overview of the Strategy

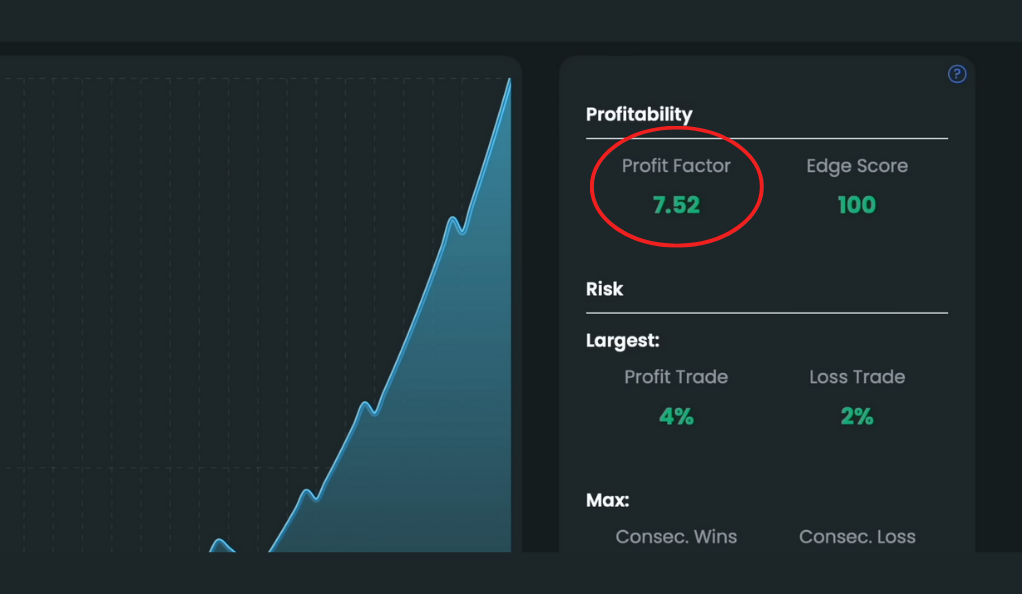

The Smart Money Concepts (SMC) trading strategy is a robust and proven approach, particularly in the cryptocurrency market. With a win ratio close to 80%, a profit factor exceeding 7, and a drawdown under 10%, it offers a balanced and effective method for traders. These numbers are not mere statistics; they represent a well-crafted strategy that maximizes gains while controlling risks. Understanding these key metrics is the first step in unlocking the potential of the SMC strategy, setting the foundation for what lies ahead in this comprehensive guide. Whether you’re a novice or an experienced trader, the SMC strategy offers a roadmap to success, providing the insights and tools needed to navigate the ever-changing landscape of trading.

Winning with Numbers

The SMC strategy is not just about intuition; it’s about numbers. With a win ratio close to 80%, a profit factor over 7, and a drawdown under 10%, it’s a strategy that has proven its worth in the cryptocurrency market. These numbers reflect a well-balanced approach that maximizes gains while minimizing risks. It’s like having a well-tuned engine that delivers performance without compromising efficiency. Understanding these numbers is the first step towards mastering the SMC strategy, and it sets the stage for what’s to come.

The Indicators You Need

In the world of Smart Money Concepts (SMC) trading, the right indicators are your compass, guiding you through the complex landscape of the market. The Higher High Lower Low Live by Lonesome helps identify trends and reversals, while the Easy SMC tool, along with alternatives like Lux algo or Zion, provides unique insights through multi-time frame order blocks. These indicators are not just tools; they are essential allies that help you follow the footprints of large institutional investors. By understanding and utilizing these indicators, you can gain a strategic edge, making informed decisions that align with market movements. Whether you’re looking to go long or short, these indicators provide the clarity and direction needed to succeed in the fast-paced world of trading.

Higher High Lower Low Live by Lonesome

The Higher High Lower Low Live by Lonesome is a crucial indicator in the SMC strategy. It helps identify potential trends and market reversals by tracking price action in real time. By adjusting the zigzag period from 10 to 20, you can fine-tune this indicator to suit your trading style. It’s like adjusting the focus on a camera lens to get the perfect shot. This indicator provides a clear visual understanding of market movements, making it an essential tool in your trading arsenal.

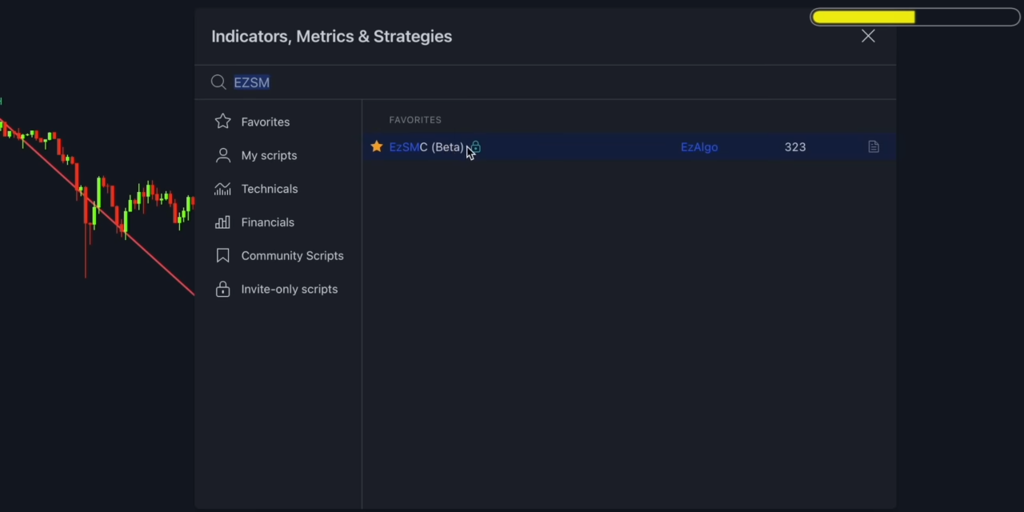

EzSMC and Alternatives

EzSMC is a premium tool that offers unique features like multi-time frame order blocks. It’s like having a VIP pass to the world of large institutional investors. By following their footprints, you can gain insights into market movements and trends. Alternatives like Lux algo or Zion provide similar functionalities, although they may lack some premium features. Choosing the right tool is like selecting the right weapon for battle; it can make all the difference in your trading success.

Understanding the SMC Indicator

The SMC Indicator is like a roadmap to the hidden trails of the market, allowing traders to follow the footprints of large institutional investors. It includes components like Market Structure Shift (MSS) and Break of Structure (BOS), which act as early signals for trend shifts. Additionally, understanding order blocks, created by large firms or smart money, can provide significant insights into future levels of support or resistance. The SMC Indicator is more than just a tool; it’s a guide that helps you navigate the complex world of trading, uncovering opportunities and providing a strategic edge. By mastering this indicator, you can align your trading decisions with the movements of the market’s influential players, enhancing your ability to make informed and successful trades.

Following the Footprints

The SMC Indicator is more than just a tool; it’s a guide that helps you follow the footprints of large institutional investors. These big players leave noticeable patterns or anomalies in price action, volume, or other market indicators. By understanding these footprints, you can gain insights into potential market movements. It’s like tracking an animal in the wild; the footprints lead you to the prize.

Market Structure Shift (MSS) and Break of Structure (BOS)

MSS and BOS are key components of the SMC Indicator. They signal potential trend shifts and provide early confirmation. Understanding these labels is like learning the language of the market; they communicate vital information that can guide your trading decisions. A bullish MSS indicates a potential shift from bearish to bullish, while a bearish MSS signals the opposite. These labels are your compass, guiding you through the complex landscape of trading.

Order Blocks: The Building Blocks

Order blocks are like the building blocks of a structure. Created by large firms or smart money, they act as future levels of support or resistance. Understanding order blocks is like understanding the architecture of a building; it helps you navigate the market with confidence. These blocks provide potential trading opportunities, especially when the price returns to these levels. They are the foundation of the SMC strategy, providing stability and direction.

Long and Short Trading Strategies

The essence of trading lies in understanding when to buy and when to sell. The Smart Money Concepts (SMC) strategy provides a clear roadmap for both long and short trading strategies. Going long involves capitalizing on a rising market, while going short is about profiting from a falling market. Both strategies have specific rules and conditions, akin to following a well-crafted recipe. From recognizing the return of price to an order block to identifying specific labels like MSS or BOS, these strategies provide a step-by-step guide to making informed trading decisions. Whether the market is bullish or bearish, understanding these long and short trading strategies equips you with the knowledge and confidence to navigate the market’s ups and downs, maximizing opportunities for success.

Going Long

Going long is about making profits when the market is rising. The SMC strategy provides a clear roadmap for going long, with specific rules and conditions. It’s like following a recipe; each step is crucial for success. From price returning to the order block to opening a long position with the right risk-reward ratio, every detail matters. This section provides a step-by-step guide to going long, ensuring you have all the ingredients for success.

Going Short

Going short is the other side of the coin. It’s about making profits when the market is falling. The strategy for short trades is similar to long trades but with conditions for selling. It’s like playing a game of chess; you need to know when to make your move. This section provides a detailed guide to going short, helping you navigate the complexities of selling in a falling market.

Real-Life Examples

Learning from real-life examples is like learning from experience. This section provides examples of both successful trades and losses, illustrating the SMC strategy in action. It’s like watching a master at work, providing insights and lessons that can only be learned through practice. These examples bring the strategy to life, making it tangible and relatable.

Time Frames: Timing is Everything

Timing is everything in trading, and the SMC strategy is no exception. It works on shorter time frames between 5 and 30 minutes, providing flexibility and responsiveness. It’s like dancing to the rhythm of the market; you need to be in sync to succeed. Understanding the right time frames is crucial for implementing the SMC strategy effectively, and this section provides the guidance you need.

Conclusion

The Smart Money Concepts (SMC) trading strategy is a comprehensive guide to trading success. It’s like having a treasure map that leads you to success. With its unique indicators, clear strategies, real-life examples, and focus on timing, it offers a complete package for traders of all levels. Whether you’re just starting or a seasoned pro, the SMC strategy provides the tools, insights, and confidence you need to thrive in the market. So why not unlock the power of SMC and take control of your trading future? The key to success is in your hands!

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)