The world of trading can often feel like navigating through a labyrinth. With a multitude of indicators and strategies at our disposal, it’s easy to feel overwhelmed. Whether you’re a seasoned trader or just dipping your toes into the market, the quest for the perfect trading strategy is a journey we all embark upon. Today, we’re setting our sights on two popular trading indicators that have made waves in the trading community: the Ichimoku Cloud and the Parabolic SAR. These indicators, with their unique functionalities and applications, have become invaluable tools for traders worldwide.

The Ichimoku Cloud and the Parabolic SAR, each with their distinct characteristics, offer a unique perspective on market trends and price directions. When used individually, they provide valuable insights. However, when combined, they form a powerful duo that can significantly enhance your trading strategy. This combination allows traders to capitalize on the strengths of both indicators, potentially leading to more informed trading decisions and better outcomes. So, fasten your seatbelts as we delve deeper into the workings of these indicators, their synergistic combination, and the effectiveness of this pairing in the dynamic and ever-evolving trading landscape.

Understanding the Parabolic SAR

The Parabolic SAR, despite its seemingly simple nature, is a potent tool in the trader’s arsenal. It’s akin to a compass, guiding traders in predicting the direction of an asset’s price. Imagine a chart, dotted with points either above or below the candlestick. These dots, far from being mere decorations, serve as crucial signposts. When the dots position themselves below the candlestick, it signals a bullish trend. Conversely, when they’re above, it’s indicative of a bearish trend. It’s a straightforward concept, but therein lies a caveat: using the Parabolic SAR in isolation can lead to numerous false signals, particularly when the price moves sideways. It’s akin to predicting tomorrow’s weather based solely on today’s temperature – it might not always hit the mark.

However, the Parabolic SAR’s simplicity is also its strength. Its visual representation of trends makes it an accessible tool for traders of all experience levels. But like any tool, its effectiveness is determined by how it’s used. While the Parabolic SAR can provide valuable insights into price direction, it’s not infallible. When the market moves sideways, the indicator can generate false signals, leading to potential trading missteps. It’s like a weather forecast predicting sunshine, only for a storm to roll in unexpectedly. Therefore, understanding the limitations of the Parabolic SAR is just as important as understanding its strengths. By doing so, traders can better navigate the ever-changing tides of the market.

The Versatility of the Ichimoku Cloud

The Ichimoku Cloud, despite its atmospheric name, is firmly grounded in the world of trading. This versatile indicator serves as a multifaceted tool, helping traders define support and resistance, identify trend directions, and gauge momentum. Much like a Swiss Army knife, the Ichimoku Cloud is equipped with multiple components, each serving a unique purpose. These components include the Tenkan-sen (conversion line), Kijun-sen (baseline), Chikou Span (lagging span), and two leading spans that form the cloud. It’s a comprehensive toolkit, offering a panoramic view of market dynamics.

The cloud, the centerpiece of the Ichimoku Cloud indicator, serves as a navigational tool for traders. If the candlesticks are positioned above the cloud, it signals a time to take long positions. Conversely, if they’re below the cloud, it’s an indicator to take short positions. It’s akin to a compass, providing traders with a directional guide amidst the often turbulent seas of the market. However, like any navigational tool, it’s not just about knowing how to read it, but understanding the landscape in which it operates. The cloud’s position can provide valuable insights into market trends, but it’s the trader’s understanding of these trends that ultimately steers the ship.

However, the Ichimoku Cloud’s versatility doesn’t stop at its navigational prowess. Its multi-component structure allows traders to glean a wealth of information from a single glance. From identifying support and resistance levels to gauging momentum, the Ichimoku Cloud provides a comprehensive overview of market conditions. It’s like having a bird’s eye view of the market landscape, providing traders with the insights they need to make informed decisions. But as with any tool, the Ichimoku Cloud is most effective when used in conjunction with a well-rounded trading strategy. After all, even the most detailed map is of little use without a planned route.

Combining the Two: A Strategy Unveiled

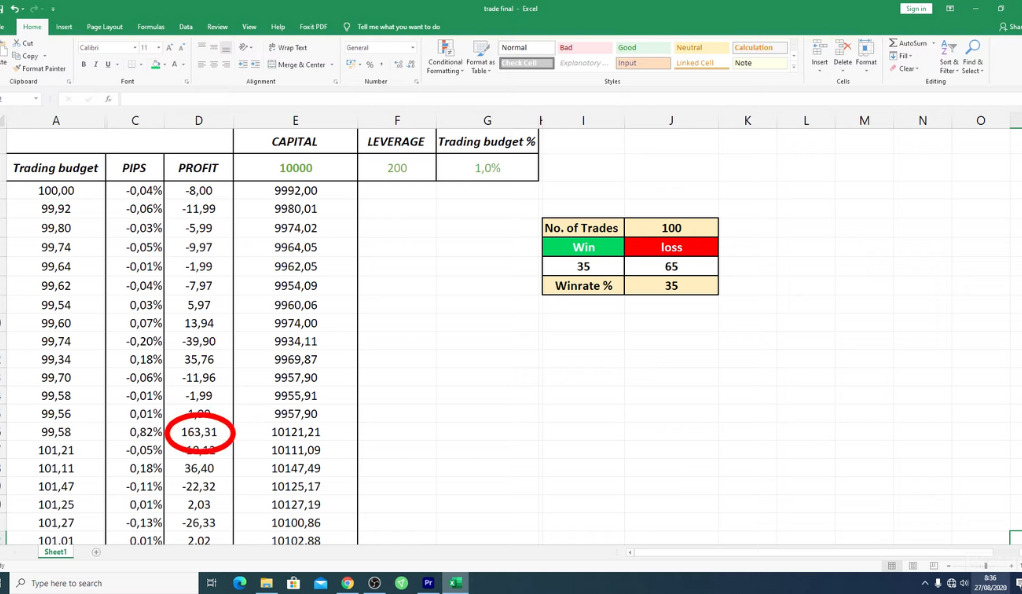

When you combine the Parabolic SAR and the Ichimoku Cloud, it’s like merging two different worlds of trading indicators. Each has its unique strengths and weaknesses, but when they come together, they form a strategy that can potentially enhance your trading decisions. To understand the power of this combination, we conducted a backtest of this strategy 100 times. The results were as fascinating as they were enlightening. The strategy yielded a 35% win rate, a figure that might not seem impressive at first glance, but becomes intriguing when you delve into the details.

The biggest single trade win from this strategy was $163, or about 82 pips. This win was almost as much as the total profit, a thrilling high that showcased the potential of this combined strategy. However, like any roller coaster ride, there were also disappointing lows. The biggest single trade loss was $62.36, or about 31 pips. These results highlight the volatile nature of trading, where exhilarating wins can be followed by disappointing losses. It’s a stark reminder that while the combination of the Parabolic SAR and the Ichimoku Cloud can lead to significant gains, it can also result in substantial losses.

However, the combination of the Parabolic SAR and the Ichimoku Cloud is more than just a strategy; it’s a learning experience. Each backtest, each trade, provides valuable insights into the dynamics of the market and the effectiveness of the strategy. The highs and lows, the wins and losses, all contribute to a deeper understanding of the market. It’s like navigating a labyrinth, where each turn, each dead end, brings you closer to finding your way. The 35% win rate might not be a jackpot, but it’s a stepping stone, a valuable lesson in the ever-evolving world of trading.

The Verdict: Is the Combination Effective?

Despite the profit, the combination of the Ichimoku Cloud and Parabolic SAR is not a silver bullet. Most of the profits came from one big trade, akin to hitting a jackpot. The Parabolic SAR often displays a late exit signal, turning a potentially profitable trade into a loss. It’s like leaving a party just when it’s getting started. The Ichimoku Cloud, on the other hand, sometimes adds unnecessary steps and wastes trade potential, like taking a long detour on a road trip.

The Potential of Parabolic SAR as an Entry Signal

The Parabolic SAR, despite its limitations, stands out as a beacon for entry signals in trading. It often detects trends early, much like a vigilant watchman who spots potential threats or opportunities before they become apparent. This early detection can provide traders with a crucial head start, allowing them to position themselves advantageously before a trend fully unfolds. It’s akin to a sprinter reacting to the starting gun, gaining a precious few moments that could make the difference between winning and losing.

However, the Parabolic SAR, like any tool, is not without its flaws. It struggles when the price moves sideways, much like a ship in still water. In these situations, the Parabolic SAR can generate false signals, leading to potential missteps. It’s like trying to navigate in fog, where objects can appear closer or further than they actually are. But there’s a silver lining to this cloud. Pairing the Parabolic SAR with another indicator that filters out false trends could potentially create a more effective strategy. It’s like using a compass along with a map, providing a more accurate and reliable guide.

Trading, at its core, is a game of probabilities. The more you tilt the odds in your favor, the better your chances of success. Finding an indicator or combination of indicators with a high win rate can provide an edge in trading. It’s like having a secret weapon in your arsenal, ready to be deployed when the situation calls for it. However, it’s important to remember that there’s no magic bullet in trading. Success comes from a combination of effective strategies, sound decision-making, and a thorough understanding of market dynamics. So, while the Parabolic SAR can be a powerful tool, it’s most effective when used as part of a broader trading strategy.

Conclusion

In the end, the combination of the Ichimoku Cloud and Parabolic SAR is like a double-edged sword. It has its strengths and weaknesses. It’s not a magic formula, but a tool that, when used correctly, can help navigate the complex world of trading. So, keep exploring, keep learning, and remember, in the world of trading, knowledge is power!

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)