In the dynamic world of trading, having a well-defined strategy is crucial. But how can you be sure that your strategy will hold up in the ever-changing market conditions? The answer lies in backtesting. This comprehensive guide will walk you through the process of backtesting in Tradingview, a popular platform among traders. We’ll explore how to view your backtesting results effectively and efficiently, ensuring you’re well-equipped to refine your trading strategy.

Understanding Backtesting: The What and Why

Backtesting is a method used by traders to evaluate their trading strategies using historical data. It involves simulating trades based on past market data to assess the potential effectiveness of a strategy. Think of it as a time machine, allowing you to travel back in time to see how your strategy would have performed under different market conditions.

But why is backtesting important? It provides a risk-free environment to test your strategy, helping you identify its strengths and weaknesses. It’s like a dress rehearsal before the actual performance, ensuring you’re ready when the curtain rises on the live market.

Backtesting in Tradingview: A Powerful Tool for Traders

Tradingview is a widely recognized platform among traders, known for its intuitive interface and an array of comprehensive tools. It’s a one-stop-shop for traders, providing charting solutions, real-time market data, and a vibrant community of traders. But one of the standout features of Tradingview is its backtesting functionality.

Backtesting in Tradingview: A Key Feature

Backtesting is a cornerstone feature of Tradingview. It provides a robust and user-friendly environment for traders to test their strategies against historical data. This feature is integrated into Tradingview’s Pine Script editor, allowing traders to code their strategies and run them against historical data with ease.

The Mechanics of Backtesting in Tradingview

The backtesting process in Tradingview begins with coding your strategy in Pine Script, Tradingview’s proprietary scripting language. Once your strategy is coded, you can run it against historical data of your chosen asset. The backtesting tool will then simulate trades based on your strategy and compile the results.

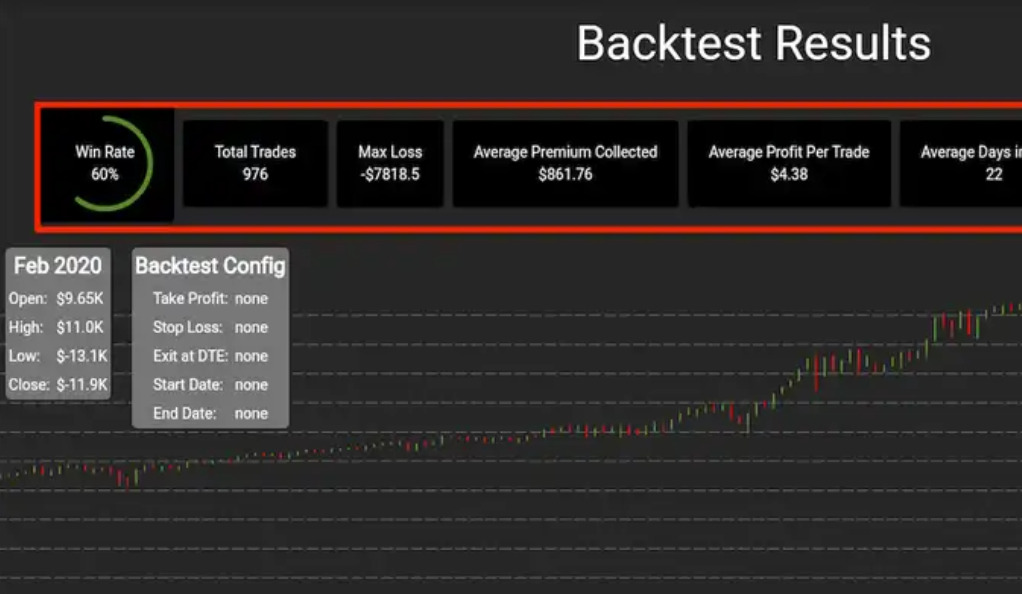

These results include crucial metrics such as the total number of trades, win rate, profit factor, and drawdown, among others. These metrics provide a comprehensive overview of your strategy’s performance, allowing you to assess its effectiveness.

The Benefits of Backtesting in Tradingview

The backtesting functionality in Tradingview offers several benefits. First, it’s integrated directly into the platform, meaning you can code your strategy, backtest it, and analyze the results all in one place. This seamless integration saves time and simplifies the process.

Second, Tradingview’s backtesting tool provides a wealth of data. It doesn’t just tell you whether your strategy was profitable; it provides detailed metrics that can help you understand why your strategy performed the way it did. This depth of information is invaluable when refining your strategy.

Finally, Tradingview’s backtesting tool is user-friendly. Even if you’re new to coding, Pine Script is relatively easy to learn. Plus, Tradingview provides extensive documentation and a supportive community to help you along the way.

Methods to View Backtesting Results: A Comparative Analysis

When it comes to viewing your backtesting results in Tradingview, you have two primary options. The first is creating an Excel spreadsheet. This method gives you a detailed overview of your results, allowing you to analyze your strategy’s performance meticulously. However, it can be time-consuming and requires a certain level of proficiency in Excel.

The second method, which we’ll focus on in this guide, is a faster and more straightforward approach. It involves using a specific website that simplifies the process, making it more accessible to traders of all levels.

Getting Started with the Faster Method: A Step-by-Step Guide

Step 1: Opening the Website

The first step in this process is to open the specific website. This website has been designed with the needs of traders in mind, offering a range of tools and resources to assist in your trading journey. It’s important to note that the website may require certain browser specifications for optimal performance, so ensure your browser is up-to-date.

Step 2: Registration

Once you’ve opened the website, the next step is to register. This usually involves providing some basic information such as your name, email address, and possibly creating a username and password. Ensure you provide accurate information and choose a strong, unique password to secure your account.

Step 3: Starting the Free Trial

After successfully registering, you’ll have the option to subscribe to a 7-day free trial. This trial period allows you to explore and utilize the website’s features, including the backtester tool, without any cost. It’s a great opportunity to familiarize yourself with the tool and see if it meets your needs.

Step 4: Subscription

Once the trial period ends, a subscription fee will apply to continue using the website’s services. The fee structure may vary, so it’s recommended to review the pricing details carefully. Remember, investing in a good backtesting tool can pay dividends in the long run by helping you refine your trading strategies.

Step 5: Using the Backtester Tool

With your subscription active, you can now start using the backtester tool. This tool simplifies the process of viewing your backtesting results, making it faster and more efficient. You can input your trading strategy, run it against historical data, and view the results all within the website.

Navigating the Backtester: Your Personal Trading Assistant

Once you’re set up, it’s time to familiarize yourself with the backtester. This tool offers two calculation options: dollars or percent. The choice depends on your risk management strategy. For instance, if you’re risking a fixed percentage of your account per trade, calculating in percent would be more suitable. This flexibility allows you to customize the backtester to suit your trading style.

Setting Up Your Backtester: Laying the Foundation

Step 1: Setting Your Initial Balance

The first step in setting up your backtester is to set your initial balance. This is the starting point of your backtesting process and represents the amount of capital you would have initially invested if you were trading live. It’s important to set a realistic initial balance that reflects the amount you’re willing and able to invest in your actual trading.

Step 2: Inputting Your Trades

The next step is to input all the trades you’ve taken based on your trading strategy. This includes both winning and losing trades. When inputting your trades, ensure to include all relevant details such as the entry price, exit price, and the number of units traded. This detailed information will allow the backtester to accurately simulate the trades and calculate the resulting profits or losses.

The Importance of Comprehensive Data

The more data you input into the backtester, the more reliable your backtesting results will be. It’s recommended to backtest a strategy at least 100 times to get a reliable picture of its performance. This means you should aim to input at least 100 trades based on your strategy.

Why is this important? The more trades you input, the more scenarios your strategy is tested against. This comprehensive testing can provide a more accurate representation of your strategy’s performance across different market conditions.

Interpreting Your Backtesting Results: Decoding the Numbers

Once you’ve input your data, the backtester will provide you with a wealth of information. This includes your win rate, profit and loss (PnL), and the total number of trades you’ve taken. These metrics are crucial in assessing the effectiveness of your strategy. They provide a snapshot of your strategy’s performance, helping you identify areas for improvement.

The Beauty of a Successful Strategy: The Reward for Your Efforts

When you’ve found a strategy that works well, you’ll see a beautiful upward curve on the graph. This curve is a visual representation of your strategy’s success. It’s the reward for your hard work and dedication, a testament to your trading prowess. But remember, a successful strategy today may not be successful tomorrow. The market is ever-changing, and so should your strategy.

Conclusion: The Journey of Continuous Learning

Backtesting is more than just a tool; it’s a journey of continuous learning and improvement. It allows you to test your strategy against historical data, providing valuable insights that can help you refine your approach. With Tradingview’s backtester, this process becomes even more accessible. So, why wait? Embark on your backtesting journey today and take your trading strategy to the next level. Remember, the key to successful trading lies not in finding the perfect strategy, but in continuously refining your approach based on market dynamics. And who knows? You might just find your cat purring in satisfaction at your trading success!

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)