With interest rates rising in 2023, investors are increasingly looking at bond exchange-traded funds (ETFs) as a way to diversify their portfolios and generate regular income with less risk than traditional investments. In this article, we will explore the benefits of investing in bond ETFs, and compare the returns of several popular bond ETFs with the average bank interest rate.

Source: https://www.federalreserve.gov/monetarypolicy/2023-03-mpr-part2.htm

The Benefits of Bond ETFs

Bond ETFs are investment vehicles that track the performance of a specific basket of bonds. These funds offer several advantages to investors, including:

- Diversification: Bond ETFs provide exposure to a wide range of bonds from different issuers, sectors, and credit ratings, reducing the risk associated with individual bond investments.

- Liquidity: Bond ETFs are traded on stock exchanges, making them more liquid than individual bonds, which can be more challenging to buy and sell.

- Lower costs: Bond ETFs typically have lower fees and expenses compared to actively managed bond funds, making them a more cost-effective investment option.

- Regular income: Bond ETFs pay out interest income regularly, providing a steady stream of income for investors.

Comparing Returns: Bank Average vs. Bond ETFs

The following table compares the average bank interest rate with the returns of several popular bond ETFs:

- Bank Average: 1.6%

- SPDR Bloomberg 1-3 Monthly T-Bill ETF (BIL): 4.34%*

- Vanguard Total Bond Market ETF (BND): 4.3%*

- iShares Core 10+ Year USD Bond ETF (ILTB): 4.84%*

- iShares iBoxx High Yield Corporate Bond ETF (HYG): 8.1%*

*Yield to maturity. Data as of April 25-26th.

As shown in the table, bond ETFs offer higher returns compared to the average bank interest rate, making them an attractive investment option for those seeking regular income and portfolio diversification.

Exploring Popular Bond ETFs

Let’s take a closer look at the bond ETFs highlighted in the table above:

- SPDR Bloomberg 1-3 Monthly T-Bill ETF (BIL): This ETF tracks the performance of the Bloomberg Barclays 1-3 Month U.S. Treasury Bill Index, providing exposure to short-term U.S. government bonds. It offers a relatively low-risk investment option with higher returns than the average bank interest rate.

- Vanguard Total Bond Market ETF (BND): BND seeks to track the performance of the Bloomberg Barclays U.S. Aggregate Float Adjusted Index, providing exposure to a wide range of U.S. bonds, including government, corporate, and mortgage-backed bonds. This ETF offers a diversified investment option for those seeking exposure to the entire U.S. bond market.

- iShares Core 10+ Year USD Bond ETF (ILTB): ILTB targets the performance of the ICE BofA 10+ Year US Corporate & Government Index, giving investors exposure to long-term U.S. bonds with maturities of 10 years or more. This ETF is suitable for investors seeking higher returns from longer-duration bonds.

- iShares iBoxx High Yield Corporate Bond ETF (HYG): HYG tracks the performance of the Markit iBoxx USD Liquid High Yield Index, providing exposure to high-yield corporate bonds. While this ETF carries a higher risk compared to other bond ETFs due to its focus on lower-rated bonds, it offers the potential for higher returns.

Conclusion

In 2023, as interest rates continue to rise, bond ETFs have emerged as an attractive investment option for investors seeking to diversify their portfolio.

Note:

Part 2: Why ETFs are a Good Investment Choice in 2023

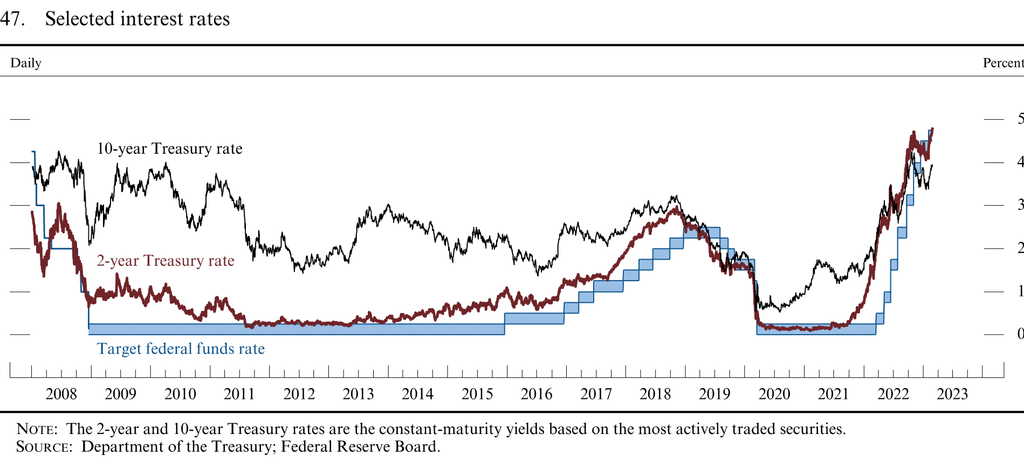

The Federal Reserve’s latest Monetary Policy Report (MPR) for March 2023 reveals some important insights into the state of the U.S. economy and the outlook for the future. According to the report, the economy has recovered strongly from the pandemic-induced recession, with real GDP growing at an annual rate of 6.5% in 2022 and projected to grow at 4.2% in 2023. The unemployment rate has fallen to 3.8%, inflation has remained near the Fed’s 2% target, and financial conditions have improved significantly.

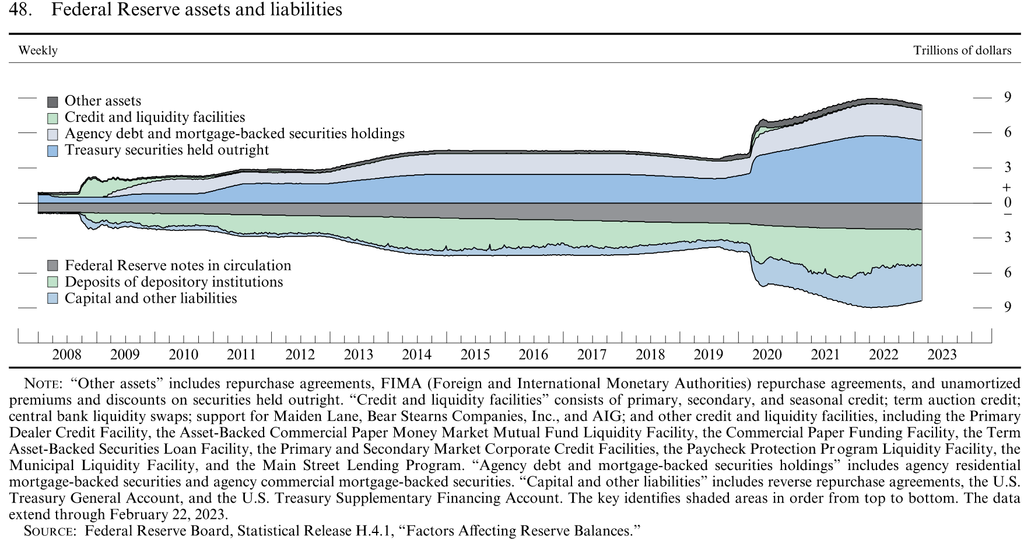

The report also indicates that the Fed has begun to normalize its monetary policy stance, after providing unprecedented support during the crisis. The Fed has raised its federal funds rate target range three times since December 2022, reaching 1.00%-1.25% as of March 2023. The Fed has also started to reduce its holdings of Treasury securities and agency mortgage-backed securities (MBS) by $20 billion per month, gradually shrinking its balance sheet.

The Fed’s policy actions reflect its confidence in the durability of the economic recovery and its expectation that inflation will remain stable in the medium term. However, the report also acknowledges some risks and uncertainties that could affect the economic outlook, such as the evolution of the pandemic and its variants, the pace of global vaccination, the fiscal policy stance, the supply chain disruptions, and the geopolitical tensions.

Given this economic and monetary policy environment, what are some of the best investment options for investors who want to take advantage of the growth opportunities and hedge against the potential risks? One possible answer is exchange-traded funds (ETFs).

ETFs are investment vehicles that track an index, a sector, a commodity, or a basket of assets. They offer several benefits over traditional mutual funds or individual stocks, such as:

- Diversification: One ETF can give exposure to a group of equities, market segments, or styles. An ETF can track a broader range of stocks, or even attempt to mimic the returns of a country or a group of countries. This can help investors reduce their portfolio risk and volatility by spreading their investments across different asset classes and regions.

- Trading flexibility: ETFs trade like stocks on an exchange throughout the day. Investors can buy and sell ETFs at any time during market hours, unlike mutual funds that are priced only once per day after the markets close. ETFs also allow investors to use various order types, such as limit orders, stop orders, or market orders, to execute their trades according to their preferences and strategies.

- Lower fees: ETFs are passively managed, meaning they follow an index or a benchmark without active intervention from a fund manager. This results in lower operating costs and expense ratios compared to actively managed funds. ETFs also tend to have lower commissions and bid-ask spreads than individual stocks.

- Tax efficiency: ETFs are generally more tax-efficient than mutual funds because they have fewer capital gains distributions. ETFs create and redeem shares in-kind with authorized participants (APs), which are large institutional investors that act as market makers for ETFs. This process minimizes the need for selling securities within the fund, which would trigger taxable events.

These advantages make ETFs an attractive investment choice for investors who want to participate in the economic growth while managing their risk and cost effectively. There are many types of ETFs available in the market that cater to different investment objectives and preferences. Some examples are:

- Broad market ETFs: These ETFs track major stock market indexes, such as the S&P 500, the Dow Jones Industrial Average, or the Nasdaq Composite. They offer exposure to a large and diversified set of companies across various sectors and industries. They are suitable for investors who want to capture the overall market performance with low cost and simplicity.

- Sector ETFs: These ETFs focus on specific sectors of the economy, such as technology, health care, energy, or consumer staples. They offer exposure to a group of companies that share similar characteristics and trends. They are suitable for investors who want to target specific growth opportunities or hedge against sector-specific risks.

- Thematic ETFs: These ETFs invest in companies that are related to a certain theme, such as cloud computing, artificial intelligence, cybersecurity, clean energy, or genomics. They offer exposure to a group of companies that are expected to benefit from disruptive innovation and long-term structural changes in the economy and society. They are suitable for investors who want to capture the growth potential of emerging trends and technologies.

Some examples of thematic ETFs are:

- First Trust Cloud Computing ETF (SKYY): This ETF tracks an index of companies that are engaged in cloud computing or related services, such as software-as-a-service (SaaS), platform-as-a-service (PaaS), or infrastructure-as-a-service (IaaS). Some of its top holdings include Amazon.com Inc. (AMZN), Microsoft Corp. (MSFT), and Salesforce.com Inc. (CRM).

- ARK Innovation ETF (ARKK): This ETF invests in companies that are involved in disruptive innovation across various sectors, such as technology, health care, and financial services. Some of its top holdings include Tesla Inc. (TSLA), Roku Inc. (ROKU), and Teladoc Health Inc. (TDOC).

- Global X Robotics & Artificial Intelligence ETF (BOTZ): This ETF tracks an index of companies that are involved in the development or production of robotics and artificial intelligence (AI) technologies, such as industrial robots, autonomous vehicles, machine learning, or computer vision. Some of its top holdings include Nvidia Corp. (NVDA), Intuitive Surgical Inc. (ISRG), and Fanuc Corp. (FANUY).

- First Trust NASDAQ Cybersecurity ETF (CIBR): This ETF tracks an index of companies that are engaged in cybersecurity or related services, such as hardware, software, consulting, or education. Some of its top holdings include CrowdStrike Holdings Inc. (CRWD), Palo Alto Networks Inc. (PANW), and Zscaler Inc. (ZS).

- iShares Global Clean Energy ETF (ICLN): This ETF tracks an index of companies that produce energy from solar, wind, or other renewable sources, or provide technology and equipment for clean energy production. Some of its top holdings include Enphase Energy Inc. (ENPH), Plug Power Inc. (PLUG), and SolarEdge Technologies Inc. (SEDG).

- ARK Genomic Revolution ETF (ARKG): This ETF invests in companies that are involved in genomics and biotechnology, such as gene editing, gene therapy, CRISPR, or synthetic biology. Some of its top holdings include Invitae Corp. (NVTA), CRISPR Therapeutics AG (CRSP), and Editas Medicine Inc. (EDIT).

- Amplify Transformational Data Sharing ETF (BLOK): This ETF invests in companies that are involved in blockchain technology or related services, such as cryptocurrency mining, exchange, or storage. Some of its top holdings include MicroStrategy Inc. (MSTR), Square Inc. (SQ), and Coinbase Global Inc. (COIN).

These thematic ETFs offer investors a way to access some of the most exciting and innovative trends in the market today. However, they also come with some challenges and risks that investors should be aware of before investing.

Some of the challenges and risks of thematic ETFs are:

- Concentration: Thematic ETFs invest in a niche theme or industry, which can result in concentration risk. If the industry experiences a downturn, the ETF’s value can suffer. Moreover, some thematic ETFs may have a limited universe of investable stocks, which can lead to overexposure to certain companies or sectors. For example, the iShares Global Clean Energy ETF (ICLN) has more than 40% of its assets in its top 10 holdings, which makes it vulnerable to idiosyncratic shocks or regulatory changes.

- Volatility: Thematic ETFs can be more volatile than broad-based ETFs due to the concentrated nature of their holdings. They can also be influenced by sentiment and speculation, which can drive up or down their prices rapidly. For example, the Amplify Transformational Data Sharing ETF (BLOK) has a standard deviation of 34.7%, compared to 18.1% for the S&P 500 Index. This means that BLOK has experienced larger price fluctuations than the broader market.

- Cost: Thematic ETFs tend to have higher expense ratios than traditional ETFs because they are more complex and specialized. They may also incur higher trading costs due to lower liquidity and wider bid-ask spreads. For example, the ARK Genomic Revolution ETF (ARKG) has an expense ratio of 0.75%, compared to 0.09% for the SPDR S&P 500 ETF Trust (SPY). This means that ARKG charges $75 for every $10,000 invested, while SPY charges only $9.

- Performance: Thematic ETFs may not always deliver the expected returns based on their underlying theme or industry. They may underperform the market or their peers due to various factors, such as poor stock selection, index methodology, market timing, or competition. For example, the First Trust Cloud Computing ETF (SKYY) has underperformed the Technology Select Sector SPDR Fund (XLK) by 8.6% over the past year, despite having a similar exposure to technology stocks.

These challenges and risks do not mean that thematic ETFs are bad investments. They simply imply that investors should be aware of what they are buying and how it fits into their overall portfolio. Thematic ETFs can offer attractive growth opportunities and diversification benefits, but they also require careful research, analysis, and monitoring. Investors should also consider their risk tolerance, time horizon, and investment objectives before investing in thematic ETFs.

Conclusion

Thematic ETFs are a popular and innovative way to invest in specific themes or industries that are expected to drive future growth and change in the economy and society. They offer several benefits over traditional ETFs or individual stocks, such as diversification, trading flexibility, lower fees, and tax efficiency. However, they also come with some challenges and risks, such as concentration, volatility, cost, and performance. Investors should weigh the pros and cons of thematic ETFs carefully and understand their features and implications before investing in them.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)