Guggenheim, a leading global financial services firm, recently reiterated its sell rating on Avista Corporation (AVA), a prominent utility company. This move by Guggenheim has sparked significant interest among investors and analysts, as it reflects the firm’s cautious stance on Avista’s stock. In this article, we will delve into the key takeaways from Guggenheim’s rating and analyze the rationale behind their sell recommendation.

Guggenheim Reiterates Avista (AVA) Sell Rating: Key Takeaways

- Challenging Market Conditions: One of the primary reasons behind Guggenheim’s sell rating on Avista is the challenging market conditions it currently faces. The utility sector is experiencing increased competition and regulatory pressures, which can negatively impact Avista’s profitability. Guggenheim believes that these market dynamics, combined with Avista’s relatively high debt levels, could hinder the company’s ability to generate strong returns for its shareholders.

- Regulatory Uncertainty: Another key concern for Guggenheim is the regulatory uncertainty surrounding Avista. The company operates in multiple states, each with its own set of regulations and requirements. Changes in regulations, especially those related to rate-setting, can significantly impact Avista’s financial performance. Guggenheim believes that the evolving regulatory environment adds an element of risk to Avista’s operations and could potentially dampen its growth prospects.

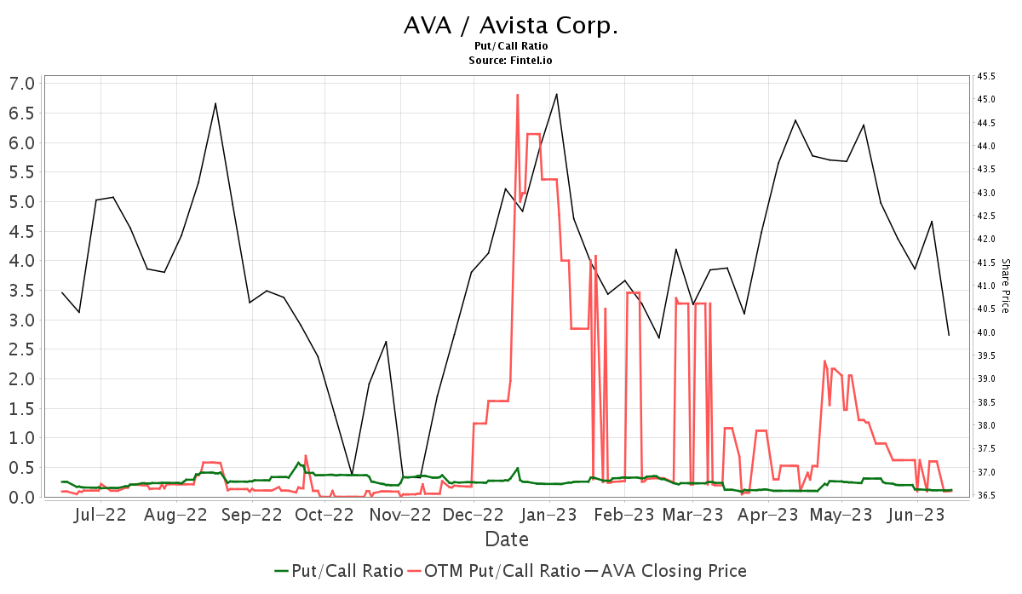

- Valuation and Stock Performance: Guggenheim’s sell rating is also driven by its assessment of Avista’s valuation and stock performance. The firm believes that Avista’s stock is overvalued at its current levels, considering the aforementioned market challenges and regulatory uncertainties. Guggenheim’s analysis suggests that Avista’s stock price may not adequately reflect the risks associated with investing in the company. Therefore, they recommend investors to consider selling their holdings in Avista.

Analysis: Guggenheim’s Stance on Avista (AVA) Sell Rating

Guggenheim’s sell rating on Avista reflects their cautious outlook on the company’s prospects. The challenging market conditions and regulatory uncertainties in the utility sector are key factors that have influenced Guggenheim’s stance. They believe that Avista’s profitability may be negatively impacted by increased competition and changing regulations, which could limit the company’s ability to generate strong returns.

Additionally, Guggenheim’s analysis of Avista’s valuation and stock performance indicates that the stock is overvalued. The firm suggests that investors should consider selling their holdings in Avista, as they believe the stock price does not adequately reflect the risks associated with investing in the company. Guggenheim’s sell rating serves as a warning to investors, urging them to carefully evaluate their positions in Avista and weigh the potential risks against the expected returns.

Guggenheim’s reiterated sell rating on Avista (AVA) has drawn attention to the cautious outlook on the company’s future prospects. The challenging market conditions, regulatory uncertainties, and perceived overvaluation of Avista’s stock are the key reasons behind Guggenheim’s recommendation. As a highly regarded financial services firm, Guggenheim’s sell rating serves as an important indicator for investors, signaling potential risks associated with investing in Avista. It is now up to individual investors to carefully consider their positions in Avista and make informed decisions based on their own risk tolerance and investment objectives.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)