In the ever-evolving and dynamic world of business, companies are ceaselessly on the hunt for effective strategies to not only sustain their profitability but also enhance it. This pursuit becomes even more critical in the face of economic headwinds such as slowing consumer spending, which has been a significant concern for businesses worldwide. Amidst this challenging backdrop, one strategy has emerged as a critical tool for companies to maintain their financial health – the concept of pricing power.

Pricing power, in its simplest form, is the ability of a company to raise the prices of its products or services without experiencing a significant loss in sales. It’s a potent tool that can help businesses maintain or even increase their revenue streams, even when the volume of sales is not particularly high. This strategy becomes even more crucial when consumer spending is slowing, as it allows companies to counterbalance the decrease in demand with higher prices.

However, the ability to wield pricing power effectively is not a given for all companies. It’s a complex art that requires a deep understanding of the market, the competitive landscape, and consumer behavior. Companies need to strike a delicate balance between raising prices to increase revenues and ensuring that the higher prices do not drive customers away.

This article delves into the contrasting experiences of two industry behemoths, Proctor & Gamble (P&G) and Tesla, as they navigate the turbulent waters of economic challenges, wielding their respective pricing powers. These two companies, although operating in vastly different sectors, provide insightful case studies on how pricing power can be utilized – or lost – in the face of economic headwinds.

In the following sections, we will delve deeper into the experiences of P&G and Tesla, exploring how they have navigated the challenges of slowing consumer spending and how their strategies have impacted their profitability. Through these case studies, we aim to provide a comprehensive understanding of the concept of pricing power and its role in corporate profitability.

Decoding Pricing Power

Before delving into the case studies, it’s essential to understand what pricing power entails. In essence, pricing power refers to a company’s ability to raise prices without losing its customer base. In an ideal business world, companies would possess unlimited pricing power. However, the reality is often starkly different. The extent of a company’s pricing power is influenced by a myriad of factors, including the level of competition, the uniqueness of the product, and the elasticity of consumer demand.

P&G: Mastering the Art of Pricing Power

In the realm of consumer staples, P&G stands as a stalwart, having demonstrated a successful exercise of pricing power. Despite witnessing a decrease in sales volumes, the company reported an increase in revenues. This scenario suggests a successful strategy of price increase, a classic example of a company leveraging its pricing power to offset the impact of declining demand.

The company’s ability to raise prices without significantly affecting its sales volume is a testament to its strong brand equity and the inelastic demand for its products. Consumers trust the P&G brand and are willing to pay a premium for its products, even in times of economic uncertainty. This trust has been built over years of delivering high-quality products and has become a powerful tool for P&G in navigating economic downturns.

The Stagflation Scenario and its Implications

The current economic environment, characterized by slow economic growth, high unemployment, and inflation, is often referred to as stagflation. In such a scenario, companies with strong pricing power, like P&G, can weather the storm by raising prices to compensate for lower sales volumes.

Stagflation presents a unique challenge for businesses. On one hand, slow economic growth and high unemployment lead to a decrease in consumer spending. On the other hand, inflation increases the cost of inputs, squeezing profit margins. In this situation, the ability to raise prices becomes a crucial survival strategy for businesses.

Tesla: A Struggle with Pricing Power

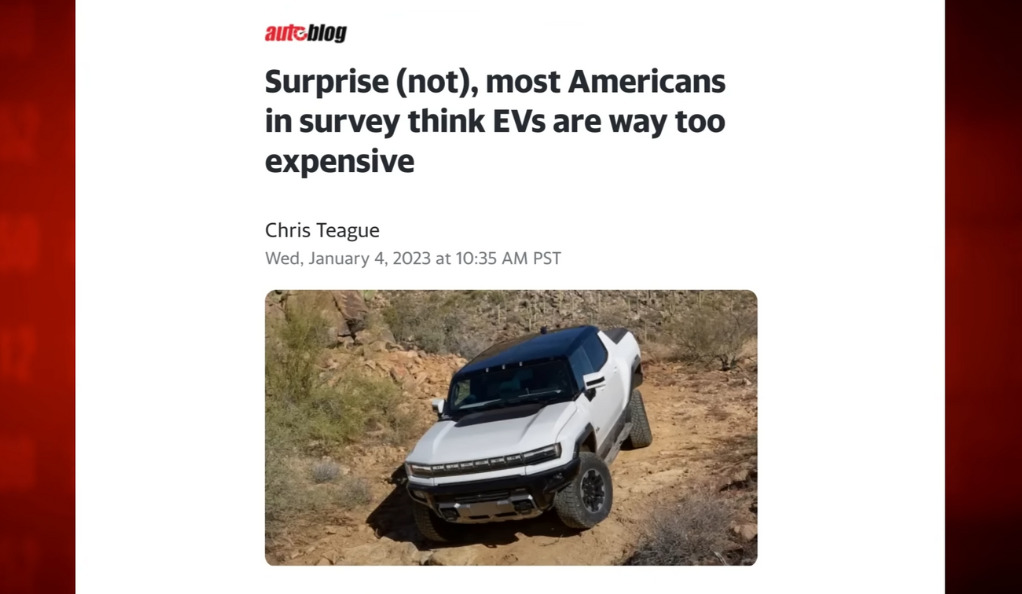

On the other end of the spectrum, we find Tesla, a company that has been grappling with its pricing power. Despite the hype and future success predictions, Tesla’s shares fell by about 60% in 2022. This decline is partly due to increasing input costs and decreasing consumer demand, despite government subsidies for electric vehicles (EVs).

Tesla’s struggle with pricing power is a stark contrast to P&G’s experience. Despite being a pioneer in the EV industry and having a strong brand, Tesla has been unable to maintain its prices in the face of increasing costs and decreasing demand. This situation underscores the challenges faced by companies without strong pricing power, even those with innovative products and strong brands.

The Challenge of High Input Costs

The high costs of lithium, nickel, cobalt, and other raw materials have limited Tesla’s ability to reduce prices. These materials are essential for the production of EVs, and their prices have been rising due to increasing demand and supply constraints. In response to these challenges, Tesla has repeatedly cut prices on its models. However, this strategy hasn’t led to a significant increase in demand, highlighting the limitations of price cuts as a strategy to boost sales.

This situation underscores the challenges faced by companieswithout strong pricing power. Despite having a revolutionary product and a strong brand, Tesla has been unable to maintain its prices in the face of increasing costs and decreasing demand. This has led to a significant decline in its share price and has raised questions about its future profitability.

Market Share Decline: A Cause for Concern

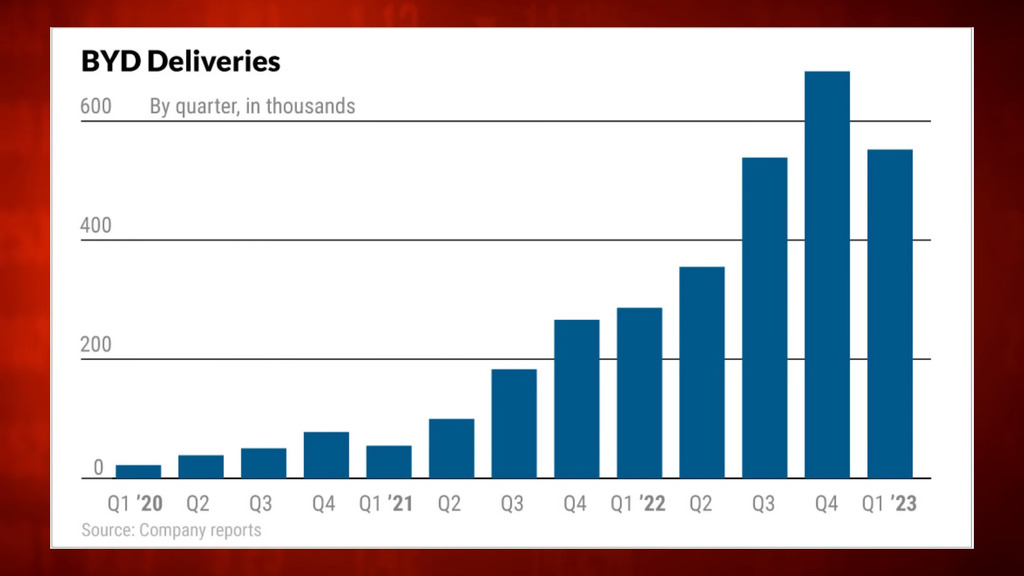

Tesla’s market share in California, its largest market, dropped from 72.7% in 2022 to 59.6% in Q1 2023. This decrease occurred despite aggressive price cuts by Tesla and increased competition from other EV manufacturers. This decline in market share is a clear indication that price cuts alone may not be enough to regain lost market share.

The decline in Tesla’s market share in California is particularly concerning given the state’s commitment to clean energy and its role as a trendsetter in the US auto market. If Tesla is losing ground in this key market, it raises questions about its ability to maintain its market share in other regions.

Tesla’s Future Strategy

In light of these challenges, Tesla has announced plans to cut prices further. However, it remains uncertain whether these additional price cuts will help Tesla regain its lost market share and improve its financial performance. While lower prices may attract some consumers, they may also erode Tesla’s brand value and lead to lower profit margins.

Tesla’s future strategy will likely involve a combination of price cuts, product innovation, and cost reduction. The company will need to find ways to reduce the cost of its inputs, either by finding cheaper alternatives or by improving its production efficiency. At the same time, it will need to continue innovating to maintain its competitive edge and justify its premium pricing.

The Role of Government Subsidies

Government subsidies for EVs have played a significant role in promoting the adoption of these vehicles. However, these subsidies have not been enough to offset the high costs of EV production and the decreasing consumer demand. This situation highlights the limitations of government subsidies as a tool to promote new technologies.

While subsidies can help reduce the price of EVs for consumers, they do not address the underlying challenges faced by manufacturers. These include the high cost of inputs and the need for significant investments in research and development. Therefore, while subsidies are important, they are not a panacea for the challenges faced by the EV industry.

Conclusion

The contrasting experiences of P&G and Tesla highlight the importance of pricing power in today’s challenging economic environment. While P&G has successfully leveraged its pricing power to maintain profitability, Tesla’s struggles underscore the difficulties faced by companies without this advantage. As the global economy continues to evolve, the ability to wield pricing power effectively will remain a key determinant of corporate success.

The tale of these two titans serves as a reminder that pricing power is not just about the ability to raise prices. It’s also about understanding the market, managing costs, and delivering value to consumers. Companies that can master these aspects will be better positioned to navigate the challenges of the global economy and achieve long-term success.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)