Trading in the financial markets can seem like a daunting task, especially for beginners. However, with the right strategy and understanding of key concepts, it can become a profitable venture. One such strategy involves mastering the art of entries, specifically the “Risk Entry” and the “Confirmation Entry”. Let’s delve into these concepts and understand how they can significantly improve your trading game.

Understanding Trading Entries

Trading entries are a fundamental aspect of any trading strategy. They represent the precise moment a trader decides to enter the market, either by buying or selling a financial instrument. The timing and positioning of these entries can significantly impact the profitability of a trade.

An entry point is typically determined based on a trader’s analysis of the market. This analysis can be technical, using chart patterns and indicators, or fundamental, using economic data and news events. Regardless of the method used, the goal is to identify points in the market where the potential for profit is high and the risk of loss is manageable.

However, it’s important to note that while entries are crucial, they are just one piece of the trading puzzle. Other factors such as risk management, position sizing, and exit strategy are equally important in determining the success of a trade.

Moreover, the best entry point in the world won’t guarantee a profitable trade. The market is unpredictable and influenced by countless factors. Therefore, it’s essential to have a well-thought-out trading plan and to stick to it, regardless of what happens after you’ve entered the trade.

In the following sections, we’ll delve into two specific types of trading entries – the Risk Entry and the Confirmation Entry – and discuss how they can be used to improve your trading strategy.

Risk Entry: The High-Reward Gamble

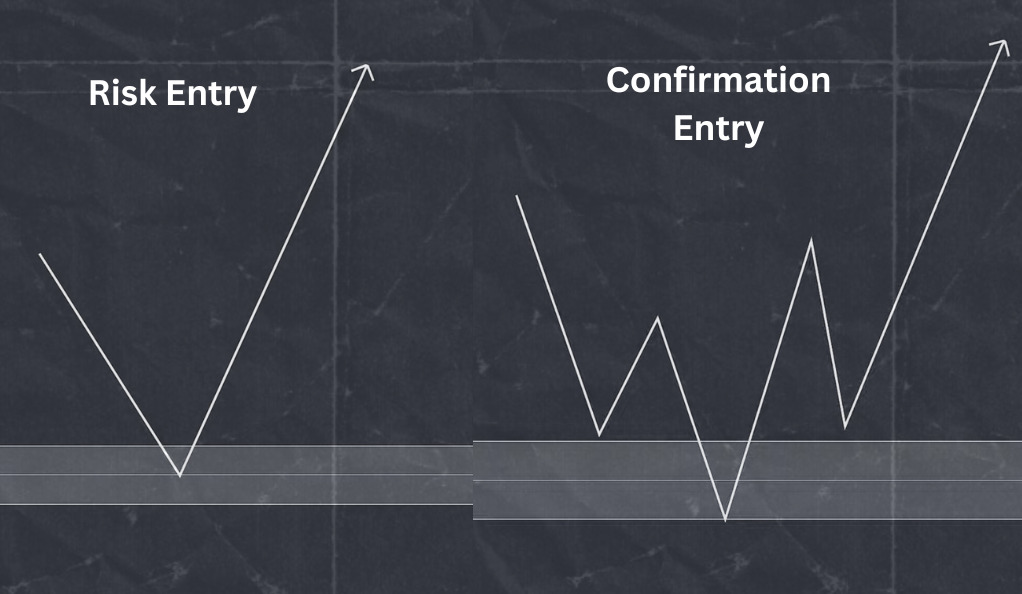

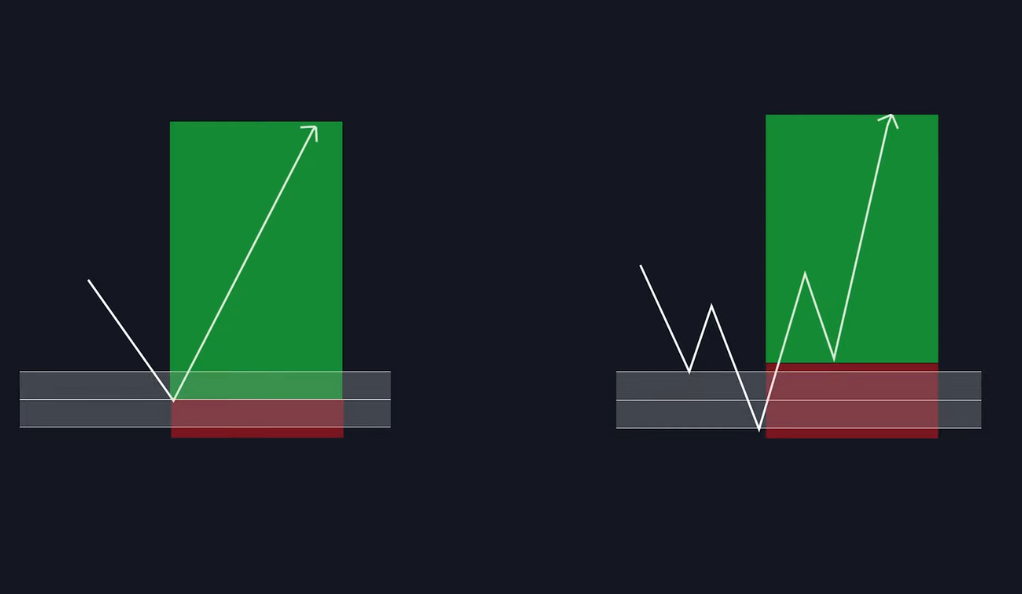

The Risk Entry is a type of trading entry that involves setting buy or sell limits within supply and demand zones. These zones are usually identified on higher timeframes, such as the 1-hour or daily charts. The idea behind this strategy is to enter the market at points where there is a high interest from other traders, increasing the likelihood of a significant price movement.

However, as the name suggests, Risk Entries come with a higher level of risk. They can either trigger and move straight into profit or trigger and get stopped out straight away. This is because they rely on the market reacting to these supply and demand zones in a predictable way, which isn’t always the case.

The advantage of the Risk Entry is that it offers a great risk-to-reward setup with a very tight stop loss. This means that if the trade goes in your favor, the potential profits can be substantial. On the other hand, the risk of getting stopped out is higher compared to the Confirmation Entry. Therefore, it requires a trader to have a higher risk tolerance and a well-thought-out risk management strategy.

Despite the risks, many traders prefer this type of entry due to the potential for high rewards. It’s a strategy that requires patience, discipline, and a deep understanding of market dynamics.

Confirmation Entry: The Safer Bet

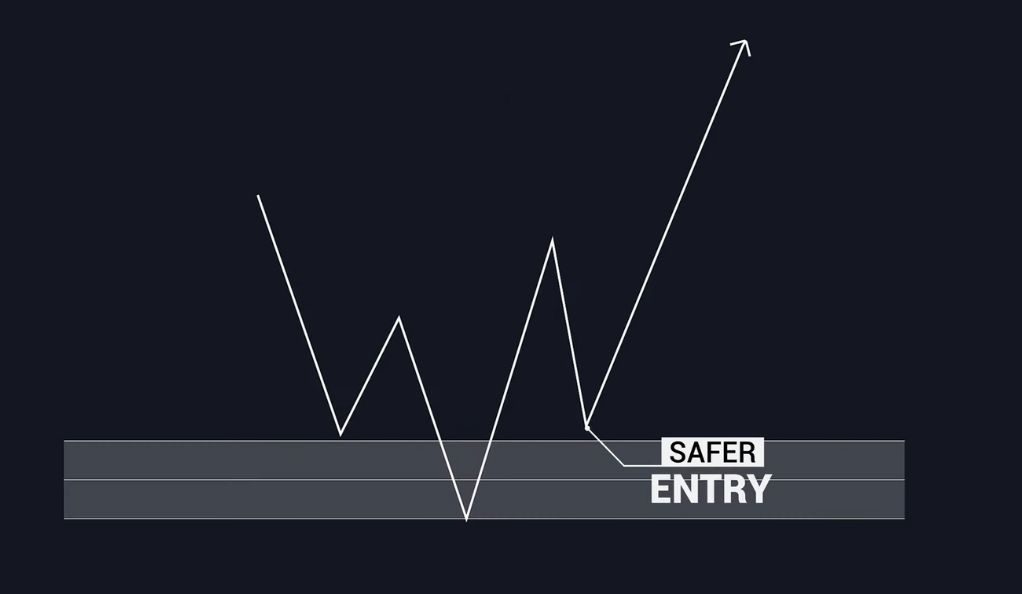

The Confirmation Entry is another type of trading entry that is considered safer compared to the Risk Entry. This strategy involves looking at a lower timeframe and identifying breaks in the market structure before entering a trade. Essentially, it involves waiting for the market to confirm your trading bias before you open a position.

The Confirmation Entry strategy is based on the principle that price movements are not random, but rather follow certain patterns or ‘structures’. By waiting for a break in this structure, traders can gain additional confirmation that the market is likely to move in their predicted direction.

One of the main advantages of the Confirmation Entry is that it is generally safer and results in fewer losses. This is because it requires more evidence before a trade is entered, reducing the likelihood of entering a trade that quickly moves against you.

However, this strategy does have its drawbacks. Sometimes, the market may not retrace back to your desired entry point, causing you to miss out on a potential trade. Additionally, the risk-to-reward ratio may be slightly lower compared to the Risk Entry as you’re entering the market at a later stage.

Despite these drawbacks, the Confirmation Entry remains a popular choice among traders due to its balance of risk and reward.

The Power of Backtesting

Backtesting is a powerful tool in a trader’s arsenal. It involves applying your trading strategy to historical market data to see how it would have performed in the past. This can provide valuable insights into the effectiveness of your strategy and highlight any potential issues.

One of the main benefits of backtesting is that it allows you to test your strategy in a risk-free environment. Instead of risking real money, you can see how your strategy would have performed in various market conditions and make adjustments as necessary.

However, it’s important to remember that past performance is not indicative of future results. Just because a strategy performed well in the past does not guarantee it will do so in the future. Market conditions change, and a strategy that worked well in one period may not work as well in another.

Despite this, backtesting remains a valuable tool for any trader. It can help you understand your strategy better, identify any potential issues, and increase your confidence in your trading decisions.

Live Trading Examples

Live trading examples are a great way to see these trading entry strategies in action. They provide a real-world context to these strategies, showing how they can be applied in various market conditions and with different financial instruments.

For example, a trader might share a live trading example where they used a Risk Entry to enter a trade at a key supply zone on the 1-hour chart. They could explain how they identified the supply zone, set their buy limit, and managed their risk with a tight stop loss. They could then show how the trade played out, highlighting any key lessons learned.

Similarly, a trader might share a live trading example where they used a Confirmation Entry to enter a trade. They could explain how they identified a break in market structure on a lower timeframe, waited for the market to retrace back to their desired entry point, and then entered the trade once their trading bias was confirmed.

These live trading examples can provide valuable insights and lessons, helping you to improve your own trading strategy and decision-making process.

Risk vs Confirmation Entry: The Final Verdict

Both Risk and Confirmation Entries have their pros and cons, and the choice between the two will largely depend on your individual trading style, risk tolerance, and overall trading goals.

The Risk Entry offers a higher potential reward but comes with a higher level of risk. It’s a strategy that requires patience, discipline, and a deep understanding of market dynamics. If you’re a more aggressive trader with a higher risk tolerance, this might be the right strategy for you.

On the other hand, the Confirmation Entry is generally safer and results in fewer losses. It’s a strategy that requires more evidence before a trade is entered, reducing the likelihood of entering a trade that quickly moves against you. If you’re a more conservative trader who prefers to wait for additional confirmation before entering a trade, this might be the right strategy for you.

In the end, the best strategy is the one that fits your individual trading style and goals. It’s important to understand both types of entries, practice them in a risk-free environment, and then apply them in the live markets once you’re comfortable.

Conclusion

Mastering the art of trading entries is a crucial step towards becoming a successful trader. Whether you choose to use Risk Entries, Confirmation Entries, or a combination of both, remember that consistency, discipline, and a solid understanding of market dynamics are key.

It’s also important to remember that entries are just one piece of the trading puzzle. Other factors such as risk management, position sizing, and exit strategy are equally important in determining the success of a trade. Therefore, it’s crucial to develop a comprehensive trading plan that covers all these aspects.

Moreover, continuous learning and improvement are key in the world of trading. The markets are constantly changing, and strategies that worked well in the past may not work as well in the future. Therefore, it’s important to stay updated with market trends, continuously test and refine your strategies, and never stop learning.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)