Are you tired of the monotonous task of manually drawing trend lines in your trading endeavors? Do you often find it challenging to keep track of when a trend line is breached? If you can relate to these common issues faced by many traders, then you’ll be delighted to discover a solution that can automate this entire process, providing you with consistency, and accuracy, and, most importantly, saving you valuable time. Introducing the Trendline Pivot Indicator and Easy Algo, two powerful tools designed to revolutionize your trading experience.

The Trendline Pivot Indicator: A Game Changer

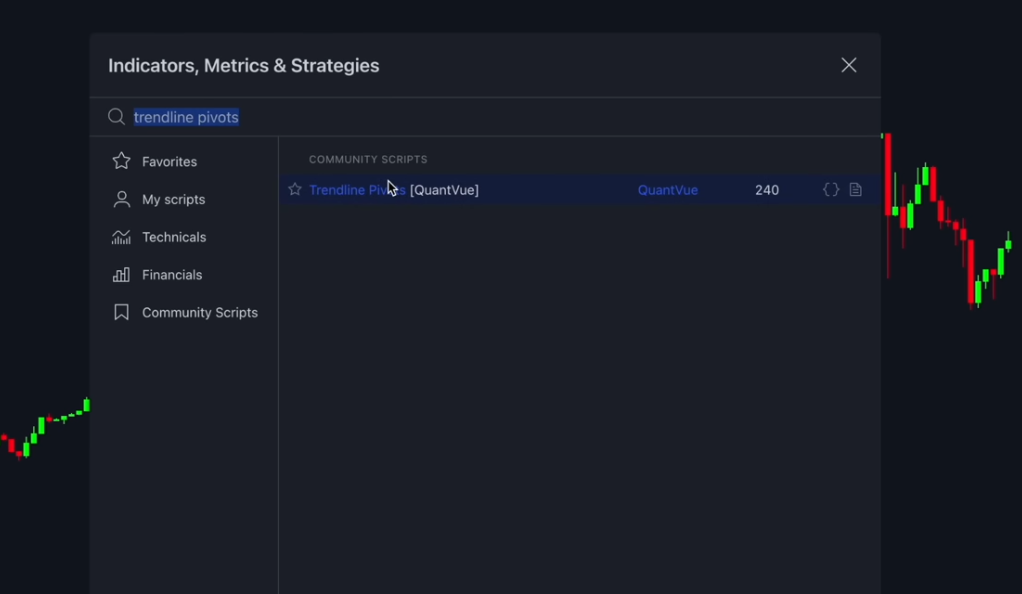

In the world of trading, the ability to identify and draw accurate trend lines is crucial. However, manually drawing trend lines can be a tedious and time-consuming task. This is where the Trendline Pivot Indicator comes to the rescue. This remarkable tool, available on popular trading platforms like Trading View, takes the burden off your shoulders by automating the process of drawing and identifying trend lines.

Not only does the Trendline Pivot Indicator save you time, but it also ensures accuracy and consistency in your trading analysis. The indicator recognizes key pivot points in the price action and automatically generates trend lines that connect these pivots. This allows you to visualize the trend direction and potential support and resistance levels with ease.

But the Trendline Pivot Indicator goes beyond just drawing trend lines. It also provides real-time alerts when price levels breach a trend line. This feature is incredibly valuable, as it allows you to stay on top of market movements and promptly adjust your trading strategy when necessary.

How to Use the Trendline Pivot Indicator

Incorporating the Trendline Pivot Indicator into your trading chart is a simple process. Most trading platforms provide a wide range of built-in indicators, including the Trendline Pivot Indicator. To access it, navigate to the indicators menu and search for the Trendline Pivot tool.

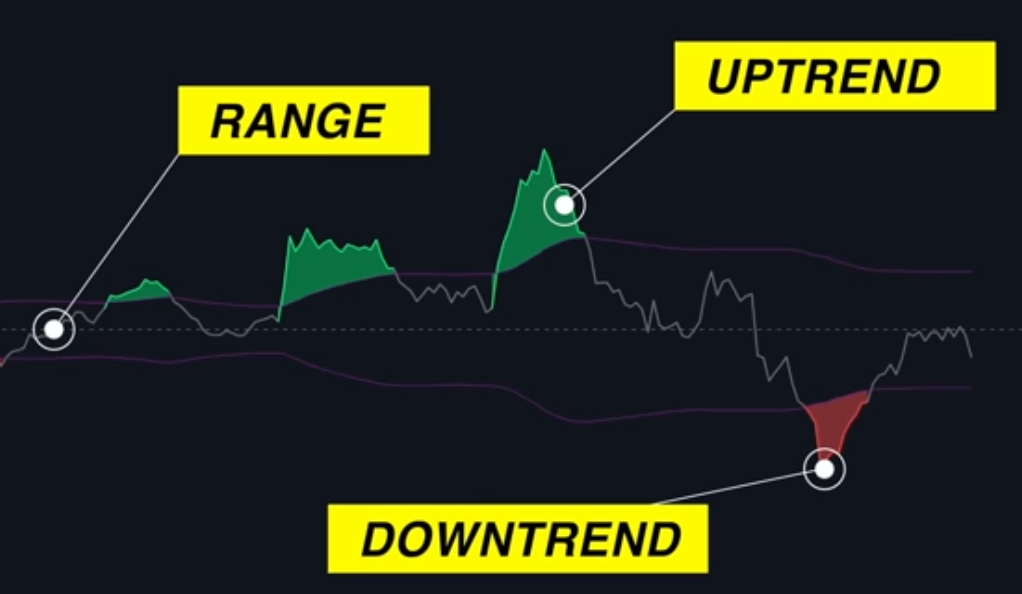

Once added to your chart, the Trendline Pivot Indicator automatically identifies and draws upward and downward trend lines based on pivot highs and pivot lows. These trend lines serve as potential points of resistance for downward trends and support for upward trends within the market.

Customizing the Trendline Pivot Indicator

The Trendline Pivot Indicator offers a high degree of customization, allowing you to tailor it to your preferences and trading style. You can modify various aspects of the indicator, such as line colors, pivot length, and the number of lines you wish to display on your chart.

Additionally, you have the option to set a maximum line length. This parameter determines the number of bars after which a trend line will disappear if it remains unbroken. Setting a maximum line length can help you focus on recent price action and prevent clutter on your chart.

Furthermore, the Trendline Pivot Indicator is compatible with different time frames and markets. Whether you are a day trader or a long-term investor, this versatile tool can adapt to your preferred trading approach.

Easy Algo: Your Trusted Trading Companion

While the Trendline Pivot Indicator automates the process of drawing and identifying trend lines, Easy Algo takes automation to the next level by providing real-time, non-repaint signals. These signals help you accurately identify profitable entry and exit points in the market.

One of the biggest challenges traders face is the emotional aspect of trading. Emotions such as fear and greed can cloud judgment and lead to poor decision-making. Easy Algo aims to eliminate these emotional biases by providing clear and objective signals based on technical analysis.

Why Choose Easy Algo

Easy Algo offers several advantages that make it an attractive tool for traders of all experience levels. First and foremost, its signals have a proven win ratio of over 80 percent. This high level of accuracy can significantly increase your chances of success in the markets.

Furthermore, Easy Algo provides real-time signals, ensuring that you stay up to date with market movements. These signals are non-repainting, which means they do not change after they appear, providing you with reliable entry and exit points.

In addition to the signals, Easy Algo also offers a supportive community of professionals. This community provides a platform for traders to share ideas, discuss strategies, and learn from one another. Being part of such a community can accelerate your learning curve and help you stay motivated on your trading journey.

Combining the Trendline Pivot Indicator and Easy Algo

The Trendline Pivot Indicator and Easy Algo can be seamlessly combined to create a powerful trading strategy. By integrating these two tools, you can enhance your trading decisions and increase your overall profitability.

The strategy involves using the Trendline Pivot Indicator to identify key trend lines that act as support or resistance levels. When the price retraces to the lower trend line during a pullback, you can look for a confirmation signal from Easy Algo indicating an oversold condition. This confluence of factors suggests a potential buying opportunity.

The beauty of this strategy lies in the synergy between the Trendline Pivot Indicator and Easy Algo. The Trendline Pivot Indicator identifies the trend and potential entry points, while Easy Algo provides confirmation based on objective technical analysis. By waiting for these signals to align, you can enter trades with higher confidence and better risk-reward ratios.

Automating Your Strategy with Pinex GPT

If you’re looking to take your trading strategy to the next level and automate it, Pinex GPT is a valuable service to consider. Pinex GPT allows you to convert your trading strategy, including the use of the Trendline Pivot Indicator and Easy Algo, into a trading bot.

Pinex GPT offers a user-friendly interface that allows you to create, backtest, and deploy your trading bot with ease. Whether you’re a coding expert or have no prior programming knowledge, Pinex GPT provides a straightforward solution for automating your trading strategy.

The Benefits of Using Pinex GPT

Using Pinex GPT to automate your trading strategy offers several benefits. Firstly, it eliminates the need for manual execution of trades, saving you time and reducing the risk of human error. The trading bot can continuously monitor the markets and execute trades based on your predefined strategy.

Additionally, Pinex GPT provides access to a wide range of pre-made strategies created by other traders. This gives you the opportunity to learn from successful traders and implement their strategies in your own trading bot. You can also backtest your strategy using historical data to evaluate its performance before deploying it in live trading.

Furthermore, Pinex GPT offers a supportive community where you can interact with other traders, share insights, and learn from each other’s experiences. This collaborative environment fosters growth and can help you refine your trading strategies over time.

Final Thoughts on Pinex GPT

Pinex GPT serves as a valuable resource for traders seeking to automate their trading strategies. Whether you prefer to create your own strategy or leverage pre-made ones, Pinex GPT offers a user-friendly platform that caters to traders of all skill levels. By harnessing the power of automation, you can potentially improve your trading outcomes and capitalize on market opportunities more efficiently.

Enhancing Your Strategy with Trendelo

In addition to the Trendline Pivot Indicator and Easy Algo, another tool that can enhance your trading strategy is Trendelo. Trendelo is specifically designed to assist in identifying price trends by calculating the percentage change in the selected price source and smoothing the resulting data.

How Trendelo Works

Trendelo employs advanced mathematical algorithms, including the Anode Lagu Moving Average (ALMA), to smooth the percentage change data. By doing so, it effectively filters out market noise and isolates valid trends. The ALMA values are then compared to a Root Mean Square band, providing a benchmark for trend analysis.

Customizing Trendelo

Trendelo offers a range of customization options, allowing you to fine-tune the indicator to suit your preferences and trading style. You can adjust parameters such as the smoothing look-back period, ALMA offset multiplier, and more. Experimenting with these settings can help you optimize the indicator for different market conditions and timeframes.

Combining Trendline Pivot, Easy Algo, and Trendelo

When you combine the Trendline Pivot Indicator, Easy Algo, and Trendelo, you create a comprehensive trading strategy that incorporates multiple layers of analysis. This multi-tool approach can provide a more robust and reliable trading system.

The combined strategy involves using the Trendline Pivot Indicator to identify key trend lines, Easy Algo for confirmation signals, and Trendelo to filter out noise and identify valid trends. By waiting for all three tools to align, you can increase the probability of successful trades.

For example, when the price retraces to the lower trend line identified by the Trendline Pivot Indicator, you can wait for confirmation from Easy Algo indicating an oversold condition. Additionally, Trendelo can help confirm the presence of a valid trend by analyzing the smoothed percentage change in price. When all three tools align, it serves as a strong indication for potential buying opportunities.

Risk Management and Exit Strategies

A successful trading strategy not only focuses on entries but also emphasizes risk management and exit strategies. When implementing the combined strategy using the Trendline Pivot Indicator, Easy Algo, and Trendelo, it’s essential to incorporate risk management principles.

Placing a stop-loss order below the trend line can help limit potential losses if the trade doesn’t go as expected. Additionally, setting a profit target based on a favorable risk-reward ratio can help you lock in profits and manage your overall trading performance.

It’s crucial to regularly evaluate and adjust your exit strategy based on market conditions. Trailing stops, break-even stops, or scaling out of positions as the trade progresses can be effective techniques to maximize profits while minimizing risk.

Improving Your Trading Strategy

While the combined strategy utilizing the Trendline Pivot Indicator, Easy Algo, and Trendelo can be powerful on its own, there are additional ways to enhance your trading strategy and increase its effectiveness.

Firstly, consider incorporating other technical indicators or oscillators to complement the signals generated by the Trendline Pivot Indicator and Easy Algo. For example, you can use oscillators like stochastic RSI or MACD to confirm overbought or oversold conditions and validate potential entry points.

Furthermore, analyzing the price action on higher timeframes can provide additional confirmation for your trades. Higher timeframe analysis can help you identify the broader trend and potential areas of support and resistance, aligning your trades with the overall market direction.

Continuous learning and improvement are key to becoming a successful trader. Actively seek out educational resources, attend webinars, and engage in discussions with fellow traders to expand your knowledge and refine your trading strategies. Keeping a trading journal to document your trades and review your performance can also be immensely beneficial in identifying strengths and weaknesses in your strategy.

Conclusion

In conclusion, the Trendline Pivot Indicator, Easy Algo, and Trendelo are powerful tools that can greatly enhance your trading strategy. When combined, they offer a comprehensive approach to analyzing market trends, identifying entry and exit points, and managing risk. By automating your trading efforts with the help of Pinex GPT, you can further streamline your strategy and optimize your trading outcomes.

However, it’s important to note that no strategy or tool can guarantee success in trading. The markets are inherently unpredictable, and there is always a risk of financial loss. Therefore, it’s crucial to approach trading with a disciplined mindset, manage your risk effectively, and continuously adapt and improve your strategies based on market conditions.

Remember, responsible trading is paramount, and it’s always advisable to seek professional advice or consult with experienced traders before making any significant trading decisions. With the right tools, knowledge, and mindset, you can navigate the markets more confidently and strive for consistent profitability in your trading endeavors.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)