In the world of trading, strategy scripts have emerged as a game-changer, offering traders a powerful tool for backtesting and analyzing their trading strategies. One platform that has gained significant popularity among traders is TradingView, which provides a wide range of functionalities, including the ability to access and adjust strategy scripts. Strategy scripts on TradingView enable traders to simulate their strategies using historical price data and evaluate their performance before implementing them in real-time trading.

To begin with, it’s important to understand the distinction between indicator scripts and strategy scripts. Indicator scripts on TradingView are used to create technical indicators that help traders identify potential buy and sell signals based on specific calculations or patterns. On the other hand, strategy scripts encompass a broader approach by combining multiple indicators and rules into a comprehensive trading strategy. Strategy scripts not only generate signals but also define the conditions for entering and exiting trades, risk management parameters, and other essential components of a trading strategy.

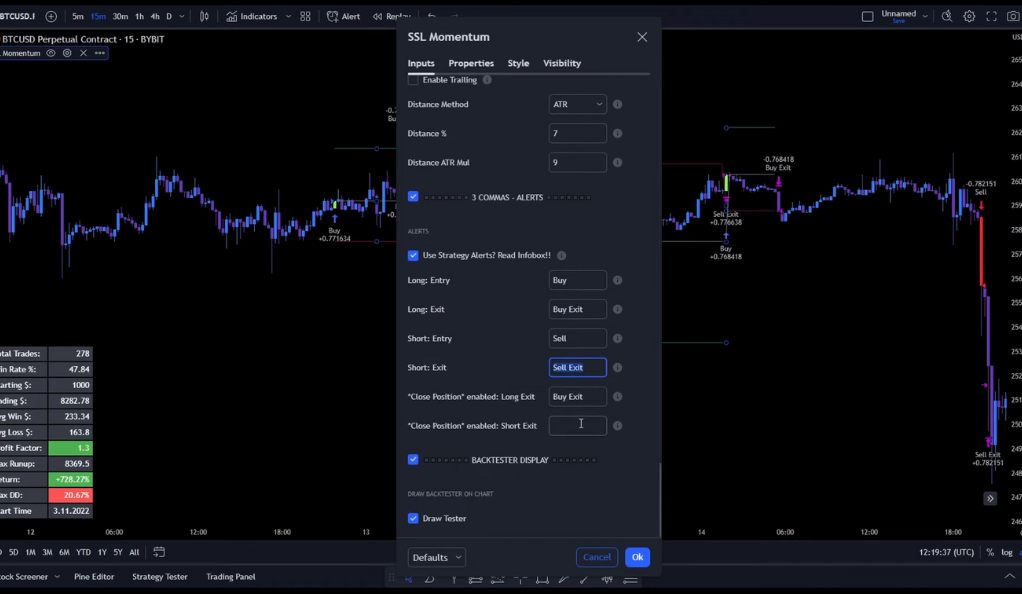

One popular and detailed strategy script on TradingView is the SSL hybrid plus momentum histogram strategy. This strategy combines the SSL (Schaff Trend Cycle) indicator, which is used to identify trend reversals, with a momentum histogram to confirm the strength of the trend. By analyzing the SSL indicator’s color changes and the momentum histogram’s movement, traders can generate buy and sell signals. The SSL hybrid plus momentum histogram strategy script on TradingView offers a customizable approach, allowing traders to adjust parameters such as SSL length, momentum histogram thresholds, and other variables to tailor the strategy to their specific trading preferences.

The Power of Strategy Scripts

The power of strategy scripts in the world of trading cannot be underestimated. They go beyond being mere lines of code and serve as the backbone of any successful trading strategy. Strategy scripts provide traders with the ability to simulate and backtest their strategies using historical price data, allowing them to assess the strategy’s performance and gain valuable insights into its potential future profitability.

While both strategy scripts and indicator scripts are important tools on trading platforms like TradingView, they differ in their purpose and scope. Indicator scripts are primarily focused on creating technical indicators that help traders identify potential buy and sell signals based on specific calculations or patterns. These indicators provide valuable information about market trends, momentum, volatility, and other relevant factors. However, they do not encompass the entire trading strategy.

On the other hand, strategy scripts offer a more comprehensive approach. They incorporate multiple indicators, rules, and parameters into a cohesive trading strategy. Strategy scripts not only generate signals but also define the conditions for entering and exiting trades, implement risk management techniques, and account for various market scenarios. By encompassing these elements, strategy scripts provide traders with a holistic view of their trading strategy’s potential performance, allowing them to make informed decisions and adjust their approach accordingly.

Indicator Scripts vs. Strategy Scripts: What’s the Difference?

In the realm of trading, understanding the difference between indicator scripts and strategy scripts is essential. Indicator scripts are designed to provide visual cues or signals to traders, indicating potential trading opportunities based on specific conditions. These scripts often generate buy and sell signals by analyzing price data, indicators, or other market variables. Traders can use these signals as a basis for their decision-making process, but the scripts themselves do not incorporate the complete framework of a trading strategy.

On the other hand, strategy scripts go beyond providing simple signals and encompass a more comprehensive approach to trading. They include functions that define the entry and exit criteria, risk management parameters, position sizing rules, and other essential components of a trading strategy. By utilizing strategy scripts, traders can simulate their strategies using historical data, backtest the performance, and evaluate the potential outcomes of their trading decisions. Strategy scripts allow traders to gain insights into the profitability, risk, and overall effectiveness of their strategies, helping them make informed decisions and potentially improve their trading results.

Accessing and Using Strategy Scripts on TradingView

To access and use strategy scripts on TradingView, a popular trading platform, traders can take advantage of the wide range of scripts created and published by various authors. These strategy scripts are written in Pine Script, which is TradingView’s proprietary scripting language. TradingView allows users to explore and search for strategy scripts based on their specific trading needs.

To begin, traders can navigate to the “Scripts” section on TradingView’s website and search for the desired strategy script by name or keyword. Once they find a script that aligns with their trading strategy, they can click on it to access the script’s page. On this page, traders can review the script’s description, study its source code, and analyze any available backtest results or performance metrics.

Adjusting Settings and Risk Management

One of the notable advantages of strategy scripts like the SSL hybrid plus momentum histogram strategy is their inherent flexibility, which enables traders to tailor them to their unique trading style and risk tolerance. By adjusting the settings, traders can fine-tune the strategy to align with their specific preferences and objectives. For example, strategy incorporates the Average True Range (ATR) indicator for stop loss and risk management purposes. The ATR indicator provides a measure of market volatility, allowing traders to dynamically adjust their stop loss levels based on current market conditions. This adaptive approach helps traders effectively manage their risk exposure and protect their capital while aiming to maximize potential profits.

The ability to customize strategy settings is crucial in the ever-changing landscape of financial markets. Traders have diverse risk tolerances, trading timeframes, and market preferences, which require adaptable strategies. By utilizing tools like the ATR indicator, traders can fine-tune their risk management parameters according to their comfort level. This allows them to set appropriate stop loss levels that are aligned with the market’s volatility, providing a buffer against adverse price movements. Moreover, the ability to adjust settings provides traders with the opportunity to optimize their strategies based on historical performance analysis and ongoing market observations, enhancing the overall effectiveness of their trading approach.

Diving into the SSL Hybrid Plus Momentum Histogram Strategy

Let’s delve deeper into the SSL hybrid plus momentum histogram strategy. This particular strategy combines two key elements: the SSL (Simple SSL) indicator and a momentum histogram. The SSL indicator helps identify potential trend reversals, while the momentum histogram provides insights into the strength of price movements. By combining these elements, the strategy aims to provide a unique approach to trading that can assist traders in identifying favorable entry and exit points.

The SSL indicator is a popular technical analysis tool used to determine the direction of price trends. It consists of a series of lines that change color based on the prevailing market conditions. For example, when the SSL lines turn green, it suggests a bullish trend, while a red color indicates a bearish trend. By incorporating the SSL indicator into the strategy, traders can benefit from its ability to identify potential trend reversals, allowing them to take advantage of favorable trading opportunities.

Backtesting Performance and Settings

The SSL hybrid plus momentum histogram strategy has shown promising results in backtesting. By adjusting the settings, traders can fine-tune the strategy to align with their trading goals and risk tolerance. Remember, backtesting is not a guarantee of future performance, but it can provide valuable insights into a strategy’s potential.

Risk Management in the SSL Hybrid Plus Momentum Histogram Strategy

Risk management is a crucial aspect of any trading strategy. In the SSL hybrid plus momentum histogram strategy, the ATR indicator for stop loss and risk management. This helps to protect traders from significant losses while also allowing for potential profits.

Strategy Scripts for Manual and Bot Trading

One of the remarkable advantages of strategy scripts is their versatility, as they can be utilized for both manual trading and bot trading. This flexibility caters to the diverse preferences and trading styles of individuals, accommodating those who prefer a hands-on approach to their trades as well as those who opt for automated trading through bots.

For traders who prefer manual trading, strategy scripts serve as valuable tools that provide guidance and generate trade signals based on predefined criteria. These scripts offer a systematic approach to trading, helping traders make informed decisions and execute trades with more confidence. Manual traders can utilize the strategy scripts as a reference, allowing them to assess market conditions, analyze the generated signals, and then make their own decisions regarding trade entry and exit points. This way, the scripts act as a supportive framework that assists traders in their decision-making process, providing valuable insights and potentially enhancing trading performance.

Conclusion

In conclusion, strategy scripts offer a powerful tool for backtesting trading strategies. They provide a glimpse into the potential performance of a strategy, allowing traders to make informed decisions. Whether you’re a manual trader or prefer bot trading, these scripts offer flexibility and control over your trading strategies. So why not dive into the world of strategy scripts on TradingView and see what they can do for your trading?

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)