Trading in financial markets can indeed be a complex and challenging endeavor, as it requires a deep understanding of various indicators and strategies. In this article, we will explore the Stock Accurate trading strategy, which has gained popularity through the YouTube channel Stock Accurate. This strategy makes use of two free TradingView indicators, namely the SSL hybrid and the momentum histogram, aiming to provide traders with a systematic and reliable framework for trading cryptocurrencies, stocks, and forex. Whether you are a novice or an experienced trader, this step-by-step guide will equip you with the necessary knowledge and tools to effectively implement the Stock Accurate trading strategy.

The Stock Accurate trading strategy revolves around the utilization of two key indicators: the SSL hybrid and the momentum histogram. The SSL hybrid indicator combines moving averages and Bollinger Bands to identify potential entry and exit points in the market. By incorporating trend-following elements and volatility measurement, this indicator helps traders capture profitable opportunities. Additionally, the momentum histogram indicator assists in identifying the strength of price movements and potential reversals. Together, these indicators provide a comprehensive framework for traders to analyze and execute trades across various financial markets.

Understanding the Stock Accurate Trading Strategy

The SSL hybrid indicator, one of the key components of the strategy, combines moving averages and Bollinger Bands. This integration allows traders to identify trends and measure market volatility, which are crucial factors for determining potential entry and exit points. By analyzing the SSL hybrid indicator, traders can assess the overall market sentiment and make well-timed trades. In addition, the momentum histogram indicator plays a vital role in the strategy by evaluating the strength of price movements and detecting possible reversals. By considering both price and volume analysis, the Stock Accurate trading strategy equips traders with a systematic and reliable framework to execute short and long trades effectively across various financial markets.

It is important for traders to fully understand the Stock Accurate trading strategy and its indicators before applying it in real trading scenarios. By gaining a comprehensive understanding of the SSL hybrid and momentum histogram indicators, traders can make well-informed decisions and increase their chances of success. However, it is worth noting that no trading strategy guarantees profits, and traders should always practice risk management and adapt the strategy to their individual trading preferences and goals.

Adding and Customizing the Indicators

To effectively implement the Stock Accurate trading strategy, it is crucial to add and customize the SSL hybrid and momentum histogram indicators on the TradingView platform. Here are step-by-step instructions to help you get started:

Open the TradingView platform and navigate to the chart you want to analyze using the Stock Accurate strategy.

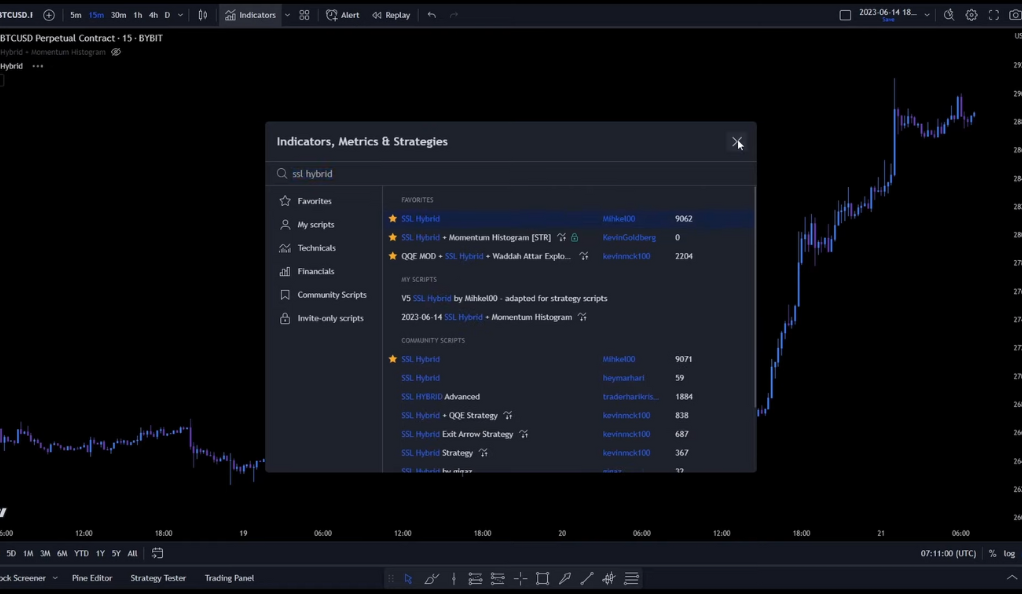

Locate the “Indicators” button on the TradingView interface and click on it. This will open a search bar where you can search for the SSL hybrid indicator.

Type “SSL hybrid” in the search bar and select the SSL hybrid indicator from the list of available options.

Once added to your chart, you can customize the parameters of the SSL hybrid indicator according to your preferences. These parameters may include selecting the source for calculation (such as close or open price) and adjusting the length of the moving averages and Bollinger Bands.

To add the momentum histogram indicator, repeat the previous steps. Click on the “Indicators” button again, search for the momentum histogram indicator, and add it to your chart.

Customize the settings of the momentum histogram indicator to align with your trading preferences. This may involve adjusting parameters such as the length of the histogram and the threshold levels for identifying strong momentum or potential reversals.

Rules for Entering Trades

The Stock Accurate trading strategy provides specific rules for entering both long and short trades. By following these guidelines, traders can increase their chances of making profitable trades. Here are the key rules to consider:

- Long Trade Entry

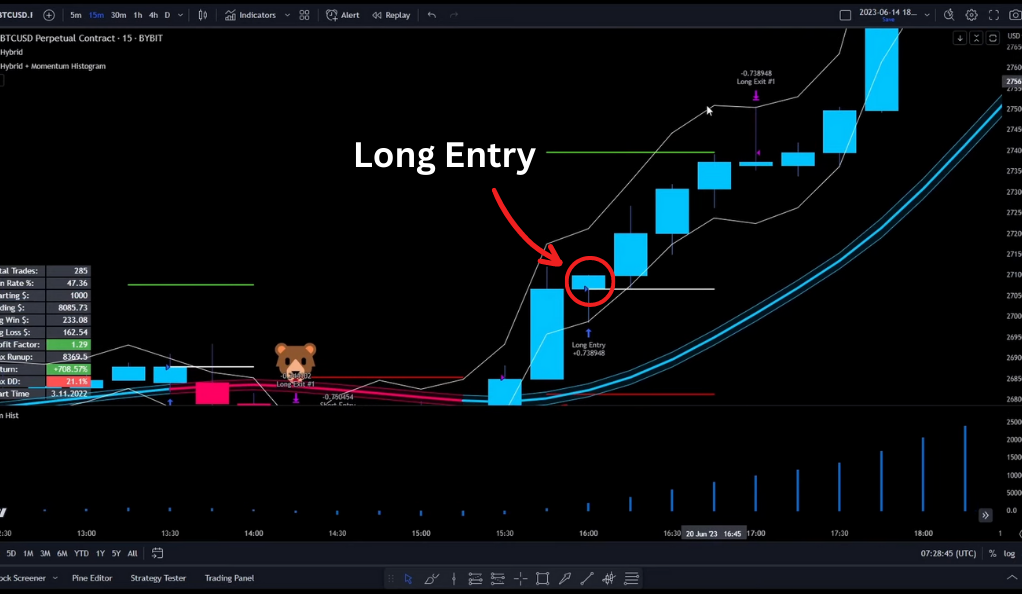

Look for a bullish SSL hybrid crossover, where the green line of the SSL hybrid indicator crosses above the red line. This indicates a potential upward trend reversal or continuation.

Confirm the bullish signal by observing a positive value in the momentum histogram. A positive value indicates strong upward momentum, further supporting the potential for a profitable long trade.

Once both indicators align with a bullish SSL hybrid crossover and a positive value in the momentum histogram, consider entering a long trade. This implies that the market conditions are favorable for a potential upward movement in price, presenting an opportunity for profit.

- Short Trade Entry

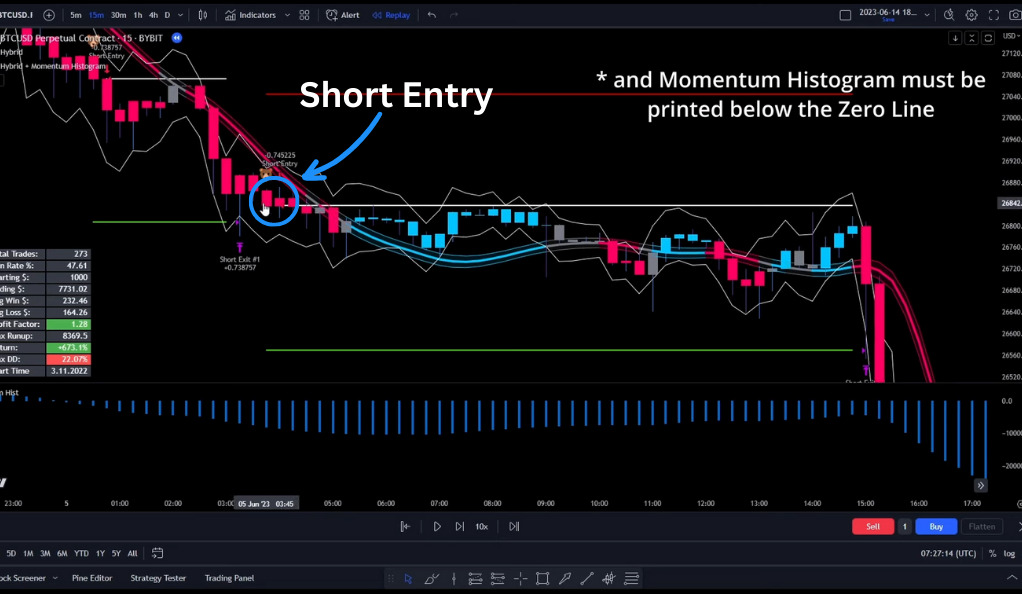

Identify a bearish SSL hybrid crossover, where the green line of the SSL hybrid indicator crosses below the red line. This signals a potential downward trend reversal or continuation.

Confirm the bearish signal by observing a negative value in the momentum histogram. A negative value indicates strong downward momentum, strengthening the case for a potential profitable short trade.

When both indicators align with a bearish SSL hybrid crossover and a negative value in the momentum histogram, consider entering a short trade. This suggests that the market conditions are conducive to a potential downward movement in price, offering an opportunity for profit.

Utilizing Stop Loss and Take Profit Targets

To effectively manage risk and protect trading positions, the Stock Accurate trading strategy emphasizes the importance of implementing stop loss and take profit targets. These measures help traders limit potential losses and secure profits when the market moves favorably. Here are some suggestions on how to utilize stop loss and take profit targets:

- Stop Loss

Determine a suitable level for placing a stop loss order. In a long trade, this level should be set below the entry point, while in a short trade, it should be placed above the entry point. This level acts as a threshold at which the trade will be automatically closed to limit losses.

Set the stop loss level based on factors such as market volatility and your individual risk tolerance. Higher levels of volatility may require wider stop loss orders to allow for price fluctuations, while lower levels of volatility may allow for tighter stop losses.

- Take Profit

Identify a reasonable target for taking profits. In a long trade, this target represents the desired price level at which you would like to secure your profits. In a short trade, it represents the price level at which you expect the market to move in your favor.

Consider using technical analysis tools or key support and resistance levels to determine potential take profit targets. These tools can help identify areas where price movement is likely to stall or reverse, indicating potential points to exit the trade with a profit.

Customizing the Strategy for Different Markets and Timeframes

The Stock Accurate trading strategy offers the advantage of customization, allowing traders to adapt it to different markets and timeframes based on their preferences and trading styles. Here are some considerations for customizing the strategy:

Market Selection

The Stock Accurate strategy can be applied to a variety of markets, including cryptocurrencies, stocks, and forex. The indicators used in the strategy are effective across these asset classes, enabling traders to utilize the strategy in different financial markets.

When customizing the strategy for a specific market, it is important to conduct thorough research and analysis that is specific to that market. Understanding the unique characteristics, trends, and factors influencing the chosen market can enhance the performance of the strategy.

Timeframe Adjustment

Traders can customize the Stock Accurate strategy to different timeframes, depending on their trading goals and preferences. For example, the strategy can be adapted for short-term intraday trading or longer-term swing trading.

When adjusting the strategy to a particular timeframe, consider the characteristics of that timeframe. Factors such as volatility and trading volume can vary across different timeframes, and it’s important to account for these factors when applying the strategy. For instance, shorter timeframes may require more frequent monitoring and quicker decision-making, while longer timeframes may provide a broader perspective on market trends.

By customizing the Stock Accurate trading strategy to different markets and timeframes, traders can align it with their preferred assets and trading styles. However, it is essential to conduct thorough research, test the strategy in a demo or controlled environment, and adapt it to suit individual preferences and risk tolerance. Additionally, ongoing analysis and adjustment are necessary to account for changes in market conditions and to optimize the strategy’s performance.

Conclusion

Mastering the Stock Accurate trading strategy can provide traders with a systematic and reliable approach to navigating the dynamic world of financial markets. By leveraging the SSL hybrid and momentum histogram indicators, traders can gain valuable insights into potential entry and exit points, effectively manage risk through stop loss and take profit targets, and adapt the strategy to different markets and timeframes. Remember to continually monitor and refine your trading approach based on market conditions and your own experience. With dedication and practice, you can harness the power of the Stock Accurate trading strategy to enhance your trading performance and strive for consistent profitability.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)