Are you looking to make more informed trading decisions? If so, you might want to consider price action trading. This popular method among traders involves making decisions based on recent and actual price movements, rather than relying solely on technical indicators. It’s a technique that allows traders to interpret and trade the ever-changing market conditions in real-time. This approach offers a direct view of what the market is doing right now, and it can provide you with a ‘feel’ for the market’s behavior.

Price action trading is not just about looking at the raw data on a chart. It’s about understanding the market sentiment, the psychology of the traders, and the market structure. It’s about being able to read the story that the chart is telling you, and then making predictions about where the market might go next. This method of trading can be incredibly rewarding, but it requires practice and a good understanding of the market.

Understanding Price Action Trading

Price action trading is a technique that allows traders to read the market and make subjective trading decisions based on the actual price movements. This method is favored by many traders because it gives them the ability to interpret and trade the ever-changing market conditions in real-time. It’s a form of technical analysis that doesn’t rely on traditional indicators.

Instead, price action traders use patterns and formations in price itself to make trading decisions. These patterns and formations are often indicative of future price movements. By learning to identify these patterns and formations, traders can gain an edge in the market. It’s a skill that can be developed over time, and with practice, it can become a powerful tool in a trader’s arsenal.

The Power of Price Action Strategy

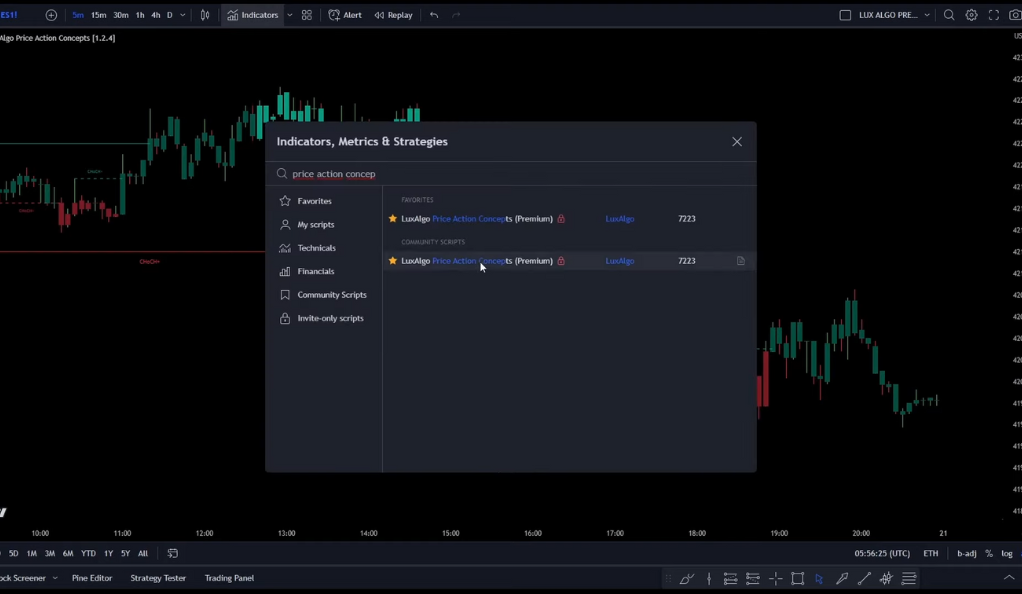

The beauty of price action trading lies in its simplicity. It doesn’t require a multitude of complex indicators. In fact, one of the most effective strategies uses just one indicator – the Lux Algo Bill Price Action Concepts. This strategy can be applied to any market with high liquidity, such as stocks, Forex, or crypto.

The Lux Algo Bill Price Action Concepts is a powerful tool that can help traders identify potential trading opportunities. It uses a unique algorithm to analyze price action and generate trading signals. This can help traders to identify potential entry and exit points, and to manage their trades more effectively. The strategy is easy to understand and implement, making it suitable for both beginners and experienced traders.

Lux Algo Premium: The All-In-One Indicator

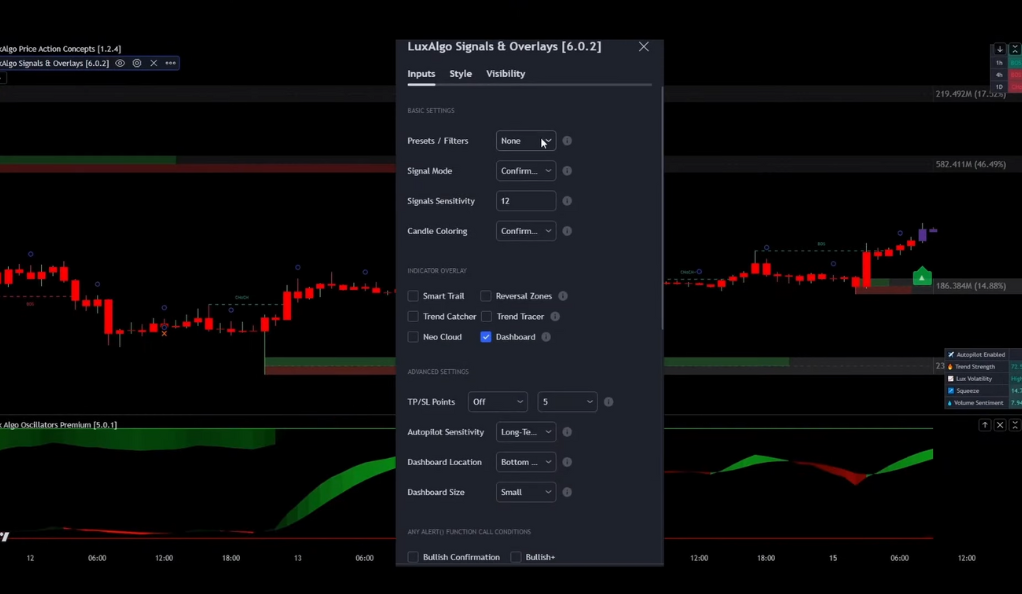

Lux Algo Premium is a paid all-in-one indicator with over 20 features. It’s designed to generate useful signals and overlays for technical analysis. Trusted by over 50,000 traders worldwide, it’s a tool that can take your trading to the next level.

Lux Algo Premium is not just an indicator; it’s a complete trading system. It provides traders with a wealth of information, including advanced signals and overlays, institutional volume estimations, and more. With Lux Algo Premium, traders can gain a deeper understanding of the market and make more informed trading decisions. It’s a tool that can help traders to navigate the complexities of the market and to trade with confidence.

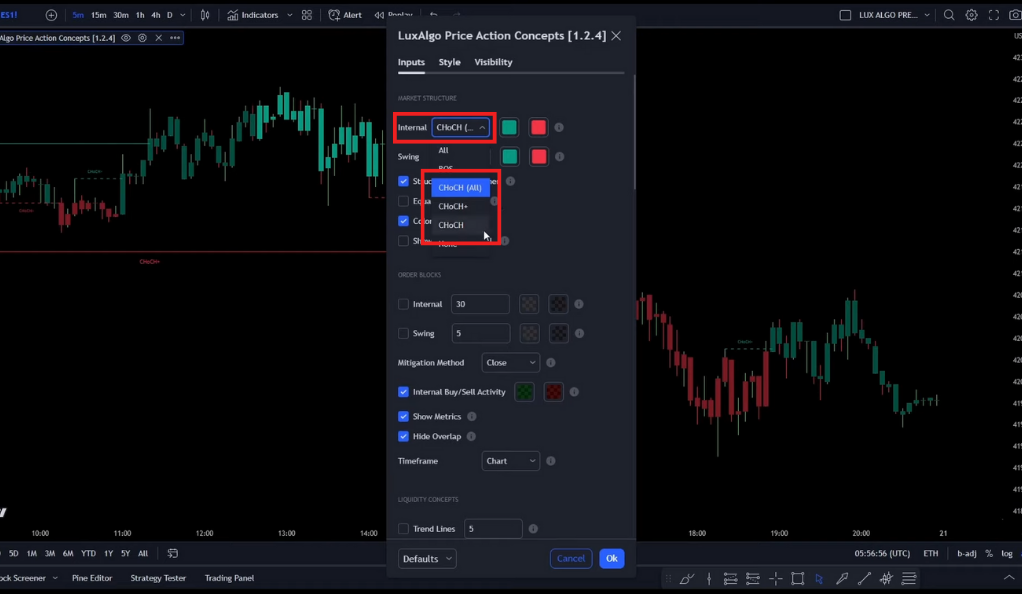

The ‘Chalk’ and ‘Chalk Plus’ Labels

A key aspect of this strategy is the use of ‘chalk’ and ‘chalk plus’ labels. These labels are based on the relative position of prior swing highs or lows. A ‘chalk’ label indicates no prior signs of a reversal, while a ‘chalk plus’ label is preceded by an early sign of market reversal. Understanding these labels can help you predict market movements with greater accuracy.

The ‘chalk’ and ‘chalk plus’ labels are powerful tools for identifying potential reversals in the market. They can help traders to identify potential entry and exit points, and to manage their trades more effectively. By understanding these labels and how they relate to the market structure, traders can gain a deeper understanding of the market and make more informed trading decisions.

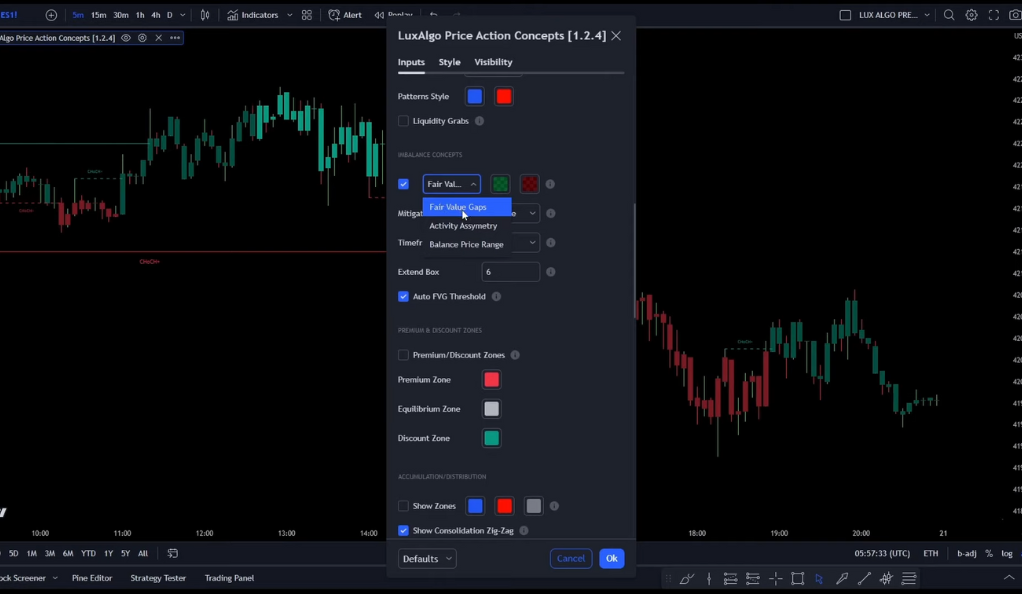

Using Fair Value Gaps as Targets

For this strategy, ‘fair value gaps’ are used as targets. The ‘auto FVG trace hold’ option should also be enabled. This approach allows you to set realistic and achievable targets for your trades.

Fair value gaps represent areas on the chart where the price has moved quickly, leaving a ‘gap’ in the market’s price history. These gaps often act as magnets for price, with the price often returning to these levels to ‘fill’ the gap. By using these gaps as targets, traders can set realistic and achievable goals for their trades.

Entering a Short Position

Entering a short position is a trading strategy that involves selling a security with the expectation that its price will decline, allowing it to be bought back at a lower price for a profit. This approach is typically used when the market is in a downtrend, meaning prices are generally decreasing.

When you enter a short position, you’re essentially expressing a bearish outlook on the market’s future performance. You’re betting that the price of the security you’re selling will decrease, enabling you to buy it back at a lower price later and make a profit. This strategy can be a powerful tool when used correctly, but it also comes with its own set of risks and challenges.

In the context of price action trading, entering a short position involves a few specific steps. First, you need to identify a bearish ‘chalk’ label on the chart. This label is an indication that the market may be about to experience a downward trend. It’s based on the relative position of prior swing highs or lows and can provide valuable insights into the market’s direction.

Once a bearish ‘chalk’ label has been identified, the next step is to determine your take profit target. For this strategy, the last bullish fair value gap is used as the take profit target. Fair value gaps represent areas on the chart where the price has moved quickly, leaving a ‘gap’ in the market’s price history. These gaps often act as magnets for price, with the price often returning to these levels to ‘fill’ the gap.

Entering a short position requires careful planning and risk management. It’s important to set a stop loss to protect against potential losses if the market doesn’t move in the expected direction. It’s also crucial to monitor the market closely and be ready to exit the position if the market conditions change.

Entering a Long Position

Entering a long position is a fundamental concept in trading and investing. It’s the process of buying a security with the expectation that it will rise in value. This strategy is commonly used when the market is in an uptrend, meaning prices are generally increasing.

When you enter a long position, you’re essentially expressing optimism about the market’s future performance. You’re betting that the price of the security you’re buying will increase, allowing you to sell it at a higher price later and make a profit. This is the most straightforward and common type of trading position.

In the context of price action trading, entering a long position involves a few specific steps. First, you need to identify a bullish ‘chalk’ label on the chart. This label is an indication that the market may be about to experience an upward trend. It’s based on the relative position of prior swing highs or lows and can provide valuable insights into the market’s direction.

Once a bullish ‘chalk’ label has been identified, the next step is to determine your take profit target. For this strategy, the last bearish fair value gap is used as the take profit target. Fair value gaps represent areas on the chart where the price has moved quickly, leaving a ‘gap’ in the market’s price history. These gaps often act as magnets for price, with the price often returning to these levels to ‘fill’ the gap.

Entering a long position requires careful planning and risk management. It’s important to set a stop loss to protect against potential losses if the market doesn’t move in the expected direction. It’s also crucial to monitor the market closely and be ready to exit the position if the market conditions change.

Conclusion

Price action trading is a powerful tool in any trader’s arsenal. This method of trading, which focuses on recent and actual price movements, offers a direct and unfiltered view of the market. It allows traders to interpret and trade the ever-changing market conditions in real-time, providing a dynamic approach to trading that can adapt to any market situation. With price action trading, you’re not just following a set of rigid rules. Instead, you’re learning to understand the market’s language and respond to its signals. This can lead to a deeper understanding of the market’s behavior, and ultimately, more informed trading decisions.

The use of tools like Lux Algo Premium and strategies like the ‘chalk’ and ‘chalk plus’ labels further enhances the effectiveness of price action trading. Lux Algo Premium, with its multitude of features, provides a comprehensive solution for technical analysis. It’s trusted by over 50,000 traders worldwide, which is a testament to its reliability and effectiveness. The ‘chalk’ and ‘chalk plus’ labels, on the other hand, offer a unique way to identify potential market reversals. These labels, based on the relative position of prior swing highs or lows, can provide valuable insights into the market’s direction. By understanding these labels, you can predict market movements with greater accuracy and confidence.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)