In the vast and dynamic world of trading, countless strategies, indicators, and methods are used by traders to navigate the often unpredictable financial markets. Amidst this sea of techniques, one strategy has recently emerged and is making waves due to its versatility and effectiveness – the Stock Accurate trading strategy. This strategy, which can be applied to a diverse range of assets including stocks, currencies, and cryptocurrencies, has been gaining traction for its unique approach and impressive results.

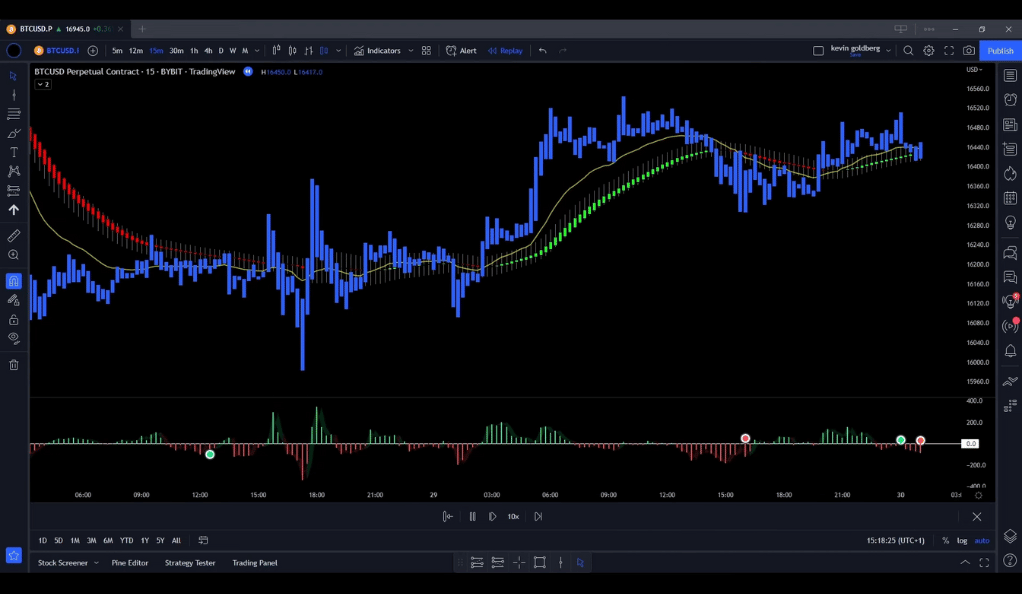

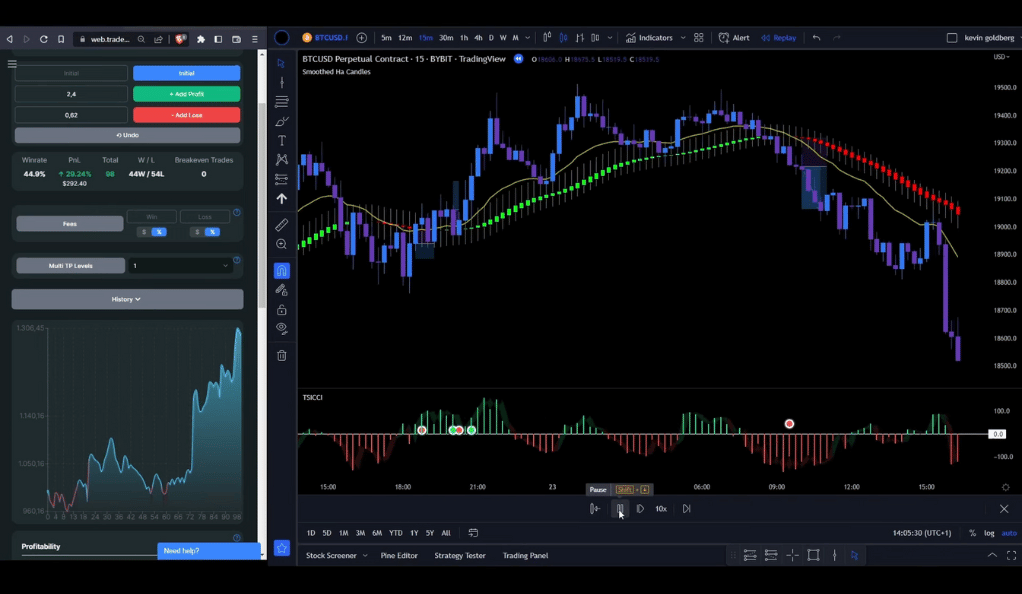

The Stock Accurate trading strategy is particularly effective when applied to a 15-minute timeframe. This makes it an attractive option for day traders and those who prefer short-term trading. The strategy’s unique approach involves a shift from regular candles to high-low-candles, providing a different perspective on price action and market volatility. However, for backtesting purposes, these high-low-candles are turned off to ensure a clear and accurate representation of the strategy’s potential performance.

In this comprehensive guide, we will delve into the details of the Stock Accurate trading strategy, exploring its unique features, backtesting results, risk management approach, and entry and exit rules. Whether you’re a seasoned trader or a beginner, this guide will provide valuable insights to enhance your trading journey.

Understanding the Stock Accurate Trading Strategy

The Stock Accurate trading strategy is a unique and innovative approach to trading that has been gaining significant attention in the financial markets. This strategy is not limited to a specific asset class but is versatile enough to be applied across stocks, currencies, and cryptocurrencies. Its effectiveness is particularly notable on a 15-minute timeframe, making it a popular choice for day traders and those who prefer short-term trading.

The strategy’s uniqueness lies in its use of high-low-candles instead of the regular candles typically used in charting. High-low-candles provide a different perspective on price action, focusing on the highest and lowest prices reached during a specific period. This can offer valuable insights into market volatility and potential price reversals. However, for backtesting purposes, the high-low-candles are turned off. This is done to ensure that the real entries and exits are clearly visible, providing a more accurate representation of the strategy’s effectiveness.

The Stock Accurate trading strategy is not just about the type of candles used. It also involves a set of specific rules for entering and exiting trades, risk management, and the use of particular indicators. These elements work together to create a comprehensive trading system that can help traders navigate the often turbulent financial markets with greater confidence and potential for success.

Backtesting: A Crucial Step

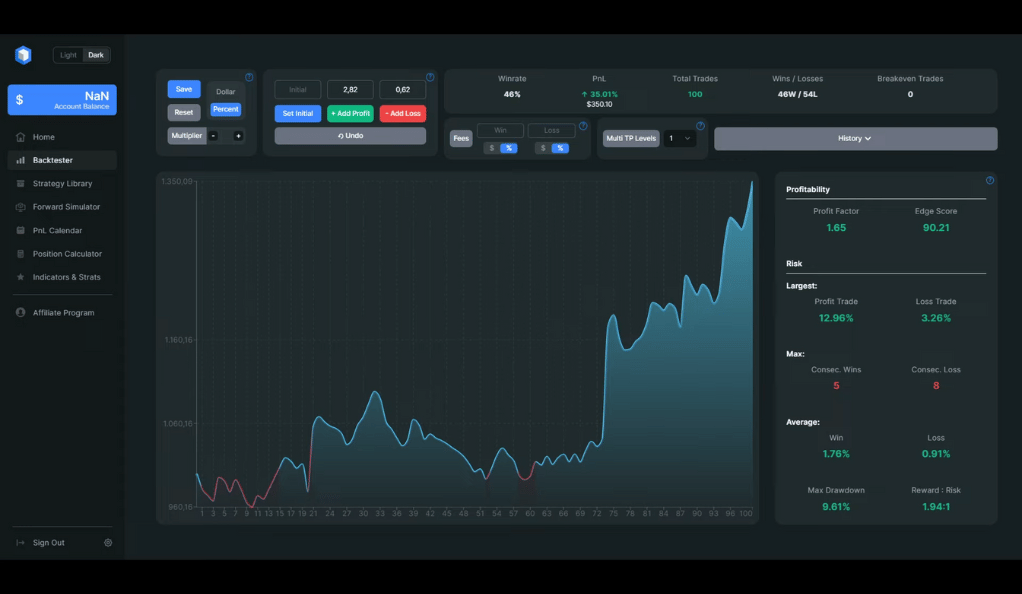

Backtesting is an essential part of any trading strategy. It involves testing the strategy against historical data to determine its effectiveness. For the Stock Accurate strategy, backtesting was conducted 100 times, with all trade results input into the Traders Edge App. This rigorous testing process provides a robust understanding of the strategy’s potential performance in real-world trading scenarios.

Risk Management: The Key to Success

In trading, managing risk is as important as identifying profitable opportunities. With the Stock Accurate strategy, the initial balance was set at 1000 USD, with a risk of 2% per trade. This risk management approach ensures that even if a trade goes south, the overall impact on the trading account is minimal.

The Results: A Testament to the Strategy’s Effectiveness

The results of the backtesting were impressive. The account grew from 1000 USD to 1350 USD, boasting a win rate of 46% and a profit and loss (PnL) of 35%. The largest profit trade was 13%, and the largest loss trade was 3%. The strategy demonstrated resilience with 5 consecutive wins and weathered the storm with 8 consecutive losses. Overall, the strategy ranked 10th out of 35, scoring 6 points, a testament to its effectiveness.

The Indicators: Tools of the Trade

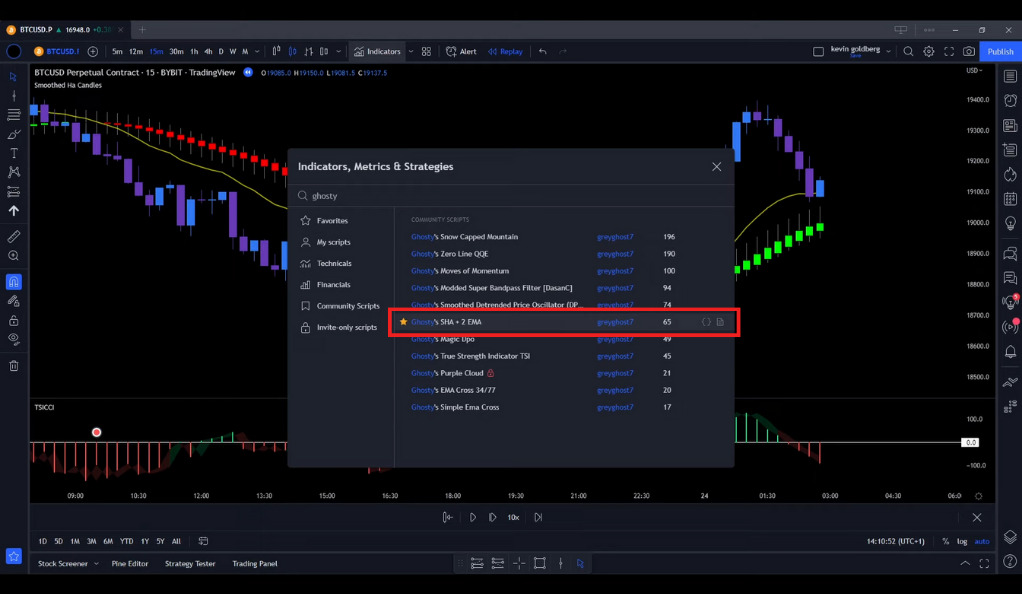

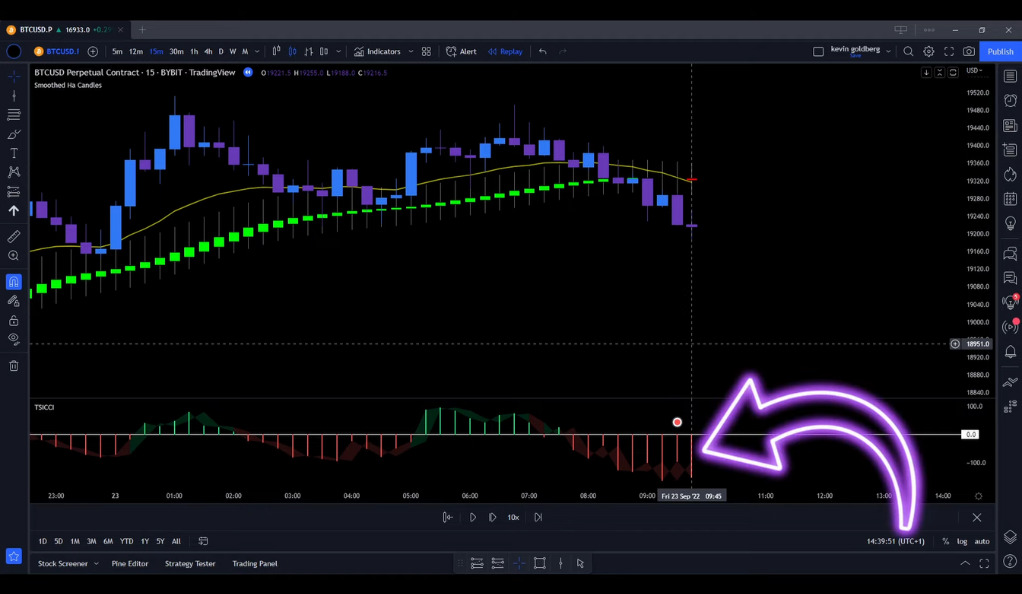

The Stock Accurate strategy employs two key indicators: “Ghosty’s SHA + 2 EMA” by greyghost7 and “TSI CCI Hull” by seaside420. These indicators, when used with specific settings adjustments, provide the necessary signals for trade entries and exits.

Entry Rules: Knowing When to Jump In

Understanding when to enter a trade is crucial. For long positions, three conditions must be met: a green candle printed by Ghosty’s Indicator, the 200 EMA from Ghosty’s Indicator crossing above the green Ghosty candle, and a green histogram printed above the Zero Line by the TSI CCI Indicator. Once these conditions are met, a buy order can be placed at the close of the trigger candlestick.

Exit Rules: Knowing When to Bow Out

Just as important as knowing when to enter a trade is knowing when to exit. For short positions, three conditions must be met: a red candle printed by Ghosty’s Indicator, the 200 EMA from Ghosty’s Indicator crossing below the red Ghosty candle, and a red histogram printed below the Zero Line by the TSI CCI Indicator. Once these conditions are met, a sell order can be placed at the close of the trigger candlestick.

Risk to Reward Ratio: Balancing the Scales

In trading, the risk to reward ratio is a crucial factor. With the Stock Accurate strategy, the stop loss is placed at the 200 EMA, and the target is a Risk to Reward Ratio from 1 to 1.5. This balance ensures that potential profits outweigh the risks involved.

Invalid Signals: Avoiding False Alarms

Not all signals should be acted upon. Certain conditions can invalidate a signal, such as when the 200 EMA-Line has not crossed the Ghosty Candle or when the TSI CCI Indicator has not printed the correct histogram. Recognizing these invalid signals can save traders from unnecessary losses.

Looking Ahead: Future Backtesting

The speaker also mentioned a future backtesting of a strategy based on the Nadaraya Watson Indicator by Lux Algo. This indicates a continuous effort to explore and refine trading strategies, ensuring they remain effective in the ever-changing financial markets.

Conclusion

In the ever-evolving world of trading, the Stock Accurate trading strategy stands out as a versatile and effective tool for navigating the financial markets. Its unique approach, combined with robust risk management and clear entry and exit rules, make it a valuable addition to any trader’s arsenal.

The strategy’s adaptability across different asset classes – stocks, currencies, and cryptocurrencies – and its effectiveness on a 15-minute timeframe make it a potent tool for both short-term and long-term traders. The use of specific indicators and the shift from regular candles to high-low-candles offer a fresh perspective on market trends and price actions.

However, as with any trading strategy, it’s crucial to remember that the Stock Accurate trading strategy is not a magic bullet. It requires rigorous backtesting, continuous learning, and regular adjustments to stay effective in the ever-changing market conditions. It’s also essential to consider individual trading styles, risk tolerance, and financial goals when implementing this strategy.

In conclusion, the Stock Accurate trading strategy offers a unique and promising approach to trading. It’s a testament to the power of innovation and strategic thinking in the world of trading. As we continue to explore and refine trading strategies, we move closer to our goal of making trading more accessible, understandable, and profitable for everyone.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)