Sometimes, the financial markets seem to get into the spirit of the holiday season. This festive cheer is often manifest in the form of the “Santa Claus rally,” a curious phenomenon characterized by an uptick in stock prices between Christmas and New Year. In the financial world, it’s almost like a visit from St. Nicholas himself, spreading festive joy among investors. But, like any good Christmas tale, this story also has its twists and turns. Today, we’ll unravel this intriguing phenomenon and understand its relevance amidst the 5-6% downturn in the market. We’ll also take a sleigh ride across the globe to Japan, where the Bank of Japan’s recent policy changes are causing ripples that might reach our Santa Claus rally. Hold tight, it’s time to jingle all the way!

Decoding the Santa Claus Rally

A Festive Anomaly or Statistical Reality?

The Santa Claus rally isn’t just a festive myth passed down in Wall Street folklore. It’s a well-documented occurrence. According to a study by the Journal of Financial Planning, U.S stocks have historically enjoyed an approximate 1% return during this period. However, with the current market downturn, one can’t help but question, will Santa’s sleigh still take flight?

Understanding Market Downturns

A 5-6% downturn in the market might seem like a chilly wind blowing against the traditionally expected Santa Claus rally. However, a market downturn doesn’t automatically spell the end of the rally. The Santa Claus rally and a market downturn aren’t like oil and water. Instead, the interplay between the two can be influenced by numerous factors, ranging from macroeconomic indicators to geopolitical events and investor sentiment.

Market Downturn and the Santa Claus Rally: Friends or Foes?

Before we jump to conclusions about the impact of a market downturn on the Santa Claus rally, it’s vital to understand that the financial market is an intricate web of interconnections. It’s like a Christmas tree, with each decoration representing a different market factor. One dull bulb doesn’t necessarily spoil the beauty of the whole tree.

Sailing Across the Ocean – The Bank of Japan’s Influence

Steering Towards a New Monetary Stance

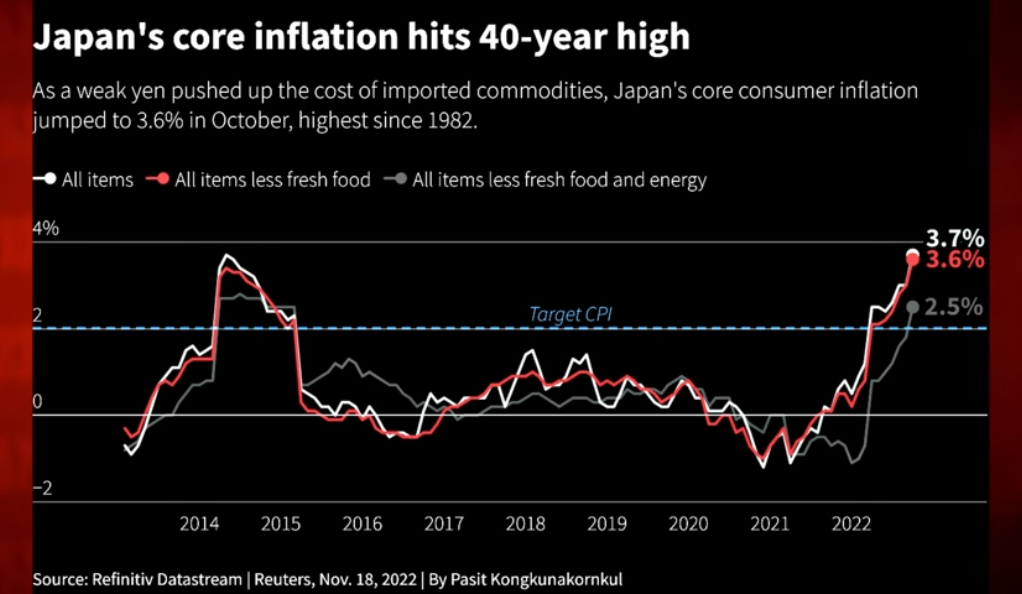

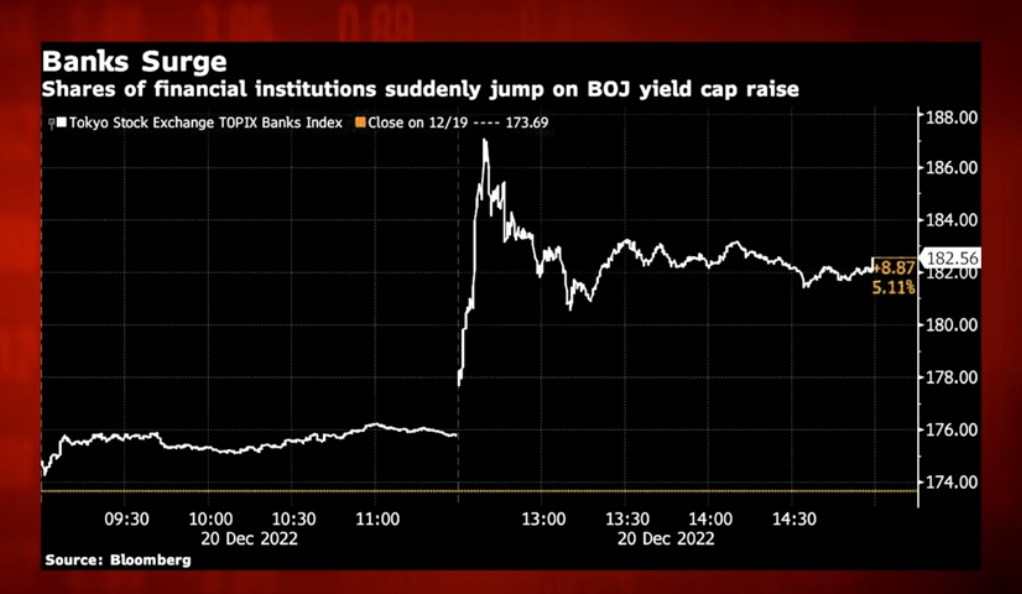

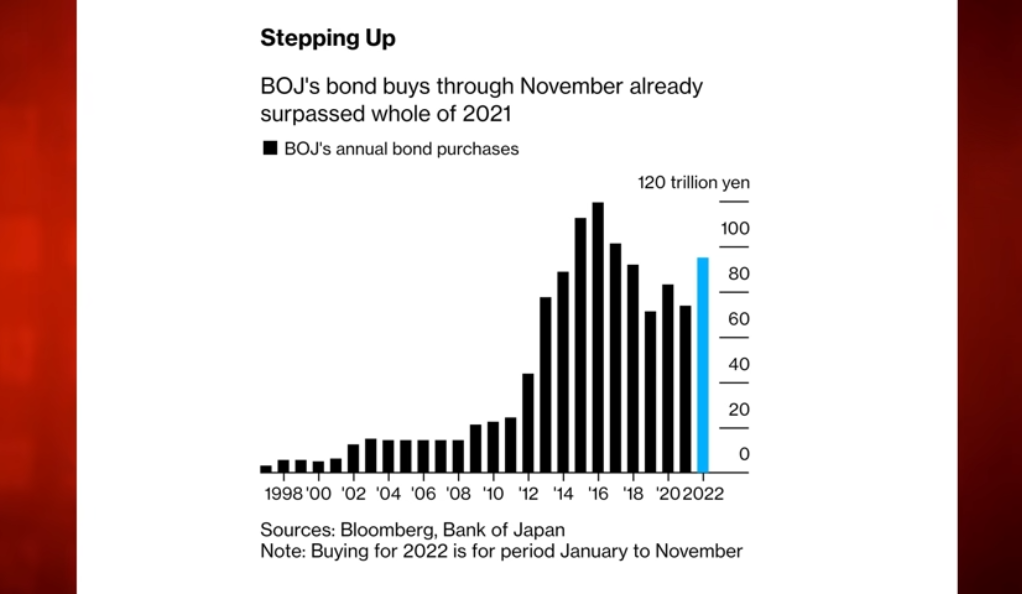

Sailing our discussion eastwards to the land of the rising sun, the Bank of Japan recently made some policy decisions worth noting. Abandoning its longstanding deflation policies and altering its stance on yield curve control, the bank has welcomed more market volatility. Much like how the unexpected twist in a Christmas tale keeps you on the edge of your seat, these changes have created ripples across the global financial scene.

A Ripple Effect Across Global Markets

The Bank of Japan’s policy changes have given rise to two significant outcomes: an appreciation in the value of the Japanese yen and a surge in Tokyo’s bank index. These movements could potentially trigger a seismic shift in global financial markets, even influencing the mighty dollar’s value. So, how does all this tie back to our jolly Santa Claus rally?

The Seismic Shift – Interplay Between the Yen, Dollar, and the Global Recession

The Rising Sun: Increasing Demand for the Japanese Yen

The Bank of Japan’s policy alterations have led to an increased demand for the yen compared to the dollar. This trend signifies a shift in investor preferences, possibly spurred by the desire for more stable, ‘safe-haven’ currencies amidst global economic uncertainty. But, could this shift in preference cast a shadow over the anticipated Santa Claus rally?

Dark Clouds on the Horizon: A Looming Recession

The frosty winds of a potential recession blowing over the U.S and the global economy also warrant consideration when evaluating the prospect of a Santa Claus rally. Much like how a sudden snowstorm can disrupt Christmas festivities, a recession could dramatically impact the seasonal stock market trend. As investors become more cautious, we may see more subdued market movements, irrespective of the time of year.

The Verdict – Will Santa Claus Rally in a Recession?

A Yuletide Mystery

With the current market conditions painting a somewhat gloomy Christmas scene, will we witness the Santa Claus rally this year? The answer to this question remains as elusive as a child’s attempt to stay up and catch a glimpse of Santa. The diverse and complex factors at play, ranging from domestic market conditions to shifts in international financial policies, and the threat of a recession make predicting this as tricky as guessing what’s wrapped in your Christmas present.

A Global Financial Tapestry

The current situation emphasizes the interwoven nature of global markets. Seemingly isolated events can converge to influence financial outcomes. As we eagerly anticipate the arrival of Santa and his rally, we must remember that successful investing involves more than following seasonal trends. It requires a thorough understanding of various economic indicators, both domestic and international.

The Wise Investor’s Christmas List

Reminiscing Past Rallies

While the Santa Claus rally’s historical pattern of attractive returns makes it seem like a wonderful Christmas tradition, investors must remember that past performance does not dictate future results. An impending recession, coupled with major shifts in global monetary policies, could significantly impact market trends, potentially overpowering seasonal patterns.

The Rising Yen and its Consequences

The Bank of Japan’s recent changes have led to an unforeseen surge in the yen’s value, leading to unexpected consequences in the global economy. A stronger yen might signify changing investor sentiments, potentially leading to increased market volatility and impacting economies across the globe.

Battening Down the Hatches for a Recession

As the frosty breath of a potential recession looms over the global economy, investors must arm themselves appropriately. One of the effective strategies could be diversifying their portfolios and integrating defensive tactics to withstand potential economic downturns. While the hope of a Santa Claus rally may lighten the spirits, it is crucial to plan for all potential scenarios.

Conclusion: Santa Claus Rally – A Festive Tale with Global Implications

The Unpredictable Christmas Guest

Much like the anticipation of Christmas morning, the arrival (or absence) of the Santa Claus rally adds an element of suspense in the financial world towards the year’s end. But amid a potential economic downturn and changes in international monetary policies, will the jolly old St. Nicholas make his annual visit to Wall Street? The unpredictability adds to the intrigue and excitement, much like a well-written Christmas story.

Learning from the Story

The anticipation around the Santa Claus rally serves as a reminder of the narrative nature of the financial markets. It’s not just about numbers and charts; it’s about understanding the story behind these figures. This story is penned by various global events and policies, shaping the plot and often, introducing unexpected turns.

Preparing for the Final Chapter

While we hope that this financial story ends with a hearty “Ho, Ho, Ho!” echoing across Wall Street, it’s crucial to prepare for all possible outcomes. The key to prudent investing doesn’t lie in merely following trends, but in interpreting the broader market context. As we turn the pages of this fascinating financial tale, remember, a new trading day always dawns, bringing fresh opportunities and challenges. May your investing journey be merry and bright, irrespective of the season!

The Magic of Uncertainty

The stock market, in all its complexity and unpredictability, is much like the magical spirit of Christmas. Both are full of surprises, joy, and a bit of uncertainty. Both have their own legends, like our Santa Claus rally, which inspire intrigue and excitement. And in both cases, the anticipation of what’s to come can often be as thrilling as the event itself.

Final Thoughts – The New Year Beckons

As we approach the end of the year, remember, the turn of the calendar is a chance for renewal and fresh starts, in life and investments alike. While we may not know what the New Year holds, we can equip ourselves with knowledge, adaptability, and a readiness to embrace whatever comes our way.

In the world of investments, it’s crucial to remember that trends like the Santa Claus rally are merely one piece of the puzzle. The real gift lies in understanding and navigating the markets in their entirety – a journey filled with constant learning, growth, and opportunities.

Whether Santa’s sleigh lands on Wall Street this year or not, the season’s spirit reminds us of the joy of anticipation, the importance of hope, and the magic of a good story. So, here’s to the stories we’ll tell and the ones we’ll live. Here’s to the rally that may or may not come, but will always be a part of the festive folklore. After all, what’s Christmas without a little mystery, a sprinkle of hope, and a whole lot of cheer?

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)