In the fast-paced realm of trading, strategies that promise zero risk and 100% accuracy often raise eyebrows and skepticism among seasoned traders. One such strategy, featured on the Stock Accurate channel, claims to offer these alluring advantages. This article delves into the intricacies of a 15-minute scalping strategy, exploring its implementation and presenting the results of a comprehensive backtest.

The 15-minute scalping strategy showcased on the Stock Accurate channel aims to capitalize on short-term price movements in the market. Scalping strategies typically involve entering and exiting trades quickly, often within minutes, to exploit small price differentials. The channel provides detailed instructions on how to implement the strategy, including specific indicators, entry and exit signals, and risk management techniques.

To evaluate the effectiveness of the strategy, a meticulous backtest was conducted, simulating trades based on historical price data. The backtest results highlight the strategy’s performance over a defined period, including the number of trades executed, their success rate, and the overall profitability. It is important to interpret these results with caution, as past performance does not guarantee future success. Traders should thoroughly understand the strategy, adapt it to their individual trading style, and consider various risk factors before employing it in live trading.

The Strategy: An Overview

The strategy under scrutiny is presented as a “Zero Risk Trading Strategy with No Loss” with the enticing claim of “100% Accurate Indicator Signals.” Primarily focused on scalping, this technique aims to generate significant profits within a brief timeframe of 15 minutes. The strategy’s objective is to enable traders to achieve a daily profit target of $200 through its implementation.

The strategy’s exact details and indicators utilized are not explicitly mentioned in the given information. However, scalping strategies generally involve quick entry and exit trades to take advantage of small price differentials. While the promise of zero risk and 100% accuracy may appear appealing, it is essential to approach such claims with skepticism and thoroughly assess the strategy’s viability before incorporating it into one’s trading approach. Successful trading typically requires a comprehensive understanding of market dynamics, risk management techniques, and ongoing evaluation and adaptation of strategies to suit individual trading styles and market conditions.

The Tools: ITG Scalper and Volume Trend Histograms

The strategy relies on two specific TradingView indicators: ITG Scalper and Volume Trend Histograms. Both of these indicators are available for free on the TradingView platform. The ITG Scalper indicator is designed to identify potential entry and exit points for scalping trades. It provides signals based on price action and specific criteria set by the trader. The Volume Trend Histograms indicator, on the other hand, focuses on volume analysis, providing insights into the strength and direction of price movements. By incorporating these indicators, traders can gain additional information to inform their trading decisions within the context of the 15-minute scalping strategy.

While the strategy utilizes these indicators, it is important to note that the effectiveness of any trading approach relies on various factors, including market conditions, individual trading skills, and risk management techniques. Traders should thoroughly understand the indicators, their settings, and their limitations. It is recommended to backtest the strategy with historical data and evaluate its performance before applying it in live trading. Additionally, customization of the indicators to suit personal trading preferences and market conditions may be necessary for optimal results.

The Trading Rules: Long and Short Positions

The strategy involves specific trading rules for both long and short positions. For long positions, traders look for buy signals generated by the ITG Scalper and Volume Trend Histograms indicators. These signals indicate potential opportunities to enter the market with the expectation of price appreciation. Conversely, for short positions, sell signals are sought based on the indicators, indicating potential opportunities to profit from price declines. By following these trading rules, traders aim to capitalize on short-term price movements in the market and achieve the desired daily profit target.

Long Position Rules

- Signal Generation: A green arrow must be printed by the ITG Scalper.

- Signal Confirmation: Wait for one more candle to close after the signal is printed.

- Entry Confirmation: A bullish candle must appear within 5 candles, including the candle where the arrow was printed, and the volume indicator line must be blue.

Short Position Rules

- Signal Generation: A red or yellow arrow must be printed by the ITG Scalper.

- Signal Confirmation: Wait for one more candle to close after the signal is printed.

- Entry Confirmation: A bearish candle must appear within 5 candles, including the candle where the arrow was printed, and the volume indicator line must be blue.

For both long and short positions, the stop loss is set at the low/high of the previous market, targeting a risk to reward ratio from 1 to 1.5.

Backtesting: The Results

The author performed an extensive backtest of the strategy using the Trader Edge platform, running it 100 times. The backtest was conducted with an initial balance of $1000 and a leverage of 2x, simulating the strategy’s performance under various market conditions. By analyzing the results obtained from this backtest, valuable insights into the strategy’s performance and potential were gained.

These backtesting results offer a glimpse into the strategy’s profitability and effectiveness. However, it’s important to approach these results with caution, as backtesting is a simulation based on historical data and may not accurately reflect real-time trading conditions. Traders should consider various factors, such as market volatility, liquidity, and slippage, which can impact actual trading results. Additionally, continuous evaluation, optimization, and adaptation of the strategy based on changing market dynamics are necessary to improve its robustness and suitability for live trading.

Win Rate and Profit

The backtesting results revealed a win rate of 53%, indicating that slightly more than half of the trades executed during the test period were successful. This suggests that the strategy has the potential to generate profits by capitalizing on favorable market conditions. Additionally, the strategy yielded a profit of 59%, resulting in a notable account growth from the initial $1000 to $1595. These results showcase the strategy’s ability to generate positive returns and increase the trading account’s value.

However, it is crucial to exercise caution and avoid solely relying on past performance. While the backtesting results provide insights into the strategy’s historical performance, they do not guarantee future success. Market conditions can change, and strategies may not perform consistently across different periods or under varying circumstances. Therefore, it is important for traders to consider the win rate, profit percentage, and overall account growth in conjunction with other factors, such as risk management techniques, market volatility, and personal trading preferences. This comprehensive evaluation will assist traders in making informed decisions about whether or how to implement the strategy in live trading, taking into account potential risks and the dynamic nature of financial markets.

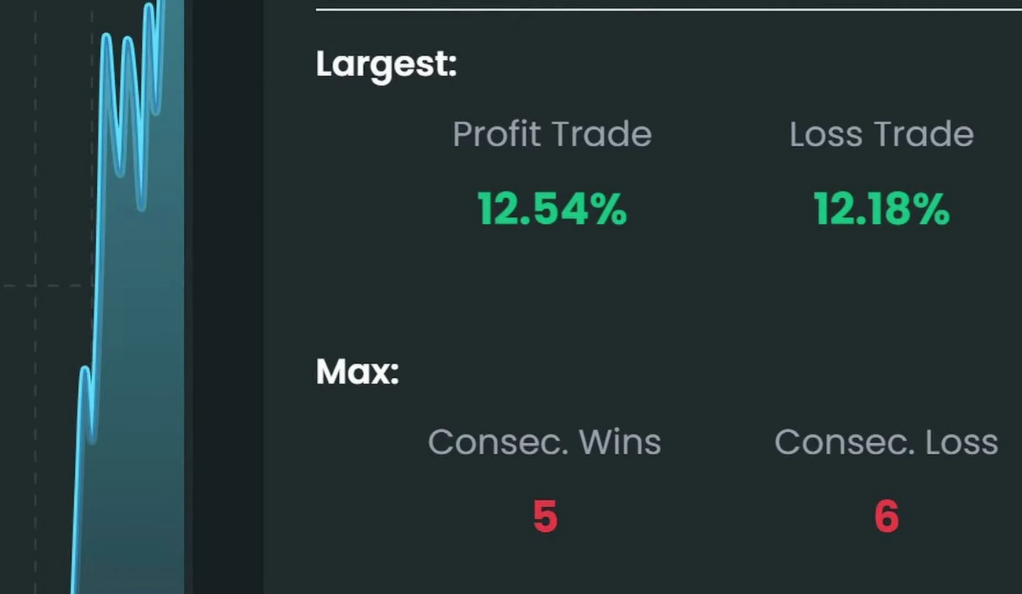

Largest Profit and Loss Trades

During the backtest, the largest profit trade observed was 12.5%. This indicates that at its peak, the strategy was capable of generating substantial gains, contributing to the overall profitability of the trading approach. However, it is important to note that the largest loss trade recorded was 12.1%. This highlights the potential risk associated with the strategy, as it can also lead to significant losses. Traders need to consider the trade-offs between potential profits and risks, ensuring they have appropriate risk management measures in place to mitigate the impact of potential losses.

These figures demonstrate the importance of closely monitoring and managing trades executed with the strategy. It is crucial to adhere to risk management principles, such as setting appropriate stop-loss levels and position sizing, to protect capital and limit potential losses. Traders should exercise caution and ensure they fully understand the strategy’s dynamics, as well as the associated risks, before implementing it in live trading. Regular evaluation and adjustment of the strategy based on market conditions and individual trading preferences can help optimize its performance while minimizing the impact of potential losses.

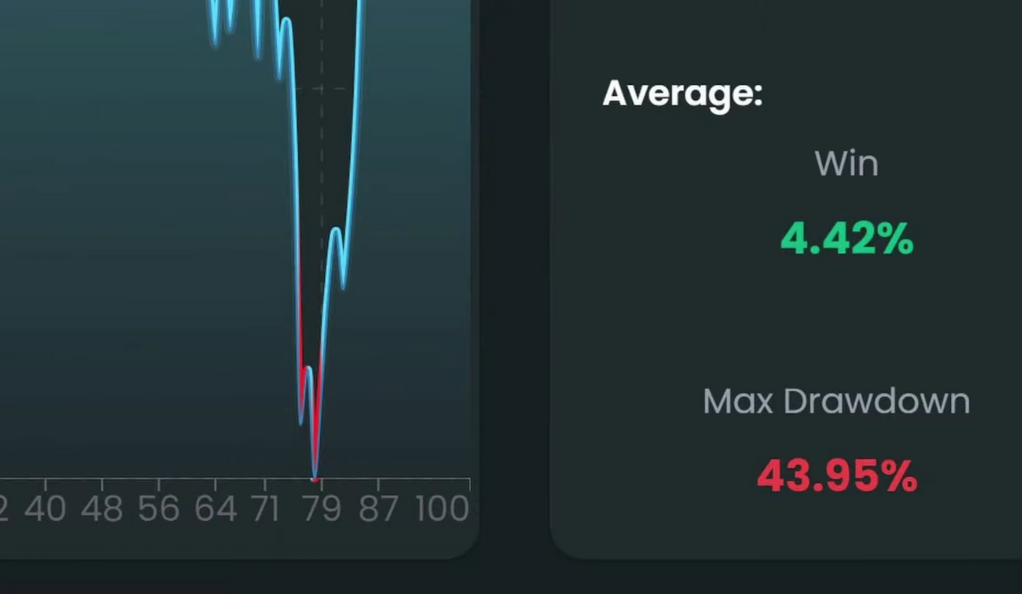

Drawdown

The backtesting results revealed a maximum drawdown of approximately 44%. Drawdown refers to the peak-to-trough decline in the trading account balance during a specific period. A drawdown of this magnitude indicates that at its lowest point, the strategy experienced a significant loss of capital. It is essential for traders to be aware of and consider the drawdown when evaluating the strategy’s risk profile. Drawdowns of such magnitude can be emotionally and financially challenging to withstand, requiring careful risk management and mental resilience.

It is worth noting that while a large drawdown can be discouraging, it does not necessarily imply a permanent loss of capital. Drawdowns are a natural part of trading, and strategies often experience periods of losses before recovering and potentially achieving new highs. Traders should analyze the drawdowns alongside other performance metrics and consider their risk tolerance and investment goals. Implementing risk management techniques such as diversification, setting appropriate stop-loss levels, and regularly reviewing and adjusting the strategy can help mitigate the impact of drawdowns and improve the overall performance and resilience of the trading approach.

Conclusion

While the “Zero Risk” Trading Strategy promises enticing benefits, the backtesting results paint a more nuanced picture. The strategy can lead to substantial profits, but it also comes with significant risks. As with any trading strategy, it’s crucial to thoroughly research and backtest before investing real money. Remember, there’s no such thing as a risk-free strategy in trading. Always trade responsibly and within your risk tolerance.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.