In the world of trading, traders are constantly in search of a winning strategy that can provide consistent profits. One such strategy that has garnered attention is the “97% Winrate Super Simple Strategy.” This strategy boasts an impressive win rate and promises lucrative returns. It relies on the combined power of four indicators: CM Super Guppy, Half Trend, Average True Range (ATR), and Highest Volume Index (HVI).

The CM Super Guppy indicator is a trend-following tool that helps traders identify the direction of the market. The Half Trend indicator, on the other hand, assists in identifying potential entry and exit points by plotting trendlines. The Average True Range (ATR) indicator measures market volatility, enabling traders to set appropriate stop-loss and take-profit levels. Lastly, the Highest Volume Index (HVI) indicator helps identify significant price levels based on high trading volumes.

While the claimed win rate of 97% may sound appealing, it is essential to approach such claims with caution. Backtesting results can provide valuable insights into the historical performance of a strategy, but they may not necessarily reflect its future performance. Factors such as changing market conditions, slippage, and other trading costs can impact the strategy’s effectiveness in real-world trading scenarios. It is crucial for traders to thoroughly analyze and test any strategy before committing real capital, taking into account their own risk tolerance and financial goals.

Understanding the Strategy

The “97% Winrate Super Simple Strategy” is based on the utilization of several indicators that work together to identify potential entry points for trades. These indicators include the CM Super Guppy, Half Trend, ATR, and HVI. Each indicator has a specific role in the strategy and contributes to the decision-making process.

In the strategy video, the author outlines specific rules that traders should follow when applying the strategy. These rules take into account factors such as the color of moving averages and the position of the HVI line. By adhering to these conditions, traders aim to identify favorable trading opportunities and increase the probability of capturing profitable trades. It is important for traders to thoroughly understand and apply these rules in order to effectively implement the strategy and potentially achieve the desired outcomes in their trading activities.

The Backtested Results

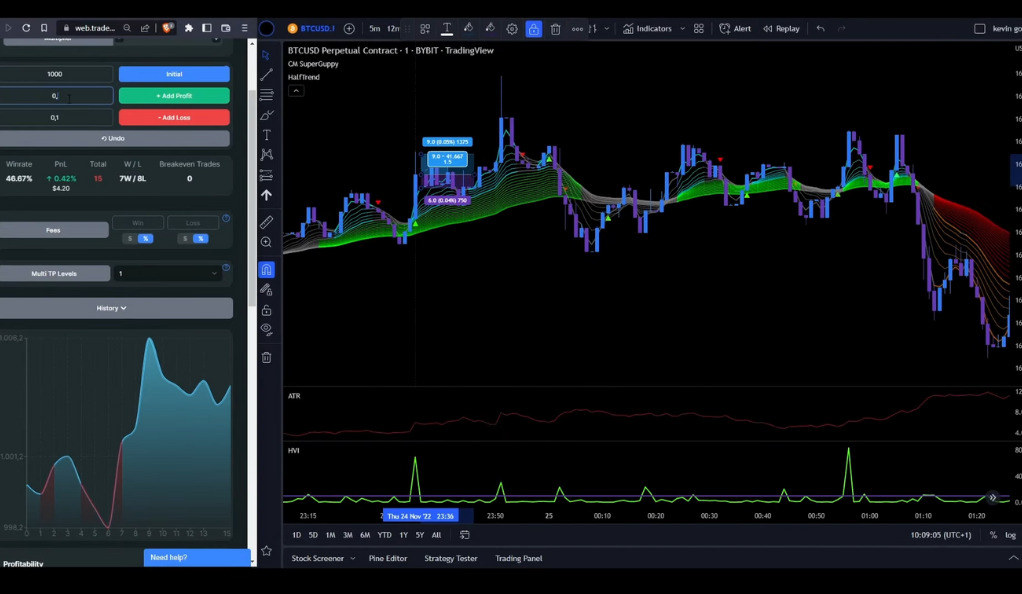

Backtesting is a valuable tool for assessing the historical performance of a trading strategy, and in the case of the “97% Winrate Super Simple Strategy,” the results did not align with the claimed win rate. The author conducted backtesting over 100 trades and found that the strategy did not perform as anticipated.

The backtesting results revealed that the author’s account balance decreased from $1000 to $970, indicating a loss of $30 or a PnL (Profit and Loss) of -3.24%. This outcome contradicts the strategy’s claim of a 97% win rate. In reality, the strategy only achieved a win rate of 43%, with only 43 out of the 100 trades being profitable. These results highlight the importance of skepticism when it comes to strategies that make extraordinary claims, emphasizing the need for traders to critically evaluate and test any strategy before committing real capital.

Analyzing the Strategy’s Performance

The underwhelming performance of the “97% Winrate Super Simple Strategy” raises questions about its effectiveness and reliability. Despite its name and the initial promise of high win rates, the strategy fell significantly short of expectations. Instead of generating profits, it resulted in a net loss.

These findings highlight the importance of caution when relying solely on backtested results. Backtesting can provide insights into a strategy’s historical performance, but it cannot guarantee future success. Market conditions, volatility, and other unpredictable factors can significantly impact a strategy’s effectiveness.

Considerations for Traders

When evaluating the “97% Winrate Super Simple Strategy” or any trading strategy, traders should consider the following factors. Firstly, they should examine the methodology and logic behind the strategy. Understanding how the indicators are used and how they interact with each other is crucial. Traders should also be aware of the limitations and potential drawbacks of relying solely on indicators, as market conditions can change rapidly and unpredictably.

Secondly, traders should conduct thorough backtesting and forward testing of the strategy using historical data and simulated trading environments. This allows them to assess the strategy’s performance across various market conditions and determine its robustness. It is important to consider factors such as slippage, trading costs, and the impact of different timeframes or assets on the strategy’s results.

Furthermore, traders should never solely rely on backtested results or claimed win rates. Real-world trading involves uncertainties and risks that cannot be fully captured by historical data alone. It is crucial to apply risk management techniques and have realistic expectations regarding profits and losses. Additionally, traders should continuously monitor and evaluate the strategy’s performance, making adjustments as necessary based on market conditions and their own trading objectives.

Risk Management

Risk management is a fundamental aspect of trading that can significantly impact a trader’s overall success. Traders must assess their risk tolerance level, which refers to the amount of potential loss they are willing to accept for each trade. This assessment helps determine the position size or the amount of capital allocated to each trade. By setting a risk threshold and adhering to it, traders can protect themselves from excessive losses and preserve their trading capital.

Traders use stop-loss orders to limit potential losses by setting a predetermined exit price for their trades. Diversifying portfolios across different assets or markets reduces the impact of individual trade losses. Staying informed about market news and being prepared for unexpected volatility is crucial. Effective risk management aims to control and mitigate losses while preserving capital for sustainable trading.

Market Conditions

Market conditions play a crucial role in the performance of trading strategies. It is important for traders to recognize that strategies that excel in specific market conditions may face challenges in different environments. Traders should closely monitor market trends, such as whether it is a bull or bear market, as well as the prevailing volatility levels.

Different strategies suit different market conditions. Trend-following strategies excel in trending markets with clear directions, while range-bound strategies are effective in sideways or choppy markets. Traders must understand and adapt to current market conditions to align their strategies accordingly. They should also consider economic indicators, geopolitical events, and central bank policies that can introduce volatility and impact strategies. Staying informed and flexible allows traders to adjust their strategies and maximize their chances of success.

Diversification

Diversification is a crucial aspect of successful trading. Relying solely on a single strategy can expose traders to heightened risks and limited opportunities. To increase the chances of long-term success, traders should consider diversifying their trading approaches and incorporating multiple strategies.

By diversifying their trading approaches, traders spread their risk across different strategies that may perform well in various market conditions. This helps mitigate the impact of potential losses from any one strategy and increases the likelihood of capturing profitable trades. Diversification allows traders to adapt to changing market dynamics and take advantage of different opportunities that may arise.

It is important for traders to carefully select and combine complementary strategies, considering factors such as timeframes, asset classes, and risk levels. This can help create a well-rounded portfolio of trading strategies that work together to achieve more consistent results. However, it is equally important to manage and monitor the diversified portfolio effectively, ensuring that each strategy aligns with the trader’s risk tolerance and overall trading goals.

Professional Advice

Seeking guidance from experienced financial professionals is a prudent step for traders looking to enhance their trading strategies and decision-making processes. These professionals possess in-depth knowledge and expertise in the financial markets, allowing them to offer valuable insights and advice tailored to individual circumstances.

Financial professionals can provide personalized recommendations based on an assessment of a trader’s risk tolerance, financial goals, and market conditions. They can help traders navigate through the complexities of the markets, identify potential risks, and develop effective strategies to mitigate those risks. Moreover, professionals can assist in analyzing market trends, economic indicators, and other relevant factors that may impact trading decisions.

By consulting with financial professionals, traders can gain a broader perspective on their trading activities and access expert opinions. This can help traders make more informed decisions and avoid common pitfalls. However, it is important to choose reputable and trustworthy professionals who have a proven track record and align with the trader’s objectives. Collaborating with financial professionals can significantly enhance a trader’s knowledge, skills, and overall success in the competitive world of trading.

Conclusion

The “97% Winrate Super Simple Strategy” may sound appealing, but the reality revealed through backtesting is far from its claim. With a win rate of only 43% and a net loss of 3.24%, this strategy failed to deliver the expected results. Traders must exercise caution when relying solely on backtested results and consider additional factors such as risk management and market conditions.

Ultimately, trading success lies in a combination of factors, including thorough research, analysis, risk management, and adaptability to changing market conditions. Rather than relying solely on the allure of high win rates, traders should aim for a holistic approach to their trading strategies to increase their chances of long-term profitability.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)