Trading in the financial markets is both an art and a science. With countless strategies and methodologies available, finding the one that resonates with your trading style can be a challenge. Among these strategies, trading with fair value gaps has emerged as a powerful tool for traders across various markets, including stocks, crypto, and forex. But what exactly are fair value gaps, and how can you harness their potential in your trading journey? This comprehensive guide will take you through every aspect of this intriguing strategy.

Understanding Fair Value Gaps: The Basics

What Are Fair Value Gaps?

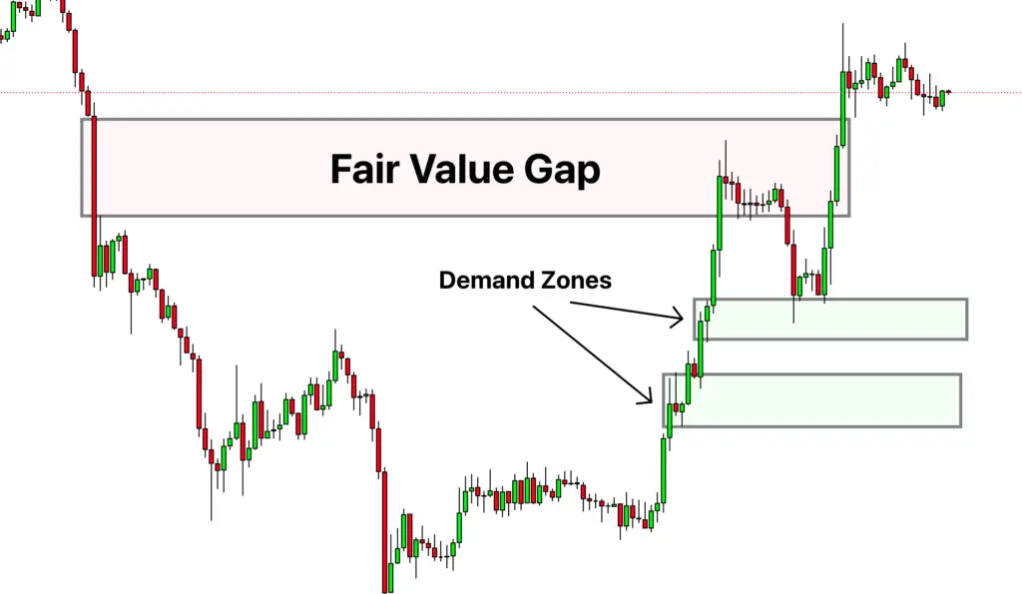

Fair value gaps occur when there’s a significant price movement in one direction without enough time for buyers or sellers to react. This sudden move creates an imbalance in the market, often leading to the price returning to this area. Understanding this phenomenon is the cornerstone of our trading strategy.

Why Do Fair Value Gaps Matter?

Fair value gaps are more than just interesting price patterns; they represent opportunities. By identifying these gaps, traders can anticipate where the price might return, providing a unique entry point for trades.

Step 1: Identifying Key Resistance or Support

Finding the Right Levels

Resistance and support levels are fundamental concepts in trading. Identifying these levels is crucial as they often act as barriers that prevent the price from moving in a particular direction. By examining recent swing highs or lows or looking at higher timeframes, traders can pinpoint these critical levels.

The Importance of Timeframes

Different timeframes can provide varying perspectives on resistance and support levels. While shorter timeframes might offer more immediate insights, longer timeframes like the 1-hour or daily chart can provide a broader view of the market’s direction.

Step 2: Spotting a Fake Out

What Is a Fake Out?

A ‘fake out’ is when the price appears to break a resistance or support level but then reverses direction. This reversal can catch many traders off guard, leading to a cascade of stop losses being triggered.

How to Spot a Fake Out

A fake out in trading refers to a situation where the price appears to break a significant resistance or support level but then quickly reverses direction. This can be a deceptive and challenging pattern to identify, but understanding how to spot a fake out can be a powerful tool in a trader’s arsenal. Here’s a detailed guide on how to recognize and respond to fake outs.

Understanding Key Levels

Before you can spot a fake out, it’s essential to understand what key levels are. These are specific price points that have historically acted as barriers, preventing the price from moving further in a particular direction. Identifying these levels requires careful analysis of historical price data and an understanding of market psychology.

Observing Price Action

Fake outs often occur after a rapid price movement towards a key level. Keen observation of price action, including the speed and momentum of the move, can provide early clues that a fake out may be imminent.

Candlestick Patterns

Candlestick patterns can be particularly revealing when it comes to spotting fake outs. Patterns such as shooting stars, hammers, and dojis may indicate a potential reversal. Learning to recognize these patterns and understanding what they signify can be instrumental in identifying fake outs.

Utilizing Technical Indicators

In addition to candlestick patterns, various technical indicators can signal a potential fake out. Tools like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands can provide insights into overbought or oversold conditions, hinting at a possible reversal.

Step 3: Confirming Direction with Two Lower Lows

Understanding Lower Lows

In a downtrend, the price often makes successive lower lows. This pattern confirms the direction of the trend and provides further evidence that the price may continue to move lower.

Applying This Concept to Trading

By waiting for two lower lows after a fake out, traders can gain additional confidence in their trade direction. This step adds an extra layer of validation to the strategy, increasing its reliability.

Step 4: Pinpointing the Fair Value Gap for Entry

Identifying the Gap

The fair value gap itself serves as the entry point for the trade. Identifying this gap requires careful analysis of the price movement and understanding where the imbalance occurred.

The Entry Point

The middle of the fair value gap is where traders aim to enter the trade. This point often acts as a magnet for the price, offering a high-probability entry.

Step 5: Setting Stop Loss and Take Profit

The Importance of Stop Loss

A stop loss is a trader’s safety net. By setting a stop loss at the recent swing high (for a short trade), traders can limit their potential losses if the trade goes against them.

Take Profit Strategies

Setting take profit levels ensures that traders capture profits at predetermined points. This can include taking partial profits at key levels, allowing for flexibility and profit maximization.

Step 6: Monitoring and Adjusting the Trade

Ongoing Monitoring

Once the trade is live, continuous monitoring is essential. Market conditions can change rapidly, and being attentive to these changes allows for timely adjustments.

Adjusting the Trade

Making adjustments might involve selling portions of the position at predetermined levels or moving stop losses to lock in profits. These adjustments can enhance the trade’s overall performance.

The Power of Risk Management

Repainting indicators, which change their values retrospectively, can be a double-edged sword in trading. Mastering these indicators requires a robust risk management strategy. By understanding how repainting indicators function and implementing proper risk controls, traders can mitigate potential pitfalls and harness the predictive power of these unique tools.

Risk-to-Reward Ratio

A favorable risk-to-reward ratio is what makes this strategy particularly appealing. By carefully managing risk and setting clear profit targets, traders can create trades that offer substantial upside with controlled downside.

Risk Management Tools

Utilizing tools like stop losses and take profit orders is not just wise; it’s essential. These tools enable traders to manage their trades effectively, protecting their capital while pursuing profits.

The Role of Practice and Experience

In the world of trading, practice and experience are invaluable assets. They transform theoretical knowledge into practical wisdom, allowing traders to navigate complex market dynamics with confidence. The journey from novice to expert is paved with continuous learning, trial and error, and the relentless pursuit of mastery.

Simulated Trading

Before applying this strategy to live trading, practicing in a simulated environment is highly recommended. This practice allows traders to hone their skills without risking real capital.

Learning from Experience

Like any skill, trading with fair value gaps requires time and experience to master. Learning from both successes and failures can provide invaluable insights that contribute to ongoing growth and development as a trader.

Conclusion

Trading with fair value gaps offers a nuanced and sophisticated approach to navigating the financial markets. By meticulously following each step, from identifying key levels to managing risk, traders can unlock the potential of this powerful strategy. However, mastery requires practice, patience, and a willingness to learn from both triumphs and setbacks. So, are you ready to embark on this exciting journey and master the art of trading with fair value gaps? The market awaits your move!

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)