Artificial intelligence (AI) has been making waves across various sectors, and the world of trading is no exception. The ability of AI to analyze vast amounts of data, identify patterns, and make predictions has made it an invaluable tool in the arsenal of modern traders. In the realm of cryptocurrency, where volatility is the name of the game, AI’s role becomes even more critical. This article will delve into the fascinating intersection of AI and Bitcoin trading, focusing on a viral machine learning indicator that’s revolutionizing the trading landscape. We’ll explore how this tool works, how it can be customized for optimal performance, and the results it has yielded in backtesting.

The Rise of AI in Trading

Artificial Intelligence has been a game-changer in various industries, and trading is no exception. The ability of AI to analyze vast amounts of data, identify patterns, and make predictions has made it a valuable tool for traders. But what happens when we apply this cutting-edge technology to the volatile world of Bitcoin trading? The result is a powerful tool that can help traders navigate the often unpredictable waters of the cryptocurrency market. By leveraging AI, traders can gain insights into market trends, predict price movements, and make more informed decisions. This not only increases the chances of success but also helps mitigate the risks associated with trading.

The Machine Learning Indicator

The “Machine Learning Lorenzian Classification” indicator by Jde Horty is a groundbreaking tool that’s been making waves in the trading community. This AI-powered indicator is designed to backtest trades, providing traders with precise entry and exit signals. These signals have been instrumental in achieving high win rates, making it a popular tool among traders. The indicator leverages machine learning algorithms to analyze historical data, identify patterns, and predict future price movements. This allows traders to make informed decisions, increasing their chances of success. The indicator’s ability to accurately predict market trends and provide reliable trading signals has made it a valuable tool for traders, especially in the volatile world of cryptocurrency trading.

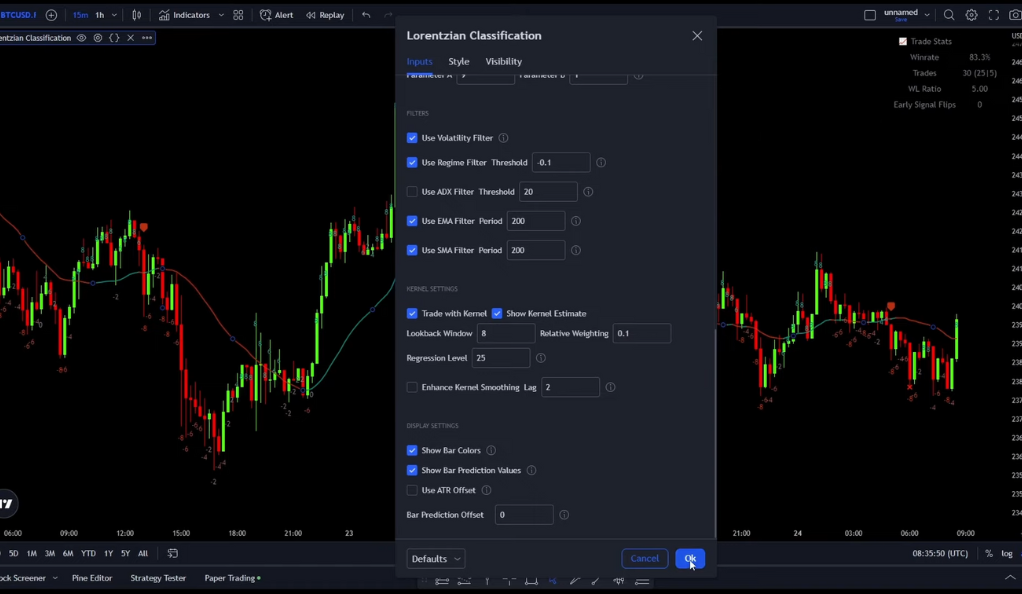

Customizing the Machine Learning Indicator

One of the key features of the Machine Learning Lorenzian Classification indicator is its flexibility. Traders can modify the indicator’s settings to increase the win rate. For instance, changing the feature count from five to two and adjusting the relative weighting from 8 to 0.1 can significantly enhance the indicator’s performance. This allows traders to tailor the indicator to their specific needs and trading style. However, these modifications should be made with caution. While they can increase the win rate, they can also increase the risk of false signals. Therefore, traders should thoroughly backtest any modifications to ensure they provide a net benefit. This balance between customization and accuracy is what makes the Machine Learning Lorenzian Classification indicator a powerful tool in the hands of a trader.

Balancing Trade-offs: EMA and SMA Filters

While using the Exponential Moving Average (EMA) and Simple Moving Average (SMA) filters can further increase the win rate, it reduces the number of signals and potential trades. This presents a trade-off that traders must navigate. On one hand, using these filters can increase the accuracy of the trading signals, reducing the risk of false signals. On the other hand, it can reduce the number of potential trades, limiting the potential profits. Therefore, traders must strike a balance between accuracy and profitability. This requires careful consideration and thorough backtesting.

The Entry Strategy: Timing is Everything

In the world of trading, timing is everything. Knowing when to enter a position can significantly impact the profitability of a trade. With the Machine Learning Lorenzian Classification indicator, traders are provided with a unique approach to timing their entries. Unlike traditional strategies that require traders to wait for the candle to close, this indicator allows traders to enter a position as soon as the entry signal appears. This means that traders can take advantage of price movements as they occur, rather than waiting for confirmation at the close of a candle. This approach can increase the potential for profit, especially in the fast-paced world of cryptocurrency trading.

Implementing the Entry Strategy

Implementing this entry strategy requires careful monitoring of the market. As soon as the entry signal appears, traders must be ready to act. The position is entered in the middle of the candlestick, allowing traders to capitalize on price movements as they happen. However, it’s important to note that this strategy requires a high level of vigilance. Traders must be prepared to enter the trade as soon as the signal appears, which can require a significant time commitment. Despite this, the potential benefits of this strategy, including increased profitability and the ability to take advantage of rapid price movements, make it a compelling option for traders looking to maximize their trading performance.

The Exit Strategy: Knowing When to Bow Out

Just as crucial as knowing when to enter a trade is knowing when to exit. The exit strategy tested in this guide is to exit four candles after the entry signal appears. This approach allows traders to take advantage of price movements while limiting the potential for loss. Exiting a trade at the right time can help preserve profits and prevent losses from escalating. With the Machine Learning Lorenzian Classification indicator, traders are provided with clear exit signals, taking the guesswork out of deciding when to bow out of a trade. This strategy provides a structured approach to exiting trades, which can help traders manage their risk and protect their profits.

Implementing the Exit Strategy

Implementing this exit strategy requires careful monitoring of the market. Traders must be ready to exit the trade as soon as the exit signal appears. This means being vigilant and keeping a close eye on the market trends and the indicator’s signals. It’s important to note that while this strategy provides a structured approach to exiting trades, it still requires a high level of discipline and emotional control. Exiting a trade too early can result in missed profits, while exiting too late can lead to unnecessary losses. Therefore, while the indicator provides valuable guidance, the final decision should always be based on a thorough analysis of the market conditions and the trader’s risk tolerance.

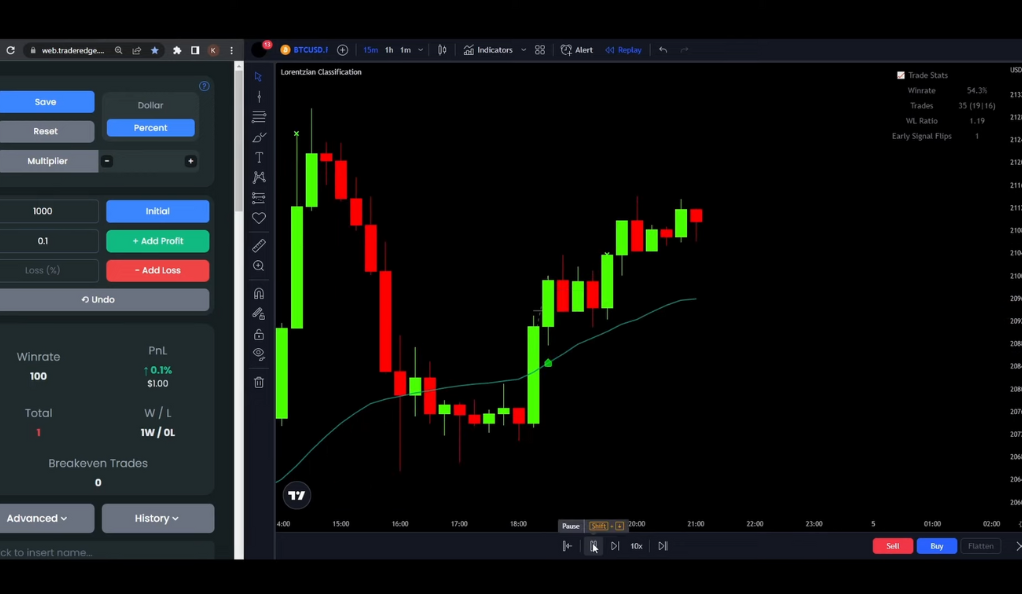

Backtesting: Putting the Strategy to the Test

Backtesting is a crucial part of any trading strategy. It allows traders to test their strategy using historical data to see how it would have performed in the past. In this guide, backtesting is conducted using the Traders Edge app, with an initial balance of $1,000 and a leverage of 2x. The results of the backtesting show a win rate of 56% and a profit of $39 after 100 trades. Considering the time frame of almost four months, these results are quite acceptable. However, it’s important to note that past performance is not a guarantee of future results. Traders should continue to monitor their strategy and make adjustments as necessary.

The Results: A Promising Strategy

The results of the backtesting paint a promising picture for traders looking to leverage the power of AI in their trading strategies. With a win rate of 56% and a profit of $39 after 100 trades, the Machine Learning Lorenzian Classification indicator has proven to be a valuable tool in the volatile world of Bitcoin trading. These results, achieved over a time frame of almost four months, are quite acceptable, especially considering the inherent volatility and unpredictability of the cryptocurrency market. The consistent increase in account size further underscores the potential of this AI-powered trading strategy.

Understanding the Implications

While the results are promising, it’s important to understand the implications of these findings. The high win rate and profit suggest that the strategy is worth exploring further. However, as with any trading strategy, it’s crucial to understand the associated risks. Trading, especially in the volatile world of cryptocurrency, is inherently risky. Therefore, traders should only invest money they can afford to lose. Despite the risks, the potential rewards of this AI-powered trading strategy make it an exciting prospect for traders. The ability to leverage AI to navigate the volatile Bitcoin market with increased confidence is a game-changer.

The Future of AI-Powered Trading Strategies

The promising results of the Machine Learning Lorenzian Classification indicator suggest a bright future for AI-powered trading strategies. As we continue to explore the potential of AI in trading, it’s clear that this technology will play a key role in shaping the future of the industry. The ability of AI to analyze vast amounts of data, identify patterns, and make predictions can give traders a significant edge in the market. As AI technology continues to evolve and improve, we can expect to see even more powerful and effective trading strategies emerge. In the meantime, the Machine Learning Lorenzian Classification indicator offers a promising glimpse into the future of AI-powered trading.

Conclusion

The intersection of AI and Bitcoin trading is an exciting frontier. The “Machine Learning Lorenzian Classification” indicator by Jde Horty is a testament to the potential of AI in trading. By leveraging this tool and optimizing the entry and exit strategies, traders can navigate the volatile Bitcoin market with increased confidence. However, as with any trading strategy, it’s essential to conduct thorough backtesting and understand the associated risks. As we continue to explore the potential of AI in trading, it’s clear that this technology will play a key role in shaping the future of the industry.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)