Cryptocurrency trading has become a global phenomenon, captivating the attention of investors worldwide. Among the various strategies employed in this dynamic market, swing trading has emerged as a popular approach. Swing trading involves taking advantage of short to medium-term price fluctuations in cryptocurrencies, aiming to profit from the market’s ups and downs. This strategy appeals to traders who seek to capitalize on market trends and price volatility, rather than holding assets for the long term.

To effectively engage in cryptocurrency swing trading, it is crucial to understand the intricacies of this strategy. The comprehensive guide provided in this article equips traders with the necessary knowledge to navigate the exciting landscape of swing trading. It covers essential aspects such as identifying swing trading opportunities, setting entry and exit points, implementing risk management techniques, and utilizing technical analysis tools. By following the insights shared in this guide, investors can enhance their understanding of cryptocurrency swing trading and make informed decisions to optimize their trading outcomes.

Understanding Cryptocurrency Swing Trading

Swing trading in the realm of cryptocurrencies involves taking advantage of short to medium-term price movements to generate profits. Unlike day trading, where positions are typically closed within the same day, swing traders hold their positions for a longer duration, ranging from a few days to several weeks. This strategy allows traders to capture potential gains resulting from price swings during this period.

The primary goal of cryptocurrency swing trading is to identify and exploit price trends and market volatility. Swing traders carefully analyze various factors, including technical indicators, chart patterns, and market sentiment, to determine favorable entry and exit points for their trades. By capitalizing on price movements, swing traders seek to generate profits both during upward trends (by buying low and selling high) and downward trends (by short selling or selling high and buying low). This approach requires a combination of technical analysis skills, risk management strategies, and the ability to adapt to changing market conditions.

It is important for swing traders to have a well-defined trading plan and to exercise discipline and patience. They must also consider factors such as market liquidity, trading volume, and news events that may impact the price movements of cryptocurrencies. While swing trading can be a lucrative strategy, it is not without risks. Traders should carefully manage their positions, set stop-loss orders to limit potential losses, and continuously monitor the market to stay informed about any significant changes that may affect their trades.

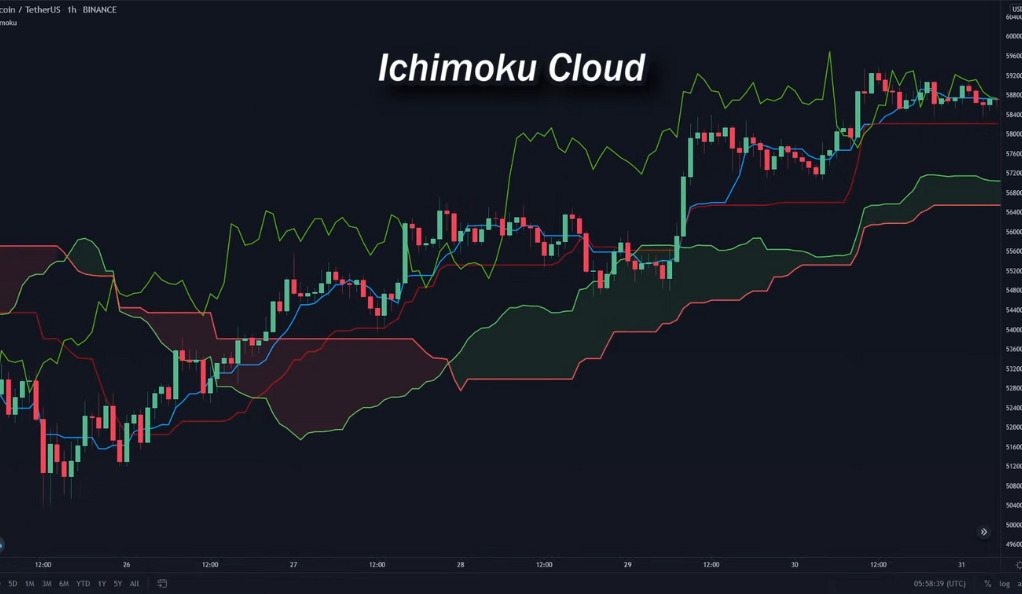

The Power of the Ichimoku Cloud Indicator

The Ichimoku Cloud indicator holds significant power for swing traders due to its ability to provide a comprehensive and holistic view of market trends. Developed by Japanese journalist Goichi Hosoda, this charting method offers a unique perspective on price action by incorporating multiple components into its analysis. The Ichimoku Cloud consists of several lines and a cloud-like area on the price chart, which together create a visual representation of support and resistance levels.

One of the key components of the Ichimoku Cloud is the Tenkan-sen, or the Conversion Line, which measures the average of the highest high and the lowest low over a specific period. Another important line is the Kijun-sen, or the Base Line, which calculates the average of the highest high and the lowest low over a longer time frame. The intersection of these lines can provide valuable insights into potential trend reversals or continuation patterns. Additionally, the cloud, known as the Kumo, is formed by plotting the area between the two lines projected forward. The width and color of the cloud indicate the strength and direction of the current trend.

Adjusting the Ichimoku Cloud Indicator for Swing Trading

The Ichimoku Cloud indicator holds significant power for swing traders due to its ability to provide a comprehensive and holistic view of market trends. Developed by Japanese journalist Goichi Hosoda, this charting method offers a unique perspective on price action by incorporating multiple components into its analysis. The Ichimoku Cloud consists of several lines and a cloud-like area on the price chart, which together create a visual representation of support and resistance levels.

One of the key components of the Ichimoku Cloud is the Tenkan-sen, or the Conversion Line, which measures the average of the highest high and the lowest low over a specific period. Another important line is the Kijun-sen, or the Base Line, which calculates the average of the highest high and the lowest low over a longer time frame. The intersection of these lines can provide valuable insights into potential trend reversals or continuation patterns. Additionally, the cloud, known as the Kumo, is formed by plotting the area between the two lines projected forward. The width and color of the cloud indicate the strength and direction of the current trend.

Interpreting the Kumo Cloud

The Kumo Cloud, a key component of the Ichimoku Cloud indicator, holds significant importance in interpreting market trends. It provides valuable insights into the direction and strength of trends. When prices are above the cloud, it suggests an uptrend in the market. This indicates that the overall sentiment is bullish, and there is a higher probability of prices continuing to rise. On the other hand, if prices are below the cloud, it indicates a downtrend, signaling a bearish market sentiment where prices are more likely to decline.

In addition to the position of prices relative to the cloud, the positioning of the two lines within the cloud, known as the Senkou Span A (green line) and Senkou Span B (red line), provides further information about the trend strength. When the green line is above the red line, it signifies a strong uptrend. This suggests that buyers have significant control in the market, and the upward momentum is robust. Conversely, if the green line is below the red line, it indicates a strong downtrend. This implies that sellers have a strong presence, and the downward momentum is substantial. Traders can utilize this information to assess the strength of the prevailing trend and make more informed trading decisions.

Implementing the Swing Trading Strategy

Implementing the swing trading strategy using the Ichimoku Cloud indicator involves specific entry and exit rules. To enter a long position, traders look for a green candle closing above the Kumo Cloud while the green line (Senkou Span A) remains above the red line (Senkou Span B). This combination signifies a bullish trend with increasing strength, suggesting that buying pressure is prevalent. By entering a long position at this point, traders aim to ride the upward momentum and capture potential gains.

As for the exit strategy, traders using this swing trading approach would close the trade if a red candle closes below the green line. This indicates a potential reversal in the trend, as the green line moving below the red line implies a weakening bullish sentiment. Exiting the trade at this point helps protect profits and prevent potential losses if the market starts to move against the trade.

Backtesting results on Bitcoin from 2017 have reportedly shown significant gains using this swing trading strategy, outperforming a simple buy-and-hold approach. It is important to note that while historical performance can provide insights, past results do not guarantee future success. Traders should continually monitor the market, adapt their strategies to changing conditions, and consider risk management techniques to ensure the longevity and success of their swing trading endeavors.

Bonus Strategy: Chaikin Money Flow and MACD Indicator

The bonus strategy for 15-minute chart trading combines the Chaikin Money Flow (CMF) and Moving Average Convergence Divergence (MACD) indicators. Traders can take long positions if the CMF is above the middle line, indicating positive money flow, and if the MACD line crosses above the signal line. Conversely, short positions can be taken if the CMF is below the middle line and the MACD line crosses below the signal line. Setting stop-loss orders and profit targets helps manage risk and potential gains.

This strategy offers a shorter-term approach to capturing price movements. By using the CMF and MACD indicators together, traders can gain insights into the money flow and potential trend reversals. It is important to thoroughly backtest and validate the strategy before using it in live trading. Additionally, staying informed about market conditions and adapting the strategy accordingly can increase the chances of success.

Choosing the Right Trading Platform

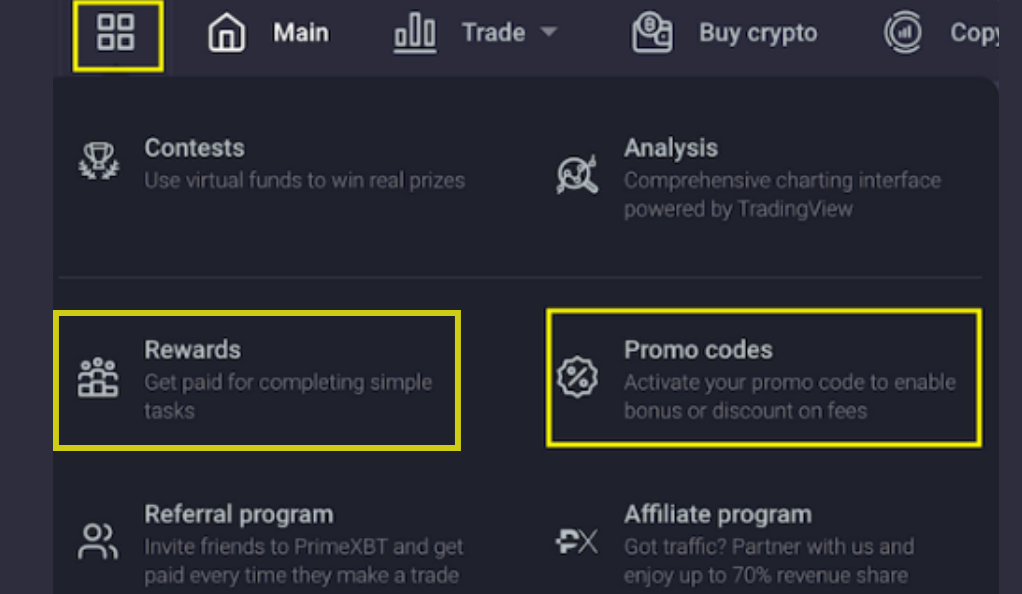

When it comes to selecting a trading platform, it is crucial to consider various factors that can influence your trading experience and potential profitability. One such platform worth considering is PrimeXBT, which offers several features that make it an attractive choice for traders. Notably, PrimeXBT provides low fees, ensuring that a smaller portion of your profits is eaten up by transaction costs. Low fees can be particularly advantageous for frequent traders or those executing high-volume trades, as they can help maximize overall profitability.

Additionally, PrimeXBT offers bonuses for new sign-ups, adding further value to the platform. These bonuses can provide an extra boost to your trading capital and potentially enhance your trading opportunities. By taking advantage of the bonuses, traders can start their trading journey with a larger initial investment, allowing for potentially greater returns.

While the fees and bonuses offered by PrimeXBT make it an appealing choice, it is essential to conduct thorough research and consider other factors as well. These factors may include the platform’s user interface, trading tools and indicators, security measures, customer support, available markets and assets, and overall reputation within the trading community. Evaluating these aspects can help you make an informed decision and select a trading platform that aligns with your trading style, preferences, and goals.

Conclusion

Cryptocurrency swing trading can be a profitable venture if executed with the right strategies and tools. The Ichimoku Cloud indicator, when adjusted for swing trading, can provide valuable insights into market trends. Additionally, the Chaikin Money Flow and MACD indicator can be used for trading on shorter time frames. As with any investment strategy, it’s crucial to do your research, understand the risks involved, and choose a reliable trading platform.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)