The “Super SMART strategy: The premium indicator became free 99% Winrate” has emerged as a sought-after approach in the ever-evolving landscape of cryptocurrency trading. This strategy’s popularity stems from its remarkable 99% win rate, which promises attractive returns to traders. The core of the Super SMART strategy lies in its utilization of specific indicators and well-defined rules to determine optimal entry and exit points in the market. By leveraging these indicators, traders can identify potentially lucrative opportunities and make well-informed decisions with a high probability of success. However, as with any trading strategy, it is essential for traders to exercise caution and thoroughly understand the underlying principles before applying it to their trading activities, considering that cryptocurrency markets are highly volatile and subject to rapid changes.

The Indicators

The Super SMART strategy relies on specific indicators to facilitate its high win rate. While the exact indicators used may vary depending on individual traders or trading platforms, they commonly include a mix of technical analysis tools such as moving averages, relative strength index (RSI), stochastic oscillators, and Fibonacci retracement levels. These indicators help traders analyze market trends, identify potential entry and exit points, and gauge price momentum and potential reversals. By integrating these indicators into their trading approach, traders can make more informed decisions and increase their chances of achieving profitable outcomes in the dynamic world of cryptocurrency trading.

UT Bot Alerts by QuantNomad

At the heart of the Super SMART strategy are the UT Bot Alerts by QuantNomad, which are utilized not just once but twice with different settings. These alerts are specifically applied to a 5-minute Bitcoin chart, offering traders timely signals to take action. By integrating this powerful indicator into the strategy, traders can benefit from its insights and make well-timed decisions in the fast-paced and volatile cryptocurrency market, aiming to capitalize on potentially profitable opportunities.

STC Indicator – A Better MACD

In conjunction with the UT Bot Alerts, the Super SMART strategy incorporates the STC Indicator – a better MACD [SHK] developed by Shayankm. This powerful indicator serves as a valuable addition, providing a comprehensive perspective on the market’s movements. By utilizing the STC Indicator, traders gain deeper insights into price trends, momentum, and potential trend reversals, enhancing their ability to make informed trading decisions. The combination of the UT Bot Alerts and the STC Indicator equips traders with a robust toolkit, enabling them to navigate the dynamic cryptocurrency market with greater confidence and precision, aiming to optimize their trading performance and capitalize on profitable opportunities.

Setting Up the Indicators

To set up the Super SMART strategy, traders need to install the UT Bot Alerts by QuantNomad and the STC Indicator – a better MACD [SHK] by Shayankm on a compatible trading platform like MetaTrader or TradingView. These indicators are then applied to a 5-minute Bitcoin chart, providing timely signals and a comprehensive view of the market’s movements to guide traders’ decisions and increase their chances of successful trades in the cryptocurrency market.

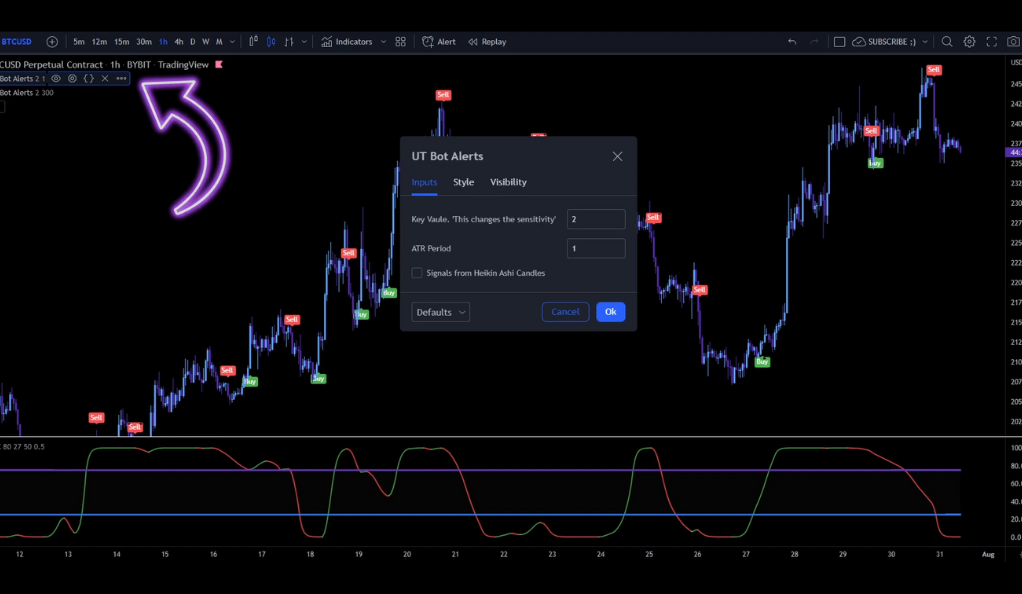

First UT Bot Alerts

The initial UT Bot Alerts configuration in the Super SMART strategy involves setting a Key Value of 2 and an ATR Period of 1. Within this setup, only the Sell Signal feature is activated, offering a distinct signal to indicate the appropriate time for exiting a position. This specific combination of parameters ensures that traders receive clear and timely alerts, enabling them to make informed decisions about when to close their positions and potentially secure profits or manage risks in the dynamic world of cryptocurrency trading.

Second UT Bot Alerts

In the Super SMART strategy, the second UT Bot Alerts is configured with a Key Value of 2 and an ATR Period of 300. Unlike the first instance, only the Buy Signal feature is activated in this setup. As a result, this indicator precisely signals traders about the opportune moments to enter positions in the cryptocurrency market. By closely monitoring the Buy Signal, traders can identify potential entry points with increased accuracy, allowing them to capitalize on favorable market conditions and potentially benefit from price upswings. With this configuration, the Super SMART strategy aims to enhance traders’ ability to make well-timed and strategic decisions, contributing to the pursuit of profitable outcomes in their cryptocurrency trading endeavors.

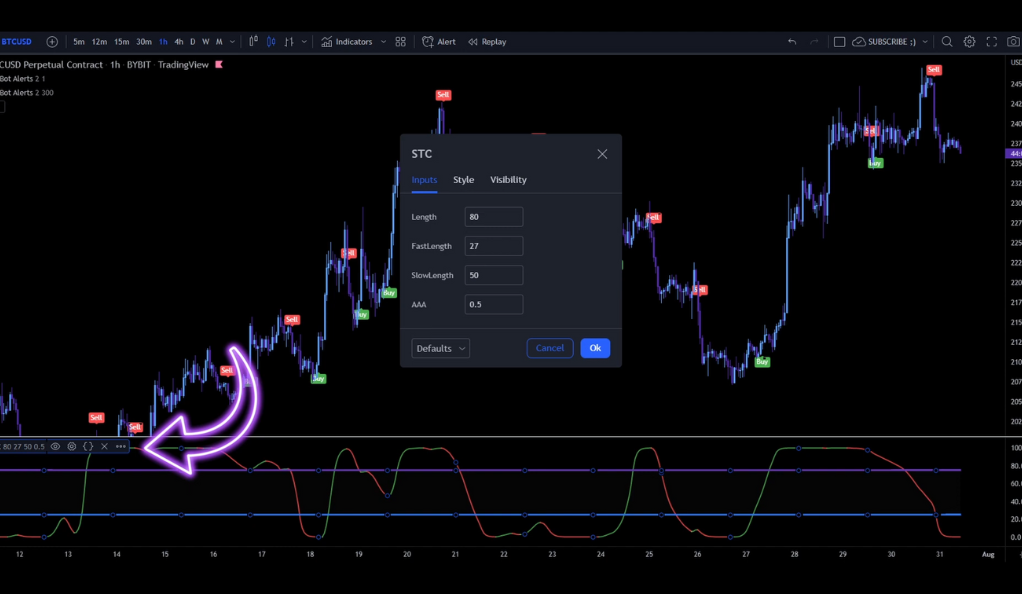

STC Indicator

In the Super SMART strategy, the STC Indicator is configured with specific settings to optimize its performance. The Length parameter is set to 80, while the Fast Length is set to 27, and the Slow Length is set to 50. Additionally, the AAA (Adaptive Acceleration Average) is set at 0.5. These carefully chosen settings are designed to provide the STC Indicator with the capability to deliver precise and timely signals. By using these settings, the STC Indicator can effectively analyze market trends, momentum, and potential trend reversals, assisting traders in making well-informed decisions and identifying favorable entry and exit points in the fast-paced and volatile cryptocurrency market.

Entry Rules

The Super SMART strategy’s entry rules rely on signals from both the UT Bot Alerts and the STC Indicator. The first UT Bot Alerts instance with the Sell Signal indicates when to exit a position, while the second instance with the Buy Signal provides entry points. The STC Indicator’s specific settings ensure accurate and timely signals for market trends and momentum, helping traders make well-timed entry decisions in the dynamic cryptocurrency trading environment.

Long Position

In the Super SMART strategy, a long position is initiated when specific criteria align. The trader enters a long position when the STC Line is positioned below the blue line, the UT Bot Alerts issue a Buy Signal, and the STC Line appears green. This combination of signals serves as a robust indication of an upward market movement, prompting the trader to enter a long position with the expectation of potentially benefiting from the anticipated price rise in the dynamic cryptocurrency market. By leveraging these precise signals, the strategy aims to optimize the trader’s chances of capitalizing on favorable market conditions and achieving profitable outcomes in their trading endeavors.

Short Position

In contrast to a long position, the Super SMART strategy prompts traders to enter a short position when specific conditions align. A short position is initiated when the STC Line is positioned above the violet line, the UT Bot Alerts issue a Sell Signal, and the STC Line appears red. This combination of signals indicates a downward market movement, providing a strong suggestion to the trader that the cryptocurrency’s price may potentially decline. By acting on these precise signals, the strategy aims to enable traders to capitalize on bearish market conditions, potentially profiting from price declines and effectively managing risk in the dynamic world of cryptocurrency trading.

Exit Rules

In the Super SMART strategy, the exit rules are as crucial as the entry rules to effectively manage trades. When holding a Long Position, traders set the Stop Loss at the recent Swing Low, aiming to limit potential losses in case the market reverses. Conversely, for a Short Position, the Stop Loss is set at the recent Swing High, providing protection against adverse price movements. To ensure the validity of signals and avoid premature actions, it is essential to wait for the Candle Close before entering or exiting a trade, confirming that the signals are confirmed and reducing the likelihood of making hasty decisions based on temporary price fluctuations. By adhering to these exit rules, traders can exercise prudent risk management and improve the overall success potential of the Super SMART strategy in navigating the dynamic cryptocurrency trading environment.

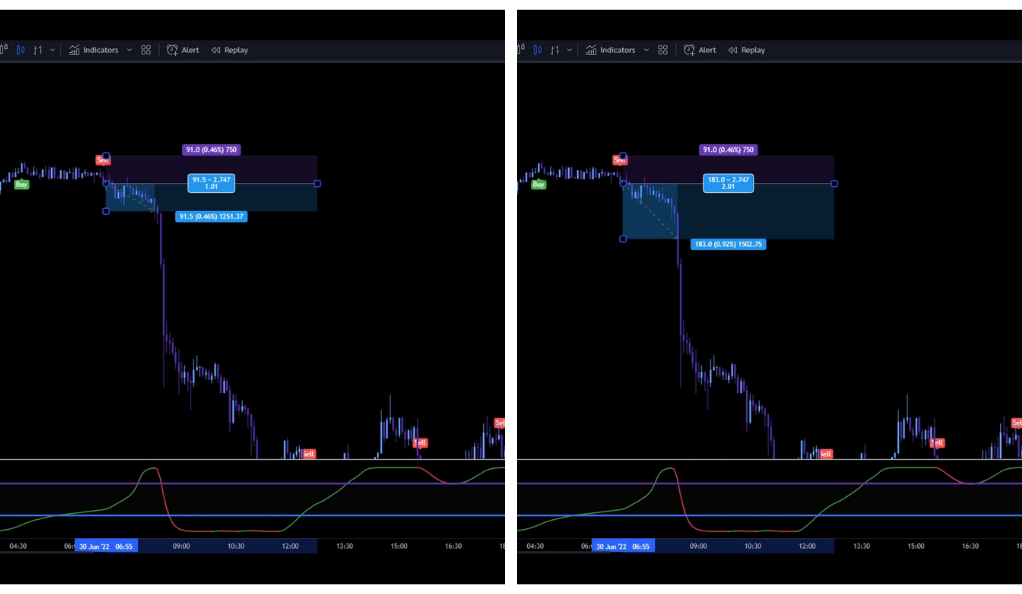

Targets and Risk Management

In the Super SMART strategy, targets are determined by a Risk to Reward Ratio. Each trade sets a first target at a 1:1 ratio, and a second target at a 1:2 ratio, and so forth. Alongside target planning, the strategy prioritizes risk management by advising traders to limit their risk exposure to 2% of their account per trade. By employing this approach, traders aim to strike a balance between potential profits and controlled risk, enhancing the overall effectiveness of the strategy in navigating the dynamic and often volatile cryptocurrency market.

Backtesting the Strategy

Backtesting is a critical process for validating the effectiveness of the Super SMART strategy. During backtesting, the strategy is tested with an initial balance of $1000 and a risk of 2% per trade. The calculation of profit or loss involves multiplying the percentage move by 2. By subjecting the strategy to historical market data in this manner, traders can assess its performance and gain valuable insights into its potential profitability and risk management capabilities. Successful backtesting can provide traders with the confidence to deploy the Super SMART strategy in real trading scenarios, allowing them to make well-informed decisions in the dynamic and ever-changing landscape of cryptocurrency trading.

Conclusion

The Super SMART strategy offers a comprehensive approach to cryptocurrency trading, leveraging specific indicators and rules to guide trading decisions. While it promises a high win rate, like any trading strategy, it’s essential to understand its nuances and apply it judiciously.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)