In the dynamic world of financial markets, staying ahead of the curve is a constant challenge. Traders and investors are always on the lookout for innovative strategies and tools to gain an edge. One such game-changer is the use of automated trading algorithms. But what exactly are these algorithms, and how can they revolutionize your trading experience? Let’s dive in and explore.

Contents

Understanding Automated Trading Algorithms

Automated trading algorithms are a revolutionary tool in the financial markets, enabling trades to be executed automatically based on predefined criteria. These algorithms, powered by advanced technologies like ChatGPT, can analyze market trends, make decisions, and execute trades faster than any human, offering a significant advantage in the fast-paced world of trading.

What Are Automated Trading Algorithms?

Automated trading algorithms are pre-programmed strategies that allow trades to be executed automatically based on specific criteria. They can analyze market trends, make decisions, and execute trades faster than any human could, eliminating the need for constant market monitoring and manual execution.

The Anatomy of a Successful Trading Algorithm

A successful trading algorithm is akin to a well-oiled machine, with each component playing a crucial role in its overall performance. It’s built on a foundation of robust technical indicators like the Exponential Moving Average (EMA), QQE Mod, and Water Adder Explosion V2. These indicators, coupled with the Average True Range (ATR) for risk management, work in harmony to analyze market dynamics and make informed trading decisions.

Key Components of a Trading Algorithm

A successful trading algorithm is built on a foundation of robust technical indicators. These indicators serve as the algorithm’s eyes and ears, helping it understand market dynamics and make informed trading decisions.

- Exponential Moving Average (EMA)

The EMA is a type of moving average that gives more weight to recent price data. It’s a crucial component of many trading algorithms, helping identify potential entry and exit points based on price trends.

- QQE Mod and Water Adder Explosion V2

These are two other technical indicators used in the creation of trading algorithms. The QQE Mod, developed by Michael, and the Water Adder Explosion V2, developed by Shang, provide additional layers of market analysis, further enhancing the algorithm’s decision-making capabilities.

The Role of Average True Range (ATR)

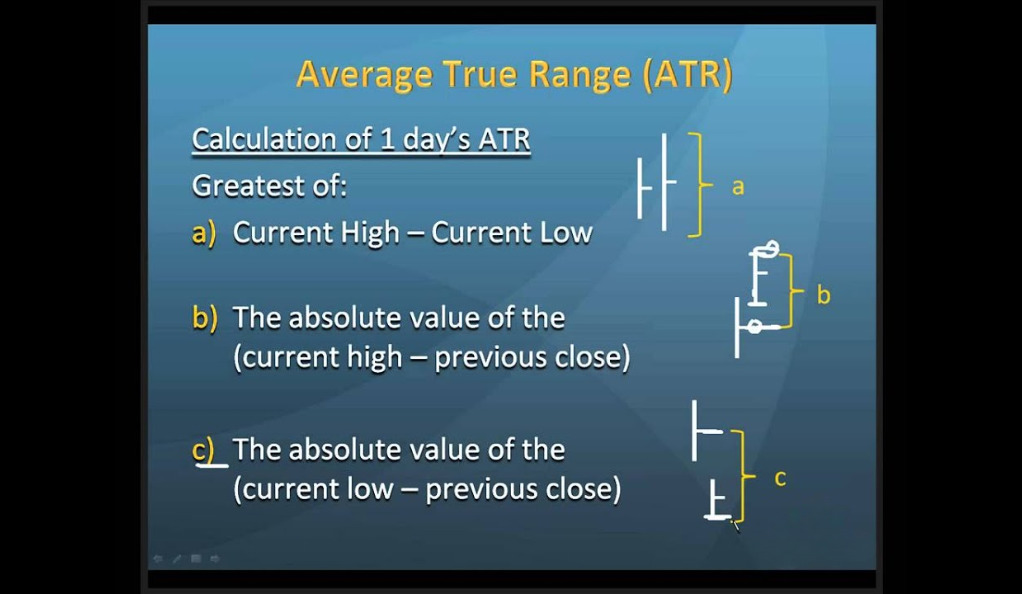

The Average True Range (ATR) plays a pivotal role in the realm of trading algorithms. As a volatility indicator, the ATR measures the degree of price fluctuations, providing valuable insights into market volatility. This information is crucial in determining stop loss and take profit targets, two essential elements in any trading strategy.

Incorporating the ATR into a trading algorithm enhances its risk management capabilities. By using the ATR to set stop loss and take profit levels, traders can more effectively manage their risk. This means they can protect their capital from significant losses during periods of high volatility while also ensuring they capture maximum profits during favorable market movements. In essence, the ATR serves as a compass, guiding traders through the often turbulent waters of the financial markets and helping them navigate their trading journey more effectively.

The Benefits of VIP Patreon Membership

A VIP Patreon membership opens the door to a wealth of resources for traders. It provides exclusive access to fully automated trading strategy scripts, which can significantly streamline the trading process. Additionally, it offers step-by-step instructions on how to connect these scripts to trading bots like Three Commas, enabling traders to fully automate their trading and focus on strategy optimization.

- Exclusive Access to Trading Scripts

A VIP Patreon membership is a gateway to a unique suite of resources, one of the most notable being the exclusive access to fully automated trading strategy scripts. These scripts are a treasure trove for both novice and seasoned traders alike. They are designed with user-friendliness in mind, ensuring that even those new to the trading world can navigate them with ease. This accessibility makes the journey into automated trading less daunting for beginners, providing them with a solid foundation to kickstart their trading endeavors.

Moreover, these scripts are not just about accessibility; they are also about efficiency. In the fast-paced world of trading, time is of the essence. Manual trading can be time-consuming, requiring constant market monitoring and timely execution of trades. This is where these automated trading strategy scripts come into play. They automate the trading process, executing trades based on predefined criteria without the need for manual intervention. This automation saves traders a significant amount of time, allowing them to focus on refining their strategies and exploring new market opportunities. In essence, these scripts are a game-changer, revolutionizing the way traders interact with the financial markets.

- Connecting Scripts to Trading Bots

A VIP Patreon membership offers more than just access to trading scripts. It also provides a comprehensive guide on how to integrate these scripts with trading bots, specifically Three Commas. This integration is a significant step forward in the automation of trading. It bridges the gap between the strategy scripts and the trading platform, creating a seamless trading ecosystem that operates with precision and efficiency.

The process of connecting scripts to trading bots can seem daunting, especially for those new to automated trading. However, with the step-by-step instructions provided with the VIP Patreon membership, this process becomes much more manageable. These instructions guide traders through each step, ensuring that they can successfully set up their automated trading system. Once set up, the trading bot takes over, executing trades based on the strategy defined in the script. This automation liberates traders from the need to constantly monitor the markets and manually execute trades, giving them more time to focus on strategy development and market analysis. In essence, the VIP Patreon membership equips traders with the tools and knowledge to navigate the world of automated trading with confidence and ease.

The Power of Backtesting

Backtesting is a powerful tool in the arsenal of any trader using automated algorithms. It involves applying a trading strategy to historical market data to assess its effectiveness. Backtesting provides invaluable insights into the potential profitability and risk of a trading algorithm, helping traders fine-tune their strategies and set realistic expectations for future performance.

Understanding Backtesting

Backtesting is a fundamental aspect of developing and refining trading strategies. It’s a process that involves applying a specific trading strategy to historical market data to gauge its efficacy. This retrospective analysis allows traders to see how their strategy would have performed in the past, providing a simulated glimpse into potential future performance.

This process is an essential step in the creation of any trading algorithm. It serves as a litmus test for the algorithm’s potential profitability and risk, offering valuable insights that can guide further strategy development. By backtesting, traders can identify strengths and weaknesses in their strategy, allowing them to make necessary adjustments before deploying the algorithm in live trading. In essence, backtesting is a powerful tool that helps traders build confidence in their strategies, manage risk effectively, and increase their potential for success in the markets.

Impressive Backtesting Results

The power of a well-designed trading algorithm is truly demonstrated when we look at its backtesting results. The algorithm in question here has shown remarkable performance in its backtesting phase. Tested on a one-hour time frame beginning from January 2021, the algorithm boasted a commendable win rate of 43%. This high win rate is a testament to the algorithm’s ability to accurately predict market movements and execute profitable trades.

But the win rate is just one part of the story. The algorithm’s impact on account growth is equally impressive. Starting with an initial balance of $1,000, the algorithm managed to grow the account to a staggering $46,466. This substantial growth, coupled with a maximum drawdown of less than 23%, underscores the algorithm’s potential in generating significant returns while effectively managing risk. These results serve as a powerful reminder of the potential that automated trading algorithms hold in transforming one’s trading experience and achieving financial success.

Conclusion

In conclusion, automated trading algorithms, when built with robust technical indicators and backtested thoroughly, can be powerful tools for traders. They offer the potential for high returns, customizable strategies, and the convenience of automation. By leveraging these algorithms, traders can navigate the financial markets with greater confidence and efficiency. Remember, though, that while these tools can enhance your trading experience, it’s essential to understand the risks involved and conduct your own research before diving in.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)