In the dynamic and ever-evolving world of cryptocurrency trading, strategies are the backbone of successful ventures. They are the roadmaps that guide traders through the volatile landscape of the crypto market, helping them navigate the peaks and troughs of price movements. Among the myriad of strategies available to crypto traders, one has been making significant waves due to its potential profitability and effectiveness – a scalping strategy specifically designed for Bitcoin.

Scalping is a trading style that specializes in profiting off small price changes. This strategy’s main idea is making a large number of trades and earning a small profit from each. When these small gains are compounded, they can result in significant profits. This Bitcoin scalping strategy claims to have a potential profit and loss (PnL) of a staggering 391.25%. This figure is not just a theoretical concept but has been tested 100 times to validate its effectiveness.

This strategy’s allure lies in its simplicity and the potential profitability it offers. It’s designed to be easy to understand and implement, even for traders who are relatively new to the crypto space. However, it also offers depth and sophistication for more experienced traders looking for a new approach to grow their portfolios.

The Core of the Strategy: Indicators and Timeframe

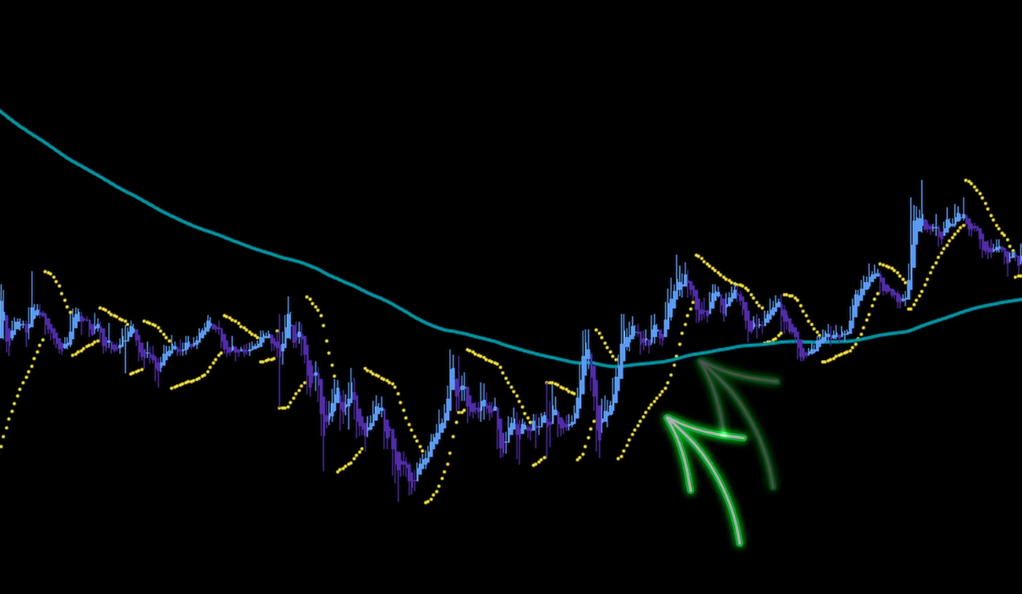

The heart of this Bitcoin scalping strategy lies in its use of a specific timeframe and three key indicators. The strategy operates on a 5-minute timeframe on the Bitcoin chart. This short timeframe allows traders to make quick decisions and take advantage of small price movements that can accumulate to substantial profits over time.

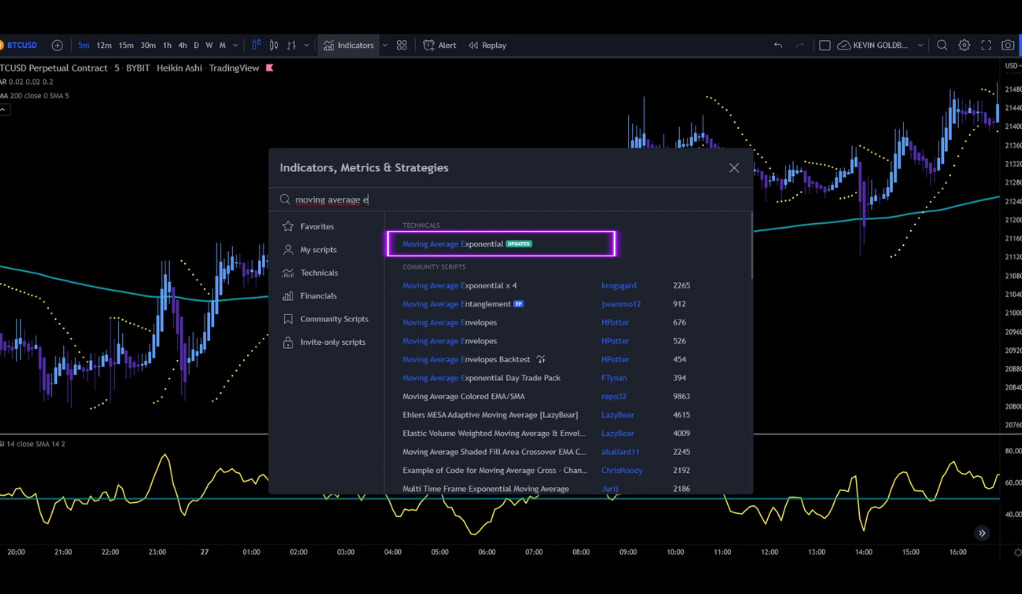

The first indicator used is the Exponential Moving Average (EMA), set to a length of 200. The EMA is a type of moving average that gives more weight to recent data. This makes it faster to respond to price changes than a simple moving average. The EMA helps traders identify the market’s direction and find potential entry and exit points.

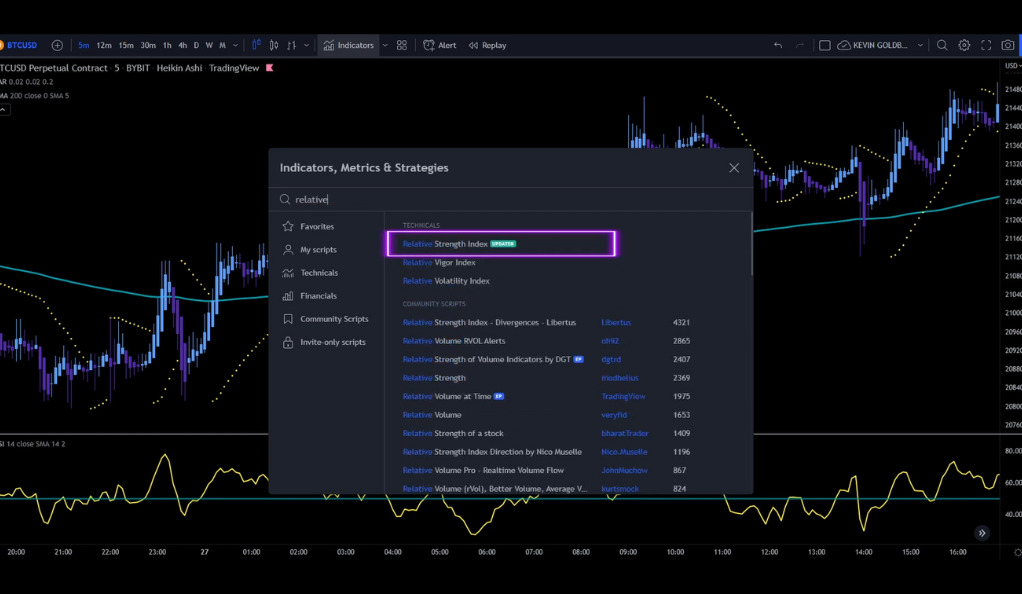

The second indicator is the Relative Strength Index (RSI). The RSI is a momentum oscillator that measures the speed and change of price movements. It helps traders identify overbought or oversold conditions, providing insights into potential reversals.

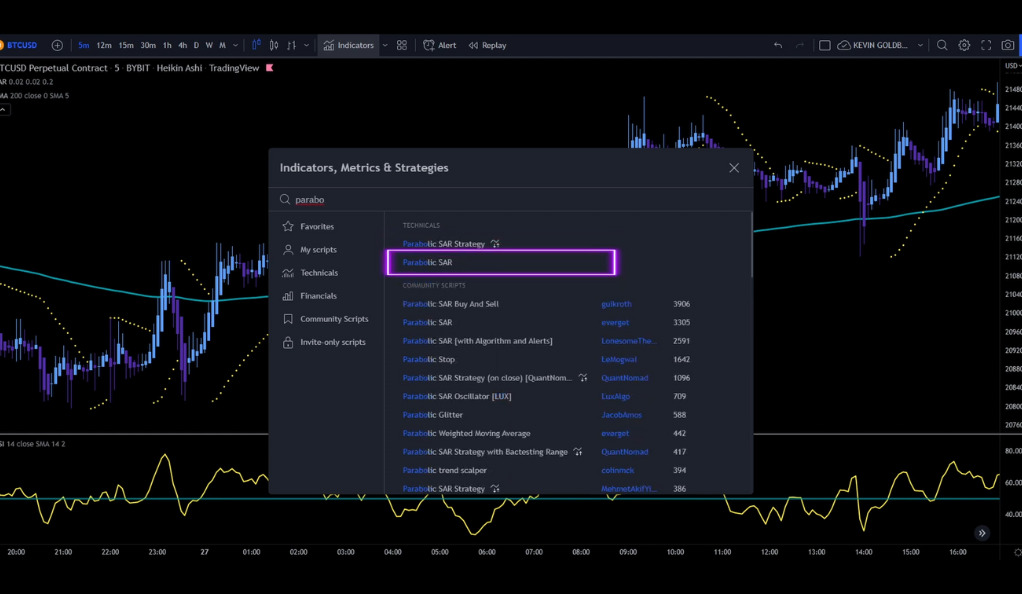

The third indicator is the Parabolic SAR. This indicator provides a straightforward way to understand the direction of a trend and its potential reversals. It’s represented as dots above or below the price, depending on the trend.

To ensure smoother price action and easier trend identification, the candlestick chart is switched from the traditional Japanese to Heikin Ashi. This type of chart filters out market noise and provides a clearer picture of the trend and its strength.

The Entry Rules: When to Dive In

The entry rules for this strategy are clear and straightforward, designed to help traders make confident and informed decisions. For long positions, entry is only permitted if the price is above the 200 EMA line. This rule ensures that traders are following the trend, a fundamental principle of successful trading.

For short positions, entry is only allowed if the price is below the 200 EMA line. This rule also ensures that traders are trading with the trend, but in this case, it’s a downward trend.

The Parabolic SAR indicator is used for entry and exit signals. If the dots are above the price, it signals a bearish trend, indicating a potential short position. If the dots are below the price, it signals a bullish trend, suggesting a possible long position.

However, the RSI indicator is used for confirmation. If the RSI line is below the 50 midline, a long trade cannot be taken, even if the other conditions are met. The same applies to short trades if the RSI line is above the 50 midline. This rule helps to avoid false signals and improve the strategy’s accuracy.

Managing Risks: Stop Losses and Exit Points

Risk management is a crucial aspect of any trading strategy. For this Bitcoin scalping strategy, stop losses are set at the recent swing high for short positions and the recent swing low for long positions. This rule helps to limit potential losses if the market moves against the trade.

Trades are exited when the Parabolic SAR indicator signals to do so. This rule allows traders to lock in profits and avoid giving back too much to the market. It also helps to keep emotions out of trading decisions, which can often lead to costly mistakes.

The Results: Proof in the Pudding

The strategy risks 2% of the account per trade. This risk level is considered moderate, allowing for potential losses but also providing room for substantial profits. The backtesting results show a win rate of 49% and a PnL of 32.56% over 9 days, starting with an initial balance of $1000. The largest trade was 8.14%, and the largest loss was 2.62%.

These results demonstrate the potential effectiveness of this Bitcoin scalping strategy. However, it’s important to remember that past performance is not indicative of future results. Each trader should test the strategy in a demo account before using it in a live trading environment.

Conclusion

The world of cryptocurrency trading is a thrilling yet challenging arena. It demands a blend of strategic planning, risk management, and a keen understanding of market trends. The Bitcoin scalping strategy we’ve explored in this article offers a robust framework for navigating the crypto trading landscape. It combines the use of key indicators, a specific timeframe, and clear entry and exit rules to create a comprehensive trading approach.

While the backtesting results of this strategy are promising, showcasing a win rate of 49% and a PnL of 32.56% over 9 days, it’s crucial to remember that past performance is not a guarantee of future results. Each trader’s experience will vary based on their understanding of the strategy, their risk tolerance, and the market conditions at the time of trading.

Moreover, it’s always recommended to add another indicator to improve results and avoid trading in sideways ranges. This suggestion underscores the importance of flexibility and adaptability in trading. As the market evolves, so should your strategies. Continual learning and adaptation are key to staying ahead in the fast-paced world of crypto trading.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)