In the world of trading, finding a strategy that consistently works 100% of the time is highly improbable. However, a strategy called the Supertrend + CCI strategy has gained attention in the Bitcoin trading scene. This strategy combines the Supertrend+ indicator by Electrified with the Commodity Channel Index (CCI), with proponents claiming it to be a game-changer.

The Supertrend+ indicator is a trend-following tool that helps traders identify potential entry and exit points based on market trends, while the CCI is a momentum-based indicator that measures price deviation from its average. By combining these indicators, traders aim to identify favorable trading opportunities in the Bitcoin market. Although the Supertrend + CCI strategy may have shown promising results in specific market conditions or historical tests, it is important to exercise caution. No strategy is foolproof, and market dynamics are complex and constantly changing. It is crucial to thoroughly backtest the strategy, evaluate its performance in different market environments, and employ effective risk management techniques before implementing it in real trading scenarios. As always, it is advisable to conduct comprehensive research, stay updated with market trends, and seek guidance from experienced professionals when considering any trading strategy.

Understanding the Supertrend + CCI Strategy

The Supertrend+ indicator developed by Electrified is a popular trend-following tool used in technical analysis. It aims to identify the prevailing market trend and provide potential entry and exit signals. The indicator calculates a dynamic stop-loss level, which acts as a trailing stop, adjusting with changes in market conditions. When the price is above the Supertrend line, it suggests a bullish trend, signaling buying opportunities. Conversely, when the price falls below the Supertrend line, it indicates a bearish trend, suggesting potential selling opportunities.

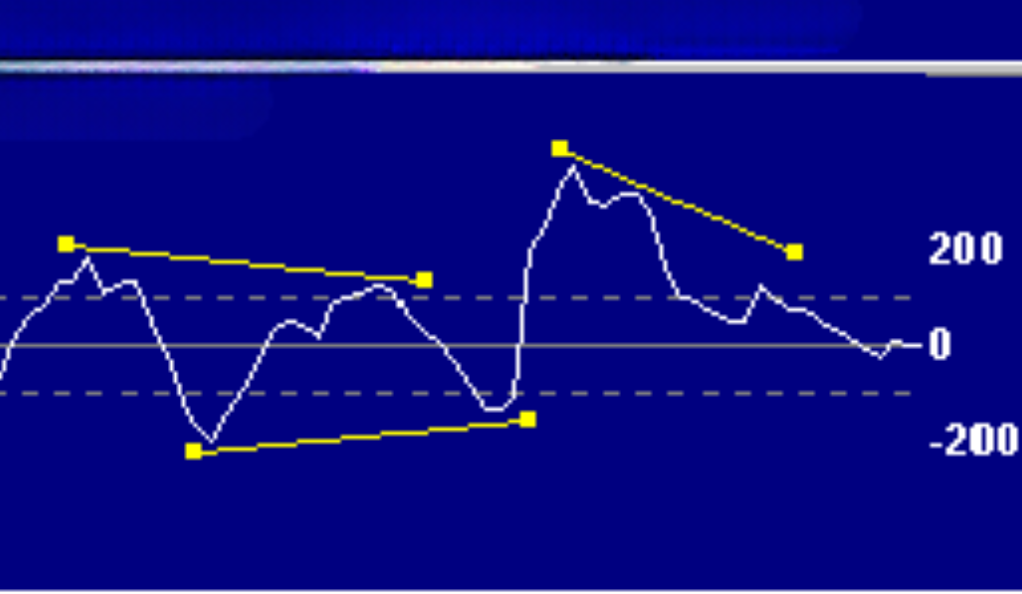

The Commodity Channel Index (CCI) is a momentum-based oscillator that measures the current price level relative to its average over a specific period. It helps identify overbought and oversold conditions in the market, indicating potential reversals. The CCI oscillates around a zero line, and readings above a certain threshold, typically +100, indicate overbought conditions, suggesting a possible price correction or trend reversal. On the other hand, readings below the negative threshold, typically -100, indicate oversold conditions, potentially signaling a price bounce or trend reversal to the upside.

By combining the Supertrend+ indicator with the CCI, traders aim to leverage the trend-following capabilities of the Supertrend along with the momentum-based insights provided by the CCI. This combination allows traders to potentially identify favorable entry and exit points in the market, aligning their trades with the prevailing trend while considering potential reversals indicated by the CCI. However, it is important to note that indicators alone do not guarantee trading success, and careful analysis, risk management, and ongoing evaluation of market conditions are essential for effective implementation of the Supertrend + CCI strategy.

The Supertrend+ Indicator

The Supertrend+ indicator is indeed a popular tool used by traders to identify market trends. It provides a visual representation of the prevailing trend, acting as a guide for potential trading opportunities. When the market is in a bullish phase, the Supertrend+ indicator typically displays a green color, signaling a favorable environment for buying or holding positions. Conversely, during bearish market conditions, the indicator turns red, indicating a potential downtrend and suggesting caution or potential selling opportunities.

The simplicity of the Supertrend+ indicator’s color-coded signals makes it user-friendly and easy to interpret for traders of various experience levels. By visually highlighting the market trend, it helps traders make informed decisions based on the direction of the market. However, it is important to note that relying solely on color signals may not provide a complete picture of the market dynamics. Traders should consider additional factors, perform thorough analysis, and incorporate risk management techniques to increase the effectiveness of their trading decisions.

The Commodity Channel Index (CCI)

The Commodity Channel Index (CCI) is a widely used momentum oscillator in trading. It provides insights into the deviation of an asset’s price from its average over a specified period. Conceptually, the CCI can be likened to a thermometer that measures the market’s temperature. When the CCI reading is high, it suggests that prices are significantly above their average, indicating a potential overbought condition. This may imply that the asset’s price has risen too quickly and a price correction or trend reversal could occur. On the other hand, a low CCI reading indicates that prices are considerably below their average, which may indicate an oversold condition. This suggests that the asset’s price has dropped sharply and a price bounce or trend reversal to the upside may be imminent.

Traders often use the CCI as a tool to gauge market conditions and identify potential entry or exit points. It helps them assess the strength and duration of a trend, as well as possible overbought or oversold conditions. However, it’s important to note that the CCI is just one tool among many, and it should be used in conjunction with other technical indicators, fundamental analysis, and risk management strategies to make well-informed trading decisions. Understanding the interpretation and limitations of the CCI can aid traders in incorporating it effectively into their overall trading approach.

The Supertrend + CCI Strategy in Action

The Supertrend + CCI strategy combines the Supertrend+ indicator and the Commodity Channel Index (CCI) to identify potential entry points for trades. The rules for entering trades using this strategy are relatively simple and based on the color signals of the Supertrend+ indicator and the CCI readings. For long trades, traders should wait for the Supertrend+ indicator to turn green, indicating a bullish trend, and the CCI to be below -100, suggesting a potential oversold condition. This combination can be seen as a signal for a favorable buying opportunity. On the other hand, for short trades, traders should look for the Supertrend+ indicator to turn red, indicating a bearish trend, and the CCI to be above +100, which may indicate an overbought condition. This combination could be seen as a potential selling opportunity.

By following these rules, traders aim to align their trades with the prevailing trend indicated by the Supertrend+ indicator while considering potential reversals or extreme conditions suggested by the CCI. However, it’s important to note that the strategy’s effectiveness may vary depending on market conditions, and it should be thoroughly backtested and evaluated before implementation. Traders should also consider incorporating appropriate risk management techniques and continuously monitor market developments to adjust their trading decisions accordingly.

Backtesting the Supertrend + CCI Strategy

Backtesting is a crucial step in evaluating the effectiveness of a trading strategy. Based on the information provided, the Supertrend + CCI strategy was backtested on the Bitcoin chart using a 5-minute timeframe, resulting in a win rate of 44% and a profit and loss (PnL) of 0.08%. These results suggest that out of the 100 trades executed during the backtesting period, approximately 44 trades were profitable.

While the win rate of 44% indicates that the strategy had more losing trades than winning trades, it is important to consider other factors such as the risk-reward ratio and the overall profitability of the strategy. A win rate alone does not provide a complete assessment of a trading strategy’s performance. Additionally, the PnL of 0.08% suggests that the cumulative profit or loss from the 100 trades was minimal.

It is important to interpret these backtesting results with caution, as backtesting is conducted on historical data and may not accurately reflect future market conditions. The performance of a strategy can vary in different market environments, and it is essential to consider factors such as slippage, transaction costs, and market volatility. Further analysis, including assessing other performance metrics and conducting robustness tests on different datasets, would be beneficial to gain a more comprehensive understanding of the Supertrend + CCI strategy’s effectiveness.

Interpreting the Results

While a win rate of 44% may appear underwhelming, it is crucial to understand that trading success is not solely determined by the number of winning trades. The key to successful trading lies in effective risk management and maximizing profits. Despite the relatively modest win rate, the Supertrend + CCI strategy demonstrated a positive profit and loss (PnL) of 0.08%. This indicates that the strategy was able to generate a net profit, considering the cumulative gains and losses from the 100 trades conducted during the backtesting period.

Profitability in trading is not solely dependent on the win rate but also on the risk-reward ratio and the overall profitability of the trades. Even with a win rate below 50%, if the strategy manages to generate profitable trades that outweigh the losses, it can still be considered a successful approach. It is important to evaluate the strategy’s performance using various metrics, such as average profit per trade, risk-adjusted returns, and drawdown analysis, to gain a comprehensive understanding of its profitability and risk management capabilities.

Traders should also keep in mind that backtesting results provide insights based on historical data, and real-world market conditions may differ. Therefore, it is essential to continuously evaluate and refine the strategy, considering factors such as market volatility, slippage, and transaction costs, to ensure its effectiveness in live trading scenarios.

The Importance of Risk Management

Risk management is a critical component of successful trading. Regardless of the profitability of a trading strategy, it is crucial for traders to effectively manage their risk exposure. This involves implementing risk management techniques such as setting appropriate stop-loss orders, diversifying their portfolio across different assets or instruments, and adhering to position sizing principles. By setting stop losses, traders define the maximum amount they are willing to lose on a trade, helping to protect their capital and limit potential losses.

Diversifying one’s portfolio is another key aspect of risk management. By spreading investments across different assets or markets, traders can reduce the impact of individual market fluctuations and minimize the risk of significant losses. Additionally, it is important for traders to only invest an amount they can afford to lose, considering their financial situation and risk tolerance. This ensures that potential losses do not have a significant negative impact on their overall financial well-being.

By practicing effective risk management, traders can safeguard their capital, preserve their profitability, and navigate the inherent uncertainties and volatility of the financial markets. It is essential to establish a comprehensive risk management plan and stick to it consistently, as it is an integral part of long-term trading success.

Conclusion

In conclusion, the Supertrend + CCI strategy, while not a guaranteed win, shows promise in the volatile world of Bitcoin trading. It’s a testament to the fact that successful trading is not about winning every trade, but about managing risk and making consistent profits. So, the next time you hear about a “100% successful trading strategy,” remember to take it with a grain of salt and do your own research. After all, in the world of trading, there’s no such thing as a sure thing.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.