In the ever-expanding realm of cryptocurrency trading, countless strategies emerge promising extraordinary success. Among them, a YouTube-advertised strategy stands out with remarkable assertions of an 81% win rate and a jaw-dropping 243% profit and loss (PnL) on the Bitcoin (BTC) 15-minute chart. This article delves into the strategy’s mechanics, conducting a thorough backtesting to uncover the accuracy of these bold claims.

Through meticulous analysis, this investigation aims to unveil the reality behind the impressive figures, assessing the strategy’s performance under various market conditions and potential limitations. By scrutinizing its historical application and evaluating the underlying principles, readers can gain valuable insights into the strategy’s viability and make informed decisions about its implementation in the dynamic landscape of cryptocurrency trading.

The Claimed Strategy

The purported YouTube strategy has captivated traders with its alluring promise of an 81% win rate and an astounding 243% profit and loss (PnL). Such impressive numbers have undoubtedly sparked curiosity and excitement among cryptocurrency enthusiasts, as they envision the possibility of transforming a small investment into significant gains. The strategy hinges on the utilization of specific indicators and well-defined entry rules for both long and short positions, offering a seemingly comprehensive and systematic approach to navigate the complexities of trading on the 15-minute chart of Bitcoin (BTC).

However, while the claimed statistics may sound enticing, it is crucial to approach such declarations with a healthy dose of skepticism. Backtesting this strategy rigorously will be vital in determining its true effectiveness and reliability in real-world trading scenarios. Moreover, any successful trading approach should be subject to thorough scrutiny, considering potential risks and market fluctuations that can significantly impact its performance. By thoroughly dissecting the strategy’s methodology and rigorously testing it against historical data, traders can gain a more accurate understanding of its potential and make informed decisions when incorporating it into their own trading practices.

The Backtesting Process

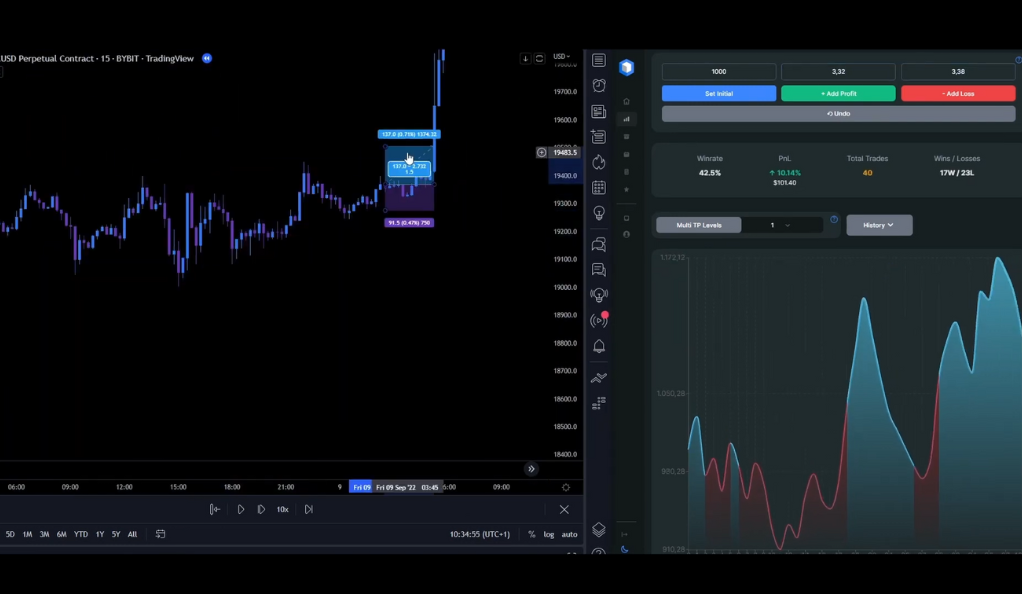

In the quest to verify a rigorous backtesting process was conducted, subjecting the approach to 100 iterations using historical data. Backtesting is an essential step in trading analysis, as it enables traders to evaluate the strategy’s efficacy by applying it to past market conditions. By simulating the strategy’s performance across various historical periods, the backtesting process offers valuable insights into its strengths, weaknesses, and overall consistency in delivering the promised 81% win rate and 243% PnL on the BTC 15-minute chart.

During the backtesting procedure, the strategy’s indicators and entry rules were meticulously applied to historical price data, reflecting how it would have fared in real trading scenarios. This comprehensive evaluation accounts for different market conditions, ranging from bullish to bearish trends, as well as periods of high volatility and relative stability. By quantitatively assessing the strategy’s historical performance, traders can gain a deeper understanding of its potential risk-reward profile and its sensitivity to changing market dynamics. Ultimately, the insights garnered from the backtesting process will serve as a critical foundation for discerning the strategy’s actual merit and for making more informed decisions about its application in live trading environments.

The Results of Backtesting

The outcome of the backtesting process delivered eye-opening revelations about the strategy’s actual performance. The strategy’s backtested results showed a substantially lower win rate of 46%. Similarly, the profit and loss (PnL) achieved through backtesting amounted to 56.5%, falling significantly short of the staggering 243% touted by the strategy’s proponents. These findings underscore the critical significance of backtesting in trading analysis, as they expose the potential disparity between asserted and the strategy’s true historical effectiveness.

The considerable deviation between the claimed and actual results serves as a cautionary tale for traders in the cryptocurrency market. It highlights the need for skepticism and due diligence when encountering strategies that promise extraordinary success without substantial evidence to support their assertions. The backtesting process allows traders to identify the strengths and weaknesses of a strategy, providing a more realistic understanding of its performance under varying market conditions. Traders can better manage their expectations, assess the risks involved, and make more informed decisions when choosing a trading approach that aligns with their goals and risk tolerance.

Indicators Used in the Strategy

These indicators, when properly employed, can offer valuable information about the market’s direction and potential opportunities for traders. By analyzing price patterns, momentum, and market trends, these indicators aim to identify optimal entry and exit points for both long and short positions. Some commonly used indicators in the strategy may include Moving Averages (MA), Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands, among others. When utilized judiciously, these indicators can help traders gain insights into market dynamics, allowing them to capitalize on favorable price movements and mitigate risks during uncertain times.

Nevertheless, the efficacy of these indicators is heavily reliant on the accuracy and consistency of the strategy’s entry rules. Entry rules determine the conditions under which traders initiate positions, and they can significantly impact the overall success of the strategy. It is essential to carefully define and backtest these entry rules to ensure they align with the underlying principles of the indicators and effectively capture profitable trading opportunities. Additionally, traders must be cautious about the risks of over-optimizing or curve-fitting the strategy to historical data, as it could lead to poor performance in real-world market conditions. Striking the right balance between indicators and entry rules is key to building a robust and reliable trading approach that stands a better chance of delivering consistent results over time.

Entry Rules for Long and Short Positions

These rules often incorporate a combination of technical indicators, price thresholds, and trend analysis to identify favorable entry points. For long positions, the strategy may seek to enter trades when specific bullish signals align, such as a bullish crossover of moving averages, an upward break of a key resistance level, or a surge in buying volume. Conversely, for short positions, the strategy might aim to capitalize on bearish signals, like a bearish crossover of moving averages, a breakdown below a critical support level, or an increase in selling volume. These entry rules are crafted to capture potential price movements and generate profitable trades in line with the strategy’s overall objectives.

However, as evidenced by the backtesting results, the real-world outcomes of these entry rules may not always align with the claimed results. Market dynamics are complex and constantly evolving, making it challenging for any strategy, even one with well-defined entry rules, to consistently outperform or achieve exceptionally high win rates. Factors such as sudden shifts in market sentiment, unexpected news events, or fluctuations in trading volumes can all influence the performance of the strategy. Consequently, traders must exercise caution and recognize that while entry rules can offer guidance, they should not be viewed as foolproof guarantees of success. Adaptability, risk management, and continuous evaluation of the strategy’s performance are all critical components of maintaining a successful trading approach in the dynamic and unpredictable world of cryptocurrency markets.

The Discrepancy Between Claimed and Actual Results

While it is conceivable that the strategy may have encountered unfavorable market conditions during the backtesting period, the magnitude of the difference between the asserted and realized outcomes is too pronounced to dismiss as solely a result of market fluctuations. Traders must approach with a critical eye and a healthy skepticism, as extraordinary success rates and profit margins in the volatile world of cryptocurrency trading often warrant closer scrutiny.

A plausible explanation for the wide gap between claimed and actual results could be over-optimization or data snooping bias. Over-optimization occurs when a strategy is excessively tailored to historical data, capturing past market patterns with precision but potentially failing to adapt to new market trends. This can lead to poor performance when applied in real-time trading scenarios where market conditions may differ significantly from historical data. Additionally, data snooping bias arises when a strategy is repeatedly tested and adjusted using historical data until it appears highly profitable. Consequently, the strategy may perform exceptionally well in the historical data it was optimized for but struggle in live trading conditions. Traders must be cautious of such pitfalls and recognize the importance of robustly testing strategies with out-of-sample data to gauge their resilience and potential to deliver consistent results across various market environments. Ultimately, a prudent and diligent approach to strategy evaluation, coupled with realistic expectations, is fundamental to navigating the complexities of cryptocurrency trading.

The Importance of Backtesting

Backtesting serves as a reality check, illuminating the potential gaps between the promised results and the strategy’s actual performance. By subjecting a strategy to historical data and simulating its application in various market conditions, traders can gain valuable insights into its strengths, weaknesses, and overall reliability. Backtesting allows traders to uncover potential pitfalls, evaluate risk-reward profiles, and identify any over-optimization or data snooping bias that could lead to erroneous assumptions about a strategy’s effectiveness.

Through backtesting, traders can validate the viability of a strategy and make more informed decisions about its suitability for live trading. It offers a controlled environment to test different parameters and fine-tune entry and exit rules, ensuring the strategy’s adaptability across diverse market situations. By acknowledging the importance of backtesting, traders can avoid falling into the trap of blindly following unsubstantiated claims and instead adopt a disciplined approach to strategy evaluation. A robust backtesting process enables traders to build confidence in their chosen approach and develop a clear understanding of the potential risks and rewards involved in their trading decisions. In the ever-evolving landscape of cryptocurrency markets, embracing backtesting as a standard practice can empower traders to navigate the uncertainties with greater precision and ultimately enhance their chances of long-term success.

Conclusion

In the world of cryptocurrency trading, it’s essential to approach any strategy with a healthy dose of skepticism. The strategy’s claimed 81% win rate and 243% PnL may sound enticing, but as our backtesting revealed, the actual performance was significantly lower. This serves as a reminder to all traders: always backtest a strategy before diving in. After all, in trading, as in life, if something sounds too good to be true, it probably is.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)