In the evolving global landscape, economic challenges and opportunities continue to morph in tandem with the ever-changing socio-political and technological parameters. From the fluctuating behavior of the stock market to the unpredictability of Bitcoin, these aspects are not just isolated economic phenomena. Instead, they are interwoven with the fabric of contemporary society, influencing individuals, organizations, and countries alike. The following discussion seeks to unwrap these complex issues and shed light on the corresponding opportunities they offer.

Contents

- 1 Navigating the Turbulence: Stock Market Volatility

- 2 Bitcoin: The Digital Gold Rush and Its Unpredictability

- 3 Unpacking the Cost of Online Content Subscriptions

- 4 Age, Societal Expectations, and Economic Impact: A Trilogy

- 5 Scandal Shakes the Economic Landscape: The Hadley Gamble and Tom Barrack Episode

- 6 Elon Musk, Tesla, and Twitter

- 7 The Big Question: Is the Economy a Beacon of Resilience or a House of Cards?

- 8 Conclusion: Making Sense of Economic Complexity

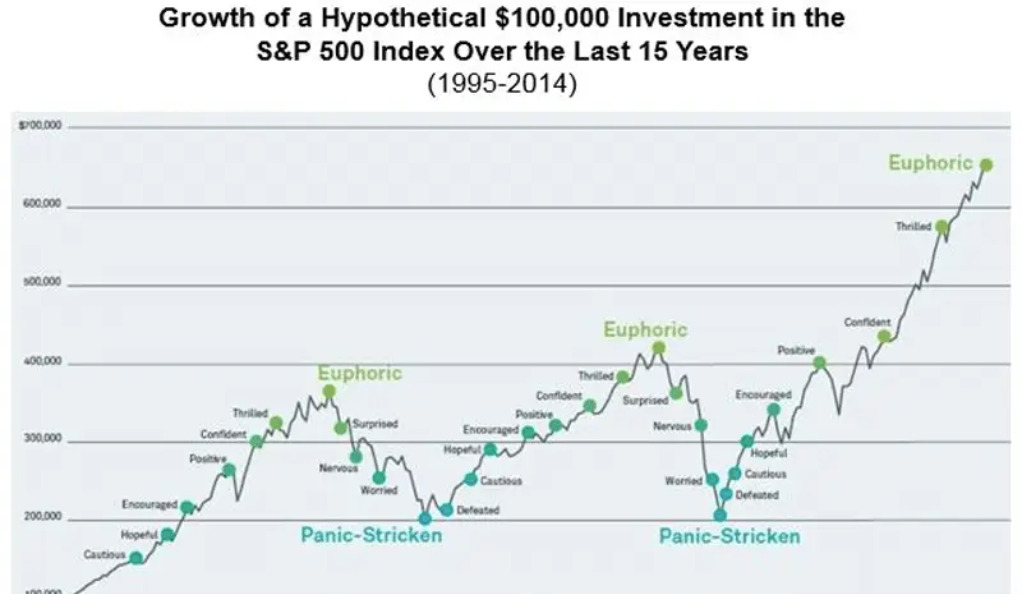

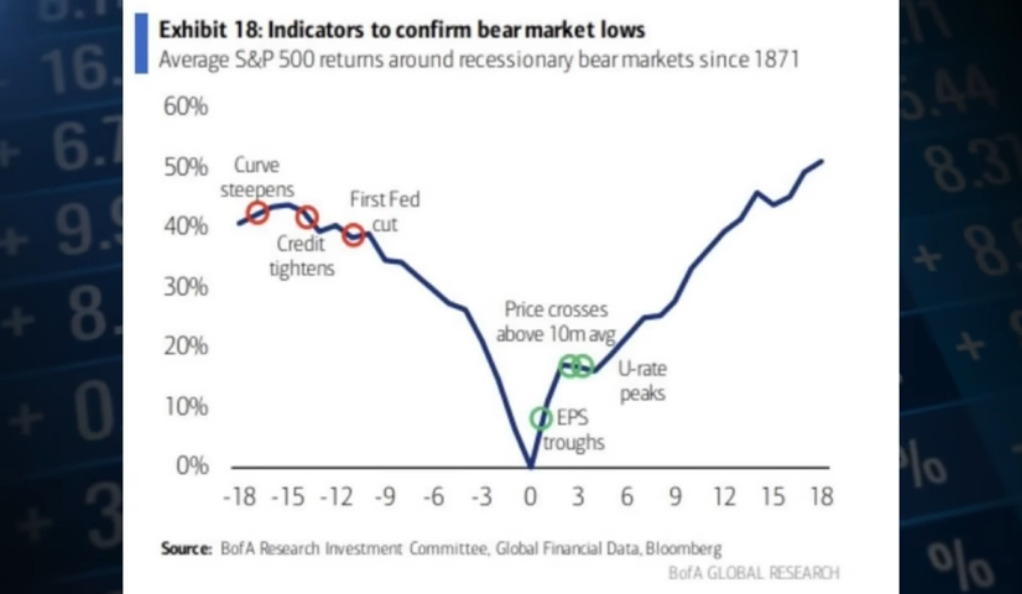

The stock market, often likened to a ship navigating stormy seas, is a realm of constant change and fluctuation. It responds dynamically to a plethora of global events, economic indicators, and investor sentiments, causing prices to rise and fall. This turbulence, or volatility, makes the stock market both an arena of potential prosperity and a platform for potential risk, emphasizing the need for shrewd navigation and informed decision-making.

A. Introduction to Market Volatility

Volatility is an inherent characteristic of the stock market. It serves as a measure of the rate at which the price of an asset, such as an index or security, increases or decreases for a set of returns. The S&P 500 and the QQQ ETF are prime examples of this oscillation, reflecting the broader economic climate, policy changes, investor sentiment, and unforeseen circumstances.

B. The Case of the S&P 500

The S&P 500 is a stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the United States. As an index, it offers a broad snapshot of the U.S. equities market. The volatile nature of the S&P 500 can be attributed to its wide-ranging composition and sensitivity to economic indicators and global events.

C. The Story of the QQQ ETF

On the other hand, the QQQ ETF, or the Invesco QQQ Trust, is a fund that includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market. The tech-heavy composition of the QQQ ETF makes its performance largely reliant on the technological sector, leading to distinctive fluctuations compared to the more diversified S&P 500.

Bitcoin: The Digital Gold Rush and Its Unpredictability

Bitcoin, often referred to as ‘Digital Gold,’ has transformed the financial landscape with its decentralized nature and potential for significant returns. Yet, its unpredictability is just as renowned, with price swings that can resemble a roller coaster ride. This digital currency offers a thrilling prospect for investors, but it also comes with a substantial risk factor, making it a quintessential symbol of the modern economic gold rush.

A. Understanding Bitcoin

A seminal development of the last decade, Bitcoin, the world’s first decentralized digital currency, has revolutionized the financial landscape. Its decentralized nature, coupled with high potential returns, has enticed investors worldwide. However, Bitcoin’s extreme price swings are renowned, rendering it a highly unpredictable investment vehicle.

B. Bitcoin and the CPI Connection

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. CPI is a significant economic indicator, and interestingly, there seems to be a correlation between Bitcoin prices and CPI. While the precise relationship is complex and necessitates a dedicated discussion, the potential implication is that Bitcoin can be an inflation hedge.

Unpacking the Cost of Online Content Subscriptions

In the realm of digital media, online content subscriptions have emerged as a significant cost factor for consumers. Despite a vast ocean of free content, these subscription services claim a stake in the market by promising high-quality, curated, and often exclusive content. However, the growing financial burden on consumers prompts a critical evaluation of the value proposition offered by these subscriptions, leading us to unpack the cost and its corresponding worth.

1. The Age of Digital Content

We live in an era where digital content is omnipresent. However, the advent of online content subscriptions has stirred a debate about the value proposition they offer, considering the internet is brimming with free content. The question then becomes: are consumers receiving their money’s worth?

2. Comparisons and the Future: AI in Content Creation

An intriguing comparison arises when online content subscription costs are contrasted with adult content platforms like OnlyFans. These platforms cater to a niche market, but the pricing models could potentially offer insights for broader digital content strategies. Furthermore, the prospect of using AI for creating virtual models for platforms like OnlyFans is worth exploring, opening new possibilities for the content industry.

Age, Societal Expectations, and Economic Impact: A Trilogy

Age, societal expectations, and economic impact form an intricate trilogy that deeply influences individuals’ lives and societal structures. Age determines life stages, shaping economic capabilities and responsibilities. Simultaneously, societal expectations, often age-specific, create pressures and opportunities that drive economic decisions. Consequently, this trilogy intertwines to cast a profound impact on personal economic health and broader economic dynamics, necessitating a nuanced understanding of its complexities.

Age and Economics: An Interplay

Age plays a more significant role in economics than one might initially consider. It influences career trajectories, income levels, and financial decision-making, thereby impacting overall economic dynamics.

Societal Expectations: The Gender Lens

Societal expectations based on age often vary between genders. These variations can manifest in economic disparities, from wage gaps to employment opportunities, underlining the need to address these disparities proactively.

Scandal Shakes the Economic Landscape: The Hadley Gamble and Tom Barrack Episode

Scandals, like earthquakes, often ripple through the economic landscape, leaving trails of disruption in their wake. The recent episode involving Hadley Gamble, a renowned CNBC reporter, and Tom Barrack, an influential businessman, is no exception. This scandal underscores the complex ties between media, finance, and power, shaking the economic landscape and sparking discussions about ethics, accountability, and the broader implications for the economy.

The Intersection of Media, Economy, and Power

Scandals often impact economic landscapes significantly. A recent case involving Hadley Gamble, a CNBC reporter, and Tom Barrack underscores the intersection of media, economy, and power. This episode prompts discussions about journalistic ethics, power dynamics, and their repercussions on the economy.

Elon Musk, Tesla, and Twitter

- Elon Musk’s Audacious Acquisition*

When discussing economic powerhouses, it is impossible to omit Elon Musk. His recent acquisition of Twitter has stirred debates about the implications for social media and its role in shaping economic landscapes.

- Strategic Plays: Selling Tesla Shares*

Simultaneously, Musk’s strategic use of his brother to sell Tesla shares for raising cash is a masterstroke that showcases the interplay between personal wealth and corporate strategy, setting a precedent for future entrepreneurs.

The Big Question: Is the Economy a Beacon of Resilience or a House of Cards?

The Resilience Debate*

As we unpack these multifaceted issues, we must evaluate the economy’s resilience. Are we standing on solid ground or on the brink of a precipice? Is our optimism justified, or are we blinded by ignorance?

Moving Forward: The Need for a Balanced Perspective*

A balanced perspective that acknowledges both the strengths and weaknesses of the economic system is crucial. This perspective can guide us in shoring up our defenses while seizing the opportunities that lie ahead.

Conclusion: Making Sense of Economic Complexity

Understanding economic realities requires more than a grasp of facts and figures; it mandates a holistic understanding of societal norms, technological advancements, and political dynamics. The resilience of our economy relies not only on our optimism but on our willingness to confront existing challenges and seize emerging opportunities. As we navigate this journey, let’s continue to question, explore, and innovate because these are the catalysts for a thriving, sustainable economy.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)