This strategy focuses on short-term trades, typically executed within a 15-minute timeframe. The main objective is to capitalize on small price movements in the market and accumulate profits through a high-frequency trading approach. Traders using this strategy often rely on technical indicators such as moving averages, stochastic oscillators, and relative strength index (RSI) to identify entry and exit points for their trades. The frequent trades and quick decision-making involved in scalping demand precision and discipline, making it suitable for experienced traders who can effectively manage risk and execute trades swiftly.

As with any trading strategy, backtesting plays a crucial role in assessing its effectiveness and potential for success. Backtesting involves running the strategy on historical market data to analyze its performance over time. While the specific backtesting results for the 15 Minute Scalping Strategy would depend on the cryptocurrency market and the parameters chosen, it typically aims to evaluate key performance metrics such as profitability, win rate, drawdowns, and risk-adjusted returns. Traders should exercise caution and thoroughly analyze the results before implementing the strategy in real-time trading, as backtesting outcomes might not always guarantee future performance. Additionally, it is essential to adapt the strategy to the dynamic and ever-changing nature of the cryptocurrency market to maximize its chances of success.

The 15 Minute Scalping Strategy

The 15 Minute Scalping Strategy is a popular trading method specifically designed for Bitcoin trading on a 15-minute timeframe. This comprehensive strategy relies on the utilization of four specific indicators to aid in decision-making and trade execution. The first indicator, the t3 Average by HPotter, is a moving average type that helps smooth out price fluctuations and identify potential trends. The second indicator, the ATR Bands by AlexanderTeaH, utilizes the Average True Range (ATR) to create bands around the price, giving traders insights into market volatility and potential breakout opportunities. The third indicator, the Range Filter Buy and Sell 5Min by guikroth, acts as a filter to determine optimal entry and exit points based on the price range. Lastly, the Waddah Attar Explosion V2 [SHK] by shayankm is an oscillator-type indicator designed to identify price momentum and potential trend reversals. By combining these four indicators, traders aim to make quick and precise trading decisions, taking advantage of short-term price movements in the Bitcoin market.

Indicator Settings

In the 15 Minute Scalping Strategy, the effectiveness of the indicators largely depends on their specific settings, which are carefully adjusted to optimize the strategy’s performance. For the T3 Indicator, the length parameter is set to 300. This length determines the number of periods used to calculate the T3 moving average, and in this case, a longer length is chosen to capture more significant price trends while reducing noise. Moving on to the ATR Bands Indicator, it utilizes an ATR Period of 14, which means it considers the average true range over the past 14 periods. The ATR Multiplier for both the Upper and Lower Bands is set to 3, indicating that the bands will be placed at three times the average true range away from the central moving average line.

As for the Range Filter Indicator, the High Target, Low Target, and Bar Color options are unchecked. By not specifying these targets and colors, the Range Filter becomes a versatile tool for detecting price breakouts and determining optimal entry and exit points based on market dynamics. Finally, in the WAE Indicator, the Explosion Line color is set to white, making it visually distinct, and the DeadZoneLine color is set to light blue for clarity. These color choices help traders quickly identify the indicator’s signals and comprehend potential market conditions. Traders should keep in mind that while these settings have been backtested and chosen to optimize the strategy, market conditions are constantly changing, and it might be necessary to fine-tune these settings periodically to adapt to evolving market trends. Furthermore, traders are advised to test the strategy thoroughly in different market environments to ensure its effectiveness and to combine it with proper risk management practices to achieve consistent success.

Entry Rules

The entry rules are fundamental to the successful implementation of the 15 Minute Scalping Strategy. Traders using this strategy typically initiate a trade when the indicators align and generate specific signals. These signals could include the t3 Average by HPotter crossing above or below price, indicating potential trend reversals or continuations. Additionally, traders might look for instances where the price breaks out of the ATR Bands created by the ATR Bands Indicator, signifying increased volatility and potential breakout opportunities. Moreover, the Range Filter Indicator may be used to confirm optimal entry points by identifying price breakouts beyond specific price ranges. The Waddah Attar Explosion V2 [SHK] Indicator could also provide entry signals based on momentum and trend strength. Understanding and adhering to these entry rules, along with considering other essential factors such as market context and risk management, can significantly enhance the trader’s ability to execute successful trades using the 15 Minute Scalping Strategy.

Long Position

To enter a long position using the 15 Minute Scalping Strategy, several conditions must be met. Firstly, the price action must be positioned above the T3 Line, indicating a potential uptrend. Secondly, the Range Filter Indicator must display a green color, indicating that the price has broken out above a specific price range and confirming a bullish bias. Additionally, the Explosion Line of the Waddah Attar Explosion V2 [SHK] Indicator must be positioned above the DeadZone, suggesting strong momentum and potential for further price gains. Finally, the candle of the WAE Indicator should be green, supporting the bullish sentiment and serving as an additional confirmation for entering the long position. By ensuring that all these criteria are met, traders can have a higher level of confidence in their long position and align their trades with the underlying trend and momentum. However, traders should always exercise caution and consider other factors such as market conditions and risk management before executing any trade using this strategy.

Short Position

To enter a short position using the 15 Minute Scalping Strategy, specific conditions must be met. Firstly, the price action must be positioned below the T3 Line, indicating a potential downtrend. Secondly, the Range Filter Indicator must display a red color, signaling that the price has broken out below a specific price range and confirming a bearish bias. Additionally, the Explosion Line of the Waddah Attar Explosion V2 [SHK] Indicator must be positioned above the DeadZone, suggesting strong downward momentum and potential for further price declines. Finally, the candle of the WAE Indicator should be red or orange, providing additional confirmation of the bearish sentiment. By ensuring that all these criteria are satisfied, traders can have increased confidence in their short position and align their trades with the prevailing downtrend and momentum. Nonetheless, as with any trading strategy, it is essential for traders to consider other factors, including market conditions and risk management, before executing any trade using this strategy.

Stop Loss and Target

In the 15 Minute Scalping Strategy, the stop loss and target levels are crucial components of effective risk management. The stop loss is determined using the ATR Bands Indicator, which utilizes the Average True Range to gauge market volatility. By setting the stop loss outside the ATR Bands, traders aim to protect their positions from significant adverse price movements and limit potential losses. On the other hand, the target is set using a Risk to Reward Ratio of 1 to 1, meaning that the potential profit target is equal to the initial risk taken. This balanced approach ensures that the potential gains are maximized while maintaining a controlled level of risk. By adhering to these stop loss and target rules, traders can enhance their overall trading performance and manage risk effectively in the dynamic and volatile cryptocurrency market environment.

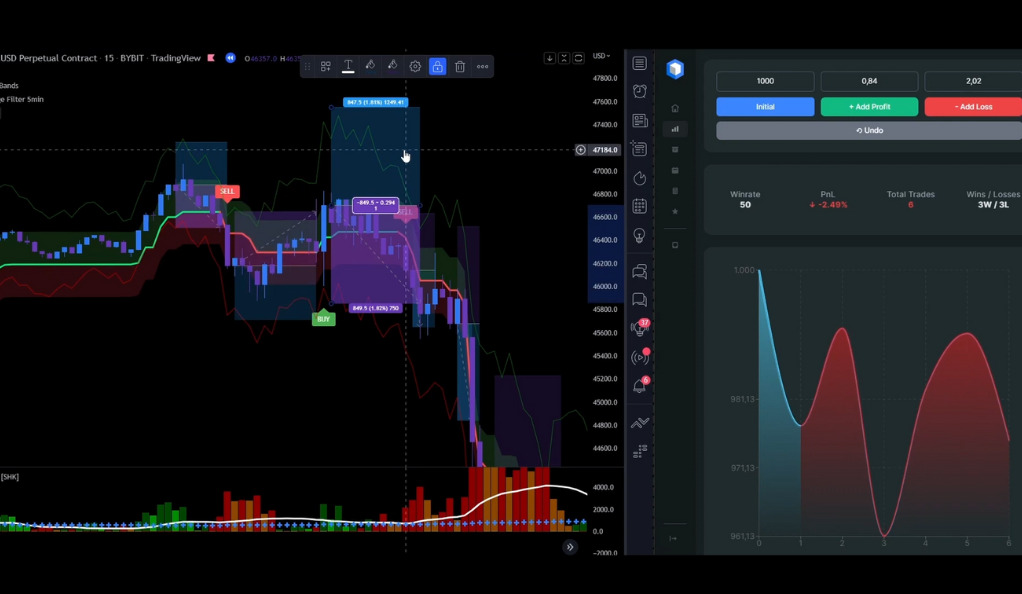

Backtesting Results

The backtesting results for the 15 Minute Scalping Strategy over a period of seven weeks showed a promising win rate of 66%, indicating that a significant majority of trades were profitable. During this backtesting period, the trading account grew from an initial 1000 USD to an impressive 2427 USD, showcasing the strategy’s potential for generating substantial returns. The largest profit trade recorded was 8.16%, allowing traders to capitalize on favorable market movements, while the largest loss trade was limited to 9.22%, demonstrating the efficacy of the strategy’s risk management measures. These backtesting outcomes provide strong evidence for the potential effectiveness of the 15 Minute Scalping Strategy when applied with discipline and precision, but traders should remain cautious and continue monitoring its performance in live trading conditions, adapting to changes in the market to ensure consistent success.

Additional Filters

In 15 Minute Scalping Strategy, two additional filters, the Flat Market Filter, and the Volume Flow Filter are employed to potentially further enhance the strategy’s effectiveness. While these filters were not included in the backtesting results mentioned earlier, they play a vital role in the overall trading approach. The Flat Market Filter helps traders identify periods of low volatility or sideways price movements, allowing them to avoid entering trades in uncertain market conditions where price trends might be less predictable. On the other hand, the Volume Flow Filter assesses the trading volume accompanying price movements, offering insights into the strength and validity of price trends. By incorporating these additional filters, traders can gain more context and make more informed decisions, potentially improving the overall performance and adaptability of the 15 Minute Scalping Strategy in different market scenarios. As with any adjustments to a trading strategy, it’s essential for traders to conduct thorough testing and analysis to validate the impact of these filters and ensure they align with their trading objectives and risk tolerance.

Conclusion

The 15 Minute Scalping Strategy, as backtested, shows promising results. With a win rate of 66% and significant account growth, it’s a strategy worth considering for those trading in the Bitcoin market. However, as with any trading strategy, it’s essential to understand the mechanics, adjust the settings to fit your trading style, and always be aware of the inherent risks involved in trading. Happy trading!

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)