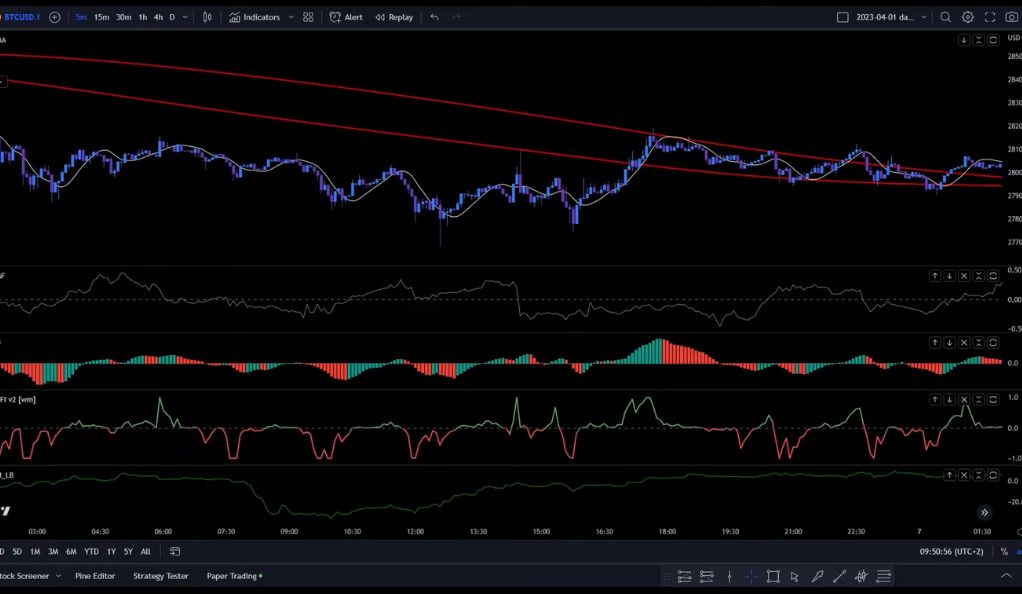

In the fast-paced realm of cryptocurrency trading, staying ahead of the curve is essential for maximizing profits. Bitcoin, as the leading digital currency, offers numerous opportunities for traders seeking short-term gains. This article introduces a cutting-edge trading strategy specifically designed for Bitcoin, utilizing a combination of powerful indicators on a five-minute chart. By incorporating indicators such as the whole moving average, T3 moving average, chicken money flow, awesome oscillator, trend direction force index V2, and volume flow indicator, this strategy aims to optimize entry and exit points, ultimately increasing profitability.

This strategy combines various indicators to understand Bitcoin’s short-term price movements. The whole moving average, T3 moving average, chicken money flow, awesome oscillator, trend direction force index V2, and volume flow indicator are utilized. By analyzing these indicators, traders can optimize their entry and exit points, particularly on the five-minute chart. However, it’s important to remember the inherent volatility and risks of cryptocurrency trading. Thorough research, risk management, and staying updated on market trends are crucial for implementing this innovative approach successfully.

Understanding the Indicators

To grasp the foundation of this trading strategy, let’s delve into the key indicators involved. The whole moving average provides a smoothed representation of Bitcoin’s price action, enabling traders to identify trends. By calculating the average price over a specific period, it helps smooth out short-term fluctuations. The T3 moving average takes it a step further by reducing lag and providing more precise signals. It adapts to market conditions and ensures traders have a better understanding of the current price trend.

Another crucial indicator is the chicken money flow, which measures the flow of money into or out of Bitcoin. It helps gauge market sentiment and identify buying or selling pressure. The awesome oscillator evaluates market momentum by comparing short-term and long-term moving averages, aiding in identifying turning points and trend continuation. The trend direction force index V2 complements this by providing insights into the current trend’s strength. Lastly, the volume flow indicator confirms price movements’ validity and helps identify market manipulation. These indicators collectively enhance traders’ understanding of Bitcoin’s price dynamics for informed entry and exit decisions.

Optimizing Indicator Settings

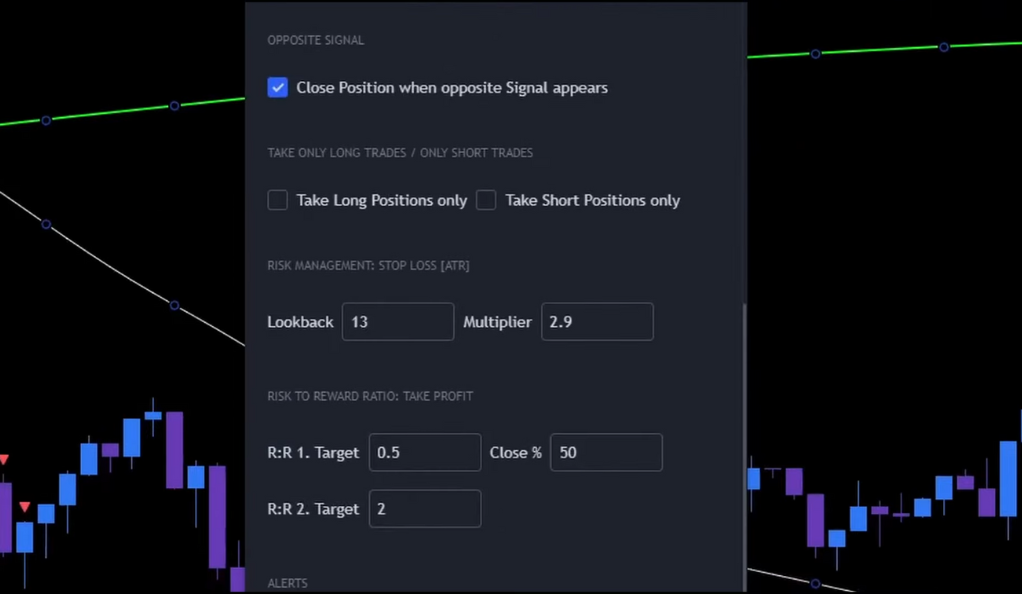

To optimize the effectiveness of each indicator in this strategy, it is crucial to adjust their specific parameters. By fine-tuning settings such as period lengths, smoothing factors, or sensitivity levels, traders can tailor the indicators to better align with Bitcoin’s volatility and market conditions. While the article offers optimized settings for each indicator, it is also important for traders to experiment with different configurations based on their individual trading style and risk tolerance.

Optimizing indicator settings involves finding the right balance between responsiveness and reliability. Shorter periods and higher sensitivity can provide more frequent signals but may also generate false alarms. On the other hand, longer periods and lower sensitivity can reduce noise but may result in delayed signals. Traders should consider the prevailing market conditions, their preferred trading timeframes, and their risk management approach when fine-tuning the indicator settings. By conducting thorough backtesting and analyzing the performance of different parameter combinations, traders can identify the optimal settings that best suit their specific trading objectives.

Entry and Exit Rules

Defining clear entry and exit rules is a vital component of a successful trading strategy. In this approach, traders can determine when to enter long or short positions based on a combination of indicators. For example, a long trade signal may be generated when the whole moving average and T3 moving average exhibit an upward crossover, accompanied by positive readings in the chicken money flow and awesome oscillator. Conversely, a short trade signal may occur when the indicators align in a bearish manner. By following these rules, traders can establish a systematic approach to capture potential price movements.

To determine exit points, traders can consider various factors, including profit targets and stop-loss levels. Profit targets can be based on specific price levels or calculated using technical analysis techniques, while stop-loss levels help manage risk by defining the maximum acceptable loss for a trade. Additionally, traders can incorporate trailing stop orders to protect profits and allow for potential upside capture if the trade moves in their favor. It is essential to adapt exit rules to the specific market conditions and adjust them accordingly as the trade progresses. By having clear entry and exit rules in place, traders can maintain discipline and increase the probability of achieving their desired trading outcomes.

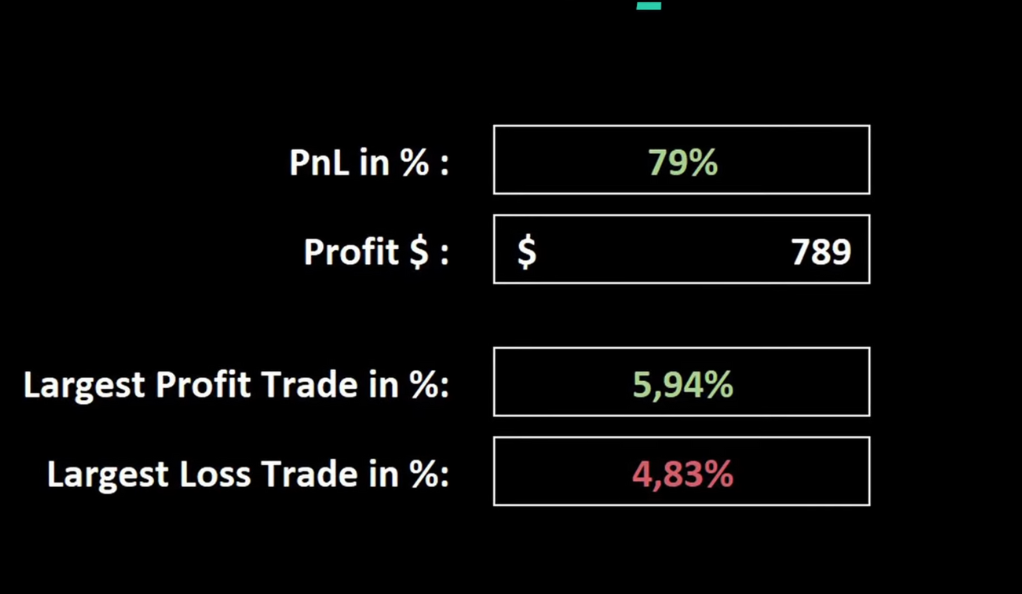

Backtesting Results: Assessing Strategy Performance

Before implementing any trading strategy, it is crucial to assess its performance through backtesting. The article presents backtesting results, indicating a win rate of 68% and a notable profit of 79% over a six-week period. However, it is important to note that these results are based on historical data and should not be seen as a guarantee of future success. Various factors, such as market conditions, execution speed, and slippage, can impact actual trading results. Therefore, it is recommended that traders conduct their own backtesting using reliable historical data and exercise caution when applying the strategy in live trading.

During backtesting, traders should consider not only the overall performance metrics but also other factors such as drawdowns, risk-reward ratios, and consistency of results over different market conditions. Additionally, it is advisable to evaluate the strategy over an extended period and across multiple market cycles to gain a more comprehensive understanding of its performance. By conducting rigorous backtesting and continuously evaluating the strategy’s results, traders can make informed decisions about its suitability and potential for success in real-world trading scenarios.

Leverage: Maximizing Potential Gains with Caution

Leverage has the potential to greatly increase gains, but it also amplifies risks. The backtesting results of the strategy mentioned in the article were achieved using a leverage of 2x. While this leverage can lead to significant profits, it is vital to approach it with careful risk management. Traders must thoroughly assess their risk appetite and implement appropriate position sizing and stop-loss measures to safeguard against substantial losses. It is important to remember that leverage should be used cautiously, and beginners are advised to start with lower leverage or even trade without leverage initially.

Using leverage requires a deep understanding of its implications and the ability to manage risk effectively. Traders should consider the potential impact of leverage on their trading capital and ensure they have sufficient margin to withstand market fluctuations. Additionally, it is advisable to have a clear plan for risk management, including predetermined stop-loss levels and regular monitoring of positions. By approaching leverage with caution and implementing appropriate risk management measures, traders can maximize their potential gains while minimizing the likelihood of significant losses.

Short-Term Focus: The Five-Minute Chart Advantage

The trading strategy presented in this article is tailored for Bitcoin and focuses on a five-minute chart. This timeframe is well-suited for traders who are seeking short-term opportunities and aim to capitalize on quick price movements. Cryptocurrency markets are known for their fast-paced nature, requiring traders to continuously monitor the market and make prompt decisions. The five-minute chart provides a more granular view of price action, allowing traders to identify and act upon short-term trends and fluctuations.

It’s important to note that trading on a five-minute chart requires a high level of engagement and attentiveness. Traders utilizing this strategy should be comfortable with active trading and possess the necessary time and dedication to monitor the market closely. The rapid pace of price movements in cryptocurrency markets can present both opportunities and risks, and traders must be prepared to adapt quickly to changing market conditions. Implementing this strategy effectively requires discipline, focus, and the ability to make timely trading decisions based on the signals generated by the indicators.

All-in-One indicator

The “All in One” indicator is a powerful tool that combines multiple technical indicators into a single comprehensive indicator. This unique indicator is designed to provide traders with a holistic view of the market by integrating various signals and parameters. By consolidating indicators such as moving averages, oscillators, volume analysis, and trend indicators, the “All in One” indicator aims to simplify trading decision-making processes. It offers a convenient way to analyze price action, identify trends, assess market momentum, and gauge market sentiment all in one place. This all-encompassing indicator can save time and streamline trading strategies by providing traders with a consolidated snapshot of the market’s overall condition.

Bitcoin: A Prime Focus for the Strategy

The trading strategy discussed in this article specifically targets Bitcoin, and for good reason. Bitcoin holds a dominant position in the cryptocurrency market, with the highest market capitalization and liquidity among digital assets. Its widespread adoption and popularity make it a prime focus for traders seeking opportunities to capitalize on price movements.

Bitcoin’s inherent volatility, driven by factors such as market demand, macroeconomic events, and investor sentiment, creates an environment conducive to trading. The strategy’s indicators and rules have been carefully tailored to align with Bitcoin’s unique characteristics. By analyzing Bitcoin’s price action and incorporating indicators that are specifically suited to capture its trends, traders can leverage the cryptocurrency’s volatility to identify potential entry and exit points.

It is worth noting that while Bitcoin’s volatility presents opportunities for profit, it also carries significant risks. Traders should exercise caution, implement risk management strategies, and stay informed about market developments when applying this trading strategy to Bitcoin or any other cryptocurrency.

The Power of Indicator Combination

The effectiveness of this trading strategy is bolstered by the power of combining multiple indicators. By using a combination of indicators, traders can cross-validate signals and improve the accuracy of trade entries and exits. Each indicator contributes a unique perspective to the analysis, allowing traders to gain a comprehensive understanding of Bitcoin’s market dynamics. The whole moving average, T3 moving average, chicken money flow, awesome oscillator, trend direction force index V2, and volume flow indicator together provide a multi-dimensional view of the market, helping traders make more informed decisions.

However, it is important to acknowledge that no trading strategy is foolproof, and false signals can still occur. Traders must exercise discretion and consider the overall context of the market, taking into account other relevant factors such as fundamental news, market sentiment, and support/resistance levels. By using the combination of indicators as a guiding framework and applying their own judgment, traders can better navigate the complexities of Bitcoin’s price movements and increase their chances of successful trading outcomes.

Conclusion

In the realm of Bitcoin trading, having a well-defined strategy is essential for success. The strategy presented in this article combines a range of indicators on a five-minute chart to identify potential trading opportunities. With optimized indicator settings, clear entry and exit rules, and promising backtesting results, this strategy offers traders a systematic approach to capitalize on short-term Bitcoin price movements. Nevertheless, it is crucial to acknowledge the risks involved, employ proper risk management measures, and adapt the strategy to individual preferences and market conditions. By staying informed, maintaining discipline, and continuously honing their skills, traders can strive to navigate the ever-evolving landscape of Bitcoin trading with greater confidence.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)