In the ever-changing landscape of cryptocurrency trading, new strategies continuously surface, enticing traders with the prospect of lucrative gains. Among these, one strategy that has garnered attention in the Bitcoin trading community involves the use of Heikin Ashi candles, along with two indicators – Chandelier Exit and Zero Lag Smoothed Moving Average. Heikin Ashi candles, which provide a smoothed representation of price movements, are combined with the Chandelier Exit indicator, designed to determine potential exit points for trades. Additionally, the Zero Lag Smoothed Moving Average aims to reduce lag and provide more accurate signals. While this strategy may have shown promising results in certain market conditions, it is crucial for traders to exercise caution and thoroughly backtest it across various market scenarios before fully embracing it. As with any trading strategy, success relies on a combination of sound analysis, risk management, and an understanding that the cryptocurrency market is highly volatile and unpredictable.

Before adopting this strategy, traders should diligently research and familiarize themselves with each indicator’s strengths and weaknesses and understand how they interact within the context of Bitcoin’s price movements. Moreover, traders should be aware that no strategy can guarantee consistent profits in the highly speculative realm of cryptocurrency trading. Market conditions can rapidly change, rendering previously successful strategies ineffective. Therefore, traders must remain adaptable and continuously refine their approach as the cryptocurrency market evolves. Ultimately, while the Heikin Ashi candles, Chandelier Exit, and Zero Lag Smoothed Moving Average strategy may hold promise, traders must exercise prudence and consider it as one potential tool among many in their arsenal.

Understanding the Trading Strategy

Understanding the trading strategy that one employs is paramount in the dynamic world of cryptocurrency trading. A trading strategy outlines a set of rules and indicators used to make informed decisions about buying, selling, or holding assets. It is crucial for traders to thoroughly comprehend the logic behind their chosen strategy, including the technical indicators and patterns used to generate trading signals. Additionally, traders must be aware of the strategy’s limitations and potential risks to make well-informed and calculated moves in the highly volatile cryptocurrency market. By gaining a deep understanding of their trading strategy, traders can better interpret market signals, implement effective risk management, and increase their chances of success in this fast-paced and unpredictable environment.

Heikin Ashi Candles

Heikin Ashi candles, derived from the Japanese term meaning ‘average bar,’ offer a unique way to represent price movements in financial markets. This type of candlestick chart is designed to mitigate the noise and volatility often found in traditional candlestick charts, providing a clearer picture of price trends. Unlike standard candlesticks that show open, high, low, and close prices for a specific time period, Heikin Ashi candles use average price data from the previous candle, which results in smoother candle formations. The calculation incorporates the average of the previous candle’s open and close prices to determine the current candle’s open, close, and body color. As a result, Heikin Ashi charts can reveal trends more effectively, making it easier for traders to identify potential entry and exit points with reduced distractions from short-term price fluctuations.

Traders find Heikin Ashi candles particularly useful in capturing the overall trend and momentum of an asset. The distinctive candlestick patterns that emerge on Heikin Ashi charts, such as bullish and bearish trends with varying degrees of strength, enable traders to make more informed decisions. By providing a smoother representation of price data, Heikin Ashi candles enhance the clarity of the underlying market sentiment and improve the visual identification of key support and resistance levels. However, while Heikin Ashi charts offer valuable insights, traders should remember that no single chart or indicator can guarantee profitable trades. As with any technical tool, it is essential to complement Heikin Ashi analysis with other indicators and conduct comprehensive market research to make well-rounded trading decisions.

Chandelier Exit

The Chandelier Exit, created by Chuck LeBeau, helps traders stay within trends until a clear reversal signal appears. It acts as a trailing stop-loss during uptrends, rising with the trend to capture maximum profit. When the trend weakens or reverses, it moves closer to the current price, signaling traders to exit positions and secure gains or limit losses. This dynamic and adaptive exit strategy is valuable for trend-following traders, providing a balance between staying in profitable trends and avoiding significant reversals.

Traders often integrate the Chandelier Exit into their trading strategies to manage risk and optimize their trade exits. As a trend-following indicator, it is particularly effective in trending markets but may produce whipsaw signals in sideways or choppy conditions. To overcome this limitation, traders often use the Chandelier Exit in conjunction with other technical tools and indicators to confirm the strength of the prevailing trend and avoid false signals. As with any trading indicator, the Chandelier Exit is not foolproof and should be used alongside prudent risk management practices. Traders should also consider market conditions, the asset being traded, and other factors before making trading decisions based on the Chandelier Exit’s signals.

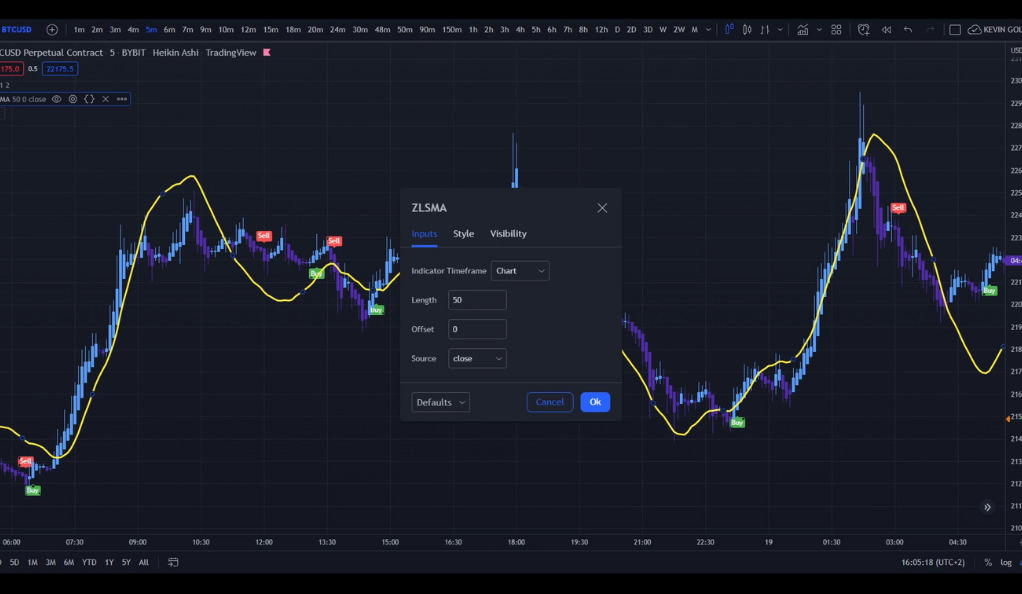

Zero Lag Smoothed Moving Average

The Zero Lag Smoothed Moving Average is a powerful and lesser-known technical indicator used in financial markets. It addresses the issue of lag commonly associated with traditional moving averages, which can lead to delayed signals and missed trading opportunities. By employing a sophisticated calculation method, this indicator significantly reduces or eliminates lag, providing traders with more accurate and timely price trend representations for better entry and exit point identification.

The Zero Lag Smoothed Moving Average achieves its effectiveness by utilizing historical price data in a manner that minimizes the impact of past price fluctuations on the current average. This helps the indicator respond more quickly to recent price changes, thereby maintaining a closer alignment with the prevailing market conditions. The reduction of lag enhances its ability to capture short-term price movements and better adapt to rapidly changing market dynamics. As with any technical indicator, traders often combine the Zero Lag Smoothed Moving Average with other tools to build a comprehensive trading strategy. While this indicator can be valuable in improving trend analysis and decision-making, traders should exercise caution and conduct thorough testing to ensure its compatibility with their specific trading style and the assets they are trading.

The Strategy in Action

The implementation of this trading strategy begins with the use of Heikin Ashi candles, which provide a smoother representation of Bitcoin’s price movements. Traders can analyze the color and formation of the Heikin Ashi candles to identify trends more effectively. During a bullish trend, the candles are predominantly green, indicating rising prices, while in a bearish trend, the candles are predominantly red, signaling falling prices. This visual clarity enables traders to make better-informed decisions about entering or exiting positions based on the prevailing trend.

To further enhance risk management and optimize trade exits, the Chandelier Exit indicator is employed. As Bitcoin’s price trend continues, the Chandelier Exit adjusts its position below the price action, serving as a trailing stop-loss. This allows traders to stay in profitable trends while providing protection against significant reversals. When the Chandelier Exit rises closer to the current price, it indicates a potential trend reversal, prompting traders to exit their positions and secure their gains or limit potential losses.

Backtesting the Strategy

Backtesting is a crucial process that allows traders to assess the effectiveness of a trading strategy by applying its rules to historical market data. In this specific case, the trading strategy, which combines Heikin Ashi candles with the Chandelier Exit and Zero Lag Smoothed Moving Average indicators, demonstrated a promising 55% win rate and achieved a total profit of $55 USD over the historical data period. These results indicate that the strategy produced profitable trades in approximately 55% of the instances it was applied to past market data, suggesting its potential profitability.

However, traders must approach these backtesting results with caution and consider other important performance metrics before implementing the strategy in live trading. While a 55% win rate is positive, it does not provide a complete picture of the strategy’s overall performance. Evaluating the risk-reward ratio and potential drawdowns is crucial to understand the potential downside and volatility the strategy may entail during real-time trading. Traders should look beyond just the win rate and assess the average size of winning and losing trades, as well as the maximum drawdown experienced during the backtesting period. These metrics offer insights into how the strategy performs during both winning and losing trades and provide a clearer understanding of its risk profile.

Furthermore, traders must keep in mind that past performance does not guarantee future results. Market conditions can change rapidly, and a strategy that performed well in backtesting might not fare as effectively in live trading. Hence, implementing effective risk management practices is vital to protect capital and mitigate potential losses. Adaptability is also essential as traders need to adjust their strategies based on current market dynamics to remain responsive to changing conditions.

Conclusion

In the high-stakes world of Bitcoin trading, strategies like the one based on Heikin Ashi candles, Chandelier Exit, and Zero Lag Smoothed Moving Average can seem enticing. However, it’s crucial to remember that no strategy is foolproof. While backtesting results can provide some insight, they are not a guarantee of future performance. Always approach new strategies with caution, understanding the risks involved, and never risk more than you can afford to lose.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)