In the rapidly evolving world of trading, maintaining a competitive edge is not just desirable, but essential. One of the most promising tools traders are utilizing to gain this advantage is artificial intelligence (AI). AI has already brought about significant transformations in various sectors, and trading is no exception. But what does the integration of AI in trading look like, and what are its potential benefits? Let’s delve deeper into this fascinating topic.

Unleashing the Potential of AI in Trading

Artificial Intelligence (AI) holds the potential to revolutionize trading with its ability to learn from patterns, make predictions, and automate complex processes. It can reduce human error and streamline trading operations. However, the true power of AI lies in its strategic application. One such application is indicator strategy testing, a method that allows traders to evaluate the effectiveness of a trading strategy. By combining AI with traditional trading indicators, this strategy aims to enhance trading outcomes, providing a more comprehensive view of the market and helping traders make more informed decisions. As we continue to harness the power of AI, the future of trading looks promising.

Demystifying Indicator Strategy Testing

Indicator strategy testing is a crucial technique used by traders to evaluate the effectiveness of a trading strategy. It involves simulating trades using historical market data to assess a strategy’s potential profitability. This process helps identify the most effective strategies and fine-tune them for optimal results.

The simulation results provide a hypothetical performance of the strategy, offering key metrics such as the number of profitable trades, average profit per trade, and overall return on investment. These insights can significantly increase the chances of success in trading.

The Intricacies of AI Indicator Strategy

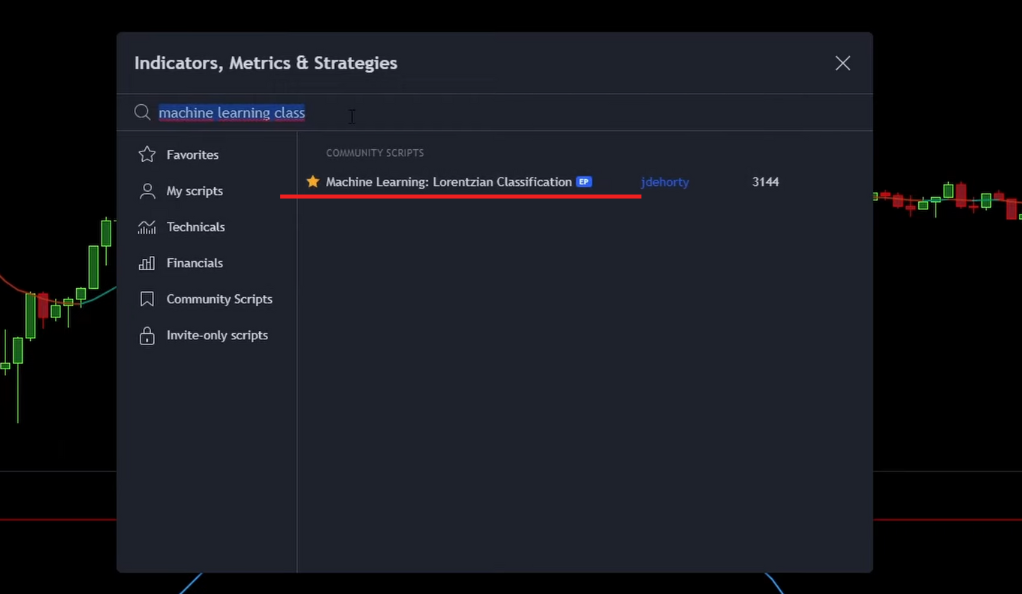

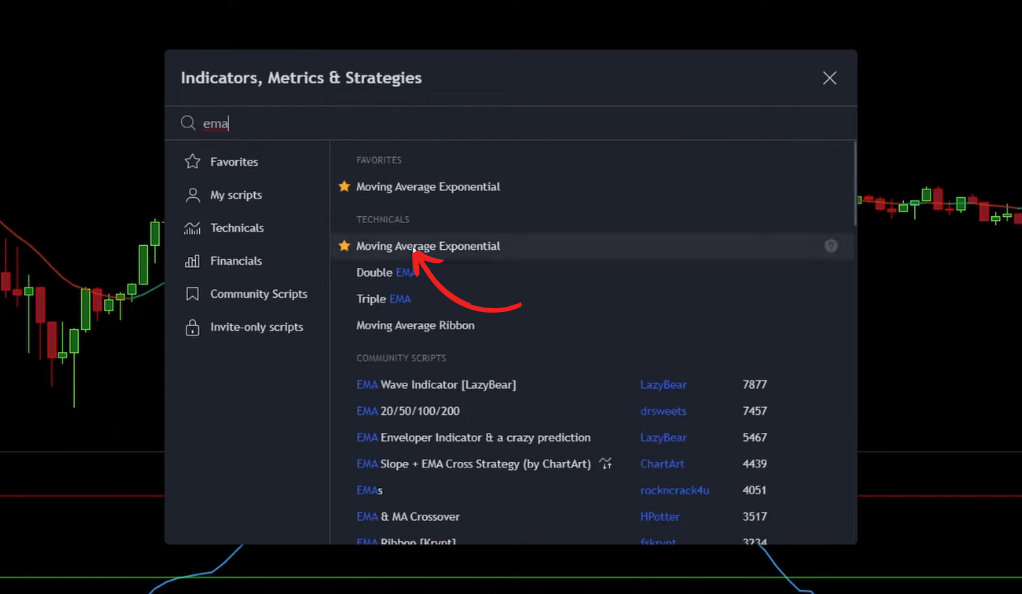

The AI indicator strategy is a novel approach in trading that combines artificial intelligence with traditional trading indicators. This strategy uses three key components: the Machine Learning Lorenzian Classification, the Exponential Moving Average (EMA), and the Legarre RSI.

The Machine Learning Lorenzian Classification uses AI to analyze market data and identify potential trading opportunities. The EMA helps identify the direction of market trends, providing insights into potential price reversals. The Legarre RSI, a momentum oscillator, identifies overbought and oversold market conditions, signaling potential reversal points.

When used together, these indicators provide a comprehensive view of the market, offering powerful insights into market trends and potential trading opportunities. This makes the AI indicator strategy a valuable tool for traders.

Configuring the AI Indicator Strategy

Setting up the AI indicator strategy involves a few key steps. Initially, the EMA indicator is adjusted to a length of 200, and the line color is changed to white for better visibility. This adjustment allows traders to track price movements over a longer period, providing a more comprehensive view of the market trend. Next, the RSI indicator is customized, with the first plot color changed to green and the second to red. This customization helps traders identify potential overbought and oversold conditions in the market. Finally, the settings of the Machine Learning indicator are tweaked to optimize the strategy. This indicator uses machine learning algorithms to classify and predict future price movements.

Understanding the Rules of Engagement

The AI indicator strategy is a sophisticated approach to trading that leverages the power of artificial intelligence. This strategy operates on specific rules for entering both long and short positions, providing a structured approach to trading.

The Importance of Structured Trading

A structured approach to trading is crucial for making informed decisions, minimizing risk, and maximizing potential returns. It provides a clear framework for traders to follow, reducing uncertainty and enhancing the potential for profitable trades.

The Rules for Long Positions

For a long position, which is essentially a buy position, the AI indicator strategy requires three conditions to be met.

Condition 1: Price Action Above the 200 EMA Line

The first condition is that the price action should close above the 200 Exponential Moving Average (EMA) line. The EMA is a type of moving average that places a greater weight on recent data, making it more responsive to new information. A close above the 200 EMA line suggests that the market is in an uptrend, indicating a potential buying opportunity.

Condition 2: Machine Learning Indicator’s Green Buy Signal

The second condition is that the Machine Learning indicator should print a green Buy Signal. This AI-based indicator uses machine learning algorithms to analyze market data and provide buy or sell signals. A green Buy Signal suggests that the indicator has identified a potential trading opportunity based on its analysis of historical data.

Condition 3: Blue RSI Line Crossing the Green Line Upwards

The third condition is that the blue line of the Relative Strength Index (RSI) indicator should cross the green line upwards. The RSI is a momentum oscillator that measures the speed and change of price movements. An upward cross of the blue RSI line over the green line suggests that the market’s momentum is increasing, further supporting the decision to enter a long position.

The Importance of Backtesting the Strategy

Backtesting is an essential component of any trading strategy. It’s a simulation process where a strategy is tested using historical data to evaluate its past performance. This process provides valuable insights, helping traders make informed decisions about the potential viability of a strategy.

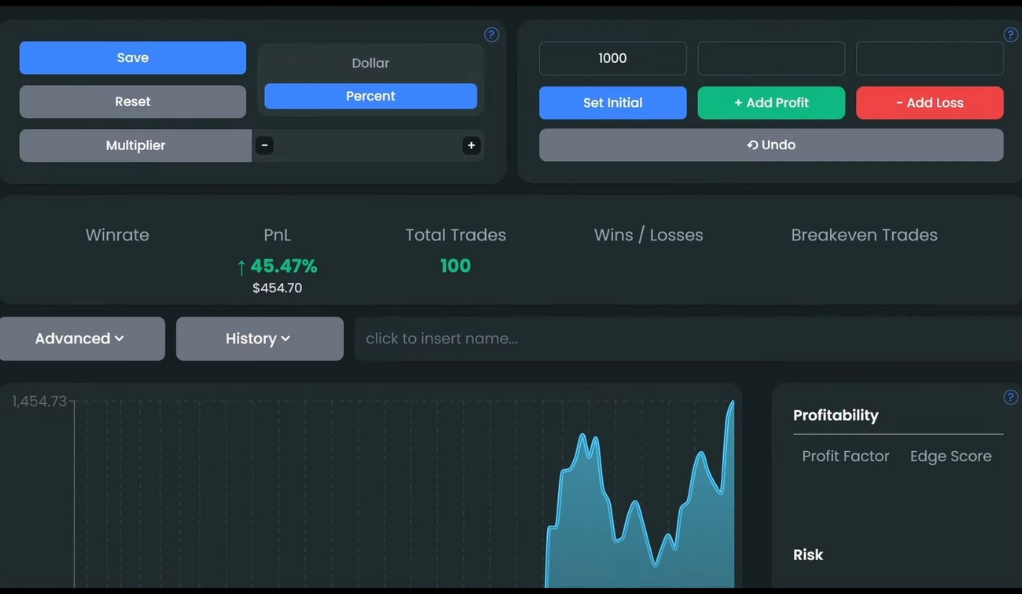

In the context of the AI indicator strategy, backtesting was conducted using the Trader’s Edge app with an initial balance of 1,000 US Dollars and a leverage of 2x. The results showed a win rate of 58% and a profit of 45.5% after 100 trades. These promising results offer a snapshot of the strategy’s potential performance.

However, it’s important to note that backtesting results are not a guarantee of future performance. They serve as a tool to assess a strategy’s potential and help in fine-tuning it for better performance. In essence, backtesting is a critical step in strategy development, providing invaluable insights into a strategy’s potential for success.

Interpreting the Results

The integration of artificial intelligence (AI) in trading is a significant shift that’s set to redefine the trading landscape. As technology continues to evolve, so too will the strategies and tools available to traders. The AI indicator strategy is a prime example of how AI can enhance trading outcomes.

AI’s ability to process vast amounts of data quickly and accurately can lead to more precise market predictions, enabling traders to identify potential trading opportunities more effectively. Moreover, AI can speed up decision-making processes and enhance the efficiency of trading operations by automating routine tasks.

Envisioning the Future of AI in Trading

The use of artificial intelligence (AI) in trading is set to increase as technology continues to evolve. The AI indicator strategy is a prime example of how AI can be harnessed to improve trading outcomes, offering more accurate market predictions, faster decision-making, and more efficient trading operations.

AI’s ability to process large amounts of data quickly and accurately can lead to more precise market predictions. It can also automate routine tasks and expedite decision-making processes, allowing traders to respond to market changes more swiftly.

Conclusion

The AI indicator strategy represents a significant advancement in the field of trading. By harnessing the power of artificial intelligence and employing thorough backtesting, this strategy offers traders the potential to enhance their trading outcomes and stay ahead in the competitive trading landscape.

Artificial intelligence, with its ability to analyze vast amounts of data, identify patterns, and make accurate predictions, brings a new level of sophistication to trading. When combined with traditional trading indicators in the AI indicator strategy, it provides a comprehensive view of the market and facilitates informed trading decisions.

Backtesting, an integral part of the AI indicator strategy, allows traders to evaluate the effectiveness of the strategy using historical data. This process provides valuable insights into the potential performance of the strategy, helping traders optimize it for better results.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)