The world of cryptocurrency trading is a dynamic and ever-evolving landscape. With the advent of new technologies and trading methodologies, traders are constantly on the lookout for innovative ways to maximize their profits and minimize their risks. One such method that has gained significant traction in recent years is bot trading. This article aims to provide a comprehensive understanding of bot trading and delve into a specific strategy that has been making waves in the crypto community – the “Lyric Turn 10K into 1.1 Million” strategy. This strategy, with its unique approach and impressive results, has piqued the interest of many traders. By the end of this article, you will have a clear understanding of what this strategy entails and how you can potentially implement it in your own trading endeavors.

Understanding Bot Trading

Bot trading, also known as algorithmic trading or automated trading, is a method of executing trades using pre-programmed trading instructions that account for variables such as time, price, and volume. This type of trading uses powerful computers to execute a large number of orders at very high speeds. It involves complex algorithms that scan the markets for specific conditions and execute trades based on these pre-set parameters. The main advantage of bot trading is its ability to remove the emotional and human errors often associated with manual trading. It allows for a more disciplined and systematic approach to trading.

Understanding bot trading involves comprehending the principles of algorithmic strategies and the technology behind them. These bots can be programmed to trade on various indicators, including moving averages, stochastic oscillators, or relative strength index (RSI), among others. They can also be set to execute trades at specific times of the day or when a certain set of conditions is met. Moreover, bot trading can be used across various markets, including forex, stocks, and commodities. However, it’s essential to remember that while bot trading can increase efficiency and reduce the impact of emotions on trading decisions, it’s not without risks. Market conditions can change rapidly, and a bot might not be able to adapt as quickly as a human trader. Therefore, it’s crucial to monitor bot trading activities and adjust the parameters as necessary.

The “Larry Turn 10K into 1.1 Million” Strategy

The “Larry Turn 10K into 1.1 Million” strategy is a unique trading script that has been meticulously designed to cater to both bot trading and manual trading. This strategy is primarily used on Binance’s Ethereum USDT Perpetual chart, focusing on a one-hour timeframe. The name of the strategy might seem audacious, but it’s not without reason. The strategy is designed to make calculated trading decisions based on a set of predefined rules. These rules are not arbitrary; they are derived from years of market data and trends. This strategy is akin to having a seasoned trader by your side, making decisions based on years of experience and market understanding. It’s a tool that combines the power of technology with the intricacies of market trends to provide a robust trading strategy.

In the realm of bot trading, the “Larry Turn 10K into 1.1 Million” strategy stands out due to its adaptability and performance. The strategy is not a rigid set of rules but a flexible framework that can be tailored to suit a trader’s style and the market’s temperament. It’s like a well-oiled machine, constantly analyzing market data, making decisions, and executing trades. The strategy’s performance has been impressive, providing a significant number of profitable trades. However, it’s essential to remember that while the strategy has shown promising results, past performance is not indicative of future results. Therefore, it’s crucial to understand the strategy thoroughly, adjust the settings to suit your risk tolerance, and monitor its performance regularly.

Optimized Settings

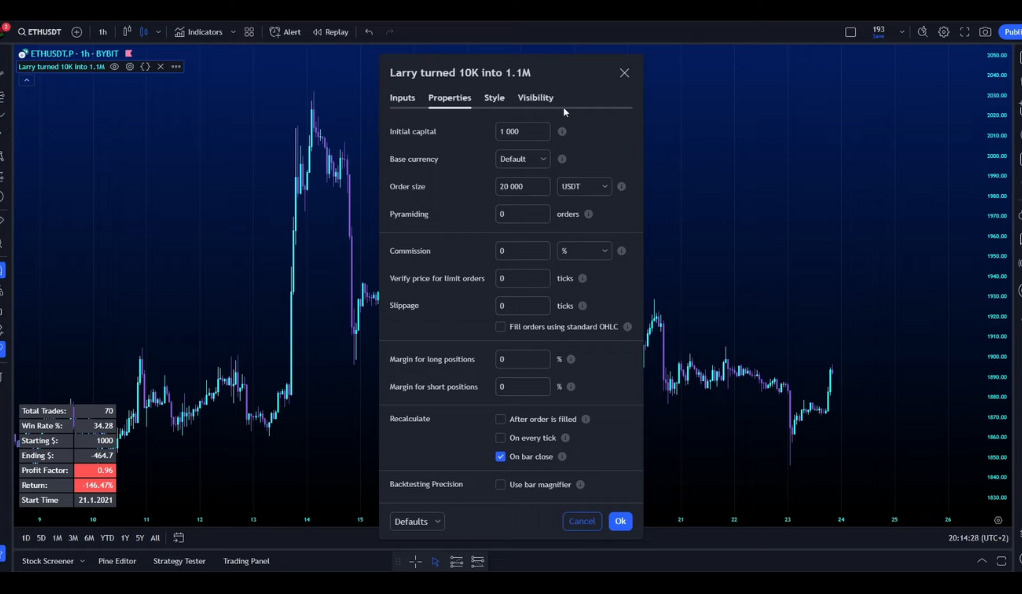

The “Larry Turn 10K into 1.1 Million” strategy is optimized for Bitcoin on a 15-minute chart. However, these settings are not set in stone. They can be adjusted to suit different trading preferences and market conditions. For instance, the strategy’s creator prefers to trade using a leverage of 20x and uses an order size of 20K to check the stats. This high leverage allows for potentially higher profits but also comes with higher risks. Therefore, it’s important to understand your risk tolerance and adjust the settings accordingly. The ability to customize these settings allows traders to tailor the strategy to their specific needs and risk tolerance.

Customizing the Strategy

Customizing a trading strategy is a critical aspect of successful trading. It involves tailoring a trading plan to fit one’s personal financial goals, risk tolerance, and trading style. The process begins with a thorough understanding of various trading strategies, their strengths, weaknesses, and the market conditions in which they perform best. Once a trader has a solid understanding of these strategies, they can begin to modify them to better suit their individual needs. This could involve adjusting the parameters of a technical indicator, changing the time frame for analysis, or even combining multiple strategies to create a hybrid approach.

However, customizing a strategy isn’t just about tweaking the technical aspects. It also involves aligning the strategy with one’s psychological comfort and lifestyle. For instance, a trader who can’t handle the stress of day trading might opt for a longer-term strategy like swing trading or position trading. Similarly, a trader with a full-time job might prefer a strategy that doesn’t require constant market monitoring. It’s also crucial to backtest a customized strategy using historical data to ensure its effectiveness before implementing it in live trading. Remember, a well-customized strategy should not only be profitable but also align with the trader’s personality, lifestyle, and risk tolerance.

Stop Loss and Take Profit Methods

Stop Loss and Take Profit are two essential methods in the world of trading, particularly in forex, stocks, and commodities. They are designed to help traders manage their risk and secure profits while minimizing potential losses. The Stop Loss method is a predetermined point at which a trader will sell a security to limit their loss. It’s an order placed with a broker to sell a security when it reaches a certain price. This method is used to prevent substantial losses when the market moves against the trader’s position. It’s a way of putting a cap on the potential loss on a particular trade.

On the other hand, the Take Profit method is a type of limit order that specifies the exact price at which to close out an open position for a profit. When the price of the security or currency reaches the take profit level, the trade is automatically closed, and the profit is secured. This method allows traders to lock in profits when they are not monitoring the market. Both Stop Loss and Take Profit orders are essential tools in a trader’s toolkit, allowing them to have a more strategic and disciplined approach to their trading activities. They help in making trading decisions more systematic and less influenced by emotional reactions.

Performance of the Strategy

The performance of a trading strategy is ultimately what determines its success. Using the settings mentioned above, the “Lyric Turn 10K into 1.1 Million” strategy provides 82 trades with a win rate of almost 52% and a return of 4,116%. With a leverage of 20x, this would have resulted in a profit of $41,157. These impressive results are a testament to the strategy’s effectiveness. However, it’s important to note that past performance is not indicative of future results. Therefore, it’s crucial to thoroughly backtest the strategy under different market conditions before implementing it.

The Power of Bot Trading

Bot trading strategies like the “Larry Turn 10K into 1.1 Million” strategy offer a new way to navigate the volatile world of cryptocurrency trading. They provide a systematic approach to trading, reducing emotional decision-making, and increasing efficiency. With bot trading, trades are executed at the optimal time, reducing the chances of missed opportunities. Furthermore, bot trading allows for 24/7 trading, something that is not possible with manual trading. This means that you can take advantage of market movements even while you sleep. The “Lyric Turn 10K into 1.1 Million” strategy harnesses the power of bot trading to provide a strategy that is not only effective but also efficient.

Conclusion

In conclusion, the “Larry Turn 10K into 1.1 Million” strategy is a powerful tool in the arsenal of any trader, whether you’re a seasoned pro or a newbie. It’s a testament to the power of bot trading and the potential it holds. This strategy offers a systematic, data-driven approach to trading that can potentially lead to impressive results. However, like any trading strategy, it’s important to understand the risks involved and to use it as part of a balanced and diversified trading portfolio. So, are you ready to dive into the world of bot trading and see what it can do for you? The “Lyric Turn 10K into 1.1 Million” strategy might just be the tool you need to take your trading to the next level.

Ainu Token aims to offer impartial and trustworthy information on cryptocurrency, finance, trading, and shares. However, we don't provide financial advice and recommend users to conduct their own studies and thorough checks.

Comments (No)